Financial Modeling

Three entrepreneurs were looking to start a new brewpub near Sacramento, California, called Roseville Brewing Company (RBC). Brewpubs provide two products to customers—food from the restaurant segment and freshly brewed beer from the beer production segment. Both segments are typically in the same building, which allows customers to see the beer-brewing process.

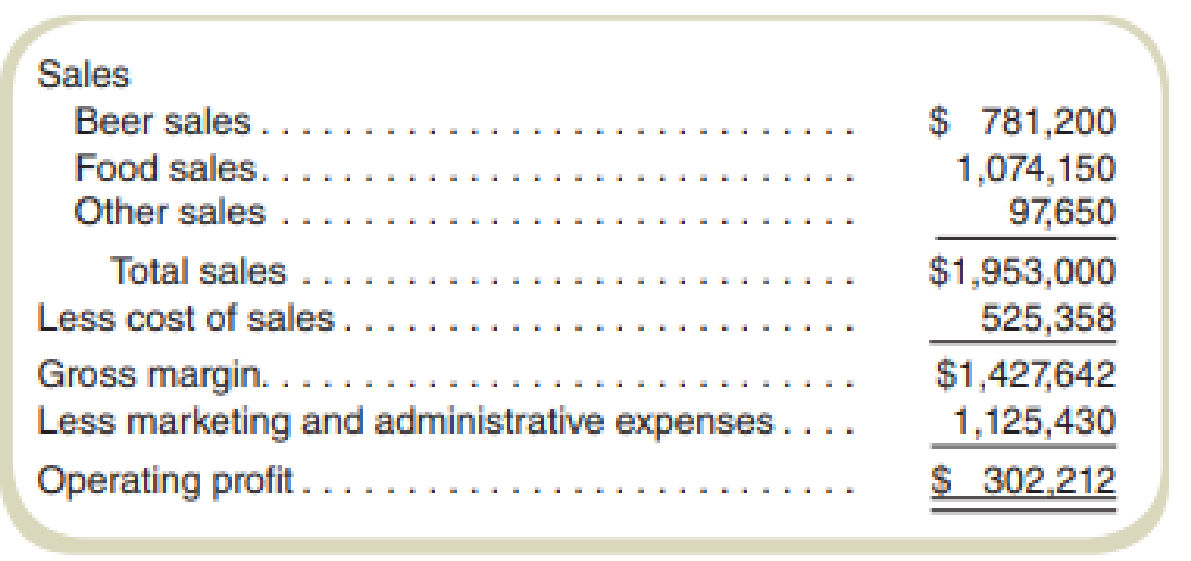

After months of research, the owners created a financial model that showed the following projections for the first year of operations:

In the process of pursuing capital through private investors and financial institutions, RBC was approached with several questions. The following represents a sample of the more common questions asked:

- What is the break-even point?

- What sales dollars will be required to make $200,000? To make $500,000?

- Is the product mix reasonable? (Beer tends to have a higher contribution margin ratio than food, and therefore product mix assumptions are critical to profit projections.)

- What happens to operating profit if the product mix shifts?

- How will changes in price affect operating profit?

- How much does a pint of beer cost to produce?

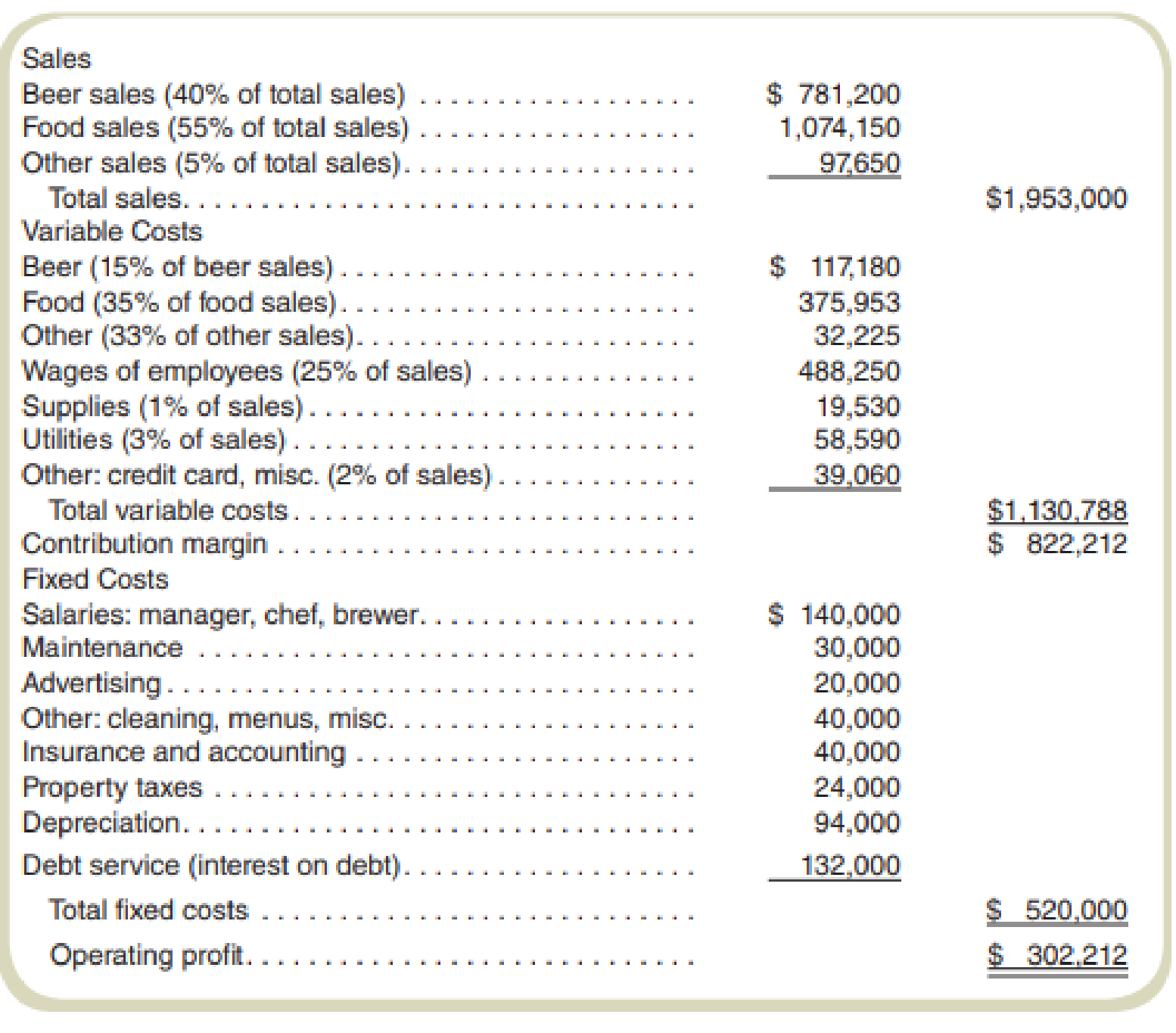

It became clear to the owners of RBC that the initial financial model was not adequate for answering these types of questions. After further research, RBC created another financial model that provided the following information for the first year of operations:

Required

- a. What were potential investors and financial institutions concerned with when asking the questions listed in the case?

- b. Why was the first financial model prepared by RBC inappropriate for answering most of the questions asked by investors and bankers? Be specific.

- c. If you were deciding whether to invest in RBC, how would you quickly check the reasonableness of RBC’s projected operating profit?

- d. Why is the question “How much does a pint of beer cost to produce?” difficult to answer?

- e. Perform a sensitivity analysis by answering the following questions:

- 1. What is the break-even point in sales dollars for RBC?

- 2. What is the margin of safety for RBC?

- 3. Why can’t RBC find the break-even point in units?

- 4. What sales dollars would be required to achieve an operating profit of $200,000? $500,000? What assumptions are made in this calculation?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Assume that you desire to operate a food truck business. You have five food trucks. Some trucks will need more repairs than others. Based on online research and discussions with other food truck owners, you determine that in a given year the following possibilities are likely. The probability of few repairs is 20% and the estimated cost is $2,500 The probability of moderate repairs is 60% with an estimated cost of $5,000 The probability of extensive repairs is 20% with an estimated cost of $25,000. What is the average expected cash flow out for repairs, based on these probabilities? Type your answer without commas or decimal places or dollar signs.arrow_forwardTamati has been pleased with the success at Fush in recent years and is thinking about expanding to a 2nd location across the city. Fush 2 will have a slightly different approach while maintaining the current culture and mission of the organisation. Tamiti is tentatively planning for the following four categories of revenue: - Beer and Wine. He estimates that 15,000 drinks will be served, with a selling price of $9 and the cost to produce the drink is $7 - Fish Dinners/ The fish dinner will sell for $19.50, with a cost of $15. Selling 20,000 meals - Dessert. Will sell for $8 at a cost of $6.50. Selling 9,500 units - Lunch specials. Selling 10,000 in the next year. lunch prices will average $10 with a cost of $8. Expenses of Fush per month in rent and utilities is $5,300 and monthly labour costs estimated $7,600 monthly (fixed cost in this case). What is the breakeven point in dollararrow_forwardSuppose that you have been given a summer job as an intern at Issac Aircams, a company that manufactures sophisticated spy cameras for remote-controlled military reconnaissance aircraft. The company, which is privately owned, has approached a bank for a loan to help finance its growth. The bank requires financial statements before approving the loan. Required: Classify each cost listed below as either a product cost or a period cost for the purpose of preparing financial statements for the bank. Costs Product Cost / Period Cost 1. Depreciation on salespersons’ cars. 2. Rent on equipment used in the factory. 3. Lubricants used for machine maintenance. 4. Salaries of personnel who work in the finished goods warehouse. 5. Soap and paper towels used by factory workers at the end of a shift. 6. Factory supervisors’ salaries. 7. Heat, water, and power consumed in the factory. 8. Materials used for boxing products for shipment overseas. (Units are…arrow_forward

- Prepare the financial section of a business case for the Cloud-Computing Case that is listed above this assignment in Canvas. Assume that this project will take eight months to complete (in Year 0) and will cost $600,000. The costs to implement some of the technologies will be $300,000 for year one and $200,000 for years two and three. Estimated benefits will start in year 1 at $400,000 and will be $600,000 for years 2 and 3. There is no benefit in year 0. Use the business case spreadsheet template (business_case_financials.xls) template provided below this assignment in Canvas to calculate the NPV, ROI, and the year in which payback occurs. Assume a 7 percent discount rate for the template. notes* Payback occurs in the first year that there is a positive value for cumulative benefits - costs. (*Negative values are presented in parenthesis) What I have so far is attached I need to make it so Pay back occurs in year 3 where there is positive cumulative benefits - costs.arrow_forwardPrepare the financial section of a business case for the Cloud-Computing Case that is listed above this assignment in Canvas. Assume that this project will take eight months to complete (in Year 0) and will cost $600,000. The costs to implement some of the technologies will be $300,000 for year one and $200,000 for years two and three. Estimated benefits will start in year 1 at$400,000 and will be $600,000 for years 2 and 3. There is no benefit in year 0. Use the business case spreadsheet template (business_case_financials.xls) template provided below this assignment in Canvas to calculate the NPV, ROI, and the year in which payback occurs. Assume a 7 percent discount rate for the template. notes* Payback occurs in the first year that there is a positive value for cumulative benefits - costs. (*Negative values are presented in parenthesis) Financial Analysis for Project Name Created by: Date: Note: Change the inputs, shown in green below (i.e. interest rate, number of…arrow_forwardSuppose that you have been given a summer job as an intern at Issac Aircams, a company that manufacturessophisticated spy cameras for remote-controlled military reconnaissance aircraft. The company, which isprivately owned, has approached a bank for a loan to help it finance its growth. The bank requires financialstatements before approving such a loan. You have been asked to help prepare the financial statements andwere given the following list of costs:1. Depreciation on salespersons’ cars.2. Rent on equipment used in the factory.3. Lubricants used for machine maintenance.4. Salaries of personnel who work in the finished goods warehouse.5. Soap and paper towels used by factory workers at the end of a shift.6. Factory supervisors’ salaries.7. Heat, water, and power consumed in the factory.8. Materials used for boxing products for shipment overseas. (Units are not normally boxed.)9. Advertising costs.10. Workers’ compensation insurance for factory employees.11. Depreciation on chairs…arrow_forward

- A famous skateboarder is planning on opening a new indoor skateboard facility in Athens. He wants to name the skate park “Accounting Central” because a lot of accountants are skaters as well. Accounting Central will us a membership model to generate revenue, allowing customers to purchase a monthly membership and gain unlimited access to the park. When operating, Accounting Central is estimated to have $650,000 in assets. Shareholders are anticipating receiving a 15% return on the assets as operating income. The facility’s annual fixed costs are expected to be $96,000. The variable costs per skater are estimated to be $15 per month. After analyzing the market, Accounting Central believes it can sell 150 memberships in the first month. Furthermore, the company has noted that a number of other skaters have started similar skate-parks in the area, leading to high competition in the area. Which of the following statements is incorrect regarding the company’s first month of…arrow_forwardYou must prepare a return on investment analysis for the regional manager of Fast & Great Burgers. This growing chain is trying to decide which outlet of two alternatives to open. The first location (A) requires a $500,000 investment and is expected to yield annual net income of $70,000. The second location (B) requires a $200,000 investment and is expected to yield annual net income of $44,000. Compute the return on investment for each Fast & Great Burgers alternative. Using return on investment as your only criterion, which location (A or B) should the company open? (The chain currently generates an 22% return on total assets.)arrow_forwardYou must prepare a return on investment analysis for the regional manager of Fast & Great Burgers. This growing chain is trying to decide which outlet of two alternatives to open. The first location (A) requires a $500,000 investment and is expected to yield annual net income of $70,000. The second location (B) requires a $200,000 investment and is expected to yield annual net income of $44,000. Compute the return on investment for each Fast & Great Burgers alternative. Using return on investment as your only criterion, which location (A or B) should the company open? (The chain currently generates an 22% return on total assets.) Complete this question by entering your answers in the tabs below. Return on Investment Choice of Location Compute the return on investment for each Fast & Great Burgers alternative. Return on Investment 1 Location A Location B Numerator Denominator 2 of 3 H Next > G Oarrow_forward

- To generate leads for new business, Gustin Investment Services offers free financial planning seminars at major hotels in Southwest Florida. Gustin conducts seminars for groups of 25 individuals. Each seminar costs Gustin $3000, and the average first-year commission for each new account opened is $5800. Gustin estimates that for each individual attending the seminar, there is a 0.01 probability that he/she will open a new account. Determine the equation for computing Gustin’s profit per seminar, given values of the relevant parameters. Round your answers to the nearest dollar.Profit = (New Accounts Opened × $( ) – $ ( ) What type of random variable is the number of new accounts opened? (Hint: Review Appendix 16.1 for descriptions of various types of probability distributions.)The number of new accounts opened is a random variable with fill in the blank 4 trials and fill in the blank 5 probability of a success on a single trial. Assume that the number of new accounts…arrow_forwardTo generate leads for new business, Gustin Investment Services offers free financial planning seminars at major hotels in Southwest Florida. Gustin conducts seminars for groups of 25 individuals. Each seminar costs Gustin $3000, and the average first-year commission for each new account opened is $4600. Gustin estimates that for each individual attending the seminar, there is a 0.01 probability that he/she will open a new account. Determine the equation for computing Gustin’s profit per seminar, given values of the relevant parameters. Round your answers to the nearest dollar.Profit = (New Accounts Opened × $ fill in the blank 1) – $ fill in the blank 2 What type of random variable is the number of new accounts opened? (Hint: Review Appendix 16.1 for descriptions of various types of probability distributions.)The number of new accounts opened is a random variable with fill in the blank 4 trials and fill in the blank 5 probability of a success on a single trial. Assume that the…arrow_forwardTo generate leads for new business, Gustin Investment Services offers free financial planning seminars at major hotels in Southwest Florida. Gustin conducts seminars for groups of 25 individuals. Each seminar costs Gustin $3100, and the average first-year commission for each new account opened is $4600. Gustin estimates that for each individual attending the seminar, there is a 0.01 probability that he/she will open a new account. a. Determine the equation for computing Gustin's profit per seminar, given values of the relevant parameters. Round your answers to the nearest dollar. Profit (New Accounts Opened x $ 4600 -$ 3100arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning