Fundamentals Of Financial Accounting

6th Edition

ISBN: 9781259864230

Author: PHILLIPS, Fred, Libby, Robert, Patricia A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 9E

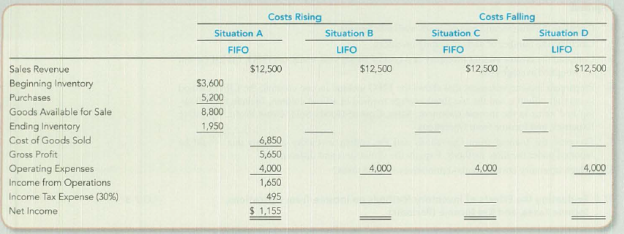

Choosing LIFO versus FIFO When Costs Are Rising and Falling

Use the following information to complete this exercise: sales, 550 units for 512,500; beginning inventory 300 units; purchases, 400 units; ending inventory, 150 units; and operating expenses, $4,000. Begin by setting up the following table and then complete the requirements that follow.

Required:

- 1. Complete the table for each situation. In Situations A and B (costs rising), assume the following: beginning inventory, 300 units at $12 = $3,600; purchases, 400 units at $13 $5,200. In Situations C and D (costs falling), assume the opposite; that is, beginning inventory, 300 units at $13 = $3,900; purchases, 400 units at $12 = $4,800. Use periodic inventory procedures.

- 2. Describe the relative effects on Income from Operations as demonstrated by requirement 1 when costs are rising and when costs are falling.

- 3. Describe the relative effects on Income Tax Expense for each situation.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Assume that Demand (D) = 10,000 units and Ordering Cost (S) = $10 (per order). Suppose that

we order at the Economic Order Quantity (EOQ) and the total inventory cost TC $500. What is

the EOQ?

Please refer to the picture below for the information. Kindly use a TABLE in showing the complete solution. Thank you so much.

Question: Using weighted average costing method, what is the amount of inventory as of December 31? and Using moving average costing method, what is the amount of inventory as of December 31, respectively?

Choices for weighted average costing method:

a. P59,000 b. P57,000 c. P61,600 d. P60,210

Choices for moving average costing method:

a. P59,010 b. P60,210 c. P60,900 d. P57,000

The following information relates to CEE Company: (Refer to image).

Assume that the company uses the average cost approach. What is the

cost ratio? Express your answer in percentage and round up to two

decimal points. *

Retail

Cost

500,000.00

Inventory, 12/31/2021

725,000.00

Purchases

1,285,000.00

2,220,000.00

Purchase returns

20,000.00

35,000.00

Purchase discounts

30,000.00

Sales (after employee discounts)

2,450,000.00

Sales returns

125,000.00

Sales allowances

70,000.00

Mark-ups

Mark-up cancellations

160,000.00

70,000.00

Mark-down

65,000.00

Mark-down cancellations

32,000.00

Freight in

Employee discounts

Normal loss from breakage

65,000.00

15,000.00

10,000.00

Chapter 7 Solutions

Fundamentals Of Financial Accounting

Ch. 7 - What are three goals of inventory management?Ch. 7 - Describe the specific types of inventory reported...Ch. 7 - The chapter discussed four inventory costing...Ch. 7 - Which inventory cost flow method is most similar...Ch. 7 - Where possible, the inventory costing method...Ch. 7 - Contrast the effects of LIFO versus FIFO on ending...Ch. 7 - Contrast the income statement effect of LIFO...Ch. 7 - Several managers in your company are experiencing...Ch. 7 - Explain briefly the application of the LCM rule to...Ch. 7 - Prob. 10Q

Ch. 7 - You work for a made-to-order clothing company,...Ch. 7 - Prob. 12QCh. 7 - (Supplement 7B) Explain why an error in ending...Ch. 7 - Which of the following statements are true...Ch. 7 - The inventory costing method selected by a company...Ch. 7 - Which of the following is not a name for a...Ch. 7 - Which of the following correctly expresses the...Ch. 7 - A New York bridal dress designer that makes...Ch. 7 - If costs are rising, which of the following will...Ch. 7 - Which inventory method provides a better matching...Ch. 7 - Which of the following regarding the lower of cost...Ch. 7 - An increasing inventory turnover ratio a....Ch. 7 - In which of the following situations is an LCM/NRV...Ch. 7 - Matching Inventory Items to Type of Business Match...Ch. 7 - Reporting Goods in Transit Abercrombie Fitch Co....Ch. 7 - Prob. 3MECh. 7 - Reporting Inventory-Related Accounts in the...Ch. 7 - Matching Financial Statement Effects to Inventory...Ch. 7 - Matching Inventory Costing Method Choices to...Ch. 7 - Calculating Cost of Goods Available for Sale,...Ch. 7 - Calculating Cost of Goods Available for Sale,...Ch. 7 - Calculating Cost of Goods Available for Sale,...Ch. 7 - Prob. 10MECh. 7 - Calculating Cost of Goods Available for Sale, Cost...Ch. 7 - Calculating Cost of Goods Available for Sale, Cost...Ch. 7 - Calculating Cost of Goods Available for Sale, Cost...Ch. 7 - Reporting Inventory under Lower of Cost or...Ch. 7 - Preparing the Journal Entry to Record Lower of...Ch. 7 - Determining the Effects of Inventory Management...Ch. 7 - Interpreting LCM Financial Statement Note...Ch. 7 - Calculating the Inventory Turnover Ratio and Days...Ch. 7 - Prob. 19MECh. 7 - Prob. 20MECh. 7 - Prob. 21MECh. 7 - (Supplement 7A) Calculating Cost of Goods Sold and...Ch. 7 - (Supplement 7B) Determining the Financial...Ch. 7 - Prob. 24MECh. 7 - Reporting Goods in Transit and Consignment...Ch. 7 - Determining the Correct Inventory Balance Seemore...Ch. 7 - Determining the Correct Inventory Balance Seemore...Ch. 7 - Calculating Cost of Ending Inventory and Cost of...Ch. 7 - Calculating Cost of Ending Inventory and Cost of...Ch. 7 - Prob. 6ECh. 7 - Analyzing and Interpreting the Financial Statement...Ch. 7 - Evaluating the Effects of Inventory Methods on...Ch. 7 - Choosing LIFO versus FIFO When Costs Are Rising...Ch. 7 - Using FIFO for Multiproduct Inventory Transactions...Ch. 7 - Reporting Inventory at Lower of Cost or Market/Net...Ch. 7 - Reporting Inventory at Lower of Cost or Market/Net...Ch. 7 - Analyzing and Interpreting the Inventory Turnover...Ch. 7 - Analyzing and Interpreting the Effects of the...Ch. 7 - Prob. 15ECh. 7 - Analyzing and Interpreting the Financial Statement...Ch. 7 - Prob. 17ECh. 7 - Analyzing the Effects of Four Alternative...Ch. 7 - Evaluating the Income Statement and Income Tax...Ch. 7 - Calculating and Interpreting the Inventory...Ch. 7 - Prob. 4CPCh. 7 - (Supplement 7B) Analyzing and Interpreting the...Ch. 7 - Analyzing the Effects of Four Alternative...Ch. 7 - Evaluating the Income Statement and Income Tax...Ch. 7 - Prob. 3PACh. 7 - Prob. 4PACh. 7 - (Supplement 7B) Analyzing and Interpreting the...Ch. 7 - Prob. 1PBCh. 7 - Prob. 2PBCh. 7 - Prob. 3PBCh. 7 - Prob. 4PBCh. 7 - (Supplement 7B) Analyzing and Interpreting the...Ch. 7 - Prob. 1COPCh. 7 - (Supplement 7A) Recording Inventory Transactions,...Ch. 7 - (Supplement 7A) Recording Inventory Purchases,...Ch. 7 - (Supplement 7A) Recording Inventory Purchases,...Ch. 7 - Prob. 5COPCh. 7 - Prob. 6COPCh. 7 - Prob. 7COPCh. 7 - Prob. 8COPCh. 7 - Prob. 9COPCh. 7 - Prob. 10COPCh. 7 - Prob. 11COPCh. 7 - Prob. 12COPCh. 7 - Prob. 1SDCCh. 7 - Prob. 2SDCCh. 7 - Critical Thinking: Income Manipulation under the...Ch. 7 - Accounting for Changing Inventory Costs In...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the last-in, first-out (LIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forwardUse the first-in, first-out (FIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forwardVariable Costing, Absorption Costing During its first year of operations, Snobegon, Inc. (located in Lake Snobegon, Minnesota), produced 40,900 plastic snow scoops. Snow scoops are oversized shovel-type scoops that are used to push snow away. Unit sales were 38,900 scoops. Fixed overhead was applied at $0.75 per unit produced. Fixed overhead was underapplied by $2,900. This fixed overhead variance was closed to Cost of Goods Sold. There was no variable overhead variance. The results of the year's operations are as follows (on an absorption-costing basis): Sales (38,900 units @ $20) $778,000 Less: Cost of goods sold 547,260 Gross margin $230,740 Less: Selling and administrative expenses (all fixed) 184,500 Operating income $ 46,240 Required: 1. Calculate the cost of the firm's ending inventory under absorption costing. Round unit cost to five decimal places. Round your final answer to the nearest dollar. %24 What is the cost of the ending inventory under variable costing? Round unit…arrow_forward

- As you watch the simulation, please keep in mind that this is a scenario where the system flow rate is R = 9 passengers per minute and the flow time is T = 6 seconds. Question 1: Use Little’s Law to compute the average inventory in this system, measured in “passengers. Question 2: On the basis of this information, would you expect the average inventory to increase or decrease from your answer to question 1? Why? Explain briefly in words. Question 3: Now use Little’s Law to compute the correct inventory when R = 10 passengers per minute. State the new inventory, I. Were you correct in question 2?arrow_forwardMercado Company's inventory transactions in the fiscal year ended December 31, 2002, follow: Beginning Inventory Jan. 10 Purchase Jan. 1 Feb. 13 Purchase Jul. 21 Purchase 775 units @ $52/unit Feb. 15 Sales @ 600 units @ $53/unit 225 units @ $54/unit Aug. 10 Sales @ 285 units @ $55/unit Aug. 5 Purchase Mercado Company uses a perpetual inventory system. Its inventory had a selling price of $115 per unit, and it entered into the following current-year sales transactions: 450 units @ $56/unit 515 units $115/unit 275 units $115/unitarrow_forwardMatch each term with the correct description. First-in, first-out (FIFO) method Choose ] Choose Measure of the average number of days inventory is held; calculated as 365 divided by inventory turnover. Inventory costing method that assumes the costs of the latest units purchased are the first to be allocated to cost of goods sold. Last-in, first-out (LIFO) method An actual physical flow costing method in which items still in inventory are specifically costed to arrive at the total cost of the ending inventory. A basis whereby inventory is stated at the lower of either its cost or its net realizable value. Inventory costing method that assumes that the costs of the earliest goods purchased are the first to be recognized as cost of goods sold. That portion of manufactured inventory that has been placed into the production process but is not yet complete. Lower-of-cost-or-net realizable value (LCNRV) basis Specific identification method [ Choose ] Weighted-average unit cost [Choose ]arrow_forward

- As a costing team member, calculate the gross profit if: Sales P6,000; Cost of Sales P5,000; Beginning Inventory P1,000; Purchases P4,000; Wages P2,000; and Office Rent P1,000?a. Loss = P2,500b. Loss = P1,500c. Profit = P2,500d. Profit = P1,000arrow_forwardCompute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. Round intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.arrow_forwardRequired 1. Compute cost of goods available for sale and the number of units available for sale. 2. Compute the number of units in ending inventory. 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (Round all amounts to cents.) 4. Compute gross profit earned by the company for each of the four costing methods in part 3.arrow_forward

- a. Present a cost-profit-volume analysis that shows the effect of adding the $8,500 annual premium to the company's fixed costs by showing current and revised CVP Income Statements. Include a column to the right of each income statement where each line item is expressed as a percentage of sales (called a common size income statement). b. Visualize the changes to net income in a chart. c. Advise the company using your quantitative support and qualitative. reasoning as to whether the company should purchase the insurance. A-Float Pools Company Income Statement (Pools Maintenance Div.) For the Year Ended December 31, 2022 In Sales (2,000 clients) Cost of Services Gross profit Operating expenses Selling Administrative Net Income $165,000 $225,000 $1,100,000 627,000 $473,000 $390,000 $83.000arrow_forwardPlease show working and calculations in answers Calculate the value of “Ending Inventory” based on the following information: “Beginning Inventory” = $700 Purchases = $300 Cost of sales = $800 Based on your answer to the previous question, what is the gross profit and gross profit margin if the sales are $1000?arrow_forwardA products demand in each period follows a Normal distribution with mean of 60 and standard deviation of 10. The order up to level S is 204. Lead time is 2 periods. What is the expected on hand inventory ? Show all formulas used, calculations and results. Do on Black Bd b. What is the stoch out probability. Show all formulas used, calculations and results. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License