Concept explainers

1,3, 5 and 8

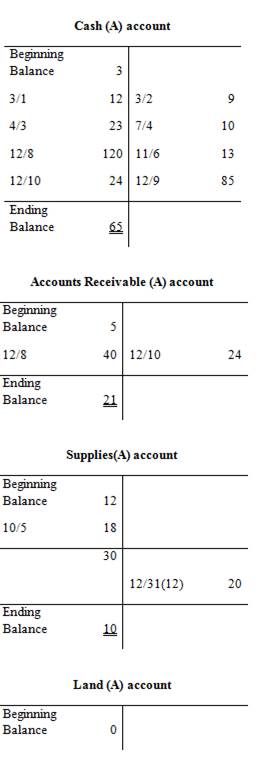

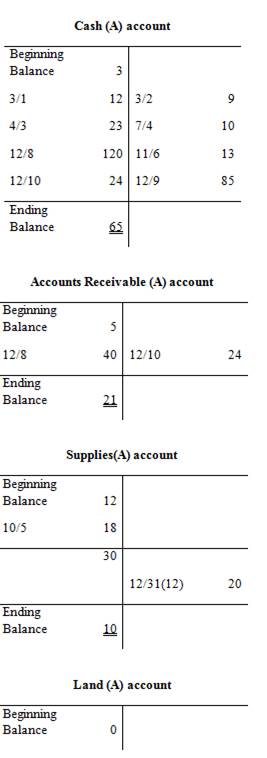

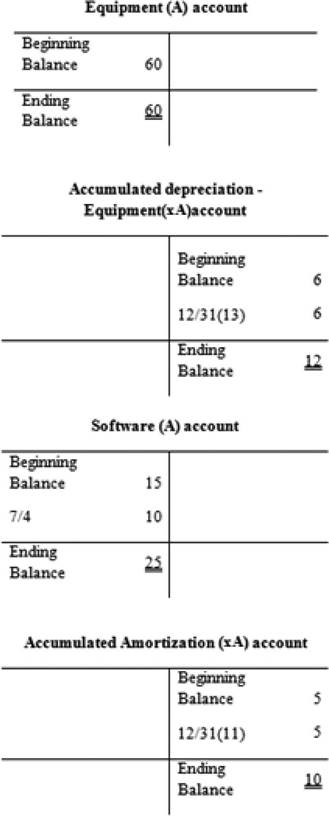

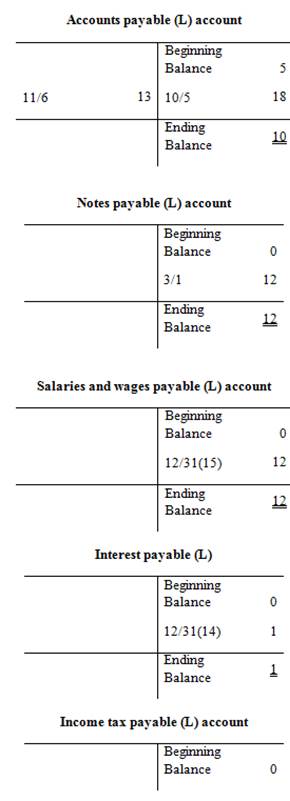

To Prepare: T-accounts for the accounts on the

1,3, 5 and 8

Explanation of Solution

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability,

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

(a)The title of the account

(b)The left or debit side

(c)The right or credit side

Prepare the T-account:

2.

To record:

2.

Explanation of Solution

Journal entries for the transactions (1) to (10) as follows:

| Date | Account Title and Explanation | Debit ($) | Credit ($) | ||

| 1) | Cash (+A) | 12 | |||

| Notes payable (Short-term) (+L) | 12 | ||||

| (To record borrowed cash on note) | |||||

| 2) | Land (+A) | 9 | |||

| Cash (-A) | 9 | ||||

| (To record purchase of land for building site) | |||||

| 3) | Cash (+A) | 23 | |||

| Common Stock (+SE) | 23 | ||||

| (To record issued common stock for cash) | |||||

| 4) | Software (+A) | 10 | |||

| Cash (-A) | 10 | ||||

| (To record Purchase of additional software) | |||||

| 5) | Supplies (+A) | 18 | |||

| Accounts payable (+L) | 18 | ||||

| (To record supplies purchased for future use) | |||||

| 6) | Accounts payable (-L) | 13 | |||

| Cash (-A) | 13 | ||||

| (To record cash paid to creditors) | |||||

| 7) | No entry required, Because no revenue has been earned in 2015 | ||||

| 8) | Cash (+A) | 120 | |||

| Accounts Receivable (+A) | 40 | ||||

| Service Revenue (+R, +SE) | 160 | ||||

| (To record service revenue earned during the year 2015) | |||||

| 9) | Salaries and Wages Expense (+E, -SE) | 85 | |||

| Cash (-A) | 85 | ||||

| (To record salaries and wages expense incurred during 2015) | |||||

| 10) | Cash (+A) | 24 | |||

| Accounts Receivable (-A) | 24 | ||||

| (To record cash collected on customer’s account) | |||||

Table (1)

3.

To Prepare: An unadjusted trial balance from requirement 2.

3.

Explanation of Solution

| Incorporation H&H | ||

| Unadjusted Trial Balance | ||

| At December 31, 2015 | ||

| (in thousands) | ||

| Account Titles | Debit ($) | Credit ($) |

| Cash | 65 | |

| Accounts Receivable | 21 | |

| Supplies | 30 | |

| Land | 9 | |

| Equipment | 60 | |

| 6 | ||

| Software | 25 | |

| Accumulated Amortization | 5 | |

| Accounts Payable | 10 | |

| Notes Payable (short–term) | 12 | |

| Salaries and Wages Payable | ||

| Interest Payable | ||

| Income Taxes Payable | ||

| Common Stock | 94 | |

| Retained Earnings | 8 | |

| Service Revenue | 160 | |

| Salaries and Wages Expense | 85 | |

| Supplies Expense | ||

| Depreciation Expense | ||

| Interest Expense | ||

| Income Tax Expense | ||

| Total | 295 | 295 |

Table (2)

4.

To record: Adjusting journal entries (11) to (16)

4.

Explanation of Solution

Prepare adjusting journal entries (11) to (16):

| Date | Account Title and Explanation | Debit ($) | Credit ($) | ||

| 11. | Amortization Expense (+E, -SE) | 5 | |||

| Accumulated Amortization (+xA, -A) | 5 | ||||

| (To record |

|||||

| 12. | Supplies expense (+E, -SE) (1) | 20 | |||

| Supplies(-A) | 20 | ||||

| (To record the use of supplies) | |||||

| 13. | 6 | ||||

| Accumulated depreciation –Equipment (+xA, -A) | 6 | ||||

| (To record adjusting entry for depreciation expense) | |||||

| 14. | Interest expense (+E, -SE) | 1 | |||

| Interest payable(+L) | 1 | ||||

| (To record the adjusting entry for interest expense) | |||||

| 15. | Salaries and wages expense (+E, -SE) | 12 | |||

| Salaries and wages payable (+L) | 12 | ||||

| (To record the adjusting entry for salaries and wages expenses) | |||||

| 16. | Income tax expense(+E, -SE) | 8 | |||

| Income tax payable(+L) | 8 | ||||

| (To record the adjusting entry for income tax expense) | |||||

Table (3)

Working notes:

12. Calculation of supplies expenses:

5.

To Prepare: An adjusted trial balance from requirement 4.

5.

Explanation of Solution

Prepare an adjusted trial balance for Incorporation H&H for December 31, 2015:

| Incorporation H&H | ||

| Adjusted Trial Balance | ||

| At December 31, 2015 | ||

| (in thousands) | ||

| Account Titles | Debit ($) | Credit ($) |

| Cash | 65 | |

| Accounts Receivable | 21 | |

| Supplies | 10 | |

| Land | 9 | |

| Equipment | 60 | |

| Accumulated Depreciation–Equipment | 12 | |

| Software | 25 | |

| Accumulated Amortization | 10 | |

| Accounts Payable | 10 | |

| Notes Payable (short–term) | 12 | |

| Salaries and Wages Payable | 12 | |

| Interest Payable | 1 | |

| Income Taxes Payable | 8 | |

| Common Stock | 94 | |

| Retained Earnings | 8 | |

| Service Revenue | 160 | |

| Salaries and Wages Expense | 97 | |

| Supplies Expense | 20 | |

| Depreciation Expense | 6 | |

| Amortization expense | 5 | |

| Interest Expense | 1 | |

| Income Tax Expense | 8 | |

| Total | 327 | 327 |

Table (4)

6.

To prepare: An income statement, Statement of retained earnings and balance sheet.

6.

Explanation of Solution

Prepare an income statement for the year ended December 31, 2015:

| Incorporation H&H | ||

| Income Statement | ||

| For the year ended December 31, 2015 | ||

| (in thousands) | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Service revenue | 160 | |

| Total revenues | 160 | |

| Less: Expenses | ||

| Salaries and wage expense | 97 | |

| Supplies expense | 20 | |

| Depreciation expense | 6 | |

| Amortization expense | 5 | |

| Interest expense | 1 | |

| Income tax expense | 8 | |

| Total expenses | 137 | |

| Net income | 23 | |

(2)

Table (5)

Prepare a statement of retained earnings:

| Incorporation H&H | ||

| Statement of Retained Earnings | ||

| For the year ended December 31, 2015 | ||

| (in thousands) | ||

| Particulars | Amount ($) | Amount ($) |

| Balance, January 1, 2015 | 8 | |

| Add: Net income | 23 | |

| 31 | ||

| Less: Dividends | (0) | |

| Balance, December 31, 2015 | 31 | |

Table (6)

Prepare a balance sheet for the year December 31, 2015:

| Incorporation H&H | ||

| Balance Sheet | ||

| At December 31, 2015 | ||

| (in thousands) | ||

| Particulars | Amount($) | Amount($) |

| Assets | ||

| Current Assets: | ||

| Cash | 65 | |

| Accounts Receivable | 21 | |

| Supplies | 10 | |

| Total current assets | 96 | |

| Land | 9 | |

| Equipment | 60 | |

| Accumulated Depreciation | (12) | |

| Equipment, net | 48 | |

| Software | 25 | |

| Accumulated amortization | (10) | 15 |

| Total Assets | 168 | |

| Liabilities : | ||

| Current liabilities : | ||

| Accounts Payable | 10 | |

| Notes payable (short-term) | 12 | |

| salaries and wages payable | 12 | |

| Interest payable | 1 | |

| Income Taxes Payable | 8 | |

| Total Current Liabilities | 43 | |

| Stockholders’ Equity | ||

| Common Stock | 94 | |

| Retained Earnings | 31 | |

| Total Stockholders’ Equity | 125 | |

| Total liabilities and stockholders’ equity | 168 |

Table (7)

7.

To prepare: The closing entry for Incorporation H&H on December 31, 2015.

7.

Explanation of Solution

Prepare closing entries for Incorporation H&H on December 31, 2015:

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| December 31, 2015 | Sales revenue(-R) | 160 | |

| Salaries and wages expense(-E) | 97 | ||

| Depreciation expense(-E) | 6 | ||

| Supplies expense(-E) | 20 | ||

| Amortization expense (-E) | 5 | ||

| Income tax expense(-E) | 8 | ||

| Interest expense (-E) | 1 | ||

| Retained earnings(+SE) (2) | 23 | ||

| (To record the closing entries for Incorporation H&H) |

Table (8)

For closing of temporary accounts, the balances of revenues, expenses, and dividend accounts will be transferred to retained earnings in order to bring zero balance for expenses and revenues accounts.

8.

To prepare: Post closing trial balance from the requirement 7.

8.

Explanation of Solution

Prepare a Post-closing trial balance for Incorporation H&H for December 31, 2015:

| Incorporation H&H | ||

| Post-closing Trial Balance | ||

| At December 31, 2015 | ||

| (in thousands) | ||

| Account Titles | Debit ($) | Credit ($) |

| Cash | 65 | |

| Accounts Receivable | 21 | |

| Supplies | 10 | |

| Land | 9 | |

| Equipment | 60 | |

| Accumulated Depreciation–Equipment | 12 | |

| Software | 25 | |

| Accumulated Amortization | 10 | |

| Accounts Payable | 10 | |

| Notes Payable (short–term) | 12 | |

| Salaries and Wages Payable | 12 | |

| Interest Payable | 1 | |

| Income Taxes Payable | 8 | |

| Common Stock | 94 | |

| Retained Earnings | 31 | |

| Dividends | 0 | |

| Service Revenue | 0 | |

| Salaries and Wages Expense | 0 | |

| Supplies Expense | 0 | |

| Depreciation Expense | 0 | |

| Amortization expense | 0 | |

| Interest Expense | 0 | |

| Income Tax Expense | 0 | |

| Total | 190 | 190 |

Table (9)

9.

To know: The net income of Incorporation H&H has been generated during 2015 and to determine the net profit margin and to explain the company has been financed primarily by liabilities or stockholders’ equity and to find the

9.

Explanation of Solution

The net income of Incorporation H&H for 2015:

Incorporation H&H generated net income in the year 2015 is $23(thousand).

Calculation of net profit margin:

The net profit margin of Incorporation H&H is 14.4%.

To see whether the Incorporation H&H is financed primarily by liabilities or stockholders’ equity:

The Incorporation H&H is financed primarily by stockholders’ equity, where by providing stockholders’ equity for $125(thousand) with the total assets and liabilities providing for $43(thousand).

Calculation of current ratio:

The current ratio is 2.23:1.

Want to see more full solutions like this?

Chapter 4 Solutions

Fundamentals of Financial Accounting

- Collection of Amounts Previously Written Off Hannah purchased a laptop computer from Perry Corp. for $1,500. Hannahs receivable has been outstanding for over 180 days, and Perry determines that the total amount is uncollectible and writes off all of Hannahs debt. Hannah later receives a windfall and pays the amount of her balance to Perry Corp. Required: Make the appropriate journal entries (if any) to record the receipt of $450 by Perry Corp.arrow_forwardRecord the following transactions for Concord Co. in the general journal. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) 2020 May 1 Received a $33,000, 12 months, 10% note in exchange for Mark Chamber’s outstanding accounts receivable. Dec. 31 Accrued interest on the Chamber note. Dec. 31 Closed the interest revenue account. 2021 May 1 Received principal plus interest on the Chamber note. (No interest has been accrued in 2021.) Date Account Titles and Explanation Debit Credit May 1, 2020Dec. 31, 2020May 1, 2021 May 1, 2020Dec. 31, 2020May 1, 2021 (To record accrued interest on note.) May 1, 2020Dec. 31, 2020May 1, 2021 (To close the…arrow_forwardOn June 1, Crane Company Ltd. borrows $66,000 from Acme Bank on a 6-month, $66,000, 8% note. The note matures on December 1. Prepare the entry on June 1. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit June 1 enter an account title for the entry on June 1 enter a debit amount enter a credit amount enter an account title for the entry on June 1 enter a debit amount enter a credit amount eTextbook and Media List of Accounts Prepare the adjusting entry on June 30. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit June 30 enter an account title for the adjusting entry on June 30 enter a debit amount enter a credit amount enter an account title for…arrow_forward

- Prepare journal entries without explanations for the following transactions involving notes payable for Wilson Company, whose fiscal year ends December 31. Show all necessary calculations. Question 1 of 3 On December 1, 2014, the company borrowed cash for a 4 month, 8 percent, $21,000 note payable. Account Names DR CR Show any necessary calculationsarrow_forwardMonty Corp. borrows $68,400 on July 1 from the bank by signing a $68,400, 8%, 1-year note payable.(a)Prepare the journal entry to record the proceeds of the note. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit July 1 enter an account title to record the proceeds of the note on July 1 enter a debit amount enter a credit amount enter an account title to record the proceeds of the note on July 1 enter a debit amount enter a credit amount (b)Prepare the journal entry to record the accrued interest at December 31, assuming adjusting entries are made only at the end of the year. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 enter an account title to record the accrued interest on December 31 enter a debit amount enter a credit…arrow_forwardThe following information has been presented to you for 2018 by Wonder Projects Limited: September October November Rand Rand Rand Cash revenue 200 000 220 000 240 000 Credit revenue 120 000 180 000 190 000 Purchases (all credit) 130 000 140 000 120 000 Additional information: Collection of credit revenue: 50% in the month of invoice 30% one month after invoice 15% two months after invoice and the balance written off as irrecoverable. Purchases are on credit and are paid for one month after the purchase, less 5% Rent income amounts to R10 000 per The rent will increase by 8% on 1 October 2018. A fixed deposit of R150 000 will mature on 31 October 2018. Interest of R15 000 will also be received on this A new computer will be purchased on 3 September 2018 for R25 000 Salaries amount to R20 000 per A 10% increase will take effect on 1 October 2018. The owner is expected to take R5 000 cash from the business on 20 October…arrow_forward

- Given the following transaction of entrepreneur ark, what journal entries would you make as its accountant, to book the followig transaction? a June 23. Received a 52,000, 90 day, 8% note date 23 from BEDA express account sept 11 the note is dishonoed by BEDA Oct 2 Received the amount due on the dishonored note plus interest for 30 days at 10% on the total amount charged to BEDA express on september 21arrow_forwardJournalize the selected transactions. Assume 360 days per year. Description choices are: Accounts Payable, Cash, Merchandise Inventory, No Entry Required, Purchases. If no entry is required, select "No Entry Required" from the dropdown and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. June 2: Received a 60-day, 8% note for $180,000 on the Ryanair account. Description Debit Credit Aug. 1: Received amount owed on June 2 note plus interest at the maturity date. Description Debit Credit Aug. 24: Received $7,600 on the Finley account and wrote off the remainder owed on a $9,000 accounts receivable balance. (The allowance method is used in accounting for uncollectible receivables.) Description Debit Credit Sept. 15: Reinstated the Finley account written off on August 24 and received $1,400 cash in full payment. Description Debit Credit…arrow_forwardCurrent Attempt in Progress At December 1, 2022, Tamarisk, Inc. Accounts Receivable balance was $17470. During December, Tamarisk had credit sales of $46800 and collected accounts receivable of $37440. At December 31, 2022, the Accounts Receivable balance is O $64270 debit O $17470 debit O $26830 credit O $26830 debit Save for Later Attempts: 0 of 1 used Submit Answerarrow_forward

- On March 4, Micro Sales makes $10,500 in sales on bank credit cards that charge a 2% service charge and deposits the funds into Micro Sales' bank accounts at the end of the business day. Required: Journalize the sales and recognition of expense as a single journal entry. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to two decimal places.arrow_forwardconverted a $5,000 Accounts payable with a Notes payable on December 1, 2015. The note is a 60 day note with an interest rate of 4%. What is included in the year end journal entry? O a. O b. Oc. d Debit to interest expense for $33 Credit to interest payable for $200 Credit to notes payable of $5,000 Debit to interest expense for $17arrow_forwardOn February 33, the billing date, Carol Ann Bluesky had a balance due of $122.39122.39 on her credit card. Her bank charges an interest rate of 1.25% per month and uses the average daily balance method. She made the transactions described in the table during the month. Feb. 88 Charge: Art supplies $21.2721.27 Feb. 1212 Payment $90.0090.00 Feb. 2323 Charge: Flowers delivered $62.5462.54 Feb. 2525 Charge: Music CD $10.9210.92 a) Find Carol Ann's average daily balance for the billing period from February 33 to March 33. Assume it is not a leap year. b) Find the finance charge to be paid on March 33. c) Find the balance due on March 33. d) Compare the result obtained to those obtained using the previous balance method. Question content area bottom Part 1 a) The average daily balance for the billing period was $enter your response here. (Round to the nearest cent as needed.)arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning