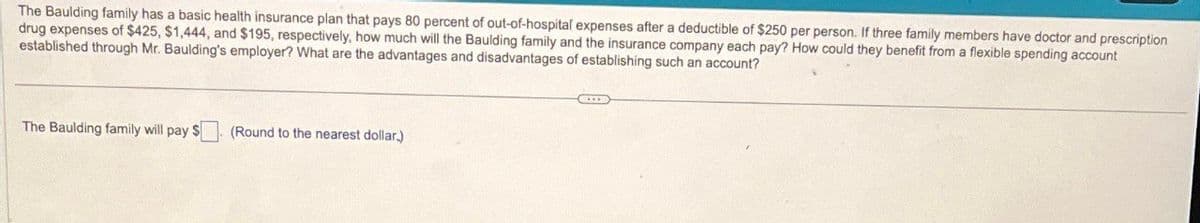

he Baulding family has a basic health insurance plan that pays 80 percent of out-of-hospital expenses after a deductible of $250 per person. If three family members have doctor and prescription rug expenses of $425, $1,444, and $195, respectively, how much will the Baulding family and the insurance company each pay? How could they benefit from a flexible spending account stablished through Mr. Baulding's employer? What are the advantages and disadvantages of establishing such an account?

he Baulding family has a basic health insurance plan that pays 80 percent of out-of-hospital expenses after a deductible of $250 per person. If three family members have doctor and prescription rug expenses of $425, $1,444, and $195, respectively, how much will the Baulding family and the insurance company each pay? How could they benefit from a flexible spending account stablished through Mr. Baulding's employer? What are the advantages and disadvantages of establishing such an account?

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 20CE

Related questions

Question

Transcribed Image Text:The Baulding family has a basic health insurance plan that pays 80 percent of out-of-hospital expenses after a deductible of $250 per person. If three family members have doctor and prescription

drug expenses of $425, $1,444, and $195, respectively, how much will the Baulding family and the insurance company each pay? How could they benefit from a flexible spending account

established through Mr. Baulding's employer? What are the advantages and disadvantages of establishing such an account?

The Baulding family will pay $

(Round to the nearest dollar)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT