Horngren's Accounting (11th Edition)

11th Edition

ISBN: 9780133856781

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem P6.31APGA

Objectives 5, 6

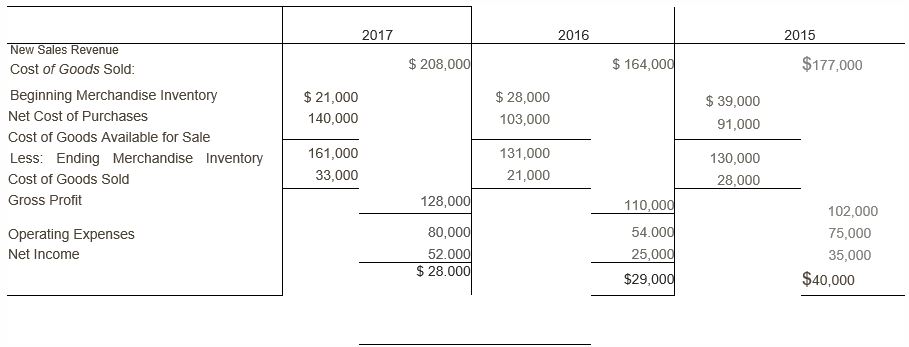

overstated $7,000 P6-31A Correcting inventory errors over a three-year period and computing inventory turnover and days sales in inventory

Lake Air Carpets's books show the following data. In early 2018, auditors found that the ending merchandise inventory for 2015 was understated by $6,000 and that the ending merchandise inventory for 2017 was overstated by $7,000. The ending merchandise inventory at December 31, 2016, was correct.

Requirements

- Prepare corrected income statements for the three years.

- State whether each year’s net income-before your corrections-is understated or overstated, and indicate the amount of the understatement or overstatement.

- Compute the inventory turnover and days’ sales in inventory using the corrected income statement for the three years. (Round all numbers to two decimals.)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

M7-17 Calculating Effect of Inventory Errors

For each of the following scenarios, determine the effect of the error on income in the current period and in the subsequent period. To answer these questions, rely on the inventory equation: Beginning inventory + Purchases - Cost of goods sold = Ending inventory

a. Porter Company received a shipment of merchandise costing $32,000 near the end of the fiscal year. The shipment was mistakenly recorded at a cost of $23,000.

b. Chiu, Inc., purchased merchandise costing $16,000. When the shipment was received, it was determined that the merchandise was damaged in shipment. The goods were returned to the supplier, but the accounting department was not notified and the invoice was paid.

c. After taking a physical count of its inventory, Murray Corporation determined that it had “shrink” of $12,500, and the books were adjusted accordingly. However, inventory costing $5,000 was never counted

#26

While examining the December 31, 2018 financial statements of Sydney company, the following errors are discovered:

*Inventory on January 1 had been overstated by P30,000.

*Inventory on December 31 was understated by P60,000.

During 2018, Donna received a P120,000 cash advance from customer for merchandise to be manufactured and shipped during 2019. The amount was credited to sales revenue.

*The net income reported on the 2018 income statement before reflecting any adjustment is P3,000,000.

What is the corrected net income for the year ended December 31, 2018?

ANSWER: 2,970,000

Pls provide solution and explanation for the answer above

PROBLEM 6: XXX Company is preparing its 2021 financial statements. Prior to any adjustments, inventory is valued at P1,605,000. The following information has been found relating to certaininventory transactions from your cut-off test:

A. Goods valued at P110,000 are on consignment with a customer. These goods werenot included in the ending inventory figure.

B.Goods costing P87,000 were received from a vendor on January 5, 2022. The relatedinvoice was received and recorded on January 12, 2022. The goods were shippedonDecember 31, 2021, terms FOB shipping point.

C. Goods costing P85,000, sold for P102,000, were shipped on December 31, 2021, andwere delivered to the customer on January 2, 2022. The terms of the invoice wereFOBshipping point. The goods were included in the ending inventory for 2021 and thesalewas recorded in 2022.

D. A P35,000 shipment of goods to a customer on December 31, terms FOB destinationwas not included in the year-end inventory. The goods cost P26,000…

Chapter 6 Solutions

Horngren's Accounting (11th Edition)

Ch. 6 - Which principle or concept states that business...Ch. 6 - Which inventory costing method assigns to ending...Ch. 6 - Assume Nile.com began April with 14 units of...Ch. 6 - Suppose Nile.com used the weighted-average...Ch. 6 - Which inventory costing method results in the...Ch. 6 - Which of the following is most closely linked to...Ch. 6 - At December 31, 2018, Stevenson Company overstated...Ch. 6 - Suppose Maestro’s had cost of goods sold during...Ch. 6 - Suppose used the LIFO inventory costing method and...Ch. 6 - Prob. 1RQ

Ch. 6 - Prob. 2RQCh. 6 - Prob. 3RQCh. 6 - Prob. 4RQCh. 6 - Discuss some measures that should be taken to...Ch. 6 - Under a perpetual inventory system, what are the...Ch. 6 - When using a perpetual inventory system and the...Ch. 6 - During periods of rising costs, which inventory...Ch. 6 - What does the lower-of-cost-or market (LCM) rule...Ch. 6 - What account is debited when recording the...Ch. 6 - What is the effect on cost of goods sold, gross...Ch. 6 - When does an inventory error cancel out, and why?Ch. 6 - How is inventory turnover calculated, and what it...Ch. 6 - How is days’ sales inventory calculated, and what...Ch. 6 - When using the periodic inventory system, which...Ch. 6 - When using periodic inventory system and...Ch. 6 - Determining inventory accounting principles...Ch. 6 - Determining inventory costing methods Learning...Ch. 6 - Prob. S6.3SECh. 6 - Prob. S6.4SECh. 6 - Prob. S6.5SECh. 6 - Prob. S6.6SECh. 6 - Prob. S6.7SECh. 6 - Prob. S6.8SECh. 6 - Prob. S6.9SECh. 6 - Prob. S6.10SECh. 6 - Prob. S6A.11SECh. 6 - Prob. S6A.12SECh. 6 - Prob. S6A.13SECh. 6 - Using accounting vocabulary Learning Objective 1,...Ch. 6 - Prob. E6.15ECh. 6 - Prob. E6.16ECh. 6 - Prob. E6.17ECh. 6 - Prob. E6.18ECh. 6 - Prob. E6.19ECh. 6 - Prob. E6.20ECh. 6 - Prob. E6.21ECh. 6 - Prob. E6.22ECh. 6 - Prob. E6.23ECh. 6 - Correcting an inventory error-two years Natural...Ch. 6 - Prob. E6.25ECh. 6 - Prob. E6A.26ECh. 6 - Prob. E6A.27ECh. 6 - Prob. P6.28APGACh. 6 - Prob. P6.29APGACh. 6 - Prob. P6.30APGACh. 6 - Objectives 5, 6 overstated $7,000 P6-31A...Ch. 6 -

Jepson Electronic Center began cost $70...Ch. 6 - Prob. P6.33BPGBCh. 6 - Prob. P6.34BPGBCh. 6 - Accounting principles for inventory and applying...Ch. 6 - Prob. P6.36BPGBCh. 6 - Prob. P6A.37BPGBCh. 6 - Prob. P6.38CPCh. 6 - Prob. P6.39PSCh. 6 - Prob. 6.1DCCh. 6 - > Fraud Case 6-1 Ever since he was a kid, Carl...Ch. 6 - Prob. 6.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- If a group of inventory items costing $3,200 had been double counted during the year-end inventory count, what impact would the error have on the following inventory calculations? Indicate the effect (and amount) as either (a) none, (b) understated $______, or (c) overstated $______. Table 10.2arrow_forwardErrors As controller of Lerner Company, which uses a periodic inventory system, you discover the following errors in the current year: 1. Merchandise with a cost of 17,500 was properly included in the final inventory, but the purchase was not recorded until the following year. 2. Merchandise purchases are in transit under terms of FOB shipping point. They have been excluded from the inventory, but the purchase was recorded in the current year on the receipt of the invoice of 4,300. 3. Goods out on consignment have been excluded from inventory. 4. Merchandise purchases under terms FOB shipping point have been omitted from the purchases account and the ending inventory. The purchases were recorded in the following year. 5. Goods held on consignment from Talbert Supply Co. were included in the inventory. Required: For each error, indicate the effect on the ending inventory and the net income for the current year and on the net income for the following year.arrow_forwardEffects of an Inventory Error The income statements for Graul Corporation for the 3 years ending in 2019 appear below. During 2019, Graul discovered that the 2017 ending inventory had been misstated due to the following two transactions being recorded incorrectly. a. A purchase return of inventory costing $42,000 was recorded twice. b. A credit purchase of inventory' made on December 20 for $28,500 was not recorded. The goods were shipped F.O.B. shipping point and were shipped on December 22, 2017. Required: 1. Was ending inventory for 2017 overstated or understated? By how much? 2. Prepare correct income statements for all 3 years. 3. CONCEPTUAL CONNECTION Did the error in 2017 affect cumulative net income for the 3-year period? Explain your response. 4. CONCEPTUAL CONNECTION Why was the 2019 net income unaffected?arrow_forward

- If a group of inventory items costing $15,000 had been omitted from the year-end inventory count, what impact would the error have on the following inventory calculations? Indicate the effect (and amount) as either (a) none, (b) understated $______, or (c) overstated $______. Table 10.1arrow_forwardQuestion Content Area Based on the following data for the current year, what is the inventory turnover? Sales on account during year $507,225 Cost of goods sold during year 190,106 Accounts receivable, beginning of year 47,004 Accounts receivable, end of year 51,339 Inventory, beginning of year 36,189 Inventory, end of year 44,233 Do not round interim calculations. Round your final answer to one decimal place. a.1.2 b.28.9 c.4.7 d.2.7arrow_forwardErrors in Inventory Count Bow Corp. accidentally overstated its 2015 ending inventory by $750. Assume that ending 2016 inventory is accurately counted. The error in 2015 will have what effect on Bow Corp.? Oa. 2015 net income is understated by $750 Ob. 2015 net income is overstated by $750. Oc, 2016 net income is understated by $750. Od. Both b and c are correct.arrow_forward

- Question 9 (i) Periodic inventory system is less commonly used by companies due to: A: the complexity in recording the sales and purchases of inventory. B: the ban of the use by the accounting systems. C: extra effort in performing the stock taking every month. D: less updated information on inventory provided during the year. (ii) Paul Company uses its periodic inventory system and you are given the following information: Sales.... . . . . . . ........................................................$65,100 Inventory- Beginning...........................................$16,800 Inventory- Ending.... . . . . . . . . . . . . . . . . . . . .$14,700 Purchases... . . . . . . . . . . . . . . . . .................... . .$48,300 How much is the gross profit? A: $14,700. B: $50,400. C: $48,300. D: $65,100.arrow_forwardJournalizing adjusting entries including estimating sales returns Emerson St. Book Shop’s unadjusted Merchandise Inventory at June 30, 2018 was 55,200. The cost associated with the physical count of inventory on hand on June 30, 2018, was $4,900. In addition, Emerson St. Book Shop estimated approximately 31,000 of merchandise sold will be returned with a cost of $400. Requirements Journalize the adjustment for inventory shrinkage. Journalize the adjustment for estimated sales returns.arrow_forwardPROBLEM 21: A physical inventory taken on December 31, 2021 resulted in an ending inventoryof P1,440,000. San Salvador Company suspects some inventory may have been takenbyemployees. To estimate the cost of missing inventory, the following were gathered: Inventory, December 31, 2020 P 1,280,000 Purchases during 2021 5,640,000 Cash sales during 2021 1,400,000 Shipment received on December 26, 2021, included in physical inventory but not recorded as purchases 40,000 Deposits made with suppliers, entered as purchases. Goods were not received in 2021 80,000 Collections on accounts receivable, 2021 7,200,000 Accounts receivable, January 1, 2021 1,000,000 Accounts receivable, December 31, 2021 1,200,000 Gross profit percentage on sales 40% 27. At December 31, 2021, what is the estimated cost of missing inventory?arrow_forward

- Malcolm Lee Industries reported the following amounts in its December 31st financial statements: 2023 $270,500 55,400 Cost of Goods sold Ending Inventory Errors were made in each year as follows: in 2023, ending inventory was overstated by $10,500 while in 2024, ending inventory was understated by $6,800. Explain the impact of these errors for 2024 profit and owners' equity. Profits will be Owners' equity will be 2024 $287,700 55,400 by $ by $arrow_forwardCurrent Attempt in Progress Blossom Company reported cost of goods sold as follows. 2017 2016 Beginning inventory $32,380 $18,370 Cost of goods purchased 184,210 172,410 Cost of goods available for sale 216,590 190,780 Less: Ending inventory 39,050 32,380 Cost of goods sold $177,540 $158,400 Blossom Company made two errors: 1. 2016 ending inventory was overstated by $2,050. 2. 2017 ending inventory was understated by $5,300. Compute the correct cost of goods sold for each year. The correct cost of goods sold 2016 2017arrow_forwardReview Exercises 7-41 M7-8 Assuming no beginning inventory, what can be said about the trend of inventory prices if cost of goods sold computed when inventory is valucd using the FIFO method exceeds cost of goods sold when inventory is valued using the LIFO method? Under the dollar-value LIFO inventory method, Kern's inventory method, Kern's inventory on December 31, 2016, would be: LO 7.5 a. $650,000 b. $655,000 c. $660,000 d. $720,000 a. Prices decreased. When the double-extension approach to the dollar-value LIFO inventory cost flow method is used, the inventory layer added in the current year is multiplied by an index number. How would the following be used in the calculation of this index number? M7-10 b. Prices remained unchanged. c. Prices increased. d. Price trend cannot be determined from information given. LO 7.7 On December 31, 2015, Kern Company adopted the dollar-value LIFO inventory method. All of Kern's inventories constitute a single pool. The inventory on Dccember 31,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License