College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 27, Problem 1CP

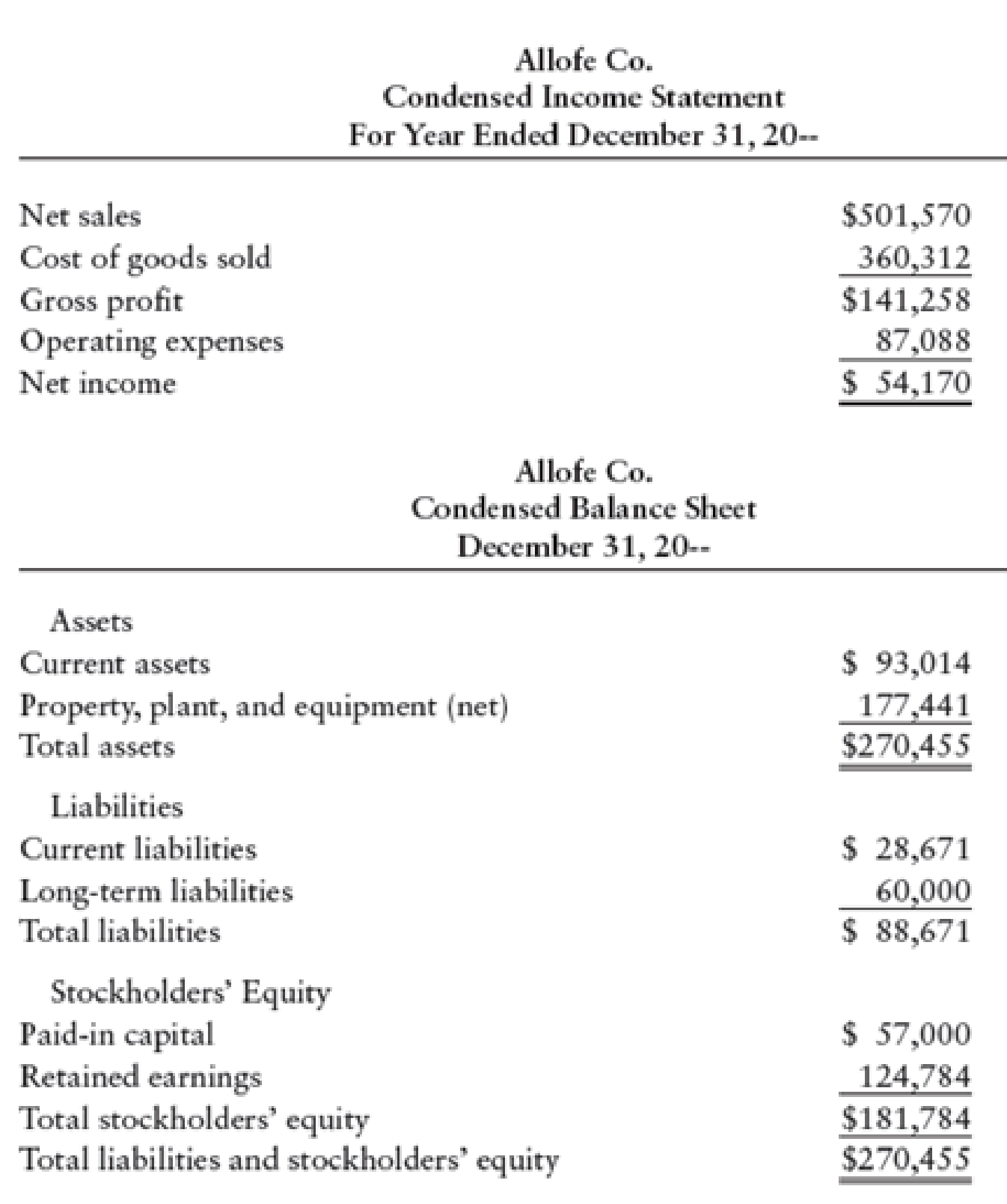

Drafts of the condensed income statement and

REQUIRED

- 1. Identify all adjusting and closing entries that would be affected by this error and prepare the missing portions of the entries.

- 2. Prepare a revised condensed income statement for Allofe.

(In solving this problem, assume that corporate income tax is not affected by the error.)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Prepare the adjusting journal entries to record the credit losses for the following

independent situations.

Required:

(Explanation for the journal entry is NOT required.)

a. The Allowance for Impairment has a S1,500 credit balance prior to adjustment. Net

credit sales during the year are $425,000 and 4% are estimated to be uncollectible.

Assume the income statement approach is used.

b. The Allowance for Impairment has a $300 debit balance prior to adjustment. Based on

an aging schedule of accounts receivable prepared on December 31, $18,100 of accounts

receivable are estimated to be uncollectible. Assume the statement of financial position

approach is used.

c. Explain how the transaction in (b) affects the accounting equation.

Assume the following data for Casper Company before its year-end adjustments:

Journalize the adjusting entries for the following:a. Estimated customer allowancesb. Estimated customer returns

At the end of the year, Metro, Inc. has an unadjusted credit balance in the Manufacturing Overhead account of $820. Which of the following is the

year−end

adjusting entry needed to adjust the account?

A.

A debit to Cost of Goods Sold of $820 and a credit to Manufacturing Overhead of $820

B.

A debit to Cost of Goods Sold of $820 and a credit to Finished Goods Inventory of $820

C.

A debit to Manufacturing Overhead of $820 and a credit to Cost of Goods Sold of $820

D.

A debit to Manufacturing Overhead of $820 and a credit to Finished Goods Inventory of $820

Chapter 27 Solutions

College Accounting, Chapters 1-27

Ch. 27 - Under the perpetual inventory system, Cost of...Ch. 27 - Prob. 2TFCh. 27 - On the spreadsheet, the factory overhead account...Ch. 27 - Prob. 4TFCh. 27 - The adjustment for factory overhead applied to...Ch. 27 - LO2 The adjustment for the amount of factory...Ch. 27 - The adjustment for depreciation expense for the...Ch. 27 - At the end of the accounting period, a credit...Ch. 27 - Prob. 4MCCh. 27 - Prob. 5MC

Ch. 27 - LO2 Prepare adjusting entries at December 31 for J...Ch. 27 - Prob. 2CECh. 27 - Prob. 3CECh. 27 - Prob. 1RQCh. 27 - Prob. 2RQCh. 27 - Prob. 3RQCh. 27 - Prob. 4RQCh. 27 - Prob. 5RQCh. 27 - What are the distinctive features of ToyJoys...Ch. 27 - Prob. 7RQCh. 27 - Prob. 8RQCh. 27 - Prob. 9RQCh. 27 - ADJUSTING ENTRIES INCLUDING ADJUSTMENT FOR...Ch. 27 - Prob. 2SEACh. 27 - Prob. 3SEACh. 27 - CLOSING JOURNAL ENTRIES Prepare closing journal...Ch. 27 - REVERSING JOURNAL ENTRIES Prepare reversing...Ch. 27 - SPRE ADSHEET, ADJUSTING ENTRIES, AND FIN ANCIAL...Ch. 27 - FINANCIAL STATEMENTS The adjusted trial balance...Ch. 27 - ADJUSTING. CLOSING. AND REVERSING ENTRIES A...Ch. 27 - ADJUSTING ENTRIES INCLUDING ADJUSTMENT FOR...Ch. 27 - Prob. 2SEBCh. 27 - ADJUSTING JOURNAL ENTRIES FOR A MANUFACTURING...Ch. 27 - Prob. 4SEBCh. 27 - REVERSING ENTRIES Prepare reversing journal...Ch. 27 - SPREADSHEET, ADJUSTING ENTRIES, AND FINANCIAL...Ch. 27 - FINANCIAL STATEMENTS The adjusted trial balance...Ch. 27 - Prob. 8SPBCh. 27 - Prob. 1MYWCh. 27 - Reese Manufacturing Company manufactures and sells...Ch. 27 - Drafts of the condensed income statement and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- When preparing the financial statements for the year ended October 31, accrued salaries owed to employees for October 30 and 31 were omitted. The accrued salaries were included in the first salary payment in November. Indicate which items will be erroneously stated, because of failure to correct the initial error, on (a) the income statement for the month of November and (b) the balance sheet as of November 30.arrow_forwardAt the end of the current year, using the aging of receivable method, management estimated that $15,750 of the accounts receivable balance would be uncollectible. Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a debit balance of $375. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?arrow_forwardIn order to generate interim financial reports that contain a reasonable portion of annual expenses, which of the following statements is true? a. an allocation of a portion of an annual bonus would be made as an interim adjustment b. any adjustments for inventory shrinkage would be deferred to year end c. the allowance for uncollectible accounts receivable will be revised at year end d. None of the above are truearrow_forward

- Year-end adjusting journal entries Prepare budgetary and proprietary journal entries to record the following year-end adjustments: Note: If a journal entry is not required, select No entry as your answers and leave the Debit and Credit answers blank (zero). 4. The agency recorded depreciation of $25,000 on its equipment.arrow_forwardErnie Upshaw is the supervising manager of Sleep Tight Bedding. At the end of the year, the company's accounting manager provides Ernie with the following information, before any adjustment. Accounts receivable Estimated percent uncollectible Allowance for uncollectible accounts. Operating income $ 520,000 $ 22,000 $ 340,000 88 (debit) In the previous year, Sleep Tight Bedding reported operating income (after adjustment) of $295,000. Ernie knows that it's important to report an upward trend in earnings. This is important not only for Ernie's compensation and employment, but also for the company's stock price. If investors see a decline in earnings, the stock price could drop significantly, and Ernie owns a large amount of the company's stock. This has caused Ernie many sleepless nights. Required: 1. Record the adjusting entry for uncollectible accounts using the accounting manager's estimate of 8% of accounts receivable. 2-a. After the adjusting entry is recorded in requirement 1, what…arrow_forwardAt the end of the first year of operations, Gaur Manufacturing had gross accounts receivable of $300,000. Gaur's management estimates that 6% of the accounts will prove uncollectible.What journal entry should Gaur record to establish an allowance for uncollectible accounts? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forward

- Ernie Upshaw is the supervising manager of Sleep Tight Bedding. At the end of the year, the company’s accounting manager provides Ernie with the following information, before any adjustment. Accounts receivable $ 518,000 Estimated percent uncollectible 9% Allowance for uncollectible accounts $ 21,800 (debit) Operating income $ 338,000 In the previous year, Sleep Tight Bedding reported operating income (after adjustment) of $293,000. Ernie knows that it’s important to report an upward trend in earnings. This is important not only for Ernie’s compensation and employment, but also for the company’s stock price. If investors see a decline in earnings, the stock price could drop significantly, and Ernie owns a large amount of the company’s stock. This has caused Ernie many sleepless nights. Required:1. Record the adjusting entry for uncollectible accounts using the accounting manager’s estimate of 9% of accounts receivable. 2-a. After the adjusting entry is recorded…arrow_forwardHow should seasonal revenues be reported in an interim report? Multiple Choice Disclose the seasonal nature of business operations, and include a pro forma report for the next 12-month period. Disclose the seasonal nature of business operations but do not include other reports supplemental to the interim report. Disclose the seasonal nature of business operations and consider a report for the 12-month period ended at the interim date to supplement the interim report. The financial statements should be adjusted to reflect the assumption that no seasonal revenues could be recognized.arrow_forwardCustomer allowances and returnsAssume the following data for Lusk Inc. before its year-end adjustments: Journalize the adjusting entries for the following:a. Estimated customer allowancesb. Estimated customer returnsarrow_forward

- At the end of the first year of operations, Mayberry Advertising had accounts receivable of $20,300. Management of the company estimates that 10% of the accounts will not be collected. What adjustment would Mayberry Advertising record to establish Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardProblem 3 Inventories, Depreciation & Accounting for Receivables Chad Goldman was operating a gold business on his own prior to starting the Company, Goldy Inc. in July 2021. He has to organize his financial records and asked for your assistance in specific areas. The following information about the company for the month of July 2021, is as follows: July 1 July 1 Beginning inventory 100 gold at a cost of $340 per gold unit. Purchased equipment for $280,000. July 3 Purchased 200 gold at a cost of $350 each. July 5 Sold 180 gold for $730 each. July 10 75 gold units from the sale on July 5 were returned to inventory. July 11 Purchased 350 gold at a cost of $380 each. July 25 Sold 400 gold for $750 each. Purchased a building with a cash price of $450,000, Člosing Cost amounted to $25,000 and remodeling charges of $45,000. July 31 NOTES: v The company implemented the FIFO cost flow assumption and a perpetual inventory system. V The building purchased on July 31 has an estimated useful life…arrow_forwardThe following transactions were completed by Irvine Company during the current fiscal year ended December 31: Required: 1. Record the January 1 credit balance of $25,685 in a T-account for Allowance for Doubtful Accounts. 2.A. Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles. B. Post each entry that affects the following selected T-accounts and determine the new balances: Allowance for Doubtful Accounts and Bad Debt Expense. 3. Determine the expected net realizable value of the accounts receivable as of December 31 (after all of the adjustments and the adjusting entry). 4. Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables, the adjusting entry on December 31 had been based on an estimated expense of ¼ of 1% of the net sales of $17,710,000 for the year, determine the following: A. Bad debt expense for the year. B. Balance in the allowance account after the adjustment of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License