Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 13.24E

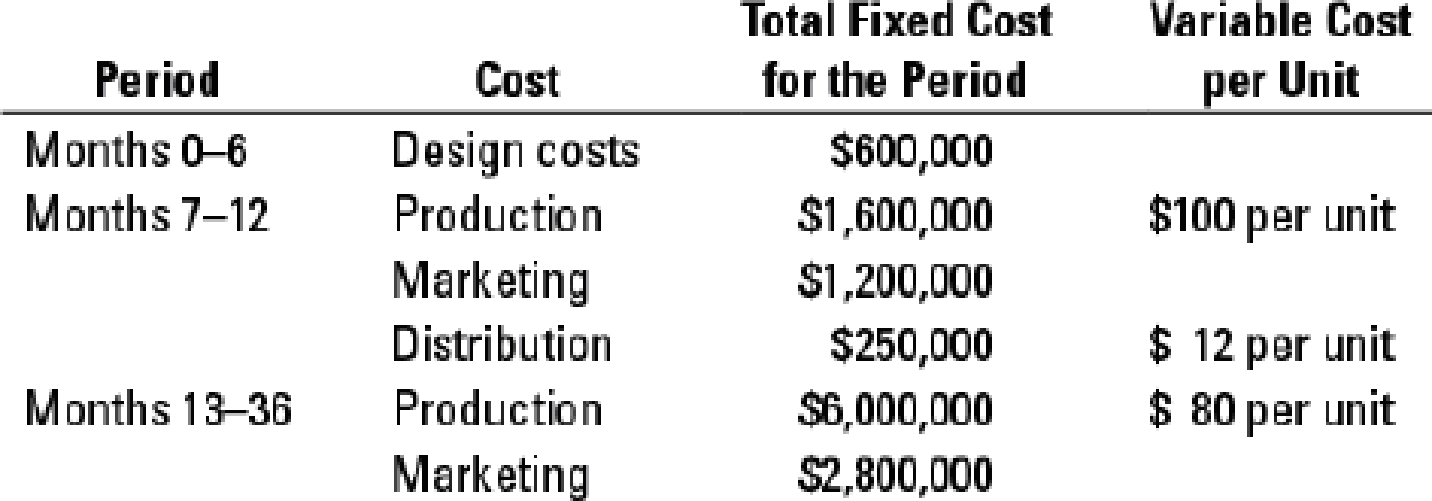

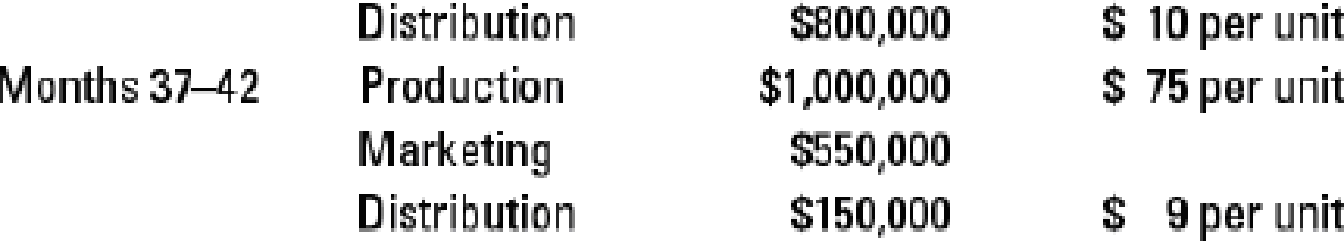

Life-cycle budgeting and costing. Arnold Manufacturing, Inc., plans to develop a new industrial-powered vacuum cleaner for household use that runs exclusively on rechargeable batteries. The product will take 6 months to design and test. The company expects the vacuum sweeper to sell 12,000 units during the first 6 months of sales; 24,000 units per year over the following 2 years; and 10,000 units over the final 6 months of the product’s life cycle. The company expects the following costs:

Ignore the time value of money.

- 1. If Arnold prices the sweepers at $400 each, how much operating income will the company make over the product’s life cycle? What is the operating income per unit? Required

- 2. Excluding the initial product design costs, what is the operating income in each of the three sales phases of the product’s life cycle, assuming the price stays at $400?

- 3. How would you explain the change in budgeted operating income over the product’s life cycle? What other factors does the company need to consider before developing the new vacuum sweeper?

- 4. Arnold is concerned about the operating income it will report in the first sales phase. It is considering pricing the vacuum sweeper at $450 for the first 6 months and decreasing the price to $400 thereafter. With this pricing strategy, Arnold expects to sell 10,000 units instead of 12,000 units in the first 6 months, and the same number of units for the remaining life cycle. Assuming the same cost structure given in the problem, which pricing strategy would you recommend? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Life-cycle budgeting and costing. Arnold Manufacturing, Inc., plans to develop a new industrialpowered vacuum cleaner for household use that runs exclusively on rechargeable batteries. The product will take 6 months to design and test. The company expects the vacuum sweeper to sell 12,000 units during the rst 6 months of sales; 24,000 units per year over the following 2 years; and 10,000 units over the nal 6 months of the product’s life cycle. The company expects the following costs:

Acme Manufacturing produces high quality metal storage cabinets residential garages. Each cabinet is raised off the floor by 4 heavy duty casters, allowing the cabinets to be moved

when fully loaded. Acme budgets to produce 10,000 cabinets per quarter for the next year. If Acme begins the year with 1,200 casters in inventory and desires to have sufficient casters

available to meet 5% of the next quarter's production needs at the end of each quarter, how many casters will Acme need to purchase for the first quarter's production?

Select one:

O

O

O

O

a. 39,300

b. 36,800

c. 43,200

d. 40,800

Create a budget for the following project: Blazer Company plans on purchasing new equipment to retool its manufacturing process. The project will involve the acquisition of equipment, installation of the new equipment, selling off the old equipment and training the workforce on the new equipment and processes. Blazer expects this project to take two years from beginning to end. Costs and expected income for the project are as shown below.

Your task is to create a two-year cash budget for the project and compute a return on investment (ROI) for the project. You may ignore the time value of money in your calculation. You may make reasonable assumptions to complete this problem so long as you document them.

Facts: a. The equipment to be purchased will cost $455,000. The equipment will be purchased and paid for at the beginning of Year 1.

b. Installation cost will be $55,000.

c. Blazer will purchase a maintenance contract for the equipment. The first year of maintenance is included in the…

Chapter 13 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 13 - What are the three major influences on pricing...Ch. 13 - Relevant costs for pricing decisions are full...Ch. 13 - Describe four purposes of cost allocation.Ch. 13 - How is activity-based costing useful for pricing...Ch. 13 - Describe two alternative approaches to long-run...Ch. 13 - What is a target cost per unit?Ch. 13 - Describe value engineering and its role in target...Ch. 13 - Give two examples of a value-added cost and two...Ch. 13 - It is not important for a company to distinguish...Ch. 13 - Prob. 13.10Q

Ch. 13 - Describe three alternative cost-plus pricing...Ch. 13 - Give two examples in which the difference in the...Ch. 13 - What is life-cycle budgeting?Ch. 13 - What are three benefits of using a product...Ch. 13 - Prob. 13.15QCh. 13 - Which of the following statements regarding price...Ch. 13 - Value-added, non-value-added costs. The Magill...Ch. 13 - Target operating income, value-added costs,...Ch. 13 - Target prices, target costs, activity-based...Ch. 13 - Target costs, effect of product-design changes on...Ch. 13 - Target costs, effect of process-design changes on...Ch. 13 - Cost-plus target return on investment pricing....Ch. 13 - Cost-plus, target pricing, working backward....Ch. 13 - Life-cycle budgeting and costing. Arnold...Ch. 13 - Considerations other than cost in pricing...Ch. 13 - Cost-plus, target pricing, working backward. The...Ch. 13 - Value engineering, target pricing, and target...Ch. 13 - Target service costs, value engineering,...Ch. 13 - Cost-plus, target return on investment pricing....Ch. 13 - Cost-plus, time and materials, ethics. C S...Ch. 13 - Cost-plus and market-based pricing. Georgia Temps,...Ch. 13 - Cost-plus and market-based pricing. (CMA, adapted)...Ch. 13 - Life-cycle costing. Maximum Metal Recycling and...Ch. 13 - Airline pricing, considerations other than cost in...Ch. 13 - Prob. 13.35PCh. 13 - Ethics and pricing. Instyle Interior Designs has...Ch. 13 - Value engineering, target pricing, and locked-in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Teletronics is going to introduce a combination phone/tablet product. Design and testing will take 8 months. Teletronics expects to sell 24,000 units during the first 6 months of sales. Sales over the next 12 months are expected to be less robust at 20,000. And, sales in the final 6 months of the expected life cycle are expected to be 9,000. Teletronics is budgeting for this product as follows: LOADING... (Click the icon to view the cost information.) Read the requirements LOADING... . Requirement 1. If Teletronics prices the phone/tablets at $280 each, how much operating income will the company make over the product's life cycle? What is the operating income per unit? Begin by preparing the life cycle income statement in order to determine how much operating income the company will make over the product's life cycle. Projected Life Cycle Income Statement Revenues Variable costs: Months 9-14 Months 15-26…arrow_forwardPrepare a production budget for the first four months of the year. Cloud Shoes manufactures recovery sandals and is planning on producing 12,000 units in March and 11,500 in April. Each sandal requires 1.2 yards if material, which costs $3.00 per yard. The company’s policy is to have enough material on hand to equal 15% of next month’s production needs and to maintain a finished goods inventory equal to 20% of the next month’s production needs. What is the budgeted cost of purchases for March?arrow_forwardLife-cycle budgeting and costing. Arnold Manufacturing, Inc., plans to develop a new industrialpowered vacuum cleaner for household use that runs exclusively on rechargeable batteries. The product will take 6 months to design and test. The company expects the vacuum sweeper to sell 12,000 units during the first 6 months of sales; 24,000 units per year over the following 2 years; and 10,000 units over the final 6 months of the product’s life cycle. The company expects the following costs:arrow_forward

- Sunset Motors, Inc., makes small motors for appliances and other uses. The company develops plans using an annual budgeting cycle. For next year, the production budget is 88,000 units. Inventories are expected to decrease by 5,000 units. Required: What is the sales budget for the coming year? Sales budget in unitsarrow_forwardEliot Sprinkler Systems produces equipment for lawn irrigation. One of the parts used in selected Eliot equipment is a specialty nozzle. The budgeting team is now determining the purchase requirements and monthly cash disbursements for this part. Eliot wishes to have in stock enough nozzles to use for the coming month. On August 1, the company has 17,100 nozzles in stock, although the latest estimate for August production indicates a requirement for only 15,600 nozzles. Total uses of the nozzle are expected to be 15,300 in September and 16,140 in October. Nozzles are purchased at a wholesale price of $11. Eliot pays 25 percent of the purchase price in cash in the month when the parts are delivered. The remaining 75 percent is paid in the following month. Eliot purchased 24,000 parts in July. Required: a. Estimate purchases of the nozzle (in units) for August and September. b. Estimate the cash disbursements for nozzles in August and September. Complete this question by entering your…arrow_forwardVaughn Chemicals has developed a new window cleaner that requires two ingredients, AM972 and CA38. Based on forecasted sales, Vaughn has developed the following budgeted production for the coming year. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 1st QuarterNext Year Forecasted production (gallons) 5,000 7,000 9,000 12,500 6,000 Each gallon of window cleaner requires 100 ounces of AM972 and 28 ounces of CA38. An ounce of AM972 costs Vaughn $0.15. An ounce of CA38 costs the company $0.25. Vaughn's inventory policy requires ending inventory equal to 20% of the next quarter's production needs. At the beginning of the year, Vaughn expects to have 80,000 ounces of AM972 and 30,000 ounces of CA38 on hand.Prepare Vaughn's AM972 purchases budget for the coming year. (Enter price per ounce to 2 decimal places, e.g. 0.35.) 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Annual select an opening purchase…arrow_forward

- Blossom's Recording Studio rents studio time to musicians in two-hour blocks. Each session includes the use of the studio facilities, a digital recording of the performance, and a professional music producer/mixer. Anticipated annual volume is 1,000 sessions. The company has invested $1,963,500 in the studio and expects a return on investment of 20%. Budgeted costs for the coming year are as follows: Per Session Total Direct materials (tapes, CDs, etc.) $20 Direct labour. 380 Variable overhead 40 Fixed overhead $925,000 Variable selling and administrative expenses 30 Fixed selling and administrative expenses 475,000arrow_forwardGrouper's Recording Studio rents studio time to musicians in 2-hour blocks. Each session includes the use of the studio facilities, a digital recording of the performance, and a professional music producer/mixer. Anticipated annual volume is 1,020 sessions. The company has invested $2,299,080 in the studio and expects a return on investment (ROI) of 20%. Budgeted costs for the coming year are as follows. Direct materials (CDs, etc.) Direct labor Variable overhead Fixed overhead Variable selling and administrative expenses $40 Fixed selling and administrative expenses (a) Per Session $20 $395 $45 Your Answer Correct Answer Total $974,100 $515,100arrow_forwardEliot Sprinkler Systems produces equipment for lawn irrigation. One of the parts used in selected Eliot equipment is a specialty nozzle. The budgeting team is now determining the purchase requirements and monthly cash disbursements for this part. Eliot wishes to have in stock enough nozzles to use for the coming month. On August 1, the company has 16,800 nozzles in stock, although the latest estimate for August production indicates a requirement for only 15,000 nozzles. Total uses of the nozzle are expected to be 14,700 in September and 15,540 in October. Nozzles are purchased at a wholesale price of $8. Eliot pays 25 percent of the purchase price in cash in the month when the parts are delivered. The remaining 75 percent is paid in the following month. Eliot purchased 21,000 parts in July. Required: a. Estimate purchases of the nozzle (in units) for August and September. b. Estimate the cash disbursements for nozzles in August and September.arrow_forward

- Jacinda Ardern makes and sells fencing panels. She is setting her budgets for the coming year. Her budgeted selling price for her fencing panels is $20 and she expects to sell 1,000 panels in June. Her budgeted raw material cost for each fencing panel is $6 and direct labour is $4 per panel. New machinery costing $7,500 is budgeted for purchase in May. The new machinery is expected to last for 5 years and have a resale value of $600 after 5 years. Jacinda depreciates her property, plant and equipment on the straight line basis. Administration overheads for June are budgeted to be $1,000. What is Jacinda's budgeted net profit for June? $8,875 $8,885 $9,000 $9,885arrow_forwardDastan Products makes digital watches. Dastan is preparing a product-life-cycle budget for a new watch, SPR21. Development of new watch is to start shortly. Estimates for SPR21 are as follows: Life-cycle units manufactured and sold 400,000 Selling price per watch $ 40 Life-cycle costs R&D and design $ 1,000,000 Manufacturing Variable cost per watch $ 15 Variable cost per batch $ 600 Watches per batch 500 Fixed costs $ 1,800,000 Marketing Variable cost per watch $ 3.20 Fixed costs $ 1,000,000 Distribution Variable cost per batch $ 280 Watches per batch 160 Fixed costs $ 720,000 Customer-service cost per watch $1.50 Calculate the budgeted life-cycle operating income for the new watch What percentage of the budgeted total product life-cycle costs will be incurred by the end of the R&D and design stages? An analysis reveals that 80% of the budgeted total product…arrow_forwardEliot Sprinkler Systems produces equipment for lawn irrigation. One of the parts used in selected Eliot equipment is a specialty nozzle. The budgeting team is now determining the purchase requirements and monthly cash disbursements for this part. Eliot wishes to have in stock enough nozzles to use for the coming month. On August 1, the company has 17,300 nozzles in stock, although the latest estimate for August production indicates a requirement for only 16,000 nozzles. Total uses of the nozzle are expected to be 15,700 in September and 16,540 in October. Nozzles are purchased at a wholesale price of $13. Eliot pays 25 percent of the purchase price in cash in the month when the parts are delivered. The remaining 75 percent is paid in the following month. Eliot purchased 26,000 parts in July. Required: a. Estimate purchases of the nozzle (in units) for August and September. b. Estimate the cash disbursements for nozzles in August and September. Complete this question by entering your…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY