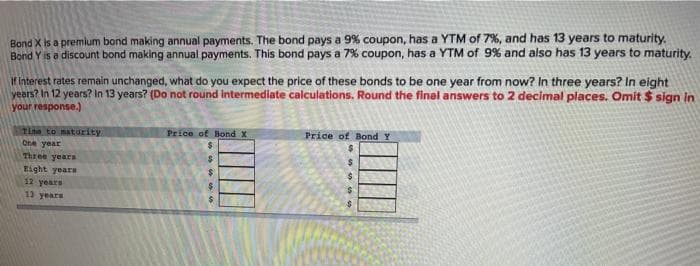

Bond X is a premium bond making annual payments. The bond pays a 9% coupon, has a YTM of 7%, and has 13 years to maturity. Bond Y is a discount bond making annual payments. This bond pays a 7% coupon, has a YTM of 9% and also has 13 years to maturity. If interest rates remain unchanged, what do you expect the price of these bonds to be one year from now? In three years? In eight years? In 12 years? In 13 years? (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) Time to maturity One year Three years Eight years 12 years 13 years Price of Bond X $ Price of Bond Y $ $ $ $

Bond X is a premium bond making annual payments. The bond pays a 9% coupon, has a YTM of 7%, and has 13 years to maturity. Bond Y is a discount bond making annual payments. This bond pays a 7% coupon, has a YTM of 9% and also has 13 years to maturity. If interest rates remain unchanged, what do you expect the price of these bonds to be one year from now? In three years? In eight years? In 12 years? In 13 years? (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) Time to maturity One year Three years Eight years 12 years 13 years Price of Bond X $ Price of Bond Y $ $ $ $

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 4P

Related questions

Question

vi.8

Transcribed Image Text:Bond X is a premium bond making annual payments. The bond pays a 9% coupon, has a YTM of 7%, and has 13 years to maturity.

Bond Y is a discount bond making annual payments. This bond pays a 7% coupon, has a YTM of 9% and also has 13 years to maturity.

If interest rates remain unchanged, what do you expect the price of these bonds to be one year from now? In three years? In eight

years? In 12 years? In 13 years? (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in

your response.)

Time to maturity

One year

Three years

Eight years

12 years

13 years

Price of Bond X

$

Price of Bond Y

$

$

$

$

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning