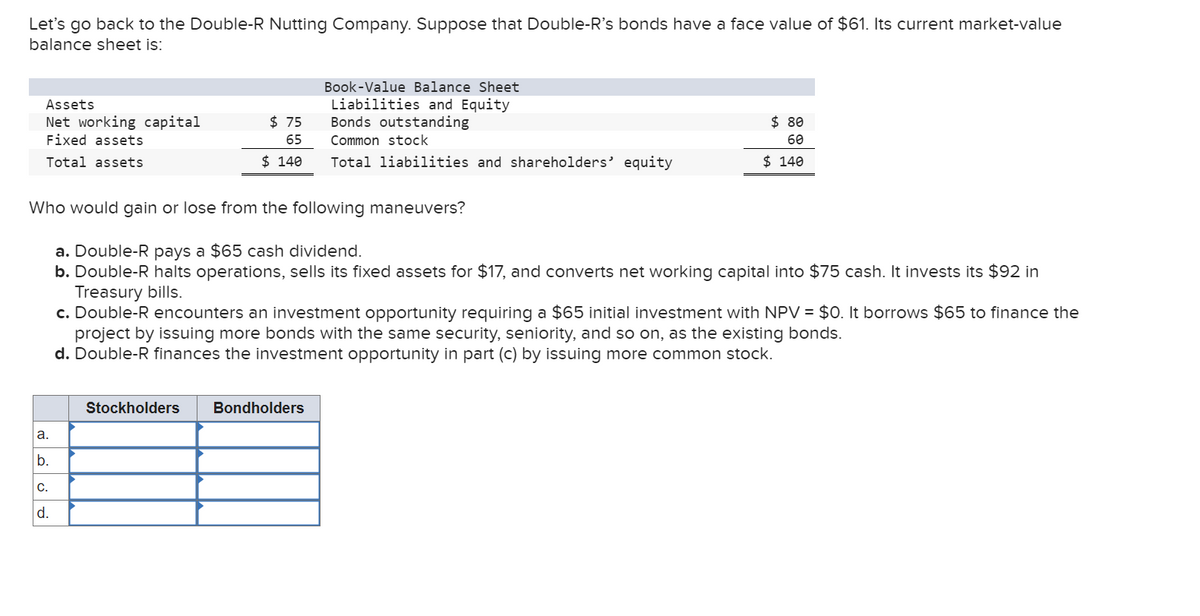

Who would gain or lose from the following maneuvers?

Q: Escargot Inc. is a 5-star restaurant in Cincinnati. The restaurant sells 500 gift cards during…

A: Revenue Recognition means the recording of revenues of an entity in its books. It is an accrual…

Q: A company like Golf USA that sells golf-related inventory typically will have inventory items such…

A: Inventory valuation is referred to as that method which helps in assigning a monetary value to the…

Q: Fizer Pharmaceutical paid $85 million on January 2, 2024, for 4 million shares of Carne Cosmetics…

A: Under the equity method of investment, the adjustment for the dividend declared and income earned…

Q: mn.3

A: The question is asking whether under International Financial Reporting Standards (IFRS), a company…

Q: Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2022. Demers reported common…

A: Consolidated financial statements represent all the business accounts (assets, liabilities,…

Q: Frolic Corporation has budgeted sales and production over the next quarter as follows: July August…

A: A cash budget helps the business in estimating the flow of cash i.e., inward or outward over a…

Q: REI sells snowboards. Assume the following information relates to REI's purchases of snowboards…

A: FIFO (First In First Out) is the inventory valuation method that determines the cost of goods sold…

Q: Skysong Corporation's charter authorized issuance of 103,000 shares of $10 par value common stock…

A: Bonus preferred stock is a discount offered on the issue of a bond.

Q: Cash $24,300 Accounts Receivable 42,500 Allowance for Uncollectible Accounts $2,700 Inventory 42,000…

A: A balance sheet is a financial statement that represents the financial position of a company as on a…

Q: For financial reporting, Kumas Poultry Farms has used the declining-balance method of depreciation…

A: Depreciation expense is recorded to record reduction in value of asset over the period of time.…

Q: Balance at beginning of year Net income (loss) Deductions: Stock dividend (34,000 shares) RENN-DEVER…

A: Retained earnings are the amount of profit a company has left over after paying all its direct…

Q: You have been given responsibility for overseeing a bank's small business loans division. The bank…

A: FIFO Method -The cost of goods sold for that specific period is affected since it is one of the…

Q: The statement of income of Pina Colada Corporation is presented here. PINA COLADA CORPORATION…

A: CASH FLOW STATEMENTCash flow statement Provides additional information to user of financial…

Q: Klinken Corporation's contribution margin ratio on the sale of its most popular product is 42%. The…

A: Break-even point in dollars refers to the amount or level of sales required to be done by the firm…

Q: Li Corporation reported pretax book income of $660,000. Tax depreciation exceeded book depreciation…

A: A deferred income tax is a kind of tax liability present on a balance sheet due to a difference in…

Q: Sheniqua, a single taxpayer, had taxable income of $79,928. Her employer withheld $12,957 in federal…

A: Income tax liability -Income tax liability is the amount of tax that an individual or entity owes to…

Q: Please help calculate product differentiation, and cost leadership. Explain how successful has…

A: To calculate the components of the change in operating income due to product differentiation and…

Q: A building acquired at the beginning of the year at a cost of $84,800 has an estimated residual…

A: The objective of the question is to calculate the double-declining-balance rate and the…

Q: Sparky Corporation uses the weighted-average method of process costing. The following information is…

A: WEIGHTED AVERAGE METHOD :— Under this method, equivalent units are calculated by adding equivalent…

Q: 22,000 shares reacquired by Sunland Corporation for $50 per share were exchanged for undeveloped…

A: Journal entry means the recording of transactions in the books of accounts of a business entity. It…

Q: The records for the Clothing Department of Oriole's Discount Store are summarized below for the…

A: Ending inventory is the value of the goods, services, or materials that are still in stock at the…

Q: Problem 14-4A (Algo) Straight-Line: Amortization of bond discount LO P2 [The following information…

A: The bonds are issued at discount when market rate is higher than the coupon rate of bonds payable.…

Q: Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of…

A: Journal Entries for Arctic CatScenario 1: Seneca prepays present value for December 31, 2024…

Q: 1. Prepare a physical flow schedule for July. Jackson ProductsPhysical Flow ScheduleFor the Month…

A: Equivalent units are those partial completed units which are used in process costing to calculate…

Q: Zippy Shoe Company uses a periodic inventory system. Zippy purchased 425 pairs of shoes at $68 each…

A: 1. FIFO (First-In, First-Out): It sells the oldest inventory first, reflecting current costs in…

Q: Happy Valley Pet Products uses a standard costing system that applies overhead to products based on…

A: Variance analysis is a type of method to assess and examine the difference between estimated…

Q: Several years ago Brant, Inc., sold $960,000 in bonds to the public. Annual cash interest of 7…

A: Bonds -Bonds are financial instruments in which a buyer loans money to a business or the…

Q: Determine the amount of the child tax credit in each of the following cases: Answer is complete but…

A: Answer:- In tax law, modified adjusted gross income (MAGI) is used to establish eligibility for…

Q: What are the four types of cash flows MOST common in a capital budgeting valuation? Group of answer…

A: The four types of cash flows most common in a capital budgeting valuation are:A) Capital…

Q: Brdova manufactures three types of stained glass windows, cleverly named llows: Sales price Variable…

A: Contribution margin is the amount of sales revenue that remains for a product or service after its…

Q: Cash $146, 125 Retained Earnings $444, 150 Accounts Receivable 262, 500 Dividends 218, 750 Inventory…

A: Lets understand the basics.Expenses are divided into administrative and selling…

Q: Homestead Crafts, a distributor of handmade gifts, operates out of owner Emma Finn's house. At the…

A: 1. In case FOB destination, seller is the owner till it reaches the buyer. So, this is part of year…

Q: A deferred tax asset would result if a. a company recorded more taxable depreciation in 2019 for an…

A: A deferred tax asset is an asset recorded on a company's balance sheet that represents the quantum…

Q: Leith Tramways Limited has a Castings Division which does casting work of various types. The…

A: a. To determine the range of transfer prices within which both divisions' profits would increase as…

Q: At the end of January, the company estimates that the remaining units of inventory purchased on…

A: Due to conservatism approach is followed in accounting standards that is recognise any loss in…

Q: www O 0 P7.3 (LO 3), AP On July 31, 2025, Keeds Company had a cash balance per books of $6,140. The…

A: The objective of this question is to prepare a bank reconciliation statement for Keeds Company as of…

Q: ww 0 E7.19 (LO 5), AP Kael Company maintains a petty cash fund for small expenditures. These…

A: The objective of this question is to understand how to journalize petty cash transactions and…

Q: On August 1, 2022, The Spa at Mill Lake, Inc., purchased inventory costing $60,000 by signing an 8%,…

A: As per real account rule, we should debit what comes in and credit what goes out. Inventory is an…

Q: Cullumber Inc.'s only temporary difference at the beginning and end of 2024 is caused by a $3.75…

A: Income statement is the important part of financial statement, which shows income and expenditure of…

Q: Crane Company uses a periodic inventory system and reports the following for the month of June. Date…

A: FIFO: "First-In, First-Out" - Items purchased or produced first are sold or used first.LIFO:…

Q: Assume that Morrell Financial Services uses the reciprocal method of service department cost…

A: Reciprocal Method of Cost Allocation:The reciprocal method of cost allocation is a technique used in…

Q: The Pension Trust Fund maintained by the city of Marydell had the following transactions and events…

A: Journal entry contains the data which is significant to a single business transaction, including the…

Q: On October 1, 2023, Mertag Company (a U.S.-based company) receives an order from a customer in…

A: Spot Rate is the cash rate that gives the immediate value of the product being transacted between…

Q: Assets and costs are proportional to sales. Debt and equity are not. The company maintains a…

A: What is internal growth rate?Internal growth rate (IGR) refers to the sales growth rate that can be…

Q: [The following information applies to the questions displayed below.] Diego Company manufactures one…

A: The cost of goods sold includes the cost of goods that are sold during the period. The gross profit…

Q: 31,000 17,000 Net sales $ Cost of goods sold $ Selling and administrative Interest income 330…

A: A multiple-step income statement is prepared by dividing the revenue and costs into operating and…

Q: Next Hope reported the following income statement for the year ended December 31, 2026: View the…

A: 1. Cost of goods sold/Average inventory=Inventory turnover62,200/12,100=5.142. Number of days in the…

Q: D sold capital property in the current year for net proceeds of $700,000. The property has an…

A: A capital asset is an item that you own for investment or personal purposes, such as stocks, bonds…

Q: Required information [The following information applies to the questions displayed below.] Oslo…

A: Contribution margin per unit = Selling price per unit - Variable cost per unit. Current selling…

Q: AIM Inc. showed the following equity account balances on the December 31, 2019, balance sheet:…

A: Retained Earnings- Any company's net profit left over after dividend payments to shareholders is…

Step by step

Solved in 3 steps

- You plan to purchase debenture bonds from one of two companies in the same industry that are similar in size and performance. The first company has $800,000 in total liabilities, and $1,200,000 in equity. the second company has $600,000 in total liabilities, and $400,000 in equity. 2. Which company's debenture bonds are less risky based on the debt-to-equity ratio? Explain. Show your calculations to support your decision.HeadAche Inc. depends on two sources of financing: bond issues and common stock. In the following table, you can see the market value of these two sources as well as required rates of return: Market Value Required Return Bonds $480,000,000 8.00% Common stock $720,000,000 12.00% Total $1,200,000,000 Other financial information: 1) Using FCFF, what is the present value of the firm, and the present value of the equity?2) Using FCFE, what is the present value of the equity?please answer with steps , explanation , computation and formulation so that I can understand the sloution easliy thanks PT Nusantara is financed with debt, preferred equity, and common equity with market values of $20 million, $10 million, and $30 million, respectively. The betas for the debt, preferred stock, and common stock are 0.2, 0.5, and 1.1, respectively. If the risk-free rate is 3.95 percent, the market risk premium is 6.01 percent, and the company’s average and marginal tax rates are both 30%, what is the company’s weighted average cost of capital?

- WorldTrans currently finances with 20.0% debt (i.e., wd = 20%), but its new CFO is considering changing the capital structure so wd = 62.5% by issuing additional bonds and using the proceeds to repurchase and retire common shares so the percentage of common equity in the capital structure (wc) = 1 – wd. Given the data shown below, by how much would this recapitalization change the firm's cost of equity? Do not round your intermediate calculations. (Hint: You must unlever the current beta and then use the unlevered beta to solve the problem.) Risk-free rate, rRF 5.00% Tax rate, T 25% Market risk prem, RPM 6.00% Current wd 20% Current beta, bL1 1.60 Target wd 62.5% Group of answer choices 10.93% 9.18% 11.39% 9.64% 11.48%concatti corporation hired your consulting firm to help them estimate the cost of equity. the yeild on the firms bonds is 10.50% and your firms economist believe that the cost of equity can be estimated using a risk premium of 4.85% over a firms own cost of debt. what is an estimate of the firms cost of equity from retained earnings?Aneka Inc. hire your consulting firm to help them estimate the cost of equity. Yield of Aneka Inc. bonds is 7.25%, and the economist company in your company believes that the cost equity can be estimated using a risk premium of 3.50% over the company's cost of debt. What is Lange's estimated cost of equity from retained earnings? a. 10.75% b. 11.18% c. 11.63% d. 12.09% e. 12.58%

- I went to finra-markets.morningstar.com, enter SNA as the company, and found the yield to maturity for each of SNA’s bonds. The weighted average cost of debt for SNA using the total book debt value of $1,450 million is 2.48% and using the total market value of $1,558.68 million is 2.49%. Moreover, SNA has a 21 percent tax rate. Now that we have all the necessary information, we can calculate the weighted average cost of capital for SNA. I suggest we do that using (a) the book value weights and (b) market value weights. Which number is more relevant?The following data pertains to Xena Corp. Xena Corp. Total Assets $21,249 Interest-Bearing Debt (market value) $11,070 Average borrowing rate for debt 10.2% Common Equity: Book Value $5,535 Market Value $23,247 Marginal Income Tax Rate 19% Market Beta 1.64 A. Using the information from the table, and assuming that the risk-free rate is 4.5% and the market risk premium is 6.2%, calculate Xena's cost of equity capital, using the capital asset pricing model: B. Using the information from the table, determine the weight on debt capital that should be used to calculate Xena's weighted-average cost of capital.The DestitutusVentis Company (DV Co) has the following items on its balance sheet (question mark means that the quantity is unknown): Type of asset/liability Market value Risk (beta) Cash holdings £20m 0 Fixed investments £180m ? Short term debt £10m 0 Long term debt £70m 0.05 Equity £120m 1.1 The risk-free rate is 3%, and the average return on the market index is 7%. The number of shares outstanding for DV Co is 100m. The corporate and investor tax rates are zero. Modigliani-Miller irrelevance of dividend policy and capital structure holds. What is the weighted average cost of capital (WACC) for DV Co? The company plans to pay a dividend per share of £0.10, which is funded by increasing the company’s long-term debt correspondingly. The new debt has the same beta as the old long-term debt. What is the value per share of the DV Co’s stock on ex-dividend day if the dividend payment goes ahead? What is the beta of the equity on…

- Virtual Excursions, Pty is financed 80% by common stock and 20% by bonds. The expected return on the common stock is 12%, and the rate of interest on the bond is 6%. The bonds are default-free and that there are no taxes. Assume that the company issues more debt and uses the proceeds to retire equity. The new financing mix is 60% equity and 40% debt. If the debt is default-free. a) What will be the expected rate of return on equity? b) What will be the expected return on the package of common stocks and bonds?Garwryk, inc., which is finance with debt and equity, presently has a debt ratio of 78 percent. What is the firm’s equity multiplier? How is the equity multiplier related to the firm’s use of debt financing (i.e., if the firm increased its use of debt financing would this increase or decrease its equity multiplier)? Explain What is the firm’s multiplier? The equity multiplier is given by: Equity multiplier =1 1-debt ratio The equity multiplier is Round to two decimal placesANB ltd has common equity of $35.5mn and $31.9mn of long-term debt and $10.3mn of preferredequity on its books. Required return on these funds are 12%, 8%, and 10%, respectively. Market valuesof the common equity and long-term debt are $46.6mn and $35mn, respectively. Market value ofpreferred equity is the same as its book value. Estimate WACC for the company given that its effectivetax rate is 30%.