Concept explainers

1.

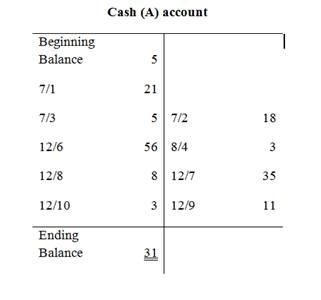

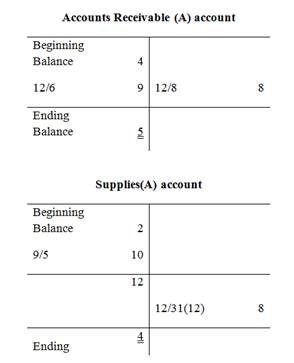

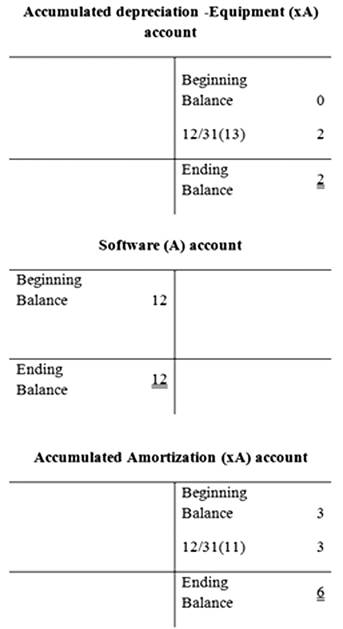

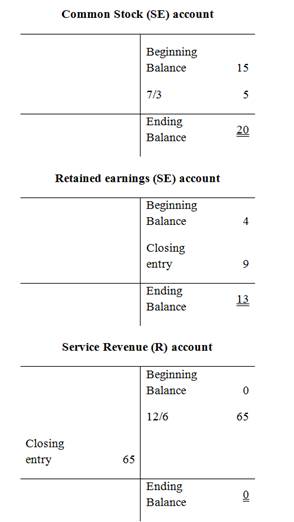

To Prepare: T-accounts for the accounts on the

1.

Explanation of Solution

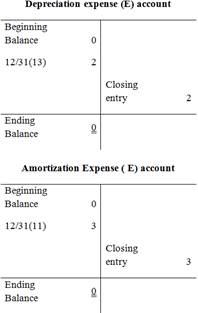

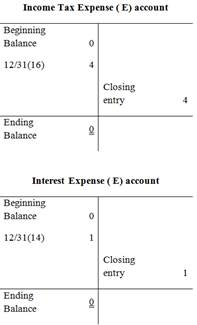

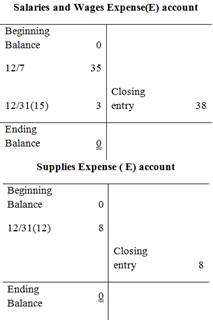

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability,

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

(a)The title of the account

(b)The left or debit side

(c)The right or credit side

Prepare the T-account:

2.

To record:

2.

Explanation of Solution

Journal entries for the transactions (1) to (10) as follows:

| Date | Account Title and Explanation | Debit ($) | Credit ($) | ||

| 1) | Cash (+A) | 21 | |||

| Notes payable (Short-term) (+L) | 21 | ||||

| (To record borrowed cash on note) | |||||

| 2) | Equipment (+A) | 18 | |||

| Cash (-A) | 18 | ||||

| (To record purchase of equipment) | |||||

| 3) | Cash (+A) | 5 | |||

| Common Stock (+SE) | 5 | ||||

| (To record issued common stock for cash) | |||||

| 4) | Equipment (+A) | 3 | |||

| Cash (-A) | 3 | ||||

| (To record Purchase of additional equipment) | |||||

| 5) | Supplies (+A) | 10 | |||

| Accounts payable (+L) | 10 | ||||

| (To record supplies purchased for future use) | |||||

| 6) | Cash (+A) | 56 | |||

| Accounts Receivable (+A) | 9 | ||||

| Service Revenue (+R, +SE) | 65 | ||||

| (To record service revenue earned during the year 2015) | |||||

| 7) | Salaries and Wages Expense (+E, -SE) | 35 | |||

| Cash (-A) | 35 | ||||

| (To record salaries and wages expense incurred during 2015) | |||||

| 8) | Cash (+A) | 8 | |||

| Accounts Receivable (-A) | 8 | ||||

| (To record cash collected on customer’s account) | |||||

| 9) | Accounts payable (-L) | 11 | |||

| Cash (-A) | 11 | ||||

| (To record cash paid to creditors) | |||||

| 10) | Cash (+A) | 3 | |||

| Unearned Revenue (+L) | 3 | ||||

| (To record receiving of customers deposit before doing work) | |||||

Table (1)

3.

To Prepare: An unadjusted trial balance from requirement 2.

3.

Explanation of Solution

| Incorporation L&S | ||

| Unadjusted Trial Balance | ||

| At December 31, 2015 | ||

| (in thousands) | ||

| Account Titles | Debit ($) | Credit ($) |

| Cash | 31 | |

| Accounts Receivable | 5 | |

| Supplies | 12 | |

| Equipment | 27 | |

| 0 | ||

| Software | 12 | |

| Accumulated Amortization | 3 | |

| Accounts Payable | 6 | |

| Notes Payable (short–term) | 21 | |

| Salaries and Wages Payable | 0 | |

| Interest Payable | 0 | |

| Income Tax Payable | 0 | |

| Unearned revenue | 3 | |

| Common Stock | 20 | |

| 4 | ||

| Service Revenue | 65 | |

| Supplies Expense | 0 | |

| Salaries and Wages Expense | 35 | |

| Depreciation Expense | 0 | |

| Amortization Expense | 0 | |

| Interest Expense | 0 | |

| Income Tax Expense | 0 | |

| Total | 122 | 122 |

Table (2)

4.

To record: Adjusting journal entries (11) to (16)

4.

Explanation of Solution

Prepare adjusting journal entries (11) to (16):

| Date | Account Title and Explanation | Debit ($) | Credit ($) | ||

| 11. | Amortization Expense (+E, -SE) | 3 | |||

| Accumulated Amortization (+xA, -A) | 3 | ||||

| (To record |

|||||

| 12. | Supplies expense (+E, -SE) (1) | 8 | |||

| Supplies(-A) | 8 | ||||

| (To record the use of supplies) | |||||

| 13. | 2 | ||||

| Accumulated depreciation –Equipment (+xA, -A) | 2 | ||||

| (To record adjusting entry for depreciation expense) | |||||

| 14. | Interest expense (+E, -SE) | 1 | |||

| Interest payable(+L) | 1 | ||||

| (To record the adjusting entry for interest expense) | |||||

| 15. | Salaries and wages expense (+E, -SE) | 3 | |||

| Salaries and wages payable (+L) | 3 | ||||

| (To record the adjusting entry for salaries and wages expenses) | |||||

| 16. | Income tax expense(+E, -SE) | 4 | |||

| Income tax payable(+L) | 4 | ||||

| (To record the adjusting entry for income tax expense) | |||||

Table (3)

Working notes:

12. Calculation of supplies expenses:

5.

To Prepare: An adjusted trial balance from requirement 4.

5.

Explanation of Solution

Prepare an adjusted trial balance for Incorporation L&S for December 31, 2015:

| Incorporation L&S | ||

| Adjusted Trial Balance | ||

| At December 31, 2015 | ||

| (in thousands) | ||

| Account Titles | Debit ($) | Credit ($) |

| Cash | 31 | |

| Accounts Receivable | 5 | |

| Supplies | 4 | |

| Equipment | 27 | |

| Accumulated Depreciation–Equipment | 2 | |

| Software | 12 | |

| Accumulated Amortization | 6 | |

| Accounts Payable | 6 | |

| Notes Payable (short–term) | 21 | |

| Salaries and Wages Payable | 3 | |

| Interest Payable | 1 | |

| Income Tax Payable | 4 | |

| Unearned revenue | 3 | |

| Common Stock | 20 | |

| Retained Earnings | 4 | |

| Service Revenue | 65 | |

| Supplies Expense | 8 | |

| Salaries and Wages Expense | 38 | |

| Depreciation Expense | 2 | |

| Amortization Expense | 3 | |

| Interest Expense | 1 | |

| Income Tax Expense | 4 | |

| Total | 135 | 135 |

Table (4)

6.

To prepare: An income statement, Statement of retained earnings and balance sheet.

6.

Explanation of Solution

Prepare an income statement for the year ended December 31, 2015:

| Incorporation L&S | ||

| Income Statement | ||

| For the year ended December 31, 2015 | ||

| (in thousands) | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Service revenue | 65 | |

| Total revenues | 65 | |

| Less: Expenses | ||

| Salaries and wage expense | 38 | |

| Supplies expense | 8 | |

| Amortization expense | 3 | |

| Depreciation expense | 2 | |

| Interest expense | 1 | |

| Income tax expense | 4 | |

| Total expenses | 56 | |

| Net income | 9 | |

(2)

Table (5)

Prepare a statement of retained earnings:

| Incorporation L&S | ||

| Statement of Retained Earnings | ||

| For the year ended December 31, 2015 | ||

| (in thousands) | ||

| Particulars | Amount ($) | Amount ($) |

| Balance, January 1, 2015 | 4 | |

| Add: Net income | 9 | |

| 13 | ||

| Less: Dividends | (0) | |

| Balance, December 31, 2015 | 13 | |

Table (6)

Prepare a balance sheet for the year December 31, 2015:

| Incorporation L&S | ||

| Balance Sheet | ||

| At December 31, 2015 | ||

| (in thousands) | ||

| Particulars | Amount($) | Amount($) |

| Assets | ||

| Current Assets: | ||

| Cash | 31 | |

| Accounts Receivable | 5 | |

| Supplies | 4 | |

| Total current assets | 40 | |

| Equipment | 27 | |

| Accumulated Depreciation | (2) | |

| Equipment, net | 25 | |

| Software | 12 | |

| Accumulated amortization | (6) | 6 |

| Total Assets | 71 | |

| Liabilities : | ||

| Current liabilities : | ||

| Accounts Payable | 6 | |

| Notes payable (short-term) | 21 | |

| salaries and wages payable | 3 | |

| Interest payable | 1 | |

| Income Taxes Payable | 4 | |

| Unearned revenue | 3 | |

| Total Current Liabilities | 38 | |

| Stockholders’ Equity | ||

| Common Stock | 20 | |

| Retained Earnings | 13 | |

| Total Stockholders’ Equity | 33 | |

| Total liabilities and stockholders’ equity | 71 |

Table (7)

7.

To prepare: The closing entry for Incorporation L&S on December 31, 2015.

7.

Explanation of Solution

Prepare closing entries for Incorporation L&S on December 31, 2015:

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| December 31, 2015 | Sales revenue(-R) | 65 | |

| Salaries and wages expense(-E) | 38 | ||

| Depreciation expense(-E) | 2 | ||

| Supplies expense(-E) | 8 | ||

| Amortization expense (-E) | 3 | ||

| Income tax expense(-E) | 4 | ||

| Interest expense (-E) | 1 | ||

| Retained earnings(+SE) (2) | 9 | ||

| (To record the closing entries for Incorporation L&S) |

Table (8)

For closing of temporary accounts, the balances of revenues, expenses, and dividend accounts will be transferred to retained earnings in order to bring zero balance for expenses and revenues accounts.

8.

To prepare: Post closing trial balance from the requirement 7.

8.

Explanation of Solution

Prepare a Post-closing trial balance for Incorporation L&S for December 31, 2015:

| Incorporation L&S | ||

| Post-closing Trial Balance | ||

| At December 31, 2015 | ||

| (in thousands) | ||

| Account Titles | Debit ($) | Credit ($) |

| Cash | 31 | |

| Accounts Receivable | 5 | |

| Supplies | 4 | |

| Equipment | 27 | |

| Accumulated Depreciation–Equipment | 2 | |

| Software | 12 | |

| Accumulated Amortization | 6 | |

| Accounts Payable | 6 | |

| Notes Payable (short–term) | 21 | |

| Salaries and Wages Payable | 3 | |

| Interest Payable | 1 | |

| Income Taxes Payable | 4 | |

| Unearned revenue | 3 | |

| Common Stock | 20 | |

| Retained Earnings | 13 | |

| Service Revenue | 0 | |

| Salaries and Wages Expense | 0 | |

| Supplies Expense | 0 | |

| Depreciation Expense | 0 | |

| Amortization expense | 0 | |

| Interest Expense | 0 | |

| Income Tax Expense | 0 | |

| Total | 79 | 79 |

Table (9)

9.

To know: The net income of Incorporation L&S has been generated during 2015 and to explain the company has been financed primarily by liabilities or stockholders’ equity.

9.

Explanation of Solution

The net income of Incorporation L&S for 2015:

Incorporation L&S generated net income in the year 2015 is $9(thousand).

To see whether the Incorporation L&S is financed primarily by liabilities or stockholders’ equity:

The Incorporation L&S is financed primarily by liabilities, where by liabilities provide for $38(thousand) with the total assets and stockholders’ equity provide for $33(thousand).

Want to see more full solutions like this?

Chapter 4 Solutions

Fundamentals of Financial Accounting

- Collection of Amounts Previously Written Off Hannah purchased a laptop computer from Perry Corp. for $1,500. Hannahs receivable has been outstanding for over 180 days, and Perry determines that the total amount is uncollectible and writes off all of Hannahs debt. Hannah later receives a windfall and pays the amount of her balance to Perry Corp. Required: Make the appropriate journal entries (if any) to record the receipt of $450 by Perry Corp.arrow_forwardLavender Company started its business on April 1, 2019. The following are the transactions that happened during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $7,500 from their personal account to the business account. B. Paid rent $600 with check #101. C. Initiated a petty cash fund $250 check #102. D. Received $350 cash for services rendered. E. Purchased office supplies for $125 with check #103. F. Purchased computer equipment $1,500, paid $500 with check #104, and will pay the remainder in 30 days. G. Received $750 cash for services rendered. H. Paid wages $375, check #105. I. Petty cash reimbursement Office Supplies $50, Maintenance Expense $80, Miscellaneous Expense $60. Cash on hand $8. Check #106. J. Increased Petty Cash by $70, check #107.arrow_forwardTasks 8-9. Application. Prepare the journal entries of the transaction below and post them to the necessary ledger books. Write your answer on a separate sheet of paper. Olson Sala Company completed the following sales transactions during the month of June 2015. All credit sales have terms of 3/10, n/30 and all invoices are dated as at the transaction date. June 1 Olson Sala invested Php 52,000 of his funds in the business. 1 Sold merchandise on account to R. Bituin, Php 32,000. Invoice no. 377 Sold merchandise on account to A. Perdales, Php 54,000. Invoice no. 378 3 4 Sold merchandise for cash, Php 46,000. 7. Received payment from R. Bltuin less discounts. Received payment from A. Perdales less discounts. 9. Required: 1. Record the transactions in the general journal. 2. Post to the accounts receivable ledger. 3. Prepare a schedule of accounts receivable.arrow_forward

- Question 1 Catherine’s Cookies has a beginning balance in the Accounts Payable control total account of RO 8,200. In the cash disbursements journal, the Accounts Payable column has total debits of RO 6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of RO10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger? Question 2 Record the following transactions in the cash receipts journal. Jun. 12 Your company received payment in full from Jolie Inc. in the amount of RO1,225 for merchandise purchased on June 4 for RO1,250, invoice number No.1032. Jolie Inc. was offered terms of 2/10, n/30. Record the payment. Jun. 15 Portman Inc. mailed you a check for RO2500. The company paid for invoice No.1027, dated June 1, in the amount of RO2,500, terms offered 3/10, n/30. Jun. 17 Your company received a refund check (its check No.12440) from the State…arrow_forwardRequirement 1 For each of the following transactions make the required entries in the General Journal: (See the General Ledger tab in the workbook Chapter 03 b - Problem 3-1 Forms for the accounts in OPJ’s accounting system.) Feb 01 Take $4,000 cash out of Big Bank to pay for February’s warehouse rent. Feb 04 Sale of inventory to a customer – selling price $62,000 – cost of inventory sold $16,000 – customer paid cash which was deposited in Big Bank. Feb 07 Take $10,000 cash out of Little Bank to pay employees for wages they have earned. Feb 15 Sale of inventory to a customer – selling price $88,000 – cost of inventory sold $22,000 – customer will pay in the future. Feb 18 Sale of inventory to a customer – selling price $110,000 – cost of inventory sold $28,000 – customer pays $40,000 cash which is deposited in Little Bank – customer will pay for the remaining amount of the sale in 30 days. Feb 22 Purchase additional inventory – pay $17,000 cash out of Big Bank for the inventory. Feb 27…arrow_forwardNotes Receivable Crowne Cleaning provides cleaning services for Amber Inc., a business with four buildings. Crowne assigned different cleaning charges for each building based on the amount of square feet to be cleaned. The charges for the four buildings are $87,600, $82,200, $102,000, and $62,400. Amber secured this amount by signing a note bearing 10% interest on June 1. Required: Question Content Area 1. Prepare the journal entry to record the sale on June 1. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select - Question Content Area 2. Determine how much interest Crowne will receive if the note is repaid on December 1.$fill in the blank 59d6dd028fbe01b_1 Question Content Area 3. Prepare Crowne’s journal entry to record the cash received to pay off the note and interest on December 1. If an amount box does not require an entry, leave it blank. blank - Select - - Select…arrow_forward

- nts eBook Print erences For each of the following situation, solve for a missing amount. In each case, there is only one debit entry and one credit entry in the account during the month. Requirement 1: a. Accounts Receivable had a balance of $25,200 at the beginning of the month and $10,600 at the end of the month. Credit sales totaled $90,000 during the month. Calculate the cash collected from customers during the month, assuming that all sales were made on account. Cash collected from customers b. The Supplies account had a balance of $40,000 at the beginning of the month and $49,600 at the end of the month. The cost of supplies used during the month was $157,200. Calculate the cost of supplies purchased during the month. Cost of supplies purchased Farrow_forwardInstruction: From the following partial worksheet of Atty. Villanueva for six-month period ended December 31, 2019, prepare the financial statement in good form. Income Statement Balance Sheet Trial Balance Debit 40,000 50,000 30,000 10,000 20,000 15,000 Credit Debit Credit Debit Credit Cash on Hand Cash in Bank 40,000 50,000 30,000 10,000 20,000 15,000 Accounts Receivable Note Receivable Prepaid Insurance Office Furniture Accounts Payable Notes Payable M. Capital M. Drawing Service Income Salaries Expense Supplies Expense Taxes and Licenses Rent Expense Interest Expense 20,000 10,000 77,000 20,000 10,000 77,000 5,000 5,000 150,000 150,000 36,000 8,000 5,000 24,000 2,000 3,000 36,000 8,000 5,000 24,000 2,000 3,000 Bad Debts Allowance for Bad Debts 3,000 3,000 Depreciation Expense Accumulated Depreciation - Furniture Insurance Expense Unused Supplies Interest Income 1,500 1,500 1,500 1,500 10,000 3,000 10,000 3,000 1,000 262,500 262,500 89,500 151,000 173,000 111,500 Net Income 61,500…arrow_forwardAdriana Graphic Design receives $2,250 from a client billed in a previous month for services provided. Which of the following general journal entries will Adriana Graphic Design make to record this transaction? Multiple Choice Cash 2,250 Accounts Receivable 2,250 Cash 2,250 Unearned Design Revenue 2,250 Accounts Receivable 2,250 Unearned Design Revenue 2,250 Prev 3 of 10 Next > nere to search W P 99% 9:34 PM 2/21/2022arrow_forward

- Requirement 1. Record the transactions for the last quarter of 2022 in the journal. Explanations are not required. (Record debits first, then credits. Exclude explanations from any journal entries.) Wrote off as uncollectible the $1,400 account receivable from Blue Carpets and the $300 account receivable from Show -N- Tell Antiques. Data table Journal Entry Accounts Credit Date Nov Debit 1,700 30 Allowance for Uncollectible Accounts Accounts Receivable and aging schedule to be used at December 31, 2022 Accounts Receivable-Blue Carpets 1,400 Accounts Receivable-Show-N-Tell Antiques 300 Accounts Receivable $235,000 Estimated percent uncollectible Age of Accounts 1-30 Days 31-60 Days 61-90 Days $ 130,000 $ 38,000 $ 14,000 $ 0.2% 2% 15% Adjusted the Allowance for Uncollectible Accounts and recorded doubtful-account expense at year-end, based on the aging of receivables. Journal Entry Date Accounts Debit Credit Dec 31 Print Done Over 90 Days 53,000 35% Xarrow_forwardKnowledge Check 01 On December 31, the company provides consulting services and bills its customer $3,000 for these services. Complete the necessary journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns. View transaction list Journal entry worksheet 1 > On December 31, the company provides consulting services and bills its customer $3,000 for these services. Note: Enter debits before credits. %24 ... *.*.......... 6:1 3/27/ Insert Prt Sc F3 F4 F5 F6 EZ F8 F9 F10 F11 F12 Fn Lockarrow_forwardWeygandt, Accounting Principles, 13th Edition, Custom WileyPLUS Course for Bronx Community College Help I System Announcements CALCULATOR PRINTER VERSION 4 ВАСК NEX Exercise 9-04 a-f (Part Level Submission) At the beginning of the current period, Cheyenne had balances in Accounts Receivable of $286,000 and in Allowance for Doubtful Accounts of $9,900 (credit). During the period, had net credit sales of $890,000 and collections of $845,500. It wrote off as uncollectible accounts receivable of $6,000. However, a $4,000 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $24,800 at the end of the period. (Omit cost of goods sold entries. (a - d) (a) Prepare the entries to record sales and collections during the period. (b) Prepare the entry to record the write-off of uncollectible accounts during the period. (c) Prepare the entries to record the recovery of the uncollectible account during the…arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning  Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,