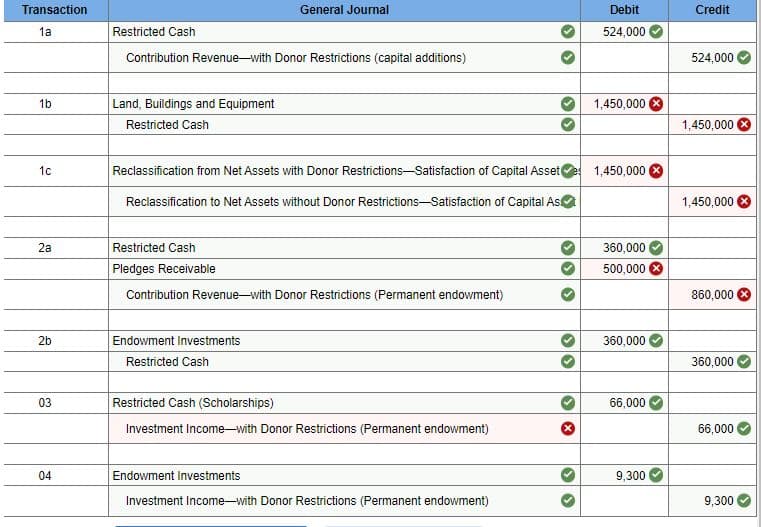

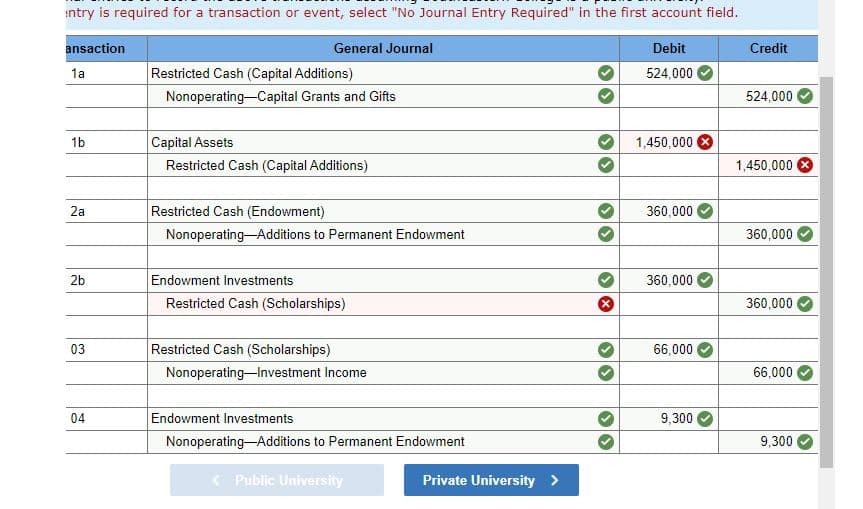

Transaction 1a General Journal Debit Credit Restricted Cash 524,000 Contribution Revenue-with Donor Restrictions (capital additions) 524,000 1b Land, Buildings and Equipment Restricted Cash 1,450,000 1,450,000 € 1c Reclassification from Net Assets with Donor Restrictions-Satisfaction of Capital Asset( 1,450,000 ( Reclassification to Net Assets without Donor Restrictions-Satisfaction of Capital As 1,450,000 2a Restricted Cash 360,000 Pledges Receivable 500,000 Contribution Revenue-with Donor Restrictions (Permanent endowment) 860,000 2b Endowment Investments Restricted Cash 03 Restricted Cash (Scholarships) Investment Income-with Donor Restrictions (Permanent endowment) 04 Endowment Investments Investment Income-with Donor Restrictions (Permanent endowment) 360,000 360,000 66,000 66,000 9,300 9,300 entry is required for a transaction or event, select "No Journal Entry Required" in the first account field. ansaction General Journal 1a Restricted Cash (Capital Additions) Nonoperating Capital Grants and Gifts Debit 524,000 524,000 Credit 1b Capital Assets Restricted Cash (Capital Additions) 1,450,000 x 1,450,000 2a Restricted Cash (Endowment) 360,000 Nonoperating-Additions to Permanent Endowment 360,000 2b Endowment Investments Restricted Cash (Scholarships) 360,000 360,000 03 Restricted Cash (Scholarships) Nonoperating Investment Income 66,000 66,000 04 Endowment Investments Nonoperating-Additions to Permanent Endowment 9,300 9,300 Public University Private University >

Transaction 1a General Journal Debit Credit Restricted Cash 524,000 Contribution Revenue-with Donor Restrictions (capital additions) 524,000 1b Land, Buildings and Equipment Restricted Cash 1,450,000 1,450,000 € 1c Reclassification from Net Assets with Donor Restrictions-Satisfaction of Capital Asset( 1,450,000 ( Reclassification to Net Assets without Donor Restrictions-Satisfaction of Capital As 1,450,000 2a Restricted Cash 360,000 Pledges Receivable 500,000 Contribution Revenue-with Donor Restrictions (Permanent endowment) 860,000 2b Endowment Investments Restricted Cash 03 Restricted Cash (Scholarships) Investment Income-with Donor Restrictions (Permanent endowment) 04 Endowment Investments Investment Income-with Donor Restrictions (Permanent endowment) 360,000 360,000 66,000 66,000 9,300 9,300 entry is required for a transaction or event, select "No Journal Entry Required" in the first account field. ansaction General Journal 1a Restricted Cash (Capital Additions) Nonoperating Capital Grants and Gifts Debit 524,000 524,000 Credit 1b Capital Assets Restricted Cash (Capital Additions) 1,450,000 x 1,450,000 2a Restricted Cash (Endowment) 360,000 Nonoperating-Additions to Permanent Endowment 360,000 2b Endowment Investments Restricted Cash (Scholarships) 360,000 360,000 03 Restricted Cash (Scholarships) Nonoperating Investment Income 66,000 66,000 04 Endowment Investments Nonoperating-Additions to Permanent Endowment 9,300 9,300 Public University Private University >

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 26E: Sinking Funds Entries The following information is available concerning Nunan Corporations sinking...

Related questions

Question

2

Southeastern College began the year with endowment investments of $1,450,000 and $860,000 of restricted cash designated by a donor for capital additions.

- During the year, an additional $524,000 ddonation was received for capital additions. These funds, together with those contributed in the prior year, were used to purchase 150 acres of land adjacent to the university.

- An alum contributed $360,000 to the permanent endowment and pledged to provide an additional $580,000 early next year. The cash was immediately invested.

- By terms of the endowment agreement, interest and dividends received on the investments are restricted for scholarships. Gains or losses from changes in the fair value of the investments, however, are not distributed but remain in the endowment. During the year, $66,000 of interest and dividends were received on endowment investments.

- At year-end, the fair value of the investments had increased by $9,300.

Required:

Prepare

-

Southeastern College is a public university.

-

Southeastern College is a private university.

Transcribed Image Text:Transaction

1a

General Journal

Debit

Credit

Restricted Cash

524,000

Contribution Revenue-with Donor Restrictions (capital additions)

524,000

1b

Land, Buildings and Equipment

Restricted Cash

1,450,000

1,450,000 €

1c

Reclassification from Net Assets with Donor Restrictions-Satisfaction of Capital Asset(

1,450,000 (

Reclassification to Net Assets without Donor Restrictions-Satisfaction of Capital As

1,450,000

2a

Restricted Cash

360,000

Pledges Receivable

500,000

Contribution Revenue-with Donor Restrictions (Permanent endowment)

860,000

2b

Endowment Investments

Restricted Cash

03

Restricted Cash (Scholarships)

Investment Income-with Donor Restrictions (Permanent endowment)

04

Endowment Investments

Investment Income-with Donor Restrictions (Permanent endowment)

360,000

360,000

66,000

66,000

9,300

9,300

Transcribed Image Text:entry is required for a transaction or event, select "No Journal Entry Required" in the first account field.

ansaction

General Journal

1a

Restricted Cash (Capital Additions)

Nonoperating Capital Grants and Gifts

Debit

524,000

524,000

Credit

1b

Capital Assets

Restricted Cash (Capital Additions)

1,450,000 x

1,450,000

2a

Restricted Cash (Endowment)

360,000

Nonoperating-Additions to Permanent Endowment

360,000

2b

Endowment Investments

Restricted Cash (Scholarships)

360,000

360,000

03

Restricted Cash (Scholarships)

Nonoperating Investment Income

66,000

66,000

04

Endowment Investments

Nonoperating-Additions to Permanent Endowment

9,300

9,300

Public University

Private University >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 1 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning