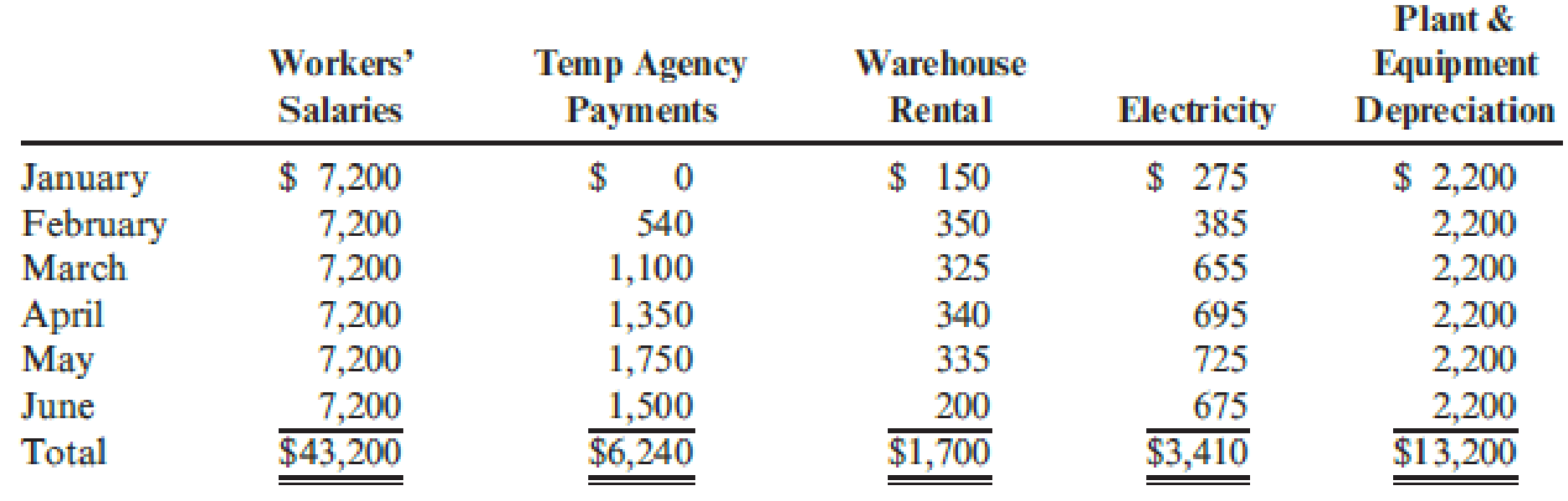

Darnell Poston, owner of Poston Manufacturing, Inc., wants to determine the cost behavior of labor and overhead. Darnell pays his workers a salary; during busy times, everyone works to get the orders out. Temps (temporary workers hired through an agency) may be hired to pack and prepare completed orders for shipment. During slower times, Darnell catches up on bookkeeping and administrative tasks while the salaried workers do preventive maintenance, clean the lines and building, etc. Temps are not hired during slow times. Darnell found that workers’ salaries, temp agency payments, rentals, utilities, and plant and equipment

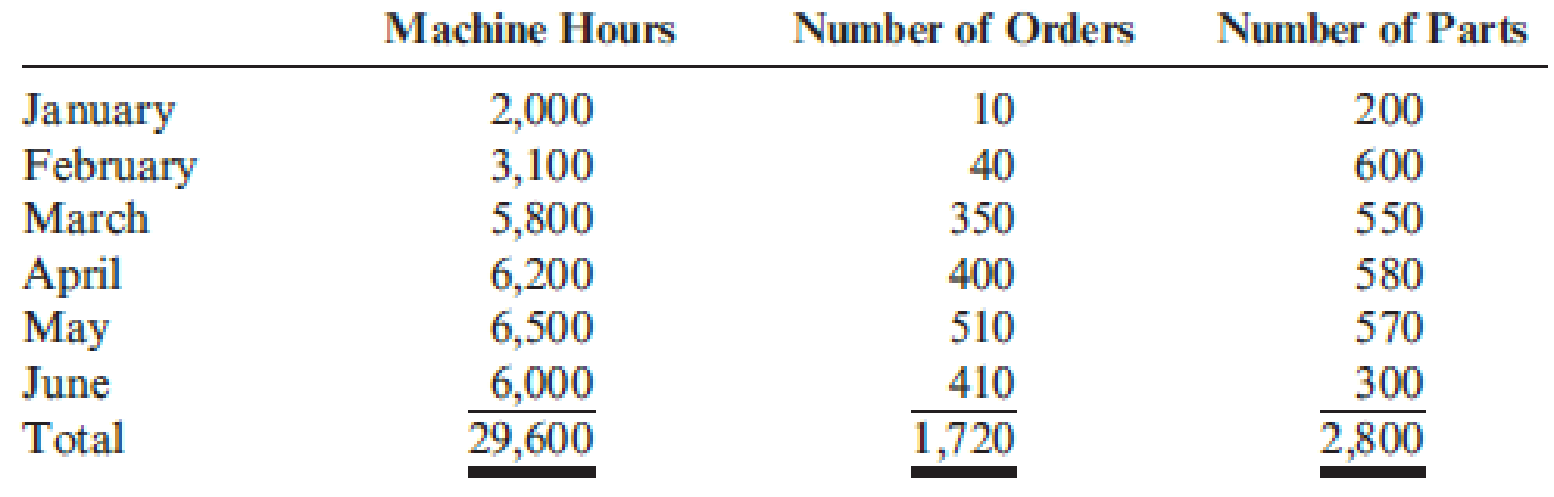

Information on number of machine hours, orders, and parts for the six-month period follows:

Required:

- 1. Calculate the monthly average account balance for each account. Calculate the average monthly amount for each of the three drivers.

- 2. Calculate fixed monthly cost and the variable rates for temp agency payments, warehouse rent, and electricity. Express the results in the form of an equation for total cost.

- 3. In July, Darnell predicts there will be 420 orders, 250 parts, and 5,900 machine hours. What is the total labor and overhead cost for July?

- 4. What if Darnell buys a new machine in July for $24,000? The machine is expected to last 10 years and will have no salvage value at the end of that time. What part of the cost equation will be affected? How? What is the new expected cost in July?

1.

Calculate the monthly average account balance for each account. Calculate the average monthly amount for each of the three drivers.

Explanation of Solution

Cost estimation: Cost estimation is the process of ascertaining the behavior of particular cost.

Calculate monthly average account balance for each account.

| Account | Workings | Amount |

| Average workers' salaries | ($43,200 ÷ 6) | $7,200 |

| Average temp agency payment | ($6,240 ÷ 6) | $1,040 |

| Average warehouse rental | ($1,700 ÷ 6) | $283 |

| Average electricity | ($3,410 ÷ 6) | $568 |

| Average depreciation | ($13,200 ÷ 6) | $2,200 |

Table (1)

Calculate the average monthly amount for each of the three drivers.

| Account | Workings | Amount |

| Average machine hours | ($29,600 ÷ 6) | $4,933 |

| Average number of orders | ($1,720÷ 6) | $287 |

| Average number of parts | ($2,800 ÷ 6) | $467 |

Table (2)

2.

Calculate fixed monthly cost and the variable rates for temp agency payments, warehouse rent, and electricity. Express the results in the form of an equation for total cost.

Explanation of Solution

Calculate monthly fixed cost.

Calculate variable rate for temp agency.

Calculate variable rate for warehouse rental.

Calculate variable rate for electricity.

Monthly cost equation is

3.

Calculate the total labor and overhead cost for July.

Explanation of Solution

Calculate the total labor and overhead cost for July.

4.

State whether, Person D buys a new machine in July for $24,000, if the machine is expected to last 10 years and will have no salvage value at the end of that time. And identify the part of the cost equation will be affected, and identify the new expected cost in July.

Explanation of Solution

Calculate new machine depreciation per month.

Calculate new total cost for July month.

Want to see more full solutions like this?

Chapter 3 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- The following describes the job responsibilities of two employees of Barney Manufacturing. Joan Dennison, Cost Accounting Manager. Joan is responsible for measuring and collecting costs associated with the manufacture of the garden hose product line. She is also responsible for preparing periodic reports that compare the actual costs with planned costs. These reports are provided to the production line managers and the plant manager. Joan helps to explain and interpret the reports. Steven Swasey, Production Manager. Steven is responsible for the manufacture of the high-quality garden hose. He supervises the line workers, helps to develop the production schedule, and is responsible for seeing that production quotas are met. He is also held accountable for controlling manufacturing costs. Required: CONCEPTUAL CONNECTION Identify Joan and Steven as line or staff and explain your reasons.arrow_forwardWhitley Construction Company is in the home remodeling business. Whitley has three teams of highly skilled employees, each of whom has multiple skills involving carpentry, painting, and other home remodeling activities. Each team is led by an experienced employee who coordinates the work done on each job. As the needs of different jobs change, some team members may be shifted to other teams for short periods of time. Whitley uses a job costing system to determine job costs and to serve as a basis for bidding and pricing the jobs. Direct materials and direct labor are easily traced to each job using Whitley's cost tracking software. Overhead consists of the purchase and maintenance of construction equipment, some supervisory labor, the cost of bidding for new customers, and administrative costs. Whitley uses an annual overhead rate based on direct labor hours. Whitley has recently completed work for three clients: Harrison, Barnes, and Tyler. The cost data for each of the three jobs are…arrow_forwardPlease I need help answering this problem O’Leary Corporation manufactures special purpose portable structures (huts, mobile offices, and so on) for use at construction sites. It only builds to order (each unit is built to customer specifications). O’Leary uses a normal job costing system. Direct labor at O’Leary is paid $30 per hour, but the employees are not paid if they are not working on jobs. Manufacturing overhead is assigned to jobs by a predetermined rate on the basis of direct labor-hours. The company incurred manufacturing overhead costs during two recent years (adjusted for price-level changes using current prices and wage rates) as follows. Year 1 Year 2 Direct labor-hours worked 69,600 56,600 Manufacturing overhead costs incurred Indirect labor $ 2,864,000 $ 2,264,000 Employee benefits 1,044,000 849,000 Supplies 696,000 566,000 Power…arrow_forward

- The following describes the job responsibilities of two employees of Barney Manufacturing.Joan Dennison, Cost Accounting Manager. Joan is responsible for measuring and collectingcosts associated with the manufacture of the garden hose product line. She is also responsiblefor preparing periodic reports that compare the actual costs with planned costs. These reportsare provided to the production line managers and the plant manager. Joan helps to explain andinterpret the reports.Steven Swasey, Production Manager. Steven is responsible for the manufacture of thehigh-quality garden hose. He supervises the line workers, helps to develop the productionschedule, and is responsible for seeing that production quotas are met. He is also held accountable for controlling manufacturing costs.Required:CONCEPTUAL CONNECTION Identify Joan and Steven as line or staff and explain yourreasons.arrow_forwardAna Perez is the plant manager of Travel Free’s Indiana plant. The Camper and Trailer operating departments manufacture products and have their own managers. The Office department, which Perez also manages, provides services equally to the two operating departments. Each performance report includes only those costs that a particular operating department manager can control: direct materials, direct labor, supplies used, and utilities. The plant manager is responsible for the department managers’ salaries, building rent, office salaries other than her own, and other office costs plus all costs controlled by the two operating department managers. The annual departmental budgets and actual costs for the two operating departments follow. The Office department’s budgeted and actual costs follow. Required Prepare responsibility accounting performance reports like those in costs controlled by the following. 1. Manager of Camper department. 2. Manager of Trailer department. 3. Manager of…arrow_forwardAlan is the owner of a new manufacturing business, producing the vehicle components for Proton Supreme V supplies. Advise him by classifying the following costs into the correct categories; fixed cost, variable costs, production overhead, administration overhead, or distribution overhead. Depreciation of machinery Repairs to machinery Supervisors’ salary Assemblers’ wages Electric power Wages for driver of delivery lorry Raw materials: steels and metals Nuts and bolts Delivery costs Salary to administrative staffarrow_forward

- ech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm’s direct labor includes salaries of consultants that work at the client’s job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 67,500 direct labor-hours would be required for the period’s estimated level of client service. The company also estimated $540,000 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm’s actual overhead cost for the year was $557,400 and its actual total direct labor was 75,000 hours. 1. Compute the predetermined overhead rate. 2.…arrow_forwardTech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm’s direct labor includes salaries of consultants that work at the client’s job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 77,500 direct labor-hours would be required for the period’s estimated level of client service. The company also estimated $775,000 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm’s actual overhead cost for the year was $789,800 and its actual total direct labor was 83,350 hours. Required: 1. Compute the predetermined…arrow_forwardTech Solutions is a consulting firm that uses a job - order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm's direct labor includes salaries of consultants that work at the client's job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor - hours. At the beginning of the year, it estimated that 55,000 direct labor - hours would be required for the period's estimated level of client service. The company also estimated $302, 500 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor - hour. The firm's actual overhead cost for the year was $321, 300 and its actual total direct labor was 58, 850 hours. Required: 1. Compute the predetermined…arrow_forward

- Tech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm's direct labor includes salaries of consultants that work at the client's job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 75,000 direct labor-hours would be required for the period's estimated level of client service. The company also estimated $712,500 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm's actual overhead cost for the year was $731,500 and its actual total direct labor was 80,650 hours. Required: 1. Compute the predetermined overhead…arrow_forwardTech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm's direct labor includes salaries of consultants that work at the client's job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 92,500 direct labor-hours would be required for the period's estimated level of client service. The company also estimated $1,156,250 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm's actual overhead cost for the year was $1,177,550 and its actual total direct labor was 97,750 hours. Required: 1. Compute the predetermined…arrow_forwardTech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and Installs on behalf of its clients. The firm's direct labor Includes salaries of consultants that work at the client's job site, and its overhead consists of costs such as depreciation, utilities, and Insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 92,500 direct labor-hours would be required for the period's estimated level of client service. The company also estimated $1,156,250 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm's actual overhead cost for the year was $1,177,550 and its actual total direct labor was 97,750 hours. Required: 1. Compute the predetermined…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning