Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 31BEB

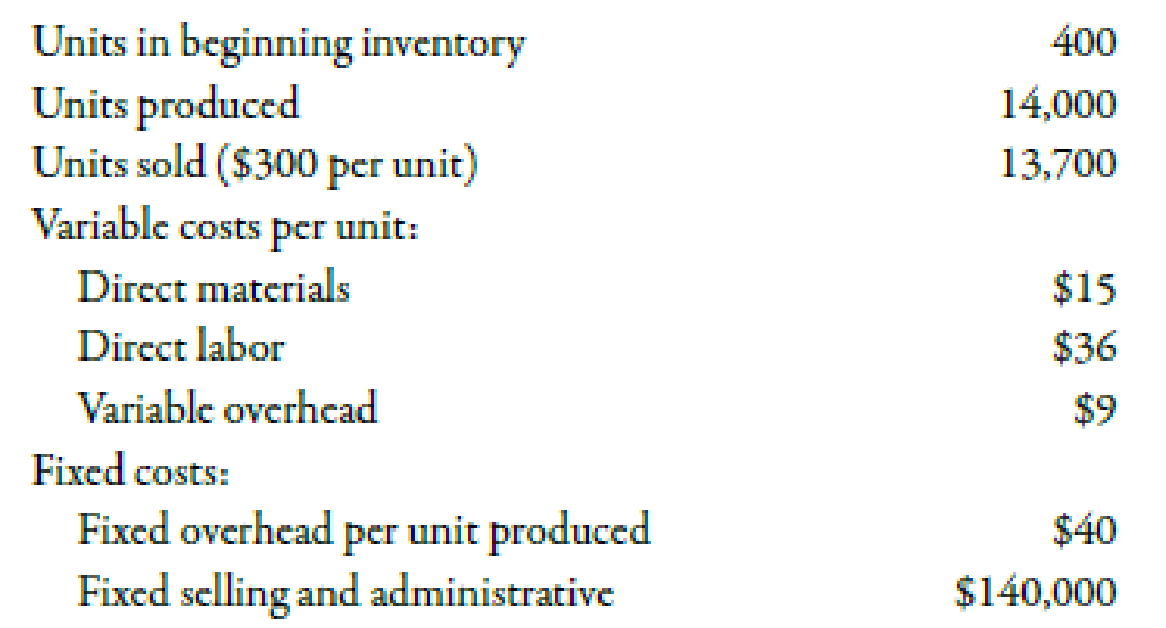

Refer to the data for Pelham Company on the previous page.

Required:

- 1. How many units are in ending inventory?

- 2. Using variable costing, calculate the per-unit product cost.

- 3. What is the value of ending inventory under variable costing?

Use the following information for Brief Exercises 3-30 and 3-31:

During the most recent year, Pelham Company had the following data associated with the product it makes:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Variable Costing, Absorption Costing

During its first year of operations, Snobegon, Inc. (located in Lake Snobegon, Minnesota), produced 40,900 plastic snow scoops. Snow

scoops are oversized shovel-type scoops that are used to push snow away. Unit sales were 38,900 scoops. Fixed overhead was applied at

$0.75 per unit produced. Fixed overhead was underapplied by $2,900. This fixed overhead variance was closed to Cost of Goods Sold.

There was no variable overhead variance. The results of the year's operations are as follows (on an absorption-costing basis):

Sales (38,900 units @ $20)

$778,000

Less: Cost of goods sold

547,260

Gross margin

$230,740

Less: Selling and administrative expenses (all fixed)

184,500

Operating income

$ 46,240

Required:

1. Calculate the cost of the firm's ending inventory under absorption costing. Round unit cost to five decimal places. Round your final

answer to the nearest dollar.

%24

What is the cost of the ending inventory under variable costing? Round unit…

Compute the Cost of Goods Manufactured and Cost of Goods Sold for West Nautical Company for the most recent year

using the amounts described next. Assume that Raw Materials Inventory contains only direct materials. (Click the icon to

view the data.) Calculation of Cost of Goods Manufactured For Current Year Plus: Manufacturing costs incurred Less:

Cost of goods manufactured Now calculate the cost of goods sold. West Nautical Company Calculation of Cost of Goods

Sold For Current Year Plus: Less: Data table \table[[, \table[[Beginning], [of Year]], \table[[\table[[End of], [Year]]], [$,27,000

Data table

0

Beginning

of Year

End of

Year

Raw materials inventory.....

25,000 $ 27,000 Insurance on plant

End of

Year

$ 10,000

Work in process inventory.

$

Finished goods inventory...

$

36,000 $

20,000 $

30,000

28,000

Depreciation-plant building and equipment

Repairs and maintenance-plant

... $ 13,100

$ 4,400

Purchases of direct materials ....

78,000 Marketing expenses

$ 81,000

Le

Direct labor..…

Cost of Goods Sold

As an accountant for Lee Company, your supervisor gave you the following calculations of the gross profit for the first quarter:

Alternative

Sales ($50 per unit)

Cost of Goods Sold

Gross Profit

A

$500,000

$200,000

$300,000

B

500,000

228,000

272,000

C

500,000

213,333

286,667

The three alternative cost flow assumptions are FIFO, average, and LIFO (the alternatives are not necessarily presented in this sequence). Lee uses the periodic inventory system. The computation of the cost of goods sold under each alternative is based on the following data:

Units

Cost/Unit

Inventory, January 1

12,000

$20

Purchase, January 10

4,000

21

Purchase, February 15

6,000

22

Purchase, March 10

8,000

23

1. Prepare schedules proving the cost of goods sold shown here under each of the three alternatives. For average cost.

LEE COMPANY

Schedules of Cost of Goods Sold

For First Quarter Ended March 31

FIFO

LIFO

Average

Beginning…

Chapter 3 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 3 - Prob. 1DQCh. 3 - What is a driver? Give an example of a cost and...Ch. 3 - Suppose a company finds that shipping cost is...Ch. 3 - Some firms assign mixed costs to either the fixed...Ch. 3 - Explain the difference between committed and...Ch. 3 - Explain why the concept of relevant range is...Ch. 3 - Why do mixed costs pose a problem when it comes to...Ch. 3 - Describe the cost formula for a strictly fixed...Ch. 3 - Describe the cost formula for a strictly variable...Ch. 3 - What is the scattergraph method, and why is it...

Ch. 3 - Describe how the scattergraph method breaks out...Ch. 3 - What are the advantages of the scattergraph method...Ch. 3 - Prob. 13DQCh. 3 - What is meant by the best-fitting line?Ch. 3 - What is the difference between the unit cost of a...Ch. 3 - Prob. 16DQCh. 3 - (Appendix 3A) Explain the meaning of the...Ch. 3 - A factor that causes or leads to a change in a...Ch. 3 - Which of the following would probably be a...Ch. 3 - Prob. 3MCQCh. 3 - In the cost formula, the term 128,000,000 a. is...Ch. 3 - In the cost formula, the term 12,000 a. is the...Ch. 3 - Prob. 6MCQCh. 3 - Prob. 7MCQCh. 3 - The following cost formula for total purchasing...Ch. 3 - An advantage of the high-low method is that it a....Ch. 3 - Prob. 10MCQCh. 3 - Prob. 11MCQCh. 3 - Prob. 12MCQCh. 3 - The total cost for monthly supervisory cost in a...Ch. 3 - Yates Company shows the following unit costs for...Ch. 3 - (Appendix 3A) In the method of least squares, the...Ch. 3 - Creating and Using a Cost Formula Big Thumbs...Ch. 3 - Using High-Low to Calculate Fixed Cost, Calculate...Ch. 3 - Using High-Low to Calculate Predicted Total...Ch. 3 - Using High-Low to Calculate Predicted Total...Ch. 3 - Using Regression to Calculate Fixed Cost,...Ch. 3 - Inventory Valuation under Absorption Costing Refer...Ch. 3 - Inventory Valuation under Variable Costing Refer...Ch. 3 - Absorption-Costing Income Statement Refer to the...Ch. 3 - Variable-Costing Income Statement Refer to the...Ch. 3 - Creating and Using a Cost Formula Kleenaire Motors...Ch. 3 - Using High-Low to Calculate Fixed Cost, Calculate...Ch. 3 - Using High-Low to Calculate Predicted Total...Ch. 3 - Brief Exercise 3-28 Using High-Low to Calculate...Ch. 3 - Using Regression to Calculate Fixed Cost,...Ch. 3 - Inventory Valuation under Absorption Costing Refer...Ch. 3 - Inventory Valuation under Variable Costing Refer...Ch. 3 - Brief Exercise 3-32 Absorption-Costing Income...Ch. 3 - Brief Exercise 3-33 Variable-Costing Income...Ch. 3 - Variable and Fixed Costs What follows are a number...Ch. 3 - Cost Behavior, Classification Smith Concrete...Ch. 3 - Prob. 36ECh. 3 - Prob. 37ECh. 3 - Prob. 38ECh. 3 - Step Costs, Relevant Range Bellati Inc. produces...Ch. 3 - Matching Cost Behavior Descriptions to Cost...Ch. 3 - Examine the graphs in Exercise 3-40. Required: As...Ch. 3 - Prob. 42ECh. 3 - Prob. 43ECh. 3 - High-Low Method Refer to the information for Luisa...Ch. 3 - Scattergraph Method Refer to the information for...Ch. 3 - Method of Least Squares Refer to the information...Ch. 3 - Use the following information for Exercises 3-47...Ch. 3 - Use the following information for Exercises 3-47...Ch. 3 - Method of Least Squares, Developing and Using the...Ch. 3 - The method of least squares was used to develop a...Ch. 3 - Identifying the Parts of the Cost Formula;...Ch. 3 - Inventory Valuation under Absorption Costing...Ch. 3 - Inventory Valuation under Variable Costing Lane...Ch. 3 - Income Statements under Absorption and Variable...Ch. 3 - (Appendix 3A) Method of Least Squares Using...Ch. 3 - (Appendix 3A) Method of Least Squares Using...Ch. 3 - Identifying Fixed, Variable, Mixed, and Step Costs...Ch. 3 - Identifying Use of the High-Low, Scattergraph, and...Ch. 3 - Identifying Variable Costs, Committed Fixed Costs,...Ch. 3 - Scattergraph, High-Low Method, and Predicting Cost...Ch. 3 - Method of Least Squares, Predicting Cost for...Ch. 3 - Cost Behavior, High-Low Method, Pricing Decision...Ch. 3 - Prob. 63PCh. 3 - Variable and Fixed Costs, Cost Formula, High-Low...Ch. 3 - Cost Separation About 8 years ago, Kicker faced...Ch. 3 - Variable-Costing and Absorption-Costing Income...Ch. 3 - Refer to the information for Farnsworth Company...Ch. 3 - (Appendix 3A) Scattergraph, High-Low Method,...Ch. 3 - (Appendix 3A) Separating Fixed and Variable Costs,...Ch. 3 - (Appendix 3A) Cost Formulas, Single and Multiple...Ch. 3 - Suspicious Acquisition of Data, Ethical Issues...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Inventory Valuation under Absorption Costing Refer to the data for Judson Company above. Required: 1. How many units are in ending inventory? 2. Using absorption costing, calculate the per-unit product cost. 3. What is the value of ending inventory under absorption costing? Use the following information for Brief Exercises 3-21 and 3-22: During the most recent year, Judson Company had the following data associated with the product it makes:arrow_forwardInventory Valuation under Variable Costing Refer to the data for Judson Company above. Required: 1. How many units are in ending inventory? 2. Using variable costing, calculate the per-unit product cost. 3. What is the value of ending inventory under variable costing? Use the following information for Brief Exercises 3-21 and 3-22: During the most recent year, Judson Company had the following data associated with the product it makes:arrow_forwardVariable-Costing Income Statement Refer to the data for Osterman Company on the previous page. Required: 1. Calculate the cost of goods sold under variable costing. 2. Prepare an income statement using variable costing. Use the following information for Brief Exercises 3-23 and 3-24: During the most recent year, Osterman Company had the following data:arrow_forward

- Absorption-Costing Income Statement Refer to the data for Osterman Company above. Required: 1. Calculate the cost of goods sold under absorption costing. 2. Prepare an income statement using absorption costing. Use the following information for Brief Exercises 3-23 and 3-24: During the most recent year, Osterman Company had the following data:arrow_forwardMethod of Least Squares, Predicting Cost for Different Time Periods from the One Used to Develop a Cost Formula Refer to the information for Farnsworth Company on the previous page. However, assume that Tracy has used the method of least squares on the receiving data and has gotten the following results: Required: 1. Using the results from the method of least squares, prepare a cost formula for the receiving activity. 2. Using the formula from Requirement 1, what is the predicted cost of receiving for a month in which 1,450 receiving orders are processed? (Note: Round your answer to the nearest dollar.) 3. Prepare a cost formula for the receiving activity for a quarter. Based on this formula, what is the predicted cost of receiving for a quarter in which 4,650 receiving orders are anticipated? Prepare a cost formula for the receiving activity for a year. Based on this formula, what is the predicted cost of receiving for a year in which 18,000 receiving orders are anticipated?arrow_forwardTotal cost method of product pricing Based on the data presented in Exercise 17, assume that Smart Stream Inc. uses the total cost method of applying the cost-plus approach to product pricing. A. Determine the total costs and the total cost amount per unit for the production and sale of 10,000 cellular phones. B. Determine the total cost markup percentage (rounded to two decimal places) for cellular phones. C. Determine the selling price of cellular phones. (Round markup to the nearest dollar.)arrow_forward

- Summarized data for Walrus Co. for its first year of operations are: A. Prepare an income statement under absorption costing B. Prepare an income statement under variable costingarrow_forwardThe following data were adapted from a recent income statement of The Procter Gamble Company (PG): Assume that the variable amount of each category of operating costs is as follows: a. Based on the data given, prepare a variable costing income statement for Procter Gamble, assuming that the company maintained constant inventory levels during the period. b. If Procter Gamble reduced its inventories during the period, what impact would that have on the operating income determined under absorption costing?arrow_forwardScattergraph, High-Low Method, and Predicting Cost for a Different Time Period from the One Used to Develop a Cost Formula Refer to the information for Farnsworth Company on the previous page. Required: 1. Prepare a scattergraph based on the 10 months of data. Does the relationship appear to be linear? 2. Using the high-low method, prepare a cost formula for the receiving activity. Using this formula, what is the predicted cost of receiving for a month in which 1,450 receiving orders are processed? 3. Prepare a cost formula for the receiving activity for a quarter. Based on this formula, what is the predicted cost of receiving for a quarter in which 4,650 receiving orders are anticipated? Prepare a cost formula for the receiving activity for a year. Based on this formula, what is the predicted cost of receiving for a year in which 18,000 receiving orders are anticipated? Use the following information for Problems 3-60 and 3-61: Farnsworth Company has gathered data on its overhead activities and associated costs for the past 10 months. Tracy Heppler, a member of the controllers department, has convinced management that overhead costs can be better estimated and controlled if the fixed and variable components of each overhead activity are known. One such activity is receiving raw materials (unloading incoming goods, counting goods, and inspecting goods), which she believes is driven by the number of receiving orders. Ten months of data have been gathered for the receiving activity and are as follows:arrow_forward

- Que. No. 1a. When production is greater than sales which method’s net operating income will be higher, AC or VC and why? Be precise and to the point in writing the answer. Que. No. 1b. Sharp Company manufactures a product for which the following data and information related to inventory is available. The company uses variable costing for internal management reports and absorption costing for external reports to the shareholders, creditors, and the government. The company has provided the following data:Year-1Year-2Year-3Inventories:Beginning (units)200160180Ending (units)160180220Variable Costing net operating income$1,080,400$1,032,400$996,400The company’s fixed manufacturing overhead per unit was constant at $650 for all the three years.Required: 1. Determine each year’s absorption costing net operating income. Present your answer in the form of a reconciliation report. (you must show all calculations)2. In year four, the company’s variable costing net operating income was $984,400…arrow_forwardGerber Clothing Inc. has designed a rain suit for outdoor enthusiasts that is about to be introduced on the market. A standard cost card has been prepared for the new suit, as follows: Direct materials Direct labour Manufacturing overhead (1/6 variable) Total standard cost per suit Salaries Advertising and other Total $ 98,455 437,000 $535,455 Standard Quantity or hours a. The only variable selling and administrative costs will be $7 per suit for shipping. Fixed selling and administrative costs will be as follows (per year): 2.6 metres 1.0 hours 1.0 hours Markup percentage Standard price or Rate $ 15 per metre 37 per hour 27 per hour b. Since the company manufactures many products, it is felt that no more than 10,900 hours of labour time per year can be devoted to production of the new suits. c. An investment of $590,000 will be necessary to carry inventories and accounts receivable and to purchase some new equipment. The company wants a 20% ROI in new product lines. d. Manufacturing…arrow_forwardAbsorption and Variable Costing Income Statements for Two Months and Analysis During the first month of operations ended July 31, Head Gear Inc. manufactured 25,400 hats, of which 23,600 were sold. Operating data for the month are summarized as follows: Sales $179,360 Manufacturing costs: Direct materials $109,220 Direct labor 27,940 Variable manufacturing cost 12,700 Fixed manufacturing cost 12,700 162,560 Selling and administrative expenses: Variable $9,440 Fixed 6,890 16,330 During August, Head Gear Inc. manufactured 21,800 hats and sold 23,600 hats. Operating data for August are summarized as follows: Sales $179,360 Manufacturing costs: Direct materials $93,740 Direct labor 23,980 Variable manufacturing cost 10,900 Fixed manufacturing cost 12,700 141,320 Selling and administrative expenses: Variable $9,440 Fixed 6,890 16,330 Required: 1a. Prepare income statement for July using the absorption costing concept. Head Gear Inc. Absorption Costing Income Statement For the Month Ended…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY