Concept explainers

Prepare Budgeted Financial Statements

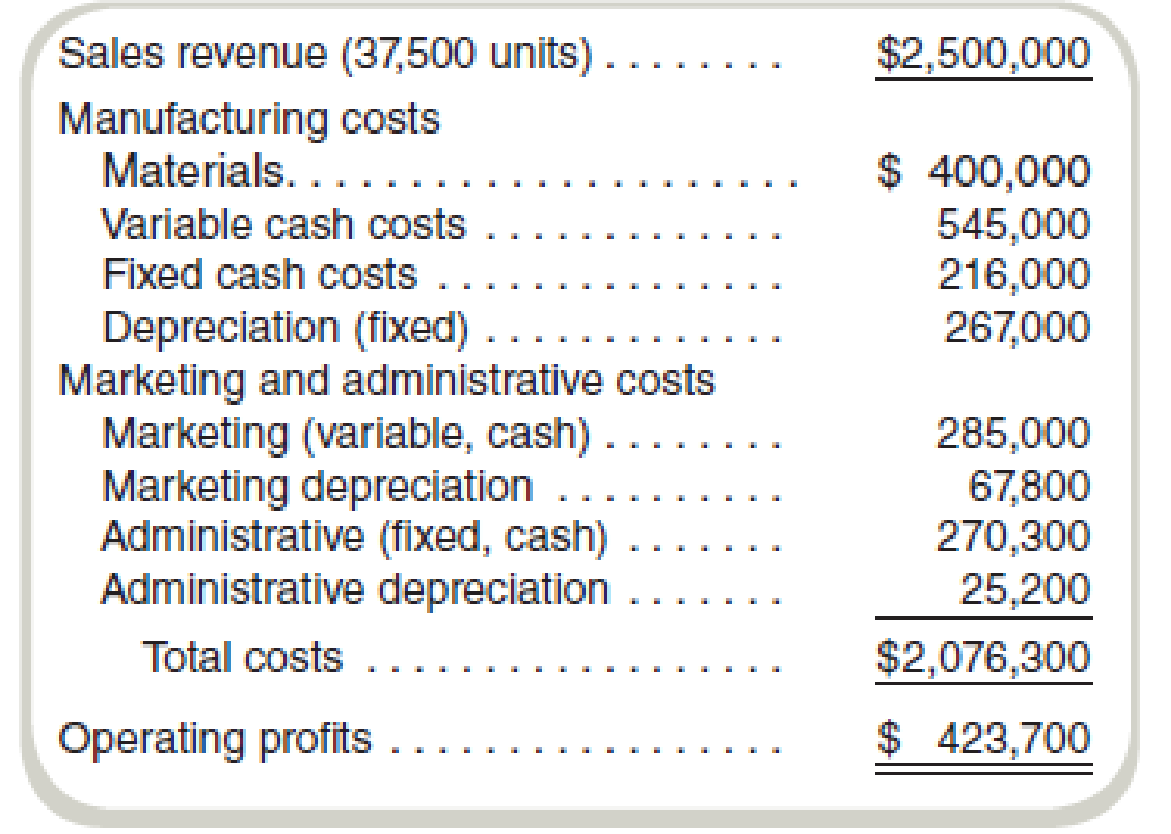

Gulf States Manufacturing has the following data from year 1 operations, which are to be used for developing year 2 budget estimates:

All

Variable marketing costs will change with volume. Administrative cash costs are expected to increase by 10 percent. Inventories are kept at zero. Gulf States operates on a cash basis.

Required

Prepare a

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- CASH BUDGETING Helen Bowers, owner of Helens Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2019 and 2020: Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10%; collected the month following the sale, 75%; collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: General and administrative salaries are approximately 27,000 a month. Lease payments under long-term leases are 9,000 a month. Depreciation charges are 36,000 a month. Miscellaneous expenses are 2,700 a month. Income tax payments of 63,000 are due in September and December. A progress payment of 180,000 on a new design studio must be paid in October. Cash on hand on July 1 will be 132,000, and a minimum cash balance of 90,000 should be maintained throughout the cash budget period. a. Prepare a monthly cash budget for the last 6 months of 2019. b. Prepare monthly estimates of the required financing or excess fundsthat is, the amount of money Bowers will need to borrow or will have available to invest. c. Now suppose receipts from sales come in uniformly during the month (that is, cash receipts come in at the rate of 1/30 each day), but all outflows must be paid on the 5th. Will this affect the cash budget? That is, will the cash budget you prepared be valid under these assumptions? If not, what could be done to make a valid estimate of the peak financing requirements? No calculations are required, although if you prefer, you can use calculations to illustrate the effects. d. Bowers sales are seasonal, and her company produces on a seasonal basis, just ahead of sales. Without making any calculations, discuss how the companys current and debt ratios would vary during the year if all financial requirements were met with short-term bank loans. Could changes in these ratios affect the firms ability to obtain bank credit? Explain.arrow_forwardReview the completed master budget and answer the following questions: Is Ranger Industries expecting to earn a profit during the next quarter? If so, how much? Does the company need to borrow cash during the quarter? Can it make any repayments? Explain. (Carefully review rows 74 through 80.)arrow_forwardAt the beginning of the period, the Fabricating Department budgeted direct labor of 72,000 and equipment depreciation of 18,500 for 2,400 hours of production. The department actually completed 2,350 hours of production. Determine the budget for the department, assuming that it uses flexible budgeting.arrow_forward

- Compute budgeted net income for the year 2020. Rombus tires preparing a budgeted income statement and has the following information. Predicted sales for the year are P850,000 and cost of goods sold is 40% of sales. The expected selling expenses are 81,000 and the expected general and administrative expenses are 70,000, which includes P23,000 of depreciation. Tax rate will be at 25%.arrow_forwardShown below are the totals from 2025 period budgets. Revenue budget $100,000 Materials usage from production budget 15,000 Labor cost budget 20,000 Manufacturing overhead budget 20,000 General and administrative budget 30,000 Capital expenditure budget 20,000 Work in Progress Inventories Beginning of 2002 10,000 End of 2002 5,000 Finished Goods Inventory Beginning of 2002 15,000 End of 2002…arrow_forwardplease explain step-by-step how to calculate an operational budget with the information provided: The time window would be in a year of operation total expenses for the year would be $22,298.57 projected income for the year would be $64,000arrow_forward

- Concord Company classifies its selling and administrative expense budget into variable and fixed components. Variable expenses are expected to be $20,640 in the first quarter, and $3,440 increments are expected in the remaining quarters of 2022. Fixed expenses are expected to be $34,400 in each quarter. Prepare the selling and administrative expense budget by quarters and in total for 2022. CONCORD COMPANY Selling and Administrative Expense Budget Quarter 2 3 $ $arrow_forwardRequired Information [The following information applies to the questions displayed below.] Phoenix Company's 2019 master budget Included the following fixed budget report. It is based on an expected production and sales volume of 15,000 units. Sales Cost of goods sold Direct materials Direct labor Gross profit Selling expenses Machinery repairs (variable cost) Depreciation-Plant equipment (straight-line) Utilities ($45,000 is variable) Plant management salaries Packaging Shipping PHOENIX COMPANY Fixed Budget Report For Year Ended December 31, 2019 Sales salary (fixed annual amount) General and administrative expenses Advertising expense Salaries Entertainment expense Income from operations Sales Variable costs Utilities PHOENIX COMPANY Flexible Budgets For Year Ended December 31, 2019 Flexible Budget Direct materials Direct labor Machinery repairs Depreciation-Plant equipment (straight-line) $ 960,000 240,000 Variable Amount per Unit 60,000 315,000 195,000 200,000 1,970,000 1,180,000…arrow_forwardPharoah Company classifies its selling and administrative expense budget into variable and fixed components. Variable expenses an expected to be $26,880 in the first quarter, and $4,480 increments are expected in the remaining quarters of 2022. Fixed expenses expected to be $44,800 in each quarter. Prepare the selling and administrative expense budget by quarters and in total for 2022.arrow_forward

- The following information pertains to Yoyo Projects for the three months ended 31 May 2020: Actual Budgeted March R April R May R Revenue (20% for cash and 80% on credit) 360 000 380 000 400 000 Purchases (10% for cash 90% on credit) 240 000 280 000 320 000 Salaries and wages paid 40 000 60 000 60 000 Cash expenses 24 000 28 000 32 000 Depreciation 2 000 2 000 2 000 Additional Information: It is expected that debtors will settle their accounts as follows: 20 % in the month of invoice 70% in the month after the month of invoice, and 5% in the second month after the month of invoice The remaining 5% is usually written off as bad Trade creditors are paid in the month after purchase at a discount of 5%. 50% of the salaries and wages are weekly wages. Since wages are paid weekly, usually 10% of the wages are paid in the month following the month in which they were Expenses are paid as they The favourable…arrow_forwardRoaring Brook Company’s total selling and administrative expenses for the fourth quarter are budgeted at $60,000, which include depreciation of $8,000 and cash disbursements of $52,000. What amount of selling and administrative expenses should be reported on the company’s budgeted income statement for the fourth quarter?arrow_forwardThe Budget Committee is now ready with the budget estimates for the preparation of the Operating Budget of YAKANG-YAKA Company for the year 2022. The following data were preseted below: Finished Product Model B 8,000 P 140 Model M 5,000 P 170 Budget sales-units Selling price per unit Inventory, Beginning in units Expected inventory end in units 850 600 700 500 Inventory, Beginning in units Expected inventory end in units Material MI 5,000 5,500 Material M2 4,000 5,000 Material M3 3,000 3,600 Model B Model M 4 units 3 units 3 units 15 hours Material Content of each unit: Material M1 Material M2 Material M3 Direct labor hours per unit 6 units 4 units 2 units 10 hours Overhead is applied based on 100% of direct labor hours. Budgeted unit costs: Material M1 Material M2 per unit Material M3 2.50 per unit Direct labor P2.00 Р.00 per uniti 3.00 per hour Other budgeted data based on production are shown below: Factory Overhead: Indirect labor Factory supplies Repairs and maintenance Other…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning