Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 7CE

Variances

Refer to Cornerstone Exercise 9.6.

Required:

- 1. Calculate the variable

overhead spending variance using the formula approach. (If you compute the actual variable overhead rate, carry your computations out to five significant digits and round the variance to the nearest dollar.) - 2. Calculate the variable overhead efficiency variance using the formula approach.

- 3. Calculate the variable overhead spending variance and variable overhead efficiency variance using the three-pronged graphical approach.

- 4. What if 26,100 direct labor hours were actually worked in February? What impact would that have had on the variable overhead spending variance? On the variable overhead efficiency variance?

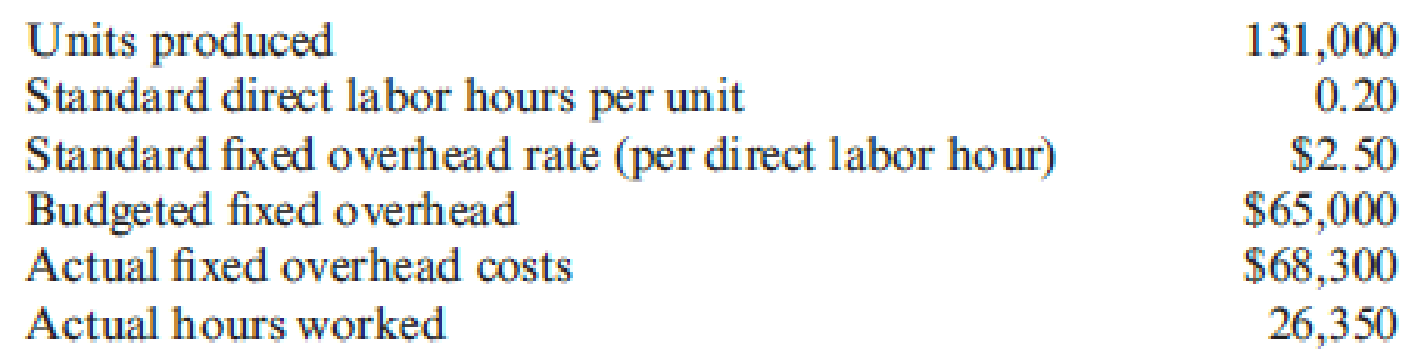

Standish Company manufactures consumer products and provided the following information for the month of February:

Required:

- 1. Calculate the fixed overhead spending variance using the formula approach.

- 2. Calculate the volume variance using the formula approach.

- 3. Calculate the fixed overhead spending variance and volume variance using the three-pronged graphical approach.

- 4. What if 129,600 units had actually been produced in February? What impact would that have had on the fixed overhead spending variance? On the volume variance?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

3. Compute the direct labor variance, including its rate and efficiency variances. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Round "Rate per hour" answers to two decimal places.)

The drop down options under "actual cost" "standard cost" and the middle box for the first row are: actual rate, standard rate

The drop down options for the left bottom 3 rows are: total variable overhead cost variance, variable overhead efficiency variance, variable overhead spending variance, volume variance, direct material variance, Direct labor efficiency variance, direct labor rate variance, direct materials price variance, direct materials quantity variance.

the drop down options for the right yellow 3 columns are: favorable, unfavorable, no variance

please use the exact format as shown in photos. Thank you !

Blaze Corporation allocates overhead on the basis of DLH and the standard amount per allocation base is 2 DLH per unit.

For March, the company planned production of 10,000 units (80% of its production capacity of 12,500 units) and prepared

the following budget. The company actually operated at 90% capacity (11,250 units) in March and incurred actual total

overhead costs of $129,230.

80% Operating

Levels

Overhead Budget

Production in units

10,000

Budgeted variable overhead

Budgeted fixed overhead

$ 58,000

$ 68,000

1. Compute the standard overhead rate. Hint. Standard allocation base at 80% capacity is 20,000 DLH, computed as

10,000 units × 2.00 DLH per unit.

2. Compute the total overhead variance.

3. Compute the overhead controllable variance.

4. Compute the overhead volume variance.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Required 4

Compute the standard overhead rate. Hint: Standard allocation base at 80% capacity is 20,000…

Best, Inc. uses a standard cost system and provides the following information. (Click the icon to view the

information.) variable overhead, $3,800; actual fixed overhead, $3, 500; actual direct labor hours, 1,400.

Read the requirements. Data table Requirement 1. Compute the variable overhead cost and efficiency

variances and fixed overhead cost and volume variances. Begin with the variable overhead cost and

efficiency variances. Select the required formulas, compute the variable overhead cost and favorable (F) or

unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead;

SC = standardco \table [[,, Formula,Variance], [VOH cost variance, = , 1 = , ], [VOH efficiency variance, =,1 =, 0

Chapter 9 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 9 - Discuss the difference between budgets and...Ch. 9 - What is the quantity decision? The pricing...Ch. 9 - Why is historical experience often a poor basis...Ch. 9 - Prob. 4DQCh. 9 - How does standard costing improve the control...Ch. 9 - The budget variance for variable production costs...Ch. 9 - Explain why the direct materials price variance is...Ch. 9 - The direct materials usage variance is always the...Ch. 9 - The direct labor rate variance is never...Ch. 9 - Prob. 10DQ

Ch. 9 - Prob. 11DQCh. 9 - What is the cause of an unfavorable volume...Ch. 9 - Prob. 13DQCh. 9 - Explain how the two-, three-, and four-variance...Ch. 9 - Prob. 15DQCh. 9 - Prob. 1CECh. 9 - Direct Materials Usage Variance Refer to...Ch. 9 - Refer to Cornerstone Exercise 9.1. Guillermos Oil...Ch. 9 - Kavallia Company set a standard cost for one item...Ch. 9 - Yohan Company has the following balances in its...Ch. 9 - Standish Company manufactures consumer products...Ch. 9 - Variances Refer to Cornerstone Exercise 9.6....Ch. 9 - Standish Company manufactures consumer products...Ch. 9 - Mangia Pizza Company makes frozen pizzas that are...Ch. 9 - Mangia Pizza Company makes frozen pizzas that are...Ch. 9 - Refer to Cornerstone Exercise 9.9. Required: 1....Ch. 9 - Quincy Farms is a producer of items made from farm...Ch. 9 - During the year, Dorner Company produced 280,000...Ch. 9 - Zoller Company produces a dark chocolate candy...Ch. 9 - Oerstman, Inc., uses a standard costing system and...Ch. 9 - Refer to the data in Exercise 9.15. Required: 1....Ch. 9 - Chypre, Inc., produces a cologne mist using a...Ch. 9 - Refer to Exercise 9.17. Chypre, Inc., purchased...Ch. 9 - Delano Company uses two types of direct labor for...Ch. 9 - Jameson Company produces paper towels. The company...Ch. 9 - Madison Company uses the following rule to...Ch. 9 - Laughlin, Inc., uses a standard costing system....Ch. 9 - Responsibility for the materials price variance...Ch. 9 - Which of the following is true concerning labor...Ch. 9 - A company uses a standard costing system. At the...Ch. 9 - Relevant information for direct labor is as...Ch. 9 - Which of the following is the most likely...Ch. 9 - Haversham Corporation produces dress shirts. The...Ch. 9 - Plimpton Company produces countertop ovens....Ch. 9 - Algers Company produces dry fertilizer. At the...Ch. 9 - Misterio Company uses a standard costing system....Ch. 9 - Petrillo Company produces engine parts for large...Ch. 9 - Business Specialty, Inc., manufactures two...Ch. 9 - Vet-Pro, Inc., produces a veterinary grade...Ch. 9 - Refer to the data in Problem 9.34. Vet-Pro, Inc.,...Ch. 9 - Energy Products Company produces a gasoline...Ch. 9 - Nuevo Company produces a single product. Nuevo...Ch. 9 - Ingles Company manufactures external hard drives....Ch. 9 - As part of its cost control program, Tracer...Ch. 9 - Aspen Medical Laboratory performs comprehensive...Ch. 9 - Leather Works is a family-owned maker of leather...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sharp Company manufactures a product for which the following standards have been set: Standard Quantity Standard Price Standard or Hours or Rate Cost $5 per foot ? per hour Direct materials 3 feet $ 15 Direct labor ? hours ? During March, the company purchased direct materials at a cost of $45,375, all of which were used in the production of 2,350 units of product. In addition, 4,800 direct labor-hours were worked on the product during the month. The cost of this labor time was $50,400. The following variances have been computed for the month: Materials quantity variance Labor spending variance Labor efficiency variance $ 2,250 U $ 3,400 U $ 1,000 U Required: 1. For direct materials: a. Compute the actual cost per foot of materials for March. b. Compute the price variance and the spending variance. 2. For direct labor: a. Compute the standard direct labor rate per hour. b. Compute the standard hours allowed for the month's production. c. Compute the standard hours allowed per unit of…arrow_forwardYou are provided with the following information. Direct materials Direct labor Variable manufacturing overhead Actual results: Actual output Actual variable manufacturing overhead cost $ Inputs Actual direct materials cost Actual direct labor cost Actual Quantity 8,050 Required: Use the information above to calculate the variances. Note: Use ABS() formula for variances. Actual Hours Actual Hours Actual Quantity 8,050 pounds 1,420 hours Actual Price Actual Rate Standard Quantity 2.9 pounds Actual Rate 0.65 hours 0.65 hours 2,420 units 9,060 $ su $ $ in is in $ $ Standard Price 4.90 22.30 per hour 6.19 per hour Actual Price 4.30 per pound 21.65 per hour Actual Quantity Actual Hours per pound Direct Materials Actual Hours Direct Labor Variable Overhead Standard Price Standard Rate Standard Rate Standard Quantity Standard Hours Standard Hours Standard Price Standard Rate Standard Ratearrow_forwardCompute for the variances of the problem using the information given. Answer the numbers only up to two decimal places. A. Compute for Labor Efficiency Variance B. Compute for Labor Spending Variance C. Compute for Labor Rate Variancearrow_forward

- Please refer to the picture below for information. Kindly show the complete solution. Thank you so much. Please answer all my questions I badly need it. ? Compute for the following: 1. Actual labor rate per hour 2. Actual labor hours utilized 3. Labor rate variancearrow_forwarda.Compute for the actual cost paid per kilogram b.Compute for the Labor Efficiency Variance Present your answer as 1000 FAVORABLE OR 1000 UNFAVORABLE if applicable Topic: Standard Costing and Variance Analysisarrow_forwardLogistics Solutions provides order fulfillment services for dot.com merchants. The company maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solutions, which pulls the item from storage, packs it, and ships it to the customer. The company uses a predetermined variable overhead rate based on direct labor-hours. In the most recent month, 175,000 items were shipped to customers using 7,400 direct labor-hours. The company incurred a total of $24,790 in variable overhead costs. k According to the company's standards, 0.04 direct labor-hours are required to fulfill an order for one item and the variable overhead rate is $3.40 per direct labor-hour. nt Required: 1. What is the standard labor-hotfs allowed (SH) to ship 175,000 items to customers? 2. What is the standard variable overhead cost allowed (SH x SR) to ship 175,000 items to customers? 3. What is the variable overhead spending…arrow_forward

- Compute the direct labor rate variance and the direct labor efficiency variance. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance. Round "Rate per hour" answers to 2 decimal places.)arrow_forwardRequirement 2. Compute the cost variance and the efficiency variance for direct materials and for direct labor. For manufacturing overhead, compute the variable overhead cost, variable overhead efficiency, fixed overhead cost, and fixed overhead volume variances. Round to the nearest dollar. Begin with the cost variances. Select the required formulas, compute the cost variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Round your answers to the nearest whole dollar. Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity.) Formula Variance Direct materials cost variance Direct labor cost variance Next compute the efficiency variances. Select the required formulas, compute the efficiency variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Round your answers to the nearest whole…arrow_forwardPrimara Corporation has a standard costing system in which it applies overhead to products on the basis of the standard direct labour- hours allowed for the actual output of the period. Data concerning the most recent year appear below: Total budgeted fixed overhead cost for the year Actual fixed overhead cost for the year Budgeted standard direct labour-hours (denominator level of activity) Actual direct labour-hours Standard direct labour-hours allowed for the actual output $ 500,000 $ 508,000 50,000 54,000 52,000 Required: 1. Compute the fixed portion of the predetermined overhead rate for the year. Predetermined overhead rate per DLHarrow_forward

- 1 S 3. Compute the variable manufacturing overhead spending and efficiency variances. (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).) Book Variable overhead sponding variance S Variable overhead efficiency variance 1 U 1 F Print 4. Compute the fixed overhead budget and volume variances. (Indicate the effect of variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (I.e., zero variance).) Fixed overhead budget variance $ Fixed overhead volumne variance $ 1U 0 Nonoarrow_forwardA company applies overhead using machine hours. Additional information follows. Standard variable overhead rate Actual variable overhead rate Standard hours of machine use (for actual production) Actual hours of machine use AH = Actual Hours AVR = Actual Variable Rate SH = Standard Hours SVR = Standard Variable Rate Compute the variable overhead spending, efficiency variances and the total variable overhead variance. Identify each variance as favorable or unfavorable. Note: Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Actual Variable Overhead $4.40 per machine hour $ 4.60 per machine hour 5,400 hours 5,550 hours Flexible Budget Variable OH Standard Applied Variable OHarrow_forwardData table Variable manufacturing overhead costs incurred Variable manufacturing overhead cost rate Fixed manufacturing overhead costs incurred Fixed manufacturing overhead costs budgeted Denominator level in machine-hours Standard machine-hour allowed per unit of output Units of output Actual machine-hours used Ending work-in-process inventory $687,100 $9 per standard machine-hour $146,500 $141,000 70,500 1.2 64,800 75,500 0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY