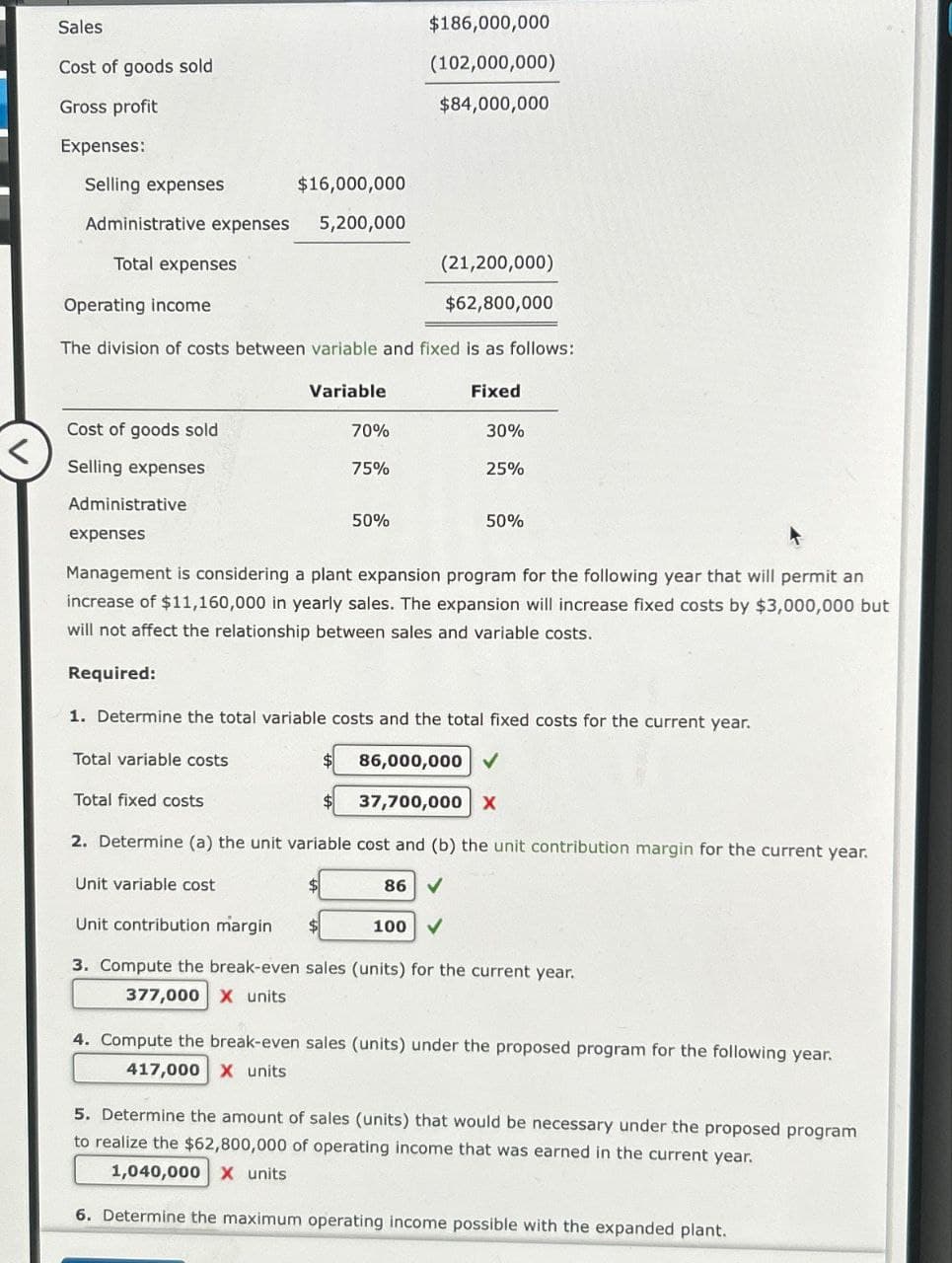

Sales Cost of goods sold $186,000,000 (102,000,000) $84,000,000 Gross profit Expenses: Selling expenses $16,000,000 Administrative expenses 5,200,000 Total expenses (21,200,000) Operating income $62,800,000 The division of costs between variable and fixed is as follows: Cost of goods sold Selling expenses Administrative expenses Variable Fixed 70% 30% 75% 25% 50% 50% Management is considering a plant expansion program for the following year that will permit an increase of $11,160,000 in yearly sales. The expansion will increase fixed costs by $3,000,000 but will not affect the relationship between sales and variable costs.

Sales Cost of goods sold $186,000,000 (102,000,000) $84,000,000 Gross profit Expenses: Selling expenses $16,000,000 Administrative expenses 5,200,000 Total expenses (21,200,000) Operating income $62,800,000 The division of costs between variable and fixed is as follows: Cost of goods sold Selling expenses Administrative expenses Variable Fixed 70% 30% 75% 25% 50% 50% Management is considering a plant expansion program for the following year that will permit an increase of $11,160,000 in yearly sales. The expansion will increase fixed costs by $3,000,000 but will not affect the relationship between sales and variable costs.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 12.16E: Product cost concept of product pricing Based on the data presented in Exercise 12-15, assume that...

Related questions

Question

Transcribed Image Text:Sales

Cost of goods sold

Gross profit

Expenses:

$186,000,000

(102,000,000)

$84,000,000

Selling expenses

$16,000,000

Administrative expenses

5,200,000

Total expenses

(21,200,000)

Operating income

$62,800,000

The division of costs between variable and fixed is as follows:

Cost of goods sold

Selling expenses

Administrative

expenses

Variable

Fixed

70%

30%

75%

25%

50%

50%

Management is considering a plant expansion program for the following year that will permit an

increase of $11,160,000 in yearly sales. The expansion will increase fixed costs by $3,000,000 but

will not affect the relationship between sales and variable costs.

Required:

1. Determine the total variable costs and the total fixed costs for the current year.

Total variable costs

Total fixed costs

86,000,000 ✓

37,700,000 X

2. Determine (a) the unit variable cost and (b) the unit contribution margin for the current year.

Unit variable cost

Unit contribution margin

86 V

✓

100

3. Compute the break-even sales (units) for the current year.

377,000 X units

4. Compute the break-even sales (units) under the proposed program for the following year.

417,000 X units

5. Determine the amount of sales (units) that would be necessary under the proposed program

to realize the $62,800,000 of operating income that was earned in the current year.

1,040,000 x units

6. Determine the maximum operating income possible with the expanded plant.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Introduction of cost-volume-profit (CVP) analysis.

VIEWStep 2: (1) Determination of Total Variable cost and Total Fixed cost.

VIEWStep 3: (3) Computation of Break even sales (units) for the current year.

VIEWStep 4: (4) Computation of Break even sales (units) for the proposed program.

VIEWStep 5: (5) Determination of required sales (units) to realize $62,800,000 of operating income.

VIEWSolution

VIEWStep by step

Solved in 6 steps with 6 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub