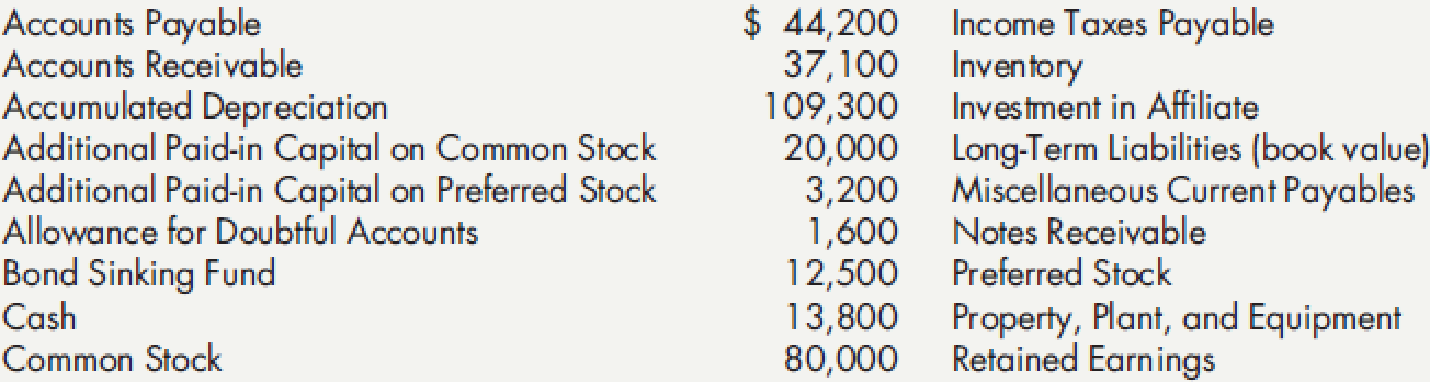

Comprehensive: Balance Sheet, Schedules, and Notes The following is an alphabetical listing of Stone Boat Company’s balance sheet accounts and account balances on December 31, 2016:

Additional information:

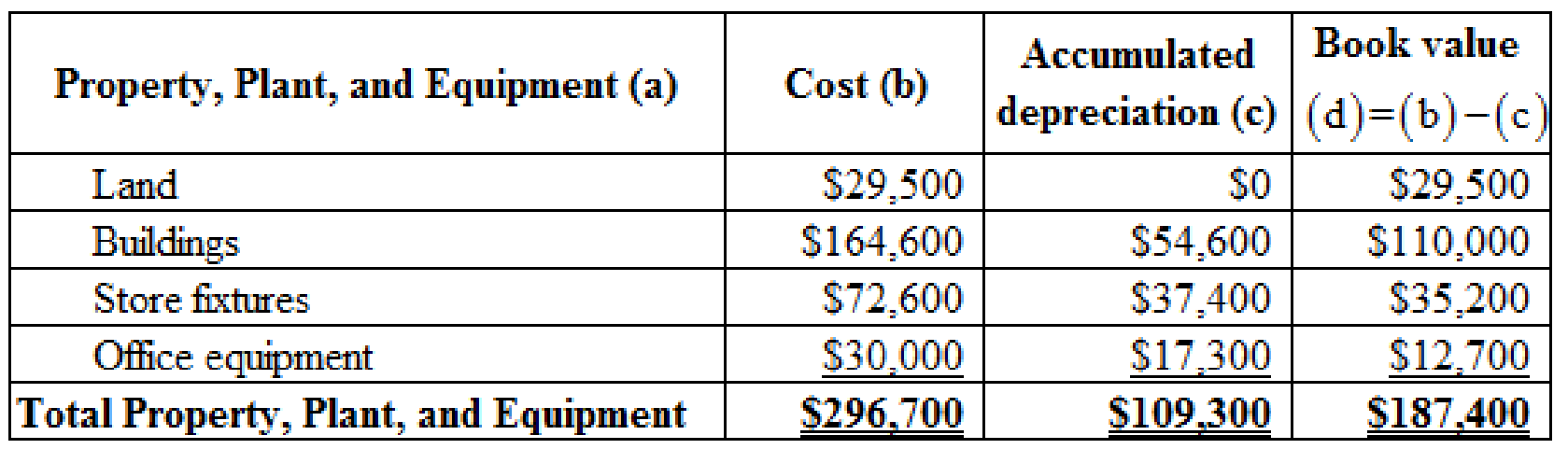

- 1. The company reports on the balance sheet the net book value of property and equipment and long-term liabilities (known as control accounts). The related details are disclosed in the notes.

- 2. The straight-line method is used to

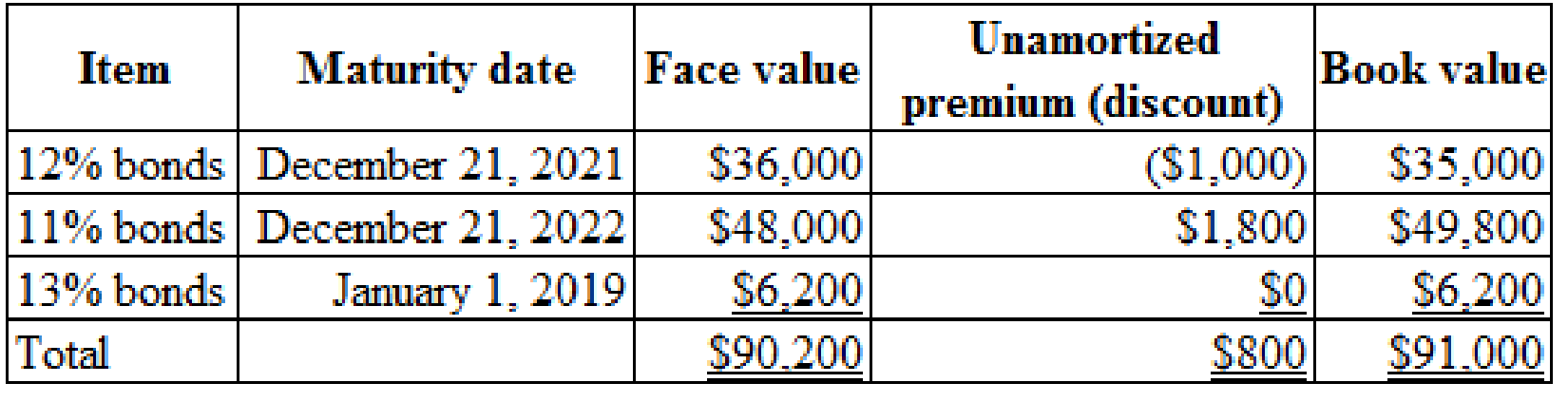

depreciate property and equipment based upon cost, estimated residual value, and estimated life. The costs of the assets in this account are: land, $29,500; buildings, $164,600; store fixtures, $72,600; and office equipment, $30,000. - 3. The

accumulated depreciation breakdown is as follows: buildings, $54,600; store fixtures, $37,400; and office equipment, $17,300. - 4. The long-term debt includes 12%, $36,000 face

value bonds that mature on December 31, 2021, and have an unamortized bond discount of $1,000; 11%, $48,000 face value bonds that mature on December 31, 2022, have a premium on bonds payable of $1,800, and whose retirement is being funded by a bond sinking fund; and a 13% note payable that has a face value of $6,200 and matures on January 1, 2019. - 5. The non-interest-bearing note receivable matures on June 1, 2020.

- 6. Inventory is listed at lower of cost or market; cost is determined on the basis of average cost.

- 7. The investment in affiliate is carried at cost. The company has guaranteed the interest on 12%, $50,000, 15-year bonds issued by this affiliate, Jay Company.

- 8. Common stock has a $10 par value per share, 10,000 shares are authorized, and 1,000 shares were issued during 2016 at a price of $13 per share, resulting in 8,000 shares issued at year-end.

- 9.

Preferred stock has a $50 par value per share, 2,000 shares are authorized, and 140 shares were issued during 2016 at a price of $55 per share, resulting in 640 shares issued at year-end. - 10. On January 15, 2017, before the December 31, 2016, balance sheet was issued, a building with a cost of $20,000 and a book value of $7,000 was totally destroyed. Insurance proceeds will amount to only $5,000.

- 11. Net income and dividends declared and paid during the year were $50,500 and $21,000, respectively.

Required:

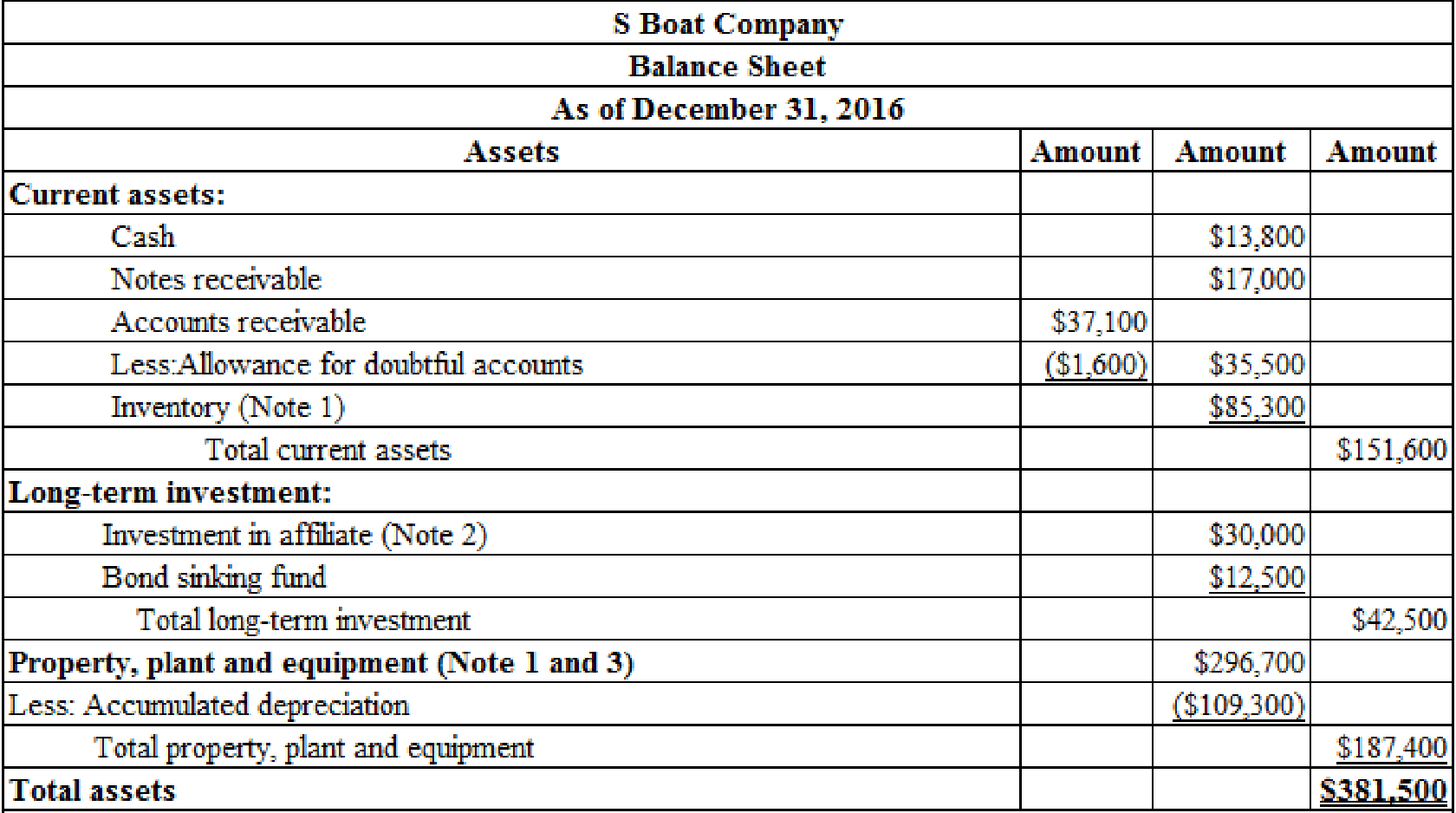

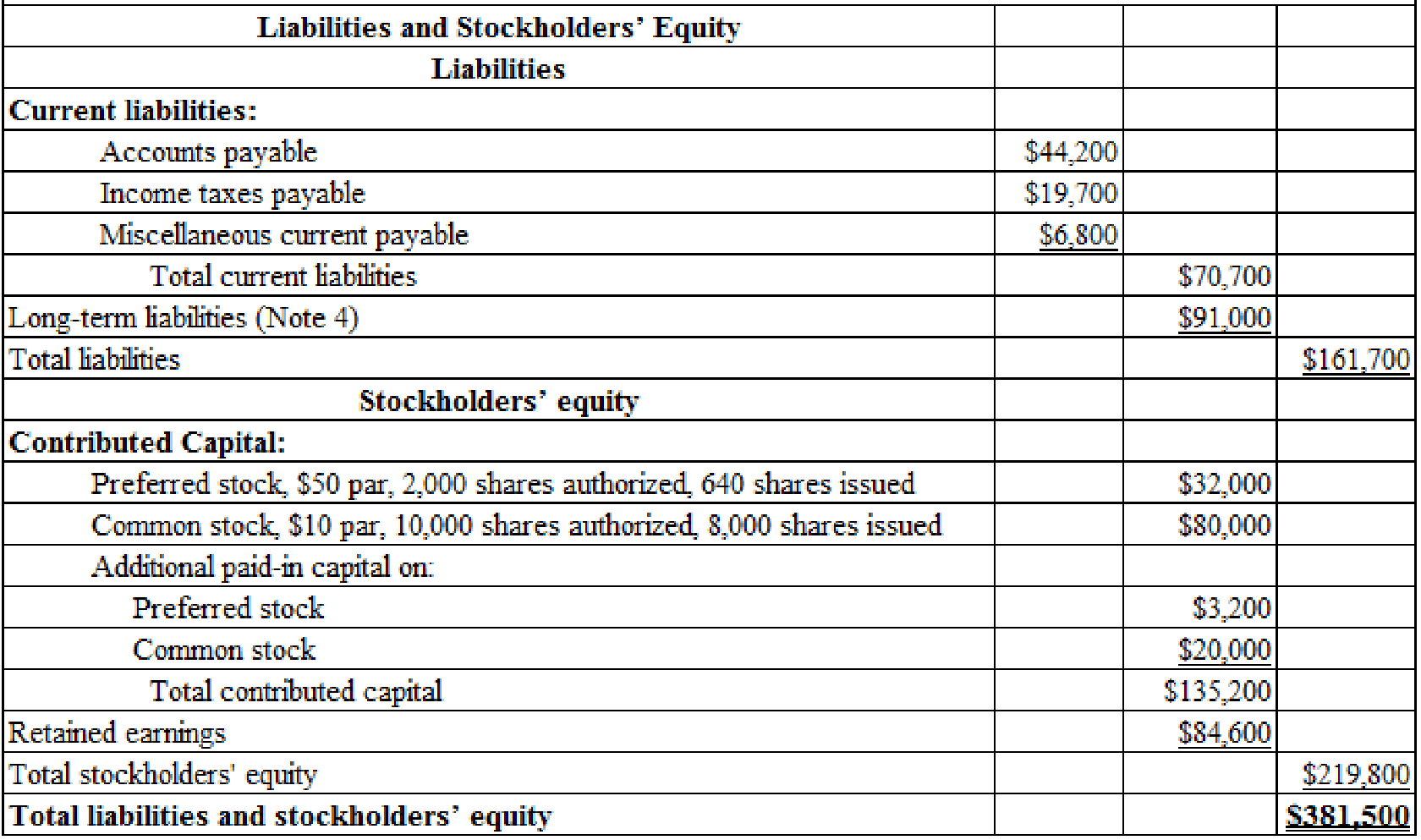

- 1. Prepare Stone Boat’s December 31, 2016, balance sheet (including appropriate parenthetical notations).

- 2. Prepare a statement of shareholders’ equity for 2016. (Hint: Work back from the ending account balances.)

- 3. Prepare notes that itemize the balance sheet control accounts and those necessary to disclose any company accounting policies,

contingent liabilities , and subsequent events. - 4. Next Level Compute the debt-to-assets ratio at the end of 2016. What is your evaluation of this ratio if it was 39% at the end of 2015?

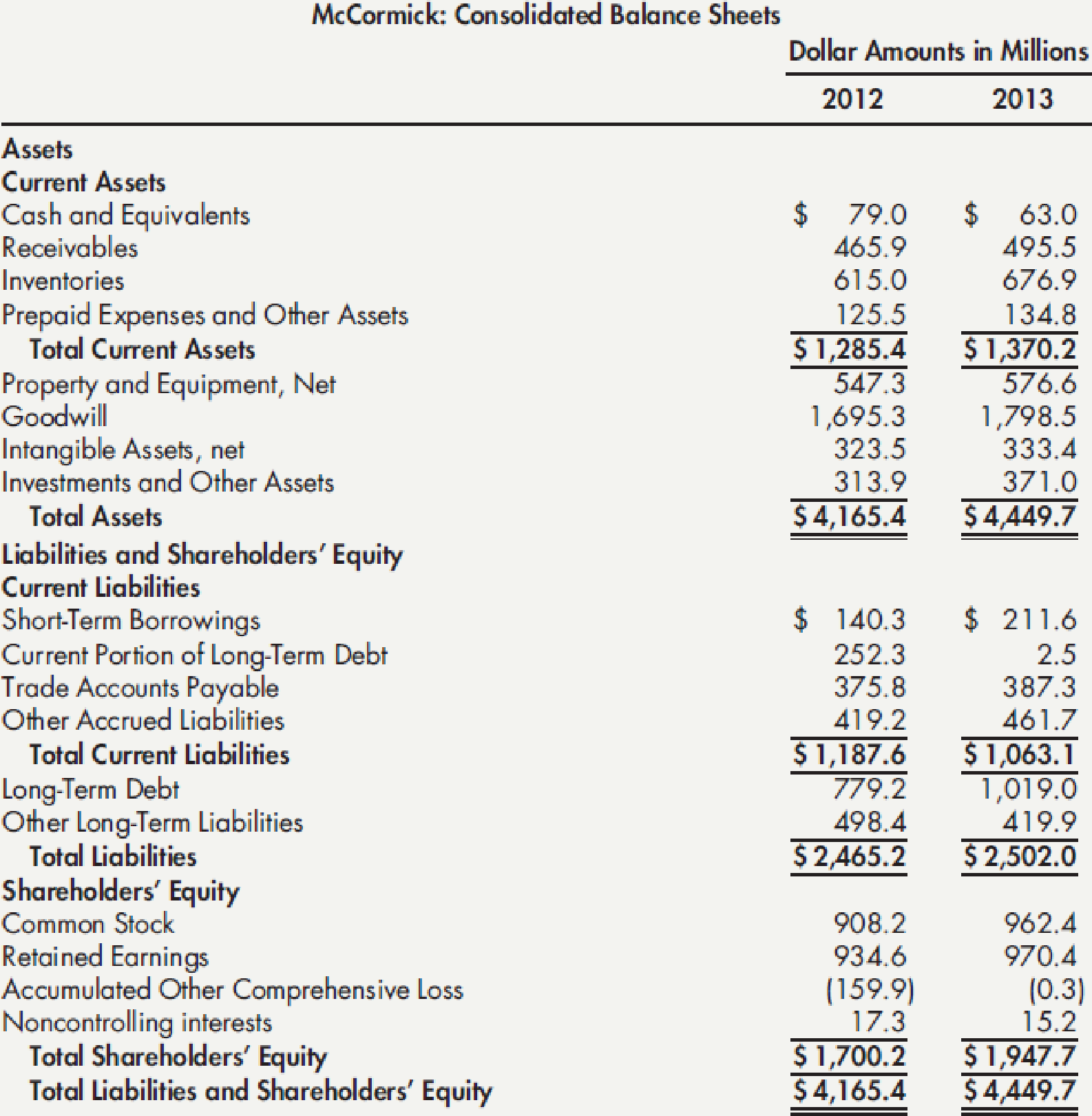

Use the following information for P4-15 and P4-16:

McCormick & Company, Inc. is one of the world’s leading producers of spices, herbs, seasonings, condiments, and other flavorings for foods. Its products are sold to consumers, with some of the leading brands of spices and seasonings, as well as to industrial producers of foods. McCormick’s consolidated balance sheets for 2012 and 2013 follow.

1.

Prepare a balance sheet for S Boat Company as of December 31, 2016.

Explanation of Solution

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare a balance sheet for S Boat Company as of December 31, 2016.

Table (1)

2

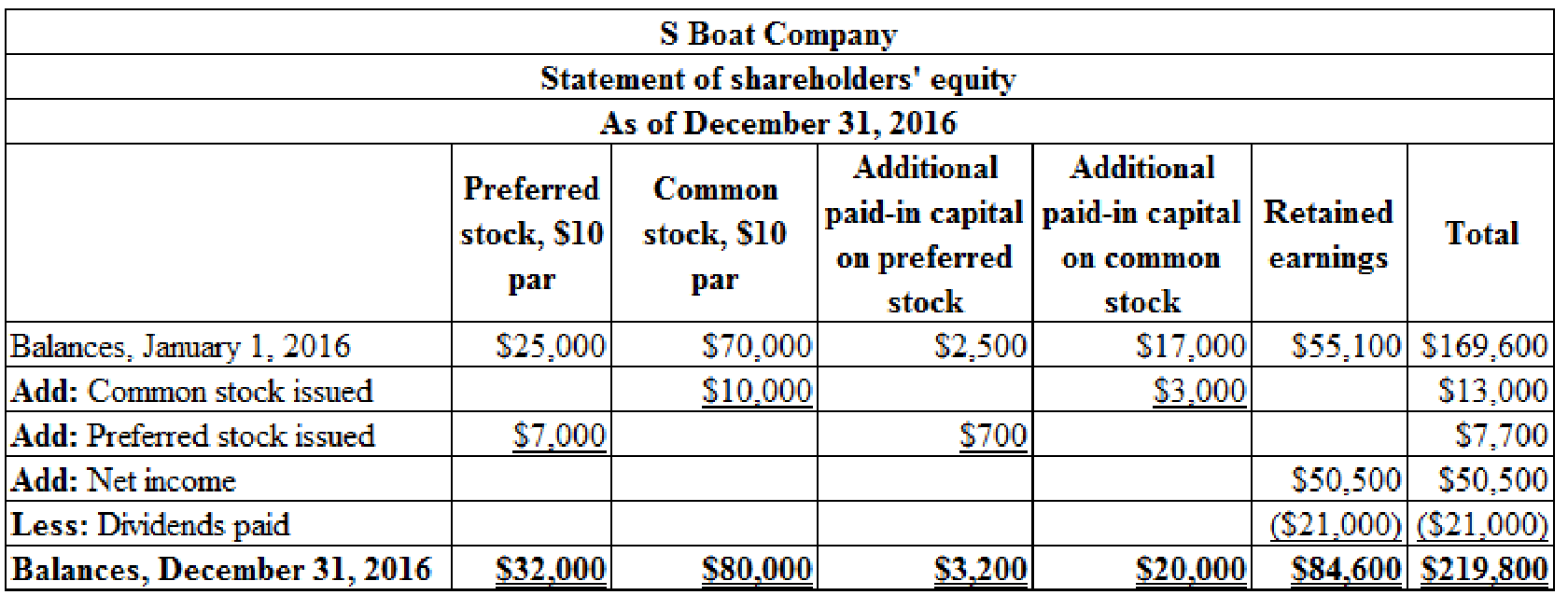

Prepare a statement of shareholders’ equity for the year 2016.

Explanation of Solution

Statement of Stockholders’ Equity:

Statement of Stockholders’ Equity is prepared to find out the changes and ending balance of contributed capital, treasury stock, retained earnings, and other comprehensive income in the business. The amount of stockholders’ equity is increased by issuance of stock and net income of the company and decreased by the payment of dividends and repurchase of treasury stock.

Prepare a statement of shareholders’ equity for the year 2016.

Table (2)

Working notes:

Determine the amount of common stock issued at par, during 2016.

Determine the amount of preference stock issued at par, during 2016.

Determine the amount of additional paid-in common stock, during 2016.

Determine the amount of additional paid-in preferred stock, during 2016.

Note: Statement of retained earnings is prepared back from ending accounts balances.

3.

Prepare notes that itemize the balance sheet control accounts, and explain how it will help to disclose any company accounting policies, contingent liabilities and subsequent events.

Explanation of Solution

Note 1:

Summary of significant accounting policies:

- Inventories are recorded at market price or cost price whichever is less.

- Straight line method is followed for depreciation of property, plant, and equipment based upon cost, estimated residual value, and useful life.

Note 2:

Guarantee to affiliate:

The company has been guaranteed by the affiliate Company J that it will be paid 12% interest on $50,000, 15-year bond.

Note 3:

Components of inventories:

The amount of inventories reported in the balance sheet is made up of the following components:

Table (3)

Note 4:

Components of long-term liabilities:

The amount of long-term liabilities reported in the balance sheet is made up of the following components:

Table (4)

Note 5:

Subsequent event:

On January 15, 2017, a building was totally destroyed. Its cost and book value are $20,000 and $7,000 respectively. However, insurance proceeds will amount to $5,000. This event has not been recorded in the balance sheet, as this event has been occurred after the balance sheet date.

4.

Determine debt-to-assets ratio of S Boat Company at the end of the year 2016.

Explanation of Solution

Debt-to-assets ratio:

Debt to assets ratio provides the relationship between the total liabilities and total assets. It helps the company to determine the amount of debt used to finance the assets.

The following formula is used to calculate debt-to-assets ratio:

Determine debt-to-assets ratio of S Boat Company at the end of the year 2016:

Hence, the debt-to-assets ratio of S Boat Company at the end of the year 2016 is 42.4%.

Evaluation:

If the debt-to-assets ratio is 39% at the end of 2015, then it has been increased by over 3% in 2016. An increase in this ratio indicates that the investors and creditors risk is increased, because a higher payment of interest has to be made by the company. The shareholder gets benefited, if the company generates a higher return on the additional debt equity than the interest paid.

Want to see more full solutions like this?

Chapter 4 Solutions

Intermediate Accounting: Reporting and Analysis (Looseleaf)

- Balance Sheet and Notes Listed here in random order are Wicks Construction Limiteds balance sheet accounts and related ending balances as of December 31, 2019: Additional information: 1. The company reports on the balance sheet the total amount for inventories and the net book value of property, plant, and equipment, with the related details for each account disclosed in notes. 2. The straight line method is used to depreciate buildings, machinery, and equipment, based upon their cost and estimated residual values and lives. A breakdown of property, plant, and equipment shows the following: land at a cost of 32,000, buildings at a cost of 182,400 and a net book value of 120,200, machinery at a cost of 63,900, and related accumulated depreciation of 18,600, and equipment (40% depreciated) at a cost of 53,000. 3. Patents are amortized on a straight line basis directly to the Patent account. 4. Inventories are listed at the lower of cost or market value using an average cost. The inventories include raw-materials, 22,200; work in process, 34,700; and finished goods, 41,600. 5. Common stock has a 10 par value per share, 12,000 shares are authorized, and 6,280 shares have been issued. 6. Preferred stock has a 100 par value per share, 1,000 shares are authorized, and 400 shares have been issued. 7. The investment in bonds is carried at the original cost, which is the face value, and is being held to maturity. 8. Short-term investments in marketable securities were purchased at year-end. 9. The bonds payable mature on December 31, 2024. 10. The company attaches a 1-year warranty on all the products it sells. Required: 1. Prepare Wicks Constructions December 31, 2019, balance sheet (including appropriate parenthetical notations). 2. Prepare notes to accompany the balance sheet that itemize company accounting policies; inventories; and property, plant, and equipment. 3. Next Level Compute the current ratio and the quick ratio. How do these two ratios provide different information about the companys liquidity? Why are these ratios useful?arrow_forwardBalance Sheet Presentation The following information relates to the assets of Westfield Semiconductors as of December 31, 2019. Westfield uses the straight-line method for depreciation and amortization. Required: Use the information above to prepare the property, plant, and equipment and intangible assets portions of a classified balance sheet for Westfield.arrow_forwardA company maintains its non-current assets at cost. Accumulated provision for depreciation accounts are kept for each asset. As at December 2014, the position was as follows: Total Cost To Date Total Depreciation To Date RM RM Machinery 59.950 25,670 Office Furniture 2,860 1,490 The following transactions were made in the year ended 31 December 2015: Purchased machinery RM 2,480 and office furniture RM 320 Sold machinery which had cost RM 2,800 in 2011 for RM 800. Depreciation is charged on a straight line basis at 10 percent on machinery and 5 percent on office furniture. Required: Prepare the asset and accumulated depreciation accounts for the year ending at 31 December 2015. The extract of Statement of Financial Position at that date.arrow_forward

- Study the information given below and answer the following questions:5.1 Calculate the profit or loss on the disposal of the equipment. 5.2 Prepare the following note to the financial statements as at 28 February 2020:* Property, plant and equipment INFORMATIONThe following balances appeared in the general ledger of Umzinto Traders on 01 March 2019, the beginning of the financial year:RVehicles 300 000Accumulated depreciation on vehicles 140 000Equipment 130 000Accumulated depreciation on equipment 75 000Additional information1) A new vehicle, cost price R160 000, was purchased on credit on 01 December 2019.2) Equipment with a cost price of R10 000, was sold for cash on 31 August 2019 for R2 000. The accumulated depreciation on the equipment sold amounted to R7 000 on 01 March 2019.3) Depreciation is calculated on equipment at 10% per annum on cost.4) Depreciation is calculated on vehicles at 20% per annum on the diminishing balance.arrow_forwardThe plant assets section of the comparative balance sheets of Anders Company is reported below. 1. 2. 3. ANDERS COMPANY Comparative Balance Sheets Plant assets Equipment Accumulated depreciation-Equipment Equipment, net Buildings Accumulated depreciation-Buildings Buildings, net 2018 Cash received from the sale of building Depreciation expense Purchase of building $ 295,000 (146,000) $ 149,000 $ 495,000 2017 $ 385,000 (256,000) $ 129,000 $ 515,000 (354,000) (169,000) $ 326,000 $ 161,000 During 2018, a building with a book value of $93,000 and an original cost of $415,000 was sold at a gain of $83,000. 1. How much cash did Anders receive from the sale of the building? 2. How much depreciation expense was recorded on buildings during 2018? 3. What was the cost of buildings purchased by Anders during 2018?arrow_forwardThe financial statements of Columbia Sportswear Company are presented in Appendix B. Click here to view Appendix B. The financial statements of Under Armour, Inc. are presented in Appendix C. Click here to view Appendix C. The complete annual report, including the notes to the financial statements, is available at the company's website. (b) What conclusions concerning the management of plant assets can be drawn from these data? 1. 2. 3. Return on assets Profit margin Asset turnover Columbia Sportswear Company 12.0% 9.8% 1.22 times Under Armour, Inc. -1.1% -0.9% 1.26 timesarrow_forward

- Property, Plant, and Equipment (PPE) Assessment:a) Describe the company’s Property, Plant and Equipment section in the balance sheet relative to the total fixed assets of the company’s industry (use quantitative and qualitative summaries to support your description. b) Analyze the accounting treatment of Property, Plant and Equipment, including depreciation methods employed and any impairments recognized, and include a brief summary of the accounting standards and principles included in the decision (reference the Notes that inform your summary). c) Discuss the significance of Property, Plant And Equipment in the company’s operations and its impact on financial performance and reporting.arrow_forwardAccounting standard IAS16: Property, Plant and Equipment make a number of recognition, measurement and disclosure requirements with regard to tangible non-current assets. The term "non-current asset" is defined in accounting standard IAS1: Presentation of Financial Statements. The information given below relates to two companies, both of which prepare accounts by 31 December. Tom Limited: Joy Plc bought a factory machine on 30 June 2020 and paid a total of £420,000. The supplier's invoice showed that this sum was made up of the following items: £ Manufacturer's list price 380,000 Less: Trade discount 38,000 342,000 Delivery charge 6,800 Installation costs 29,600 Maintenance charge for a year to 30 June 2021 27,000 Small spare parts 14,600 £420,000 Jerry Limited: On 1 January 2010, Jerry Ltd bought freehold property for £800,000. This figure was made up of land £300,000 and buildings £500,000. The land was non-depreciable…arrow_forwardAccounting standard IAS16: Property, Plant and Equipment make a number of recognition, measurement and disclosure requirements with regard to tangible non-current assets. The term "non-current asset" is defined in accounting standard IAS1: Presentation of Financial Statements. The information given below relates to two companies, both of which prepare accounts by 31 December. Tom Limited: Joy Plc bought a factory machine on 30 June 2020 and paid a total of £420,000. The supplier's invoice showed that this sum was made up of the following items: £ Manufacturer's list price 380,000 Less: Trade discount 38,000 342,000 Delivery charge 6,800 Installation costs 29,600 Maintenance charge for a year to 30 June 2021 27,000 Small spare parts 14,600 £420,000 Jerry Limited: On 1 January 2010, Jerry Ltd bought freehold property for £800,000. This figure was made up of land £300,000 and buildings £500,000. The land was non-depreciable…arrow_forward

- Journalizing partial-year depreciation and asset disposals and exchanges During 2018, Lora Company completed the following transactions: Record the transactions in the journal of Lora Company.arrow_forwardThe following information was extracted from the financial records including the asset register for Fit Line Gym for the year ended 31 December 2020: Property, plant & equipment:Balances at 1 January 2020 Buildings : Cost- 550 000 Accumulated depreciation- (27 500) Gym Equipment: Cost- 275 000 Accumulated depreciation- (140 000) Furniture & Fittings: Cost- 88 000 Accumulated depreciation- (23 500) Additional information:1. Accounting policies with regards to depreciation of property, plant and equipment:1.1 Buildings are depreciated at 2% per year on the fixed instalment method.1.2 Gym equipment is depreciated at 20% per year using the reducing balancemethod. 1.3 Furniture and fittings are depreciated on the fixed instalment method overan estimated useful life of 4 years.2. The following transactions which are not included in the above balances, took place during the financial year ended 31 December 2020:2.1 Due to increased membership, the owner decided to extend the…arrow_forwardREQUIRED: A. Based on the application of the necessary procedures and appreciation of the above data, you are to provide the answers to the following: 1. What is the gain on sale of truck on September 30? 2. What is the gain on sale of machinery on December 20? 3. What is the adjusted balance of the cost of property, plant and equipment as of December 31, 2022? 4. What is the total depreciation expense for the year ended December 31, 2022? 5. What is the carrying amount of the property, plant and equipment as of December 31, 2022? B. Show the lapsing schedule as of December 31, 2022.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning