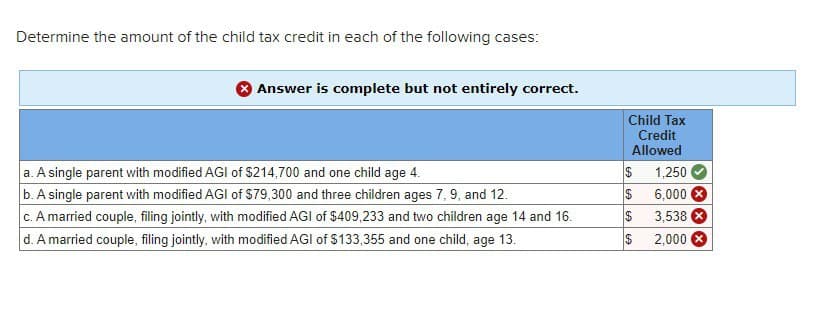

Determine the amount of the child tax credit in each of the following cases: Answer is complete but not entirely correct. Child Tax Credit Allowed a. A single parent with modified AGI of $214,700 and one child age 4. $ 1,250 b. A single parent with modified AGI of $79,300 and three children ages 7, 9, and 12. $ 6,000* c. A married couple, filing jointly, with modified AGI of $409,233 and two children age 14 and 16. d. A married couple, filing jointly, with modified AGI of $133,355 and one child, age 13. $ 3,538 $ 2,000

Determine the amount of the child tax credit in each of the following cases: Answer is complete but not entirely correct. Child Tax Credit Allowed a. A single parent with modified AGI of $214,700 and one child age 4. $ 1,250 b. A single parent with modified AGI of $79,300 and three children ages 7, 9, and 12. $ 6,000* c. A married couple, filing jointly, with modified AGI of $409,233 and two children age 14 and 16. d. A married couple, filing jointly, with modified AGI of $133,355 and one child, age 13. $ 3,538 $ 2,000

Chapter10: Deduct Ions And Losses: Certain Itemized Deduct Ions

Section: Chapter Questions

Problem 5BCRQ

Related questions

Question

Transcribed Image Text:Determine the amount of the child tax credit in each of the following cases:

Answer is complete but not entirely correct.

Child Tax

Credit

Allowed

a. A single parent with modified AGI of $214,700 and one child age 4.

$

1,250

b. A single parent with modified AGI of $79,300 and three children ages 7, 9, and 12.

$

6,000 ×

c. A married couple, filing jointly, with modified AGI of $409,233 and two children age 14 and 16.

d. A married couple, filing jointly, with modified AGI of $133,355 and one child, age 13.

$

3,538

$

2,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT