Fundamentals Of Cost Accounting (6th Edition)

6th Edition

ISBN: 9781259969478

Author: WILLIAM LANEN, Shannon Anderson, Michael Maher

Publisher: McGraw Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 34E

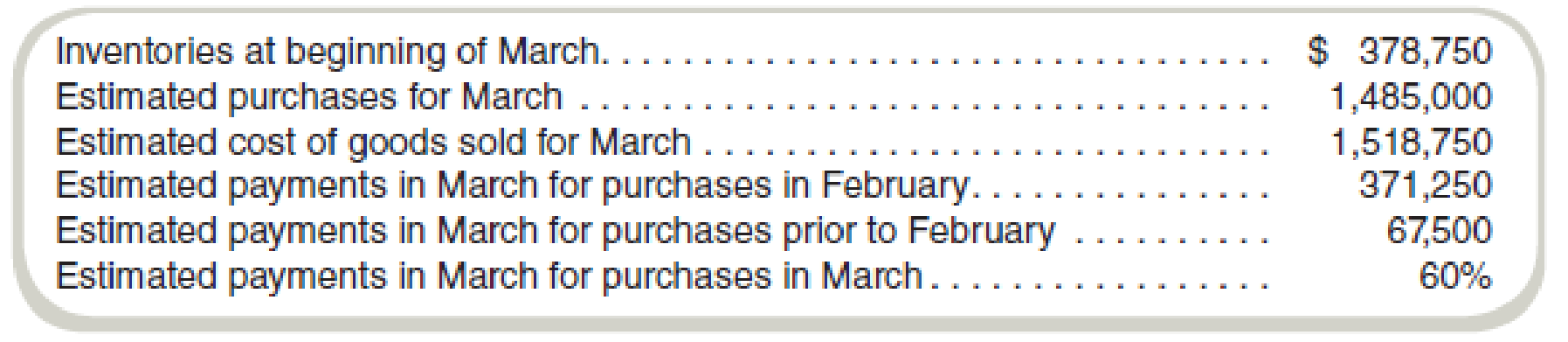

Estimate Cash Disbursements

Cascade, Ltd., a merchandising firm, is preparing its

Required

What are the estimated cash disbursements in March?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Preparing a financial budget—schedule of cash receipts, schedule cash payments, cash budget

Baxter Company’s budget committee provides the following information:

Requirements

Prepare the schedule of cash receipts from customers for January and February 2018. Assume cash receipts are 80% in the month of the sale and 20% in the month following the sale.

Prepare the schedule of cash payments for purchases for January and February 2018. Assume purchases are paid 60% in the month of purchase and 40% in the month following the purchase.

Prepare the schedule of cash payments for selling and administrative expenses for January and February 2018. Assume 40% of the accrual. for Salaries and Commissions Payable is for commissions and 60% is for salaries. The December 31 balance will be paid in January. Salaries and commissions are paid 30% in the month incurred and 70% in the following month. Rent and income tax expenses are paid as incurred. Insurance expense is an expiration of the prepaid…

Cash Flows; Budgeted Income Statement and Balance Sheet

Wolfpack Company is a merchandising company that is preparing a budget for the month of July. It has provided the following information:

Budgeting Assumptions:

1. All sales are on account. Thirty percent of the credit sales are collected in the month of sale and the remaining 70% are collected in the month subsequent to the sale. The accounts receivable at June 30 will be collected in July.

2. All merchandise purchases are on account. Twenty percent of merchandise inventory purchases are paid in the month of the purchase and the remaining 80% is paid in the month after the purchase.

3. The budgeted inventory balance at July 31 is $22,000.

4. Depreciation expense is $3,000 per month. All other selling and administrative expenses are paid in full in the month the expense is incurred.

5. The company’s cash budget for July shows expected cash collections of $77,000, expected cash disbursements for merchandise purchases of $44,500, and…

Schedule of Expected Cash Collections; Cash Budget

The president of the retailer Prime Products has just approached the company’s bank with a request for a $30,000, 90-day loan. The purpose of the loan is to assist the company in acquiring inventories. Because the company has had some difficulty in paying off its loans in the past, the loan officer has asked for a cash budget to help determine whether the loan should be made. The following data are available for the months April through June, during which the loan will be used:

a. On April 1, the start of the loan period, the cash balance will be $24,000. Accounts receivable on April 1 will total $140,000, of which $120,000 will be collected during April and $16,000 will be collected during May. The remainder will be uncollectible.

b. Past experience shows that 30% of a month’s sales are collected in the month of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2% is bad debts that are never…

Chapter 13 Solutions

Fundamentals Of Cost Accounting (6th Edition)

Ch. 13 - Prob. 1RQCh. 13 - Prob. 2RQCh. 13 - Prob. 3RQCh. 13 - What role does the master budget play in the...Ch. 13 - What problems might arise if a firm relies solely...Ch. 13 - What is the coordinating role of budgeting?Ch. 13 - Prob. 7RQCh. 13 - Write out the inventory equation that is used to...Ch. 13 - What makes creating budgets for marketing and...Ch. 13 - Prob. 10RQ

Ch. 13 - Preparing a budget is a waste of time. The...Ch. 13 - In the Business Application feature, Using the...Ch. 13 - Prob. 13CADQCh. 13 - Would the budgeting plans for a company that uses...Ch. 13 - Government agencies are limited in spending by...Ch. 13 - What is the difference between the planning and...Ch. 13 - When might the master budget start with a forecast...Ch. 13 - In some organizations (firms, universities,...Ch. 13 - Our cash budget shows a surplus for the quarter,...Ch. 13 - Your boss asks for your estimate on the costs of a...Ch. 13 - The chapter identified four techniques used for...Ch. 13 - Role of Budgets and Plans

Cosmic Corporation is a...Ch. 13 - Human Element in Budgeting

Roller Partners is a...Ch. 13 - Estimate Sales Revenues Stubs-R-Us is a local...Ch. 13 - Estimate Sales Revenues Friendly Financial has 160...Ch. 13 - Estimate Sales Revenues Larson, Inc., manufactures...Ch. 13 - Estimate Production Levels Offenbach Son has just...Ch. 13 - Estimate Sales Levels Using Production Budgets...Ch. 13 - Estimate Inventory Levels Using Production Budgets...Ch. 13 - Estimate Production Levels: Capacity Constraints...Ch. 13 - Prob. 31ECh. 13 - Estimate Purchases and Cash Disbursements Midland...Ch. 13 - Estimate Purchases and Cash Disbursements Lakeside...Ch. 13 - Estimate Cash Disbursements Cascade, Ltd., a...Ch. 13 - Estimate Cash Collections Minot Corporation is...Ch. 13 - Estimate Cash Collections Ewing Company is...Ch. 13 - Estimate Cash Receipts Scare-2-B-U (S2BU)...Ch. 13 - Estimate Cash Receipts Varmit-B-Gone is a pest...Ch. 13 - Prepare Budgeted Financial Statements

Refer to the...Ch. 13 - Prepare Budgeted Financial Statements Cycle-1 is a...Ch. 13 - Prepare Budgeted Financial Statements Carreras Caf...Ch. 13 - Budgeting in a Service Organization Executive...Ch. 13 - Prob. 43ECh. 13 - Prob. 44ECh. 13 - Prob. 45ECh. 13 - Prob. 46ECh. 13 - Sensitivity Analysis Sanjanas Sweet Shoppe...Ch. 13 - Sensitivity Analysis Classic Limo, Inc., provides...Ch. 13 - Prob. 49ECh. 13 - Prob. 50ECh. 13 - Prepare Budgeted Financial Statements The...Ch. 13 - Prob. 52PCh. 13 - Prepare Budgeted Financial Statements Gulf States...Ch. 13 - Prob. 54PCh. 13 - Prob. 55PCh. 13 - Prepare a Production Budget Haggstrom, Inc.,...Ch. 13 - Sales Expense Budget SPU, Ltd., has just received...Ch. 13 - Budgeted Purchases and Cash Flows Mast Corporation...Ch. 13 - Prepare Budgeted Financial Statements HomeSuites...Ch. 13 - Prob. 60PCh. 13 - Comprehensive Budget Plan Brighton, Inc.,...Ch. 13 - Comprehensive Budget Plan Panther Corporation...Ch. 13 - Budgeted Financial Statements in a Retail...Ch. 13 - Cash Budgets and Sensitivity Analysis in a Retail...Ch. 13 - Prob. 66IC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pilsner Inc. purchases raw materials on account for use in production. The direct materials purchases budget shows the following expected purchases on account: Pilsner typically pays 25% on account in the month of billing and 75% the next month. Required: 1. How much cash is required for payments on account in May? 2. How much cash is expected for payments on account in June?arrow_forwardBudgeted income statement and supporting budgets The budget director of Birding Homes Feeders Inc., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for January: Estimated sales for January: Estimated inventories at January 1: Desired inventories at January 31: Direct materials used in production: Anticipated cost of purchases and beginning and ending inventory of direct materials: Direct labor requirements: Estimated factory overhead costs for January: Estimated operating expenses for January: Estimated other revenue and expense for January: Estimated tax rate: 25% Instructions Prepare a sales budget for January. Prepare a production budget for January. Prepare a direct materials purchases budget for January. Prepare a direct labor cost budget for January. Prepare a factory overhead cost budget for January. Prepare a cost of goods sold budget for January. Work in process at the beginning of January is estimated to be 9,000, and work in process at the end of January is estimated to be 10,500. Prepare a selling and administrative expenses budget for January. Prepare a budgeted income statement for January.arrow_forwardSales, production, direct materials purchases, and direct labor cost budgets The budget director of Gourmet Grill Company requests estimates of sales, production, and other operating data from the various administrative units every month. Selected information concerning sales and production for July is summarized as follows: Estimated sales for July by sales territory: Estimated inventories at July 1: Desired inventories at July 31: Direct materials used in production: Anticipated purchase price for direct materials: Direct labor requirements: Instructions Prepare a sales budget for July. Prepare a production budget for July. Prepare a direct materials purchases budget for July. Prepare a direct labor cost budget for July.arrow_forward

- CASH BUDGETING Helen Bowers, owner of Helens Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2019 and 2020: Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10%; collected the month following the sale, 75%; collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: General and administrative salaries are approximately 27,000 a month. Lease payments under long-term leases are 9,000 a month. Depreciation charges are 36,000 a month. Miscellaneous expenses are 2,700 a month. Income tax payments of 63,000 are due in September and December. A progress payment of 180,000 on a new design studio must be paid in October. Cash on hand on July 1 will be 132,000, and a minimum cash balance of 90,000 should be maintained throughout the cash budget period. a. Prepare a monthly cash budget for the last 6 months of 2019. b. Prepare monthly estimates of the required financing or excess fundsthat is, the amount of money Bowers will need to borrow or will have available to invest. c. Now suppose receipts from sales come in uniformly during the month (that is, cash receipts come in at the rate of 1/30 each day), but all outflows must be paid on the 5th. Will this affect the cash budget? That is, will the cash budget you prepared be valid under these assumptions? If not, what could be done to make a valid estimate of the peak financing requirements? No calculations are required, although if you prefer, you can use calculations to illustrate the effects. d. Bowers sales are seasonal, and her company produces on a seasonal basis, just ahead of sales. Without making any calculations, discuss how the companys current and debt ratios would vary during the year if all financial requirements were met with short-term bank loans. Could changes in these ratios affect the firms ability to obtain bank credit? Explain.arrow_forwardBudgeted income statement and supporting budgets The budget director of Gold Medal Athletic Co., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for March: Estimated sales for March: Estimated inventories at March 1: Desired inventories at March 31: Direct materials used in production: Anticipated cost of purchases and beginning and ending inventory of direct materials: Direct labor requirements: Estimated factory overhead costs for March: Estimated operating expenses for March: Estimated other revenue and expense for March: Estimated tax rate: 30% Instructions Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be 15,300, and work in process at the end of March is desired to be 14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March.arrow_forwardEcho Amplifiers prepared the following sales budget for the first quarter of 2018: It also has this additional information related to its expenses: Prepare a sales and administrative expense budget for each month in the quarter ending March 31, 2018.arrow_forward

- The Express Company is preparing its cash budget for the month of June. The following information is available concerning its inventories: Inventories at beginning of June Estimated purchases of June Estimated cost of goods sold for June Estimated payments in June for purchases in May Estimated payments in June for purchases prior to May Estimated payments in June for purchases in June $ 83,500 362,000 369,500 88,250 47,000 B0 What are the estimated cash disbursements for inventories in June? Multple Choice $405,840. O $432,450.arrow_forwardPrepare schedules for (1) expected collections from customers and (2) expected payments for direct materials purchases for January and February. Prepare a cash budget for January and February in columnar form. please dont provide answer in an image format thnkuarrow_forwardEvergreen Furniture, a retailing company, is preparing the cash budget for August. The following inventory information available: Estimated payments in August for purchases in August Estimated purchases for August Estimated cost of goods sold for August Estimated payments in August for purchases in July Estimated payments in August for purchases prior to July Inventories at beginning of August Required: What are the estimated cash disbursements in August? Estimated cash disbursements 70% $ 2,444,000 2,600,000 696,000 176,000 674,000arrow_forward

- Assets Cash $ 12,000 77,500 42,000 Accounts receivable Inventory Buildings and equipment, net of depreciation 225,000 $ 356,500 Total assets Liabilities and Stockholders' Equity Accounts payable Note payable $ 78,250 19,300 180,000 Common stock Retained earnings 78,950 $ 356,500 Total liabilities and stockholders' equity The company is in the process of preparing a budget for May and has assembled the following data: a. Sales are budgeted at $231,000 for May. Of these sales, $69,300 will be for cash; the remainder will be credit sales. One-half of a month's credit sales are collected in the month the sales are made, and the remainder is collected in the following month. All of the April 30 accounts receivable will be collected in May. b. Purchases of inventory are expected to total $139,000 during May. These purchases will all be on account. Forty percent of all purchases are paid for in the month of purchase; the remainder are paid in the following month. All of the April 30 accounts…arrow_forwardRequired 1. Prepare a cash receipts budget schedule for each of the first three months (July – September), including the total receipts per month 2. Prepare a material purchases budget schedule for each of the first three months (July – September), including the total purchases per month 3. Prepare a cash budget for the month of July. Include the owners’ cash contributionsarrow_forwardThe budgeted cash collections in March for the sales made in March is __________ The budgeted cash receipts for the month of April is ___________ The budgeted purchases of merchandise for February is _____________ The budgeted cash disbursements for operating expenses (other than cost of goods sold) during the month of April is ___________ The budgeted cash disbursements to be made in April for merchandise purchases is _____________ Assume that the expected cash balance at the beginning of April is P 51,600. How much is the budgeted cash balance as of April 30? ______arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY