Fundamentals Of Financial Accounting

6th Edition

ISBN: 9781259864230

Author: PHILLIPS, Fred, Libby, Robert, Patricia A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 1COP

Recording and Reporting Credit Sales and

Okay Optical. Inc. (OOI), began operations in January, selling inexpensive sunglasses to large retailers like Walgreens and other smaller stores. Assume the following transactions occurred during its first six months of operations.

| January | 1 | Sold merchandise to Walgreens for $20,000; the cost of these goods to OOI was $12,000. |

| February | 12 | Received payment in full from Walgreens. |

| March | 1 | Sold merchandise to Bravis Pharmaco on account for $3,000; the cost of these goods to OOI was $1,400. |

| April | 1 | Sold merchandise to Tony’s Pharmacy on account for $8,000. The cost to OOI was $4,400. |

| May | 1 | Sold merchandise to Anjuli Stores on account for $2,000; the cost to OOI was $1,200. |

| June | 17 | Received $6,500 on account from Tony’s Pharmacy. |

Required:

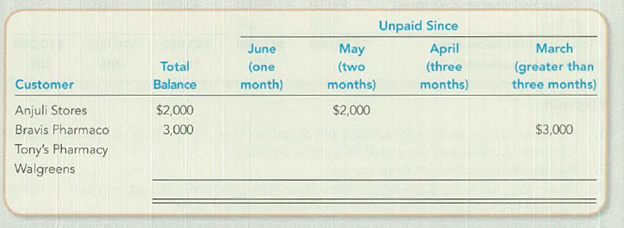

- 1. Complete the following aged listing of customer accounts at June 30.

- 2. Estimate the Allowance for Doubtful Accounts required at June 30 assuming the following uncollectible rates: one month, 1 percent; two months, 5 percent; three months, 20 percent: more than three months, 40 percent.

- 3. Show how OOI would report its accounts receivable on its June 30

balance sheet . What amounts would be reported on an income statement prepared for the six-month period ended June 30? - 4. Bonus Question: In July, OOI collected the balance due from Bravis Pharmaco but discovered that the balance due from Tony’s Pharmacy needed to be written off. Using this information, determine how accurate OOI was in estimating the Allowance for Doubtful Accounts needed for each of these two customers and in total.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Llang Company began operations in Year 1. During its first two years, the company completed a number of transactions involving sales

on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows.

Year 1

a. Sold $1,354,500 of merchandise on credit (that had cost $983,300), terms n/30.

b. Wrote off $20,200 of uncollectible accounts receivable.

c. Received $670,000 cash in payment of accounts receivable.

d. In adjusting the accounts on December 31, the company estimated that 1.50% of accounts receivable would be uncollectible.

Year 2

e. Sold $1,561,900 of merchandise (that had cost $1,258,400) on credit, terms n/30.

f. Wrote off $33,800 of uncollectible accounts receivable.

g. Received $1,195,000 cash in payment of accounts receivable.

h. In adjusting the accounts on December 31, the company estimated that 1.50 % of accounts receivable would be uncollectible.

Required:

Prepare journal entries to record Liang's Year 1 and Year 2 summarized…

Liang Company began operations in Year 1. During its first two years, the company completed a number of transactions involving sales

on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows.

Year 1

a. Sold $1,353,500 of merchandise on credit (that had cost $979,500), terms n/30.

b. Wrote off $18,100 of uncollectible accounts receivable.

c. Received $671,300 cash in payment of accounts receivable.

d. In adjusting the accounts on December 31, the company estimated that 3.00% of accounts receivable would be uncollectible.

Year 2

e. Sold $1,556,800 of merchandise (that had cost $1,295,500) on credit, terms n/30.

f. Wrote off $26,000 of uncollectible accounts receivable.

g. Received $1,394,400 cash in payment of accounts receivable.

h. In adjusting the accounts on December 31, the company estimated that 3.00% of accounts receivable would be uncollectible.

Required:

Prepare journal entries to record Liang's Year 1 and Year 2 summarized…

Liang Company began operations in Year 1. During its first two years, the company completed a number of transactions involving sales

on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows.

Year 1

a. Sold $1,346,600 of merchandise on credit (that had cost $979,500), terms n/30.

b. Wrote off $18,800 of uncollectible accounts receivable.

c. Received $669,400 cash in payment of accounts receivable.

d. In adjusting the accounts on December 31, the company estimated that 3.00% of accounts receivable would be uncollectible.

Year 2

e. Sold $1,579,500 of merchandise (that had cost $1,326,000) on credit, terms n/30.

f. Wrote off $31,400 of uncollectible accounts receivable.

g. Received $1,251,500 cash in payment of accounts receivable.

h. In adjusting the accounts on December 31, the company estimated that 3.00% of accounts receivable would be uncollectible.

Required:

Prepare journal entries to record Liang's Year 1 and Year 2 summarized…

Chapter 8 Solutions

Fundamentals Of Financial Accounting

Ch. 8 - What are the advantages and disadvantages of...Ch. 8 - Prob. 2QCh. 8 - Which basic accounting principles does the...Ch. 8 - Using the allowance method, is Bad Debt Expense...Ch. 8 - What is the effect of the write-off of...Ch. 8 - How does the use of calculated estimates differ...Ch. 8 - A local phone company had a customer who rang up...Ch. 8 - What is the primary difference between accounts...Ch. 8 - What are the three components of the interest...Ch. 8 - As of May 1, 2016, Krispy Kreme Doughnuts had...

Ch. 8 - Does an increase in the receivables turnover ratio...Ch. 8 - What two approaches can managers take to speed up...Ch. 8 - When customers experience economic difficulties,...Ch. 8 - (Supplement 8A) Describe how (and when) the direct...Ch. 8 - (Supplement 8A) Refer to question 7. What amounts...Ch. 8 - 1. When a company using the allowance method...Ch. 8 - 2. When using the allowance method, as Bad Debt...Ch. 8 - 3. For many years, Carefree Company has estimated...Ch. 8 - 4. Which of the following best describes the...Ch. 8 - 5. If the Allowance for Doubtful Accounts opened...Ch. 8 - 6. When an account receivable is recovered a....Ch. 8 - Prob. 7MCCh. 8 - 8. If the receivables turnover ratio decreased...Ch. 8 - Prob. 9MCCh. 8 - Prob. 10MCCh. 8 - Prob. 1MECh. 8 - Evaluating the Decision to Extend Credit Last...Ch. 8 - Reporting Accounts Receivable and Recording...Ch. 8 - Recording Recoveries Using the Allowance Method...Ch. 8 - Recording Write-Offs and Bad Debt Expense Using...Ch. 8 - Determining Financial Statement Effects of...Ch. 8 - Estimating Bad Debts Using the Percentage of...Ch. 8 - Estimating Bad Debts Using the Aging Method Assume...Ch. 8 - Recording Bad Debt Estimates Using the Two...Ch. 8 - Prob. 10MECh. 8 - Prob. 11MECh. 8 - Recording Note Receivable Transactions RecRoom...Ch. 8 - Prob. 13MECh. 8 - Determining the Effects of Credit Policy Changes...Ch. 8 - Prob. 15MECh. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Bad Debt Expense Estimates and...Ch. 8 - Determining Financial Statement Effects of Bad...Ch. 8 - Prob. 3ECh. 8 - Recording Write-Offs and Recoveries Prior to...Ch. 8 - Prob. 5ECh. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Recording and Reporting Allowance for Doubtful...Ch. 8 - Recording and Determining the Effects of Write-Off...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Using Financial Statement Disclosures to Infer...Ch. 8 - Using Financial Statement Disclosures to Infer Bad...Ch. 8 - Prob. 15ECh. 8 - Analyzing and Interpreting Receivables Turnover...Ch. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions Jung ...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions CS...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Prob. 2PBCh. 8 - Prob. 3PBCh. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording and Reporting Credit Sales and Bad Debts...Ch. 8 - Prob. 2COPCh. 8 - Recording Daily and Adjusting Entries Using FIFO...Ch. 8 - Prob. 1SDCCh. 8 - Prob. 2SDCCh. 8 - Ethical Decision Making: A Real-Life Example You...Ch. 8 - Critical Thinking: Analyzing the Impact of Credit...Ch. 8 - Using an Aging Schedule to Estimate Bad Debts and...Ch. 8 - Accounting for Receivables and Uncollectible...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Catherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forwardCasebolt Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31: a. Journalize the write-offs under the direct write-off method. b. Journalize the write-offs under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded 5,250,000 of credit sales during the year. Based on past history and industry averages, % of credit sales are expected to be uncollectible. c. How much higher (lower) would Casebolt Companys net income have been under the direct write-off method than under the allowance method?arrow_forwardAmerican Signs allows customers to pay with their Jones credit card and cash. Jones charges American Signs a 3.5% service fee for each credit sale using its card. Credit sales for the month of June total $328,430, where 40% of those sales were made using the Jones credit card. Based on this information, what will be the total in Credit Card Expense at the end of June?arrow_forward

- Liang Company began operations in Year 1. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows. Year 1 a. Sold $1,349,500 of merchandise on credit (that had cost $976,000), terms n/30. b. Wrote off $18,900 of uncollectible accounts receivable. c. Received $669,100 cash in payment of accounts receivable. d. In adjusting the accounts on December 31, the company estimated that 1.10% of accounts receivable would be uncollectible. Year 2 e. Sold $1,580,200 of merchandise (that had cost $1,267,600) on credit, terms n/30. f. Wrote off $27,900 of uncollectible accounts receivable. g. Received $1,386,100 cash in payment of accounts receivable. h. In adjusting the accounts on December 31, the company estimated that 1.10% of accounts receivable would be uncollectible. Required: Prepare journal entries to record Liang's Year 1 and Year 2 summarized…arrow_forwardLiang Company began operations in Year 1. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows.Year 1 Sold $1,352,400 of merchandise on credit (that had cost $979,500), terms n/30. Wrote off $18,400 of uncollectible accounts receivable. Received $668,400 cash in payment of accounts receivable. In adjusting the accounts on December 31, the company estimated that 2.40% of accounts receivable would be uncollectible. Year 2 Sold $1,516,800 of merchandise (that had cost $1,299,500) on credit, terms n/30. Wrote off $34,500 of uncollectible accounts receivable. Received $1,187,600 cash in payment of accounts receivable. In adjusting the accounts on December 31, the company estimated that 2.40% of accounts receivable would be uncollectible Required:Prepare journal entries to record Liang’s Year 1 and Year 2 summarized transactions and its year-end…arrow_forwardLiang Company began operations in Year 1. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows. Check my work mode: This shows what is correct or incorrect for the work you have completed so Year 1 a. Sold $1,353,900 of merchandise on credit (that had cost $978,100), terms n/30. b. Wrote off $20,900 of uncollectible accounts receivable. c. Received $670,600 cash-in payment of accounts receivable. d. In adjusting the accounts on December 31, the company estimated that 2.00% of accounts receivable would be uncollectible. Year 2 e. Sold $1,532,900 of merchandise (that had cost $1,268,900) on credit, terms n/30. f. Wrote off $31,100 of uncollectible accounts receivable. g. Received $1,245,100 cash in payment of accounts receivable. h. In adjusting the accounts on December 31, the company estimated that 2.00% of accounts receivable would be…arrow_forward

- Liang Company began operations in Year 1. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows. Year 1 Sold $1,346,100 of merchandise on credit (that had cost $983,000), terms n/30. Wrote off $21,100 of uncollectible accounts receivable. Received $673,300 cash in payment of accounts receivable. In adjusting the accounts on December 31, the company estimated that 1.80% of accounts receivable would be uncollectible. Year 2 Sold $1,577,400 of merchandise (that had cost $1,329,500) on credit, terms n/30. Wrote off $25,000 of uncollectible accounts receivable. Received $1,122,600 cash in payment of accounts receivable. In adjusting the accounts on December 31, the company estimated that 1.80% of accounts receivable would be uncollectible. Required: Prepare journal entries to record Liang's Year 1 and Year 2 summarized transactions and its year-end…arrow_forwardLiang Company began operations in Year 1. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows. Year 1 a. Sold $1,345,434 of merchandise (that had cost $975,000) on credit, terms n∕30. b. Wrote off $18,300 of uncollectible accounts receivable. c. Received $669,200 cash in payment of accounts receivable. d. In adjusting the accounts on December 31, the company estimated that 1.5% of accounts receivable would be uncollectible. Year 2 e. Sold $1,525,634 of merchandise on credit (that had cost $1,250,000), terms n∕30. f. Wrote off $27,800 of uncollectible accounts receivable. g. Received $1,204,600 cash in payment of accounts receivable. h. In adjusting the accounts on December 31, the company estimated that 1.5% of accounts receivable would be uncollectible. Required Prepare journal entries to record Liang’s summarized transactions and its year-end…arrow_forwardLiang Company began operations in Year 1. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows. Year 1 Sold $1,350,700 of merchandise on credit (that had cost $984,200), terms n/30. Wrote off $19,700 of uncollectible accounts receivable. Received $674,900 cash in payment of accounts receivable. In adjusting the accounts on December 31, the company estimated that 1.30% of accounts receivable would be uncollectible. Year 2 Sold $1,533,900 of merchandise (that had cost $1,314,500) on credit, terms n/30. Wrote off $33,700 of uncollectible accounts receivable. Received $1,115,300 cash in payment of accounts receivable. In adjusting the accounts on December 31, the company estimated that 1.30% of accounts receivable would be uncollectible. Required:Prepare journal entries to record Liang’s Year 1 and Year 2 summarized transactions and its year-end…arrow_forward

- Current Attempt in Progress On May 10, Sunland Company sold merchandise for $5.800 and accepted the customer's Best Business Bank MasterCard. At the end of the day, the Best Business Bank MasterCard receipts were deposited in the company's bank account. Best Business Bank charges a 4.5% service charge for credit card sales. Prepare the entry on Sunland Company's books to record the sale of merchandise. (Omit cost of goods sold entries.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation May 10 eTextbook and Media Save for Later Debit Credit Attempts: 0 of 2 used Submit Answerarrow_forwardSherman Co. began operations in Year 1. During its first two years, the company completed several transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows. Year 1 a. Sold $685,350 of merchandise on credit (that had cost $500,000), terms n∕30. b. Received $482,300 cash in payment of accounts receivable. c. Wrote off $9,350 of uncollectible accounts receivable. d. In adjusting the accounts on December 31, the company estimated that 1% of accounts receivable would be uncollectible. Year 2 e. Sold $870,220 of merchandise on credit (that had cost $650,000), terms n∕30. f. Received $990,800 cash in payment of accounts receivable. g. Wrote off $11,090 of uncollectible accounts receivable. h. In adjusting the accounts on December 31, the company estimated that 1% of accounts receivable would be uncollectible. Required Prepare journal entries to record Sherman’s summarized transactions and its year-end adjusting entries…arrow_forwardcalculate the unknown amount. On September 30, Valerian Co. had a $102,500 balance in Accounts Receivable. During October, the company collected $102,890 from its credit customers. The October 31 balance in Accounts Receivable was $89,000. Determine the amount of sales on account that occurred in October.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License