Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 6, Problem 8P

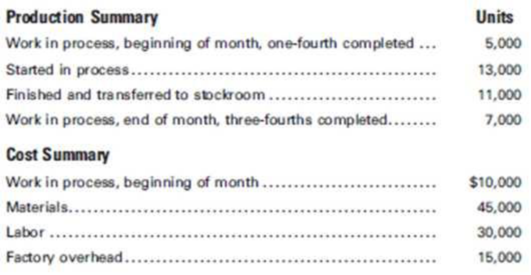

Daytona Beverages Inc. uses the FIFO cost method and adds all materials, labor, and factory overhead evenly to production. A record of the factory operations for October follows:

Required:

Prepare a cost of production summary for the month.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Hartley Uniforms produces uniforms. The company allocates manufacturing overhead based on the machine hours each job uses. Hartley Uniforms reports the following cost data for the past year:

E (Click the icon to view the cost data.)

Read the requirements.

Data table

Requirement 1. Compute the predetermined manufacturing overhead rate.

Enter the formula for predetermined manufacturing overhead rate, then compute the rate.

Budget

Actual

Estimated yearly overhead costs

Estimated yearly machine hours

Predetermined overhead rate

Direct labor hours.

7,600 hours

6,100 hours

194,400

7,200

$

27

per machine hour

Machine hours.

7,200 hours 6,300 hours

Requirement 2. Calculate the allocated manufacturing overhead for the past year.

Depreciation on salespeople's autos

23,000 $

23,000

Indirect materials..

$

48,500 $

50,500

Manufacturing

Depreciation on trucks used to deliver uniforms to customers

$

13,000 $

11,000

Actual machine hours

Predetermined overhead rate

overhead allocated

Depreciation on…

Drew Manufacturing Company had the following purchases and usage of materials X for the month of August (see table below). Determine the cost of raw materials issued to production using FIFO-Periodic: *

Sundance Solar Company operates two factories. The company applies factory overhead to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine hours are as follows:See Attachmenta. Determine the factory overhead rate for Factory 1.b. Determine the factory overhead rate for Factory 2.c. Journalize the entries to apply factory overhead to production in each factory for March.d. Determine the balances of the factory overhead accounts for each factory as of March 31 and indicate whether the amounts represent over- or underapplied factory overhead.

Chapter 6 Solutions

Principles of Cost Accounting

Ch. 6 - Under what conditions may the unit costs of...Ch. 6 - When is it necessary to use separate equivalent...Ch. 6 - Why is it usually reasonable to assume that labor...Ch. 6 - If materials are not put into process uniformly,...Ch. 6 - In what way do the cost of production summaries in...Ch. 6 - Why might the total number of units completed...Ch. 6 - What is the usual method of handling the cost of...Ch. 6 - If some units are normally lost during the...Ch. 6 - How is the cost of units normally lost reflected...Ch. 6 - Prob. 10Q

Ch. 6 - What adjustment must be made if materials added in...Ch. 6 - What is the difference between the unit costs are...Ch. 6 - What advantage does the FIFO cost method have over...Ch. 6 - How would you define each of the following? a....Ch. 6 - What are three methods of allocating joint costs?

Ch. 6 - Prob. 16QCh. 6 - Prob. 17QCh. 6 - Using the data given for Cases 13 below, and...Ch. 6 - Precision Inc. manufactures wristwatches on an...Ch. 6 - The following data appeared in the accounting...Ch. 6 - Conte Chemical Co. uses the weighted average cost...Ch. 6 - Assuming that all materials are added at the...Ch. 6 - Foamy Inc. manufactures shaving cream and uses the...Ch. 6 - Calculating unit costs; units lost in production...Ch. 6 - Sonoma Products Inc. manufactures a liquid product...Ch. 6 - A company manufactures a liquid product called...Ch. 6 - Using the data given for Cases 1–3 and the FIFO...Ch. 6 - Assume each of the following conditions concerning...Ch. 6 - Adirondack Bat Co. processes rough timber to...Ch. 6 - Computing joint costssales value at split-off and...Ch. 6 - LeMoyne Manufacturing Inc.’s joint cost of...Ch. 6 - Making a journal entryby-product Petrone Metals...Ch. 6 - Espana Co. makes one main product, Uno, and a...Ch. 6 - Manufacturing data for January and February in the...Ch. 6 - Manufacturing data for June and July in the...Ch. 6 - On December 1, Carmel Valley Production Inc. had a...Ch. 6 - Akron Manufacturing Co. manufactures a...Ch. 6 - Green Products Inc. cans peas and uses the...Ch. 6 - Monterrey Products Co. uses the process cost...Ch. 6 - Prob. 7PCh. 6 - Daytona Beverages Inc. uses the FIFO cost method...Ch. 6 - Clearwater Candy Co. had a cost per equivalent...Ch. 6 - Mt. Palomar Manufacturing Co. uses a process cost...Ch. 6 - Otto Inc. specializes in chicken farming. Chickens...Ch. 6 - Otto Inc. specializes in chicken farming. Chickens...Ch. 6 - Venezuela Oil Inc. transports crude oil to its...Ch. 6 - Clark Kent Inc. buys crypton for $.80 a gallon. At...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (5th Edition)

Ravenna Candles recently purchased candleholders for resale in its shops. Which of the following costs would be...

Financial Accounting (12th Edition) (What's New in Accounting)

Analysis of inventory errors A2 Hallam Company’s financial statements show the following. The company recently ...

FINANCIAL ACCT.FUND.(LOOSELEAF)

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Calculating certain information using the direct method (Learning Objective 4) 20-25 min. Trudeaus Marine, Inc....

Financial Accounting, Student Value Edition (5th Edition)

18. What is the calculation for return on assets (ROA)? Explain what ROA measures.

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dublin Brewing Co. uses the process cost system. The following data, taken from the organizations books, reflect the results of manufacturing operations during October: Production Costs Work in process, beginning of period: Costs incurred during month: Production Data: 13,000 units finished and transferred to stockroom Work in process, end of period, 2,000 units one-half completed Required: Prepare a cost of production summary for October.arrow_forwardKokomo Kayak Inc. uses the process cost system. The following data, taken from the organizations books, reflect the results of manufacturing operations during the month of March: Production Costs Work in process, beginning of period: Costs incurred during month: Production Data: 18,000 units finished and transferred to stockroom. Work in process, end of period, 3,000 units, two-thirds completed. Required: Prepare a cost of production summary for March.arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forward

- Gunnison Company had the following equivalent units schedule and cost information for its Sewing Department for the month of December: Required: 1. Calculate the unit cost for December, using the FIFO method. 2. Calculate the cost of goods transferred out, calculate the cost of EWIP, and reconcile the costs assigned with the costs to account for. 3. What if you were asked for the unit cost from the month of November? Calculate Novembers unit cost and explain why this might be of interest to management.arrow_forwardAero Aluminum Inc. uses a process cost system. The records for May show the following information: Required: Prepare a cost of production summary for each department. (Hint: When preparing the Converting production summary, refer to the Rolling production summary for the costs transferred in during the month.)arrow_forwardMonterrey Products Co. uses the process cost system. A record of the factory operations for the month of October follows: Required: Prepare a cost of production summary, assuming that the production losses are considered to be normal.arrow_forward

- Prepare a cost of production report for the Cutting Department of Dalton Carpet Company for January. Assuming that direct materials are placed in process during production, use the weighted average method with the following data:arrow_forwardThe controller at Bethune Chemicals asks for your help in sorting out some cost information. You receive the following sheet for the most recent year: Cost of goods manufactured Cost of goods sold Direct labor costs Direct materials inventory, December 31 Direct materials purchased Finished goods inventory, December 31 Prime costs for the year Total manufacturing costs Work-in-process inventory, January 11 Required: Compute: a. Direct materials used. b. Direct materials inventory, January 1. c. Conversion costs. d. Work-in-process inventory, December 31. e. Manufacturing overhead. 1. Finished goods inventory, January 1. a. Direct materials used b. Direct materials inventory c. Conversion costs d. Work-in-process inventory e. Manufacturing overhead f. Finished goods inventory $ 906,000 727,400 184,000 52,000 263,200 236,400 466,600 914,400 26,200arrow_forwardEclipse Solar Company operates two factories. The company applies factory overheadto jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours inFactory 2. Estimated factory overhead costs, direct labor hours, and machine hours are as follows: a. Determine the factory overhead rate for Factory 1.b. Determine the factory overhead rate for Factory 2.c. Journalize the entries to apply factory overhead to production in each factory for August.d. Determine the balances of the factory overhead accounts for each factory as of August 31, andindicate whether the amounts represent over- or underapplied factory overhead.arrow_forward

- Sultan Company uses an activity-based costing system. At the beginning of the year, the company made the following estimates of cost and activity for its five activity cost pools: 17 Activity Cost Pool Labor-related Purchase orders Parts management Board etching General factory Activity Measure Direct labor-hours Number of orders Number of part types Number of boards Machine-hours Activity Cost Pool Required: 1. Compute the activity rate for each of the activity cost pools. 2. The expected activity for the year was distributed among the company's four products as follows: Product A 7,100 78 38 550 2,900 Labor-related Purchase orders Parts management Board etching General factory Expected Overhead Cost $ 270,900 $ 11,745 $78,570 $ 72,400 $ 212,400 Requir1 Required 2 Compute the activity rate for each of the activity cost pools. Activity Cost Pool Labor-related (DLHs) Product C 4,000 47 Purchase orders (orders) Parts management (part types) 30 Board etching (boards) 520 General factory…arrow_forwardThe chief cost accountant for Voltaire Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning May 1 would be $2,340,000 and total direct labor costs would be $1,800,000. During May, the actual direct labor cost totaled $145,000 and factory overhead cost incurred totaled $192,100. Question Content Area a. What is the predetermined factory overhead rate based on direct labor cost? Enter your answer as a whole percent not in decimals. fill in the blank 1772e2fb3039fb1_1 % Question Content Area b. Journalize the entry to apply factory overhead to production for May. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select - Question Content Area c. What is the May 31 balance of the account Factory Overhead—Blending Department? Amount: $fill in the blank 1ea1070e903a021_1 Debit or Credit? d. Does the balance in part (c) represent overapplied or underapplied factory…arrow_forwardThe following data on materials purchased and issued during the month of June were shown: the cost of materials issued to production (under FIFO method) should be: 2.Of the following costs, how much is the total product/manufacturing costs? Direct Labor> P 50,000. Factory Rent >P 10,000. Indirect Labor >P10,000 . Salaries of Factory Supervisor >P35,000. Factory supplies used >P 5,000. Indirect Materials >P15,000. Direct Materials >P45,000. Salary of sales >P35,000. Insurance of Machineries >P 12,000. 3. Of the following costs, how much is the prime cost? Direct Labor> P 50,000. Factory Rent >P 10,000. Indirect Labor >P10,000 . Salaries of Factory Supervisor >P35,000. Factory supplies used >P 5,000. Indirect Materials >P15,000. Direct Materials >P45,000. Salary of sales >P35,000. Insurance of Machineries >P 12,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY