College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 4PA

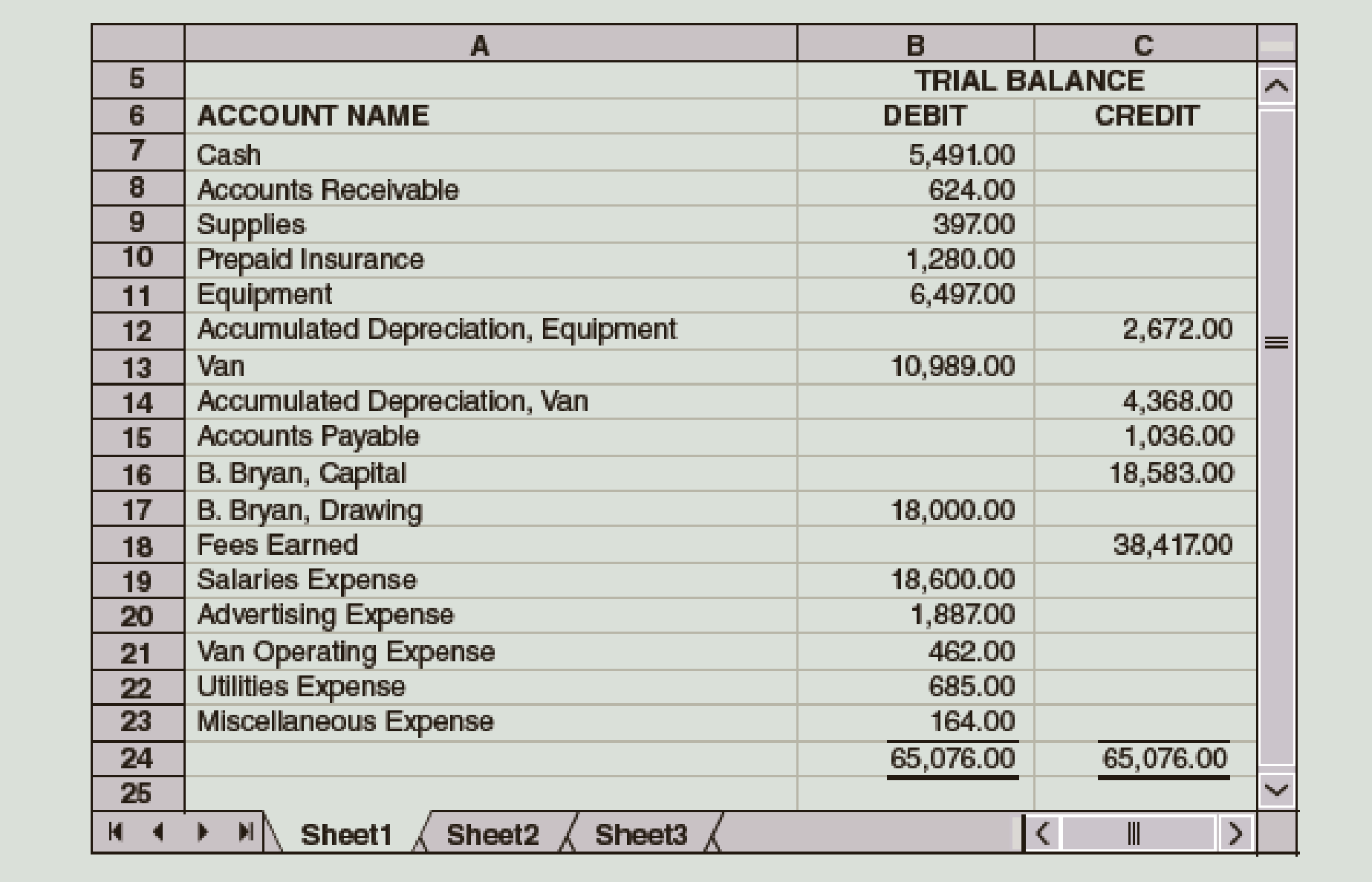

The account balances of Bryan Company as of June 30, the end of the current fiscal year, are as follows:

Required

- 1. Data for the adjustments are as follows:

- a. Expired or used up insurance, $495

- b.

Depreciation expense on equipment, $670. - c. Depreciation expense on the van, $1,190.

- d. Salary accrued (earned) since the last payday, $540 (owed and to be paid on the next payday).

- e. Supplies used during the period, $97.

Your instructor may want you to use a work sheet for these adjustments.

- 2. Journalize the

adjusting entries . - 3. Prepare an income statement.

- 4. Prepare a statement of owner’s equity. Assume that there was an additional investment of $2,000 on June 10.

- 5. Prepare a balance sheet.

- 6. Journalize the closing entries using the four steps in the correct sequence.

Check Figure

Net Income, $13,627

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Unadjusted account balances at December 31, 2019, for Rapisarda Company are as follows: The following data are not yet recorded:a. Depreciation on the equipment is $18,350.b. Unrecorded wages owed at December 31, 2019: $4,680.c. Prepaid rent at December 31, 2019: $9,240.d. Income taxes expense: $5,463.Required:Prepare a completed worksheet for Rapisarda Company.

Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31 follow. Assume that the company’s income tax rate is 30% for all items.

Debit

Credit

a.

Interest revenue

$ 14,600

b.

Depreciation expense—Equipment

$ 34,600

c.

Loss on sale of equipment

26,450

d.

Accounts payable

44,600

e.

Other operating expenses

107,000

f.

Accumulated depreciation—Equipment

72,200

g.

Gain from settlement of lawsuit

44,600

h.

Accumulated depreciation—Buildings

175,700

i.

Loss from operating a discontinued segment (pretax)

18,850

j.

Gain on insurance recovery of tornado damage

29,720

k.

Net sales

1,004,500

l.

Depreciation expense—Buildings

52,600

m.

Correction of overstatement of prior year’s sales (pretax)

16,600

n.

Gain on sale of discontinued segment’s assets (pretax)

37,000

o.

Loss from settlement of lawsuit

24,350

p.

Income tax expense

?

q.

Cost of goods sold

488,500…

The following items are taken from the adjusted trial balance of Westley Company for the month ending July 31, 2021:

Accounts payable

Accounts receivable

Accumulated depreciation - equipment

Cash

Common Stock

Depreciation expense

Equipment

Retained earnings 7/1/21

Service revenue

Supplies

$2,000

3,300

8,000

2,600

30,000

2,000

54,000

22,000

33,000

1,200

Prepare the current assets section of Westley's classified balance sheet. (List Current Assets in order of liquidity)

WESTLEY COMPANY

Balance Sheet (Partial)

Assets

$

Chapter 5 Solutions

College Accounting (Book Only): A Career Approach

Ch. 5 - What is the third step in the accounting cycle?...Ch. 5 - Which of the following accounts would be closed...Ch. 5 - If Income from Services had a 20,400 credit...Ch. 5 - Which of the following accounts would appear on a...Ch. 5 - Under the cash basis of accounting, which of the...Ch. 5 - Prob. 6QYCh. 5 - Number in order the following steps in the...Ch. 5 - List the steps in the closing procedure in the...Ch. 5 - What is the purpose of closing entries? What is a...Ch. 5 - What are real accounts? What are nominal accounts?...

Ch. 5 - What is the purpose of the Income Summary account?...Ch. 5 - What is the purpose of the post-closing trial...Ch. 5 - Write the third closing entry to transfer the net...Ch. 5 - Prob. 8DQCh. 5 - Prob. 9DQCh. 5 - Classify the following accounts as real...Ch. 5 - The ledger accounts after adjusting entries for...Ch. 5 - As of December 31, the end of the current year,...Ch. 5 - The Income Statement columns of the work sheet of...Ch. 5 - The Income Statement columns of the work sheet of...Ch. 5 - After all revenue and expenses have been closed at...Ch. 5 - Identify whether the following accounts would be...Ch. 5 - Considering the following events, determine which...Ch. 5 - Indicate with an X whether each of the following...Ch. 5 - Prepare a statement of owners equity for The...Ch. 5 - Prob. 1PACh. 5 - The partial work sheet for Ho Consulting for May...Ch. 5 - The account balances of Bryan Company as of June...Ch. 5 - Williams Mechanic Services prepared the following...Ch. 5 - Prob. 1PBCh. 5 - The partial work sheet for Emil Consulting for...Ch. 5 - The account balances of Miss Beverlys Tutoring...Ch. 5 - Toms Catering Services prepared the following work...Ch. 5 - Rather than going directly to college, some...Ch. 5 - Prob. 2ACh. 5 - The post-closing trial balance submitted to you by...Ch. 5 - You are preparing a post-closing trial balance for...Ch. 5 - The bookkeeper has completed a work sheet and has...Ch. 5 - This problem is designed to enable you to apply...Ch. 5 - This problem is designed to enable you to apply...Ch. 5 - After the adjusting entries are recorded and...

Additional Business Textbook Solutions

Find more solutions based on key concepts

What are assets limited as to use and how do they differ from restricted assets?

Accounting for Governmental & Nonprofit Entities

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

Principles Of Taxation For Business And Investment Planning 2020 Edition

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

The managers of an organization are responsible for performing several broad functions. They are ______________...

Principles of Accounting Volume 2

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (4th Edition)

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing and Assurance Services (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardThe following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal year. The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. Required 1. Prepare a work sheet for the fiscal year ended January 31. Ignore this step if using QuickBooks or general ledger. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. Ignore this step if using CLGL. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. Check Figure Net loss, 1,737arrow_forwardAssume the following data for Oshkosh Company before its year-end adjustments: Journalize the adjusting entries for the following: a. Estimated customer refunds and allowances b. Estimated customer returnsarrow_forward

- Journalize the adjusting entry for each of the following accrued expenses at the end of the current year:a. Product warranty cost, $26,800.b. Interest on the 19 remaining notes owed to Gallardo Co.arrow_forwardSelected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31 follow. Assume that the company’s income tax rate is 40% for all items. Debit Credit a. Interest revenue $ 14,400 b. Depreciation expense—Equipment $ 34,400 c. Loss on sale of equipment 26,250 d. Accounts payable 44,400 e. Other operating expenses 106,800 f. Accumulated depreciation—Equipment 72,000 g. Gain from settlement of lawsuit 44,400 h. Accumulated depreciation—Buildings 175,300 i. Loss from operating a discontinued segment (pretax) 18,650 j. Gain on insurance recovery of tornado damage 29,520 k. Net sales 1,002,500 l. Depreciation expense—Buildings 52,400 m. Correction of overstatement of prior year’s sales (pretax) 16,400 n. Gain on sale of discontinued segment’s assets (pretax) 36,000 o. Loss from settlement of lawsuit 24,150 p. Income tax expense ? q. Cost of goods sold 486,500…arrow_forwardSelected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31 follow. Assume that the company’s income tax rate is 40% for all items. Debit Credit a. Interest revenue $ 14,400 b. Depreciation expense—Equipment $ 34,400 c. Loss on sale of equipment 26,250 d. Accounts payable 44,400 e. Other operating expenses 106,800 f. Accumulated depreciation—Equipment 72,000 g. Gain from settlement of lawsuit 44,400 h. Accumulated depreciation—Buildings 175,300 i. Loss from operating a discontinued segment (pretax) 18,650 j. Gain on insurance recovery of tornado damage 29,520 k. Net sales 1,002,500 l. Depreciation expense—Buildings 52,400 m. Correction of overstatement of prior year’s sales (pretax) 16,400 n. Gain on sale of discontinued segment’s assets (pretax) 36,000 o. Loss from settlement of lawsuit 24,150 p. Income tax expense ? q. Cost of goods sold 486,500…arrow_forward

- Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31 follow. Assume that the company’s income tax rate is 40% for all items. Debit Credit a. Interest revenue $ 14,400 b. Depreciation expense—Equipment $ 34,400 c. Loss on sale of equipment 26,250 d. Accounts payable 44,400 e. Other operating expenses 106,800 f. Accumulated depreciation—Equipment 72,000 g. Gain from settlement of lawsuit 44,400 h. Accumulated depreciation—Buildings 175,300 i. Loss from operating a discontinued segment (pretax) 18,650 j. Gain on insurance recovery of tornado damage 29,520 k. Net sales 1,002,500 l. Depreciation expense—Buildings 52,400 m. Correction of overstatement of prior year’s sales (pretax) 16,400 n. Gain on sale of discontinued segment’s assets (pretax) 36,000 o. Loss from settlement of lawsuit 24,150 p. Income tax expense ? q. Cost of goods sold 486,500…arrow_forwardThe estimated amount of depreciation on equipment for the current year is $6,475. Journalize the adjusting entry to record the depreciation. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardThe following items were selected from among the transactions completed by Sherwood Co. during the current year:Required:1. Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year. Round your answers to the nearest dollar.2. Journalize the adjusting entry for each of the following accrued expenses at the end of the current year (refer to the Chart of Accounts for exact wording of account titles):a. Product warranty cost, $29,000.b. Interest on the nine remaining notes owed to Greenwood Co. Assume a 360-day year.arrow_forward

- prepare these entries for Sarah's plant services. prepare general journal entries for the needed balance dy adjustments for the year ending 30/6/21: A stocktake of the inventory on hand was completed on 30/6/21. The value of the stocktake was $17,000. The inventory asset account as at 30/6/21 before adjustments was $18.000 The allowance for Doubtful debts should be 5% of the balance of Accounts Receivable. The accounts receivable balance at 30/6/21 is $76,120 and the balance of the Allowance for Doubtful Debts was $3,450arrow_forwardRequired information [The following information applies to the questions displayed below.] Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31 follow. Assume that the company's income tax rate is 40% for all items. a. Interest revenue b. Depreciation expense-Equipment c. Loss on sale of equipment d. Accounts payable. e. Other operating expenses f. Accumulated depreciation-Equipment g. Gain from settlement of lawsuit h. Accumulated depreciation-Buildings i. Loss from operating a discontinued segment (pretax) j. Gain on insurance recovery of tornado damage k. Net sales 1. Depreciation expense-Buildings m. Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segment's assets (pretax) o. Loss from settlement of lawsuit p. Income tax expense q. Cost of goods sold. 4. What is the amount of net income for the year? Net income Debit $ 34,100 25,950 106,500 18,350 52,100 16,100 23,850 ?…arrow_forwardGrouper Company has the following selected accounts after posting adjusting entries: Accounts Payable $57,040 Notes Payable, 3-month 36,800 Accumulated Depreciation—Equipment 12,880 Notes Payable, 5-year, 6% 73,600 Payroll Tax Expense 3,680 Interest Payable 2,760 Mortgage Payable 110,400 Sales Taxes Payable 34,960 1 .Prepare the current liability section of Grouper Company's balance sheet, assuming $14,720 of the mortgage is payable next year. (For Notes Payable enter the account name only and do not provide any additional descriptive information e.g. due 2017, 5 Months.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License