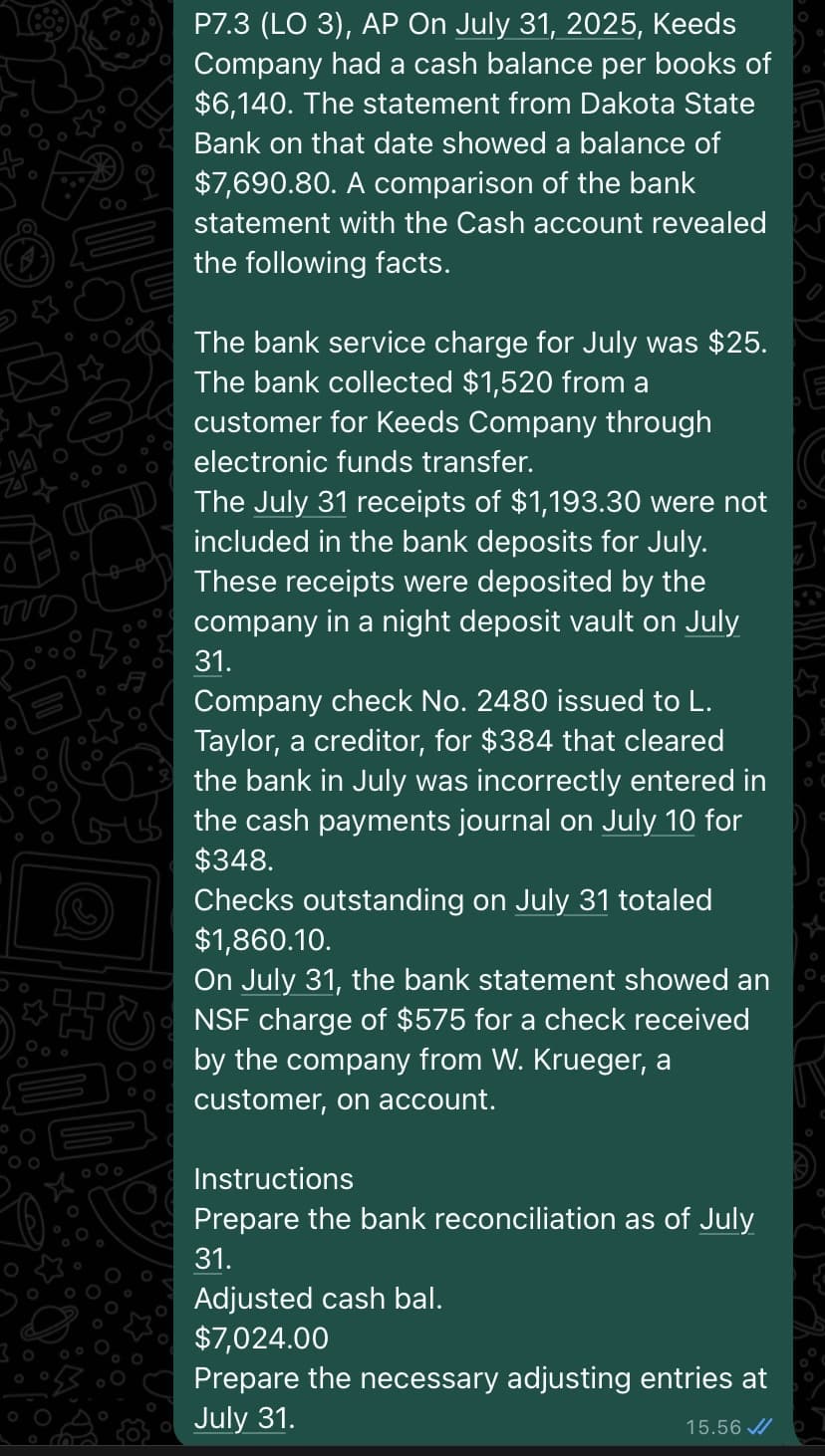

www O 0 P7.3 (LO 3), AP On July 31, 2025, Keeds Company had a cash balance per books of $6,140. The statement from Dakota State Bank on that date showed a balance of $7,690.80. A comparison of the bank statement with the Cash account revealed the following facts. The bank service charge for July was $25. The bank collected $1,520 from a customer for Keeds Company through electronic funds transfer. The July 31 receipts of $1,193.30 were not included in the bank deposits for July. These receipts were deposited by the company in a night deposit vault on July 31. Company check No. 2480 issued to L. Taylor, a creditor, for $384 that cleared the bank in July was incorrectly entered in the cash payments journal on July 10 for $348. Checks outstanding on July 31 totaled $1,860.10. On July 31, the bank statement showed an NSF charge of $575 for a check received by the company from W. Krueger, a customer, on account. Instructions Prepare the bank reconciliation as of July 31. Adjusted cash bal. $7,024.00 Prepare the necessary adjusting entries at July 31. 15.56

www O 0 P7.3 (LO 3), AP On July 31, 2025, Keeds Company had a cash balance per books of $6,140. The statement from Dakota State Bank on that date showed a balance of $7,690.80. A comparison of the bank statement with the Cash account revealed the following facts. The bank service charge for July was $25. The bank collected $1,520 from a customer for Keeds Company through electronic funds transfer. The July 31 receipts of $1,193.30 were not included in the bank deposits for July. These receipts were deposited by the company in a night deposit vault on July 31. Company check No. 2480 issued to L. Taylor, a creditor, for $384 that cleared the bank in July was incorrectly entered in the cash payments journal on July 10 for $348. Checks outstanding on July 31 totaled $1,860.10. On July 31, the bank statement showed an NSF charge of $575 for a check received by the company from W. Krueger, a customer, on account. Instructions Prepare the bank reconciliation as of July 31. Adjusted cash bal. $7,024.00 Prepare the necessary adjusting entries at July 31. 15.56

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 5E

Related questions

Question

Transcribed Image Text:www

O

0

P7.3 (LO 3), AP On July 31, 2025, Keeds

Company had a cash balance per books of

$6,140. The statement from Dakota State

Bank on that date showed a balance of

$7,690.80. A comparison of the bank

statement with the Cash account revealed

the following facts.

The bank service charge for July was $25.

The bank collected $1,520 from a

customer for Keeds Company through

electronic funds transfer.

The July 31 receipts of $1,193.30 were not

included in the bank deposits for July.

These receipts were deposited by the

company in a night deposit vault on July

31.

Company check No. 2480 issued to L.

Taylor, a creditor, for $384 that cleared

the bank in July was incorrectly entered in

the cash payments journal on July 10 for

$348.

Checks outstanding on July 31 totaled

$1,860.10.

On July 31, the bank statement showed an

NSF charge of $575 for a check received

by the company from W. Krueger, a

customer, on account.

Instructions

Prepare the bank reconciliation as of July

31.

Adjusted cash bal.

$7,024.00

Prepare the necessary adjusting entries at

July 31.

15.56

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College