Hager’s Home Repair Company, a regional hardware chain, which specializes in “do-it-yourself” materials and equipment rentals, is considering an acquisition of Lyon Lighting (LL). Doug Zona, Hager’s treasurer and your boss, has been asked to place a value on the target and he has enlisted your help.

LL has 20 million shares of stock trading at $12 per share. Security analysts estimate LL’s beta to be 1.25. The risk-free rate is 5.5% and the market risk premium is 4%. LL’s capital structure is 20% financed with debt at an 8% interest rate; any additional debt due to the acquisition also will have an 8% rate. LL has a 25% federal-plus-state tax rate, which will not change due to the acquisition.

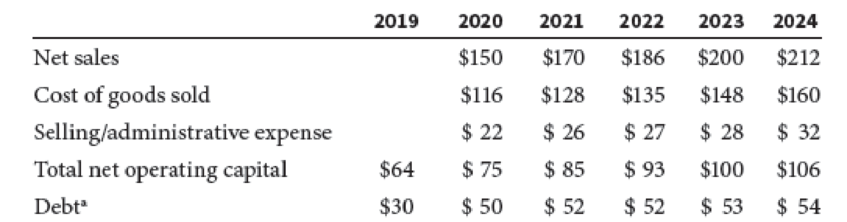

The following data incorporate expected synergies and required levels of total net operating capital for LL should Hager’s complete the acquisition. The

Note:

aDebt is added on the first day of the year, so the 2019 debt is LL’s debt prior to the acquisition.

Hager’s management is new to the merger game, so Zona has been asked to answer some basic questions about mergers as well as to perform the merger analysis. To structure the task, Zona has developed the following questions, which you must answer and then defend to Hager’s board:

What are the steps in valuing a merger using the compressed APV approach?

Want to see the full answer?

Check out a sample textbook solution

Chapter 22 Solutions

Financial Management: Theory & Practice

- Hager’s Home Repair Company, a regional hardware chain, which specializes in “do-it-yourself” materials and equipment rentals, is considering an acquisition of Lyon Lighting (LL). Doug Zona, Hager’s treasurer and your boss, has been asked to place a value on the target and he has enlisted your help. LL has 20 million shares of stock trading at $12 per share. Security analysts estimate LL’s beta to be 1.25. The risk-free rate is 5.5% and the market risk premium is 4%. LL’s capital structure is 20% financed with debt at an 8% interest rate; any additional debt due to the acquisition also will have an 8% rate. LL has a 25% federal-plus-state tax rate, which will not change due to the acquisition. The following data incorporate expected synergies and required levels of total net operating capital for LL should Hager’s complete the acquisition. The forecasted interest expense includes the combined interest on LL’s existing debt and on new debt. After 2024, all items are expected to grow at a constant 6% rate. Note: aDebt is added on the first day of the year, so the 2019 debt is LL’s debt prior to the acquisition. Hager’s management is new to the merger game, so Zona has been asked to answer some basic questions about mergers as well as to perform the merger analysis. To structure the task, Zona has developed the following questions, which you must answer and then defend to Hager’s board: Why can’t we estimate LL’s value to Hager’s by discounting the FCFs at the WACC? What method is appropriate? Use the projections and other data to determine the LL division’s free cash flows and interest tax savings for 2020 through 2024. Notice that the LL division’s sales are expected to grow rapidly during the first years before leveling off at a sustainable long-term growth rate.arrow_forwardHager’s Home Repair Company, a regional hardware chain, which specializes in “do-it-yourself” materials and equipment rentals, is considering an acquisition of Lyon Lighting (LL). Doug Zona, Hager’s treasurer and your boss, has been asked to place a value on the target and he has enlisted your help. LL has 20 million shares of stock trading at $12 per share. Security analysts estimate LL’s beta to be 1.25. The risk-free rate is 5.5% and the market risk premium is 4%. LL’s capital structure is 20% financed with debt at an 8% interest rate; any additional debt due to the acquisition also will have an 8% rate. LL has a 25% federal-plus-state tax rate, which will not change due to the acquisition. The following data incorporate expected synergies and required levels of total net operating capital for LL should Hager’s complete the acquisition. The forecasted interest expense includes the combined interest on LL’s existing debt and on new debt. After 2024, all items are expected to grow at a constant 6% rate. Note: aDebt is added on the first day of the year, so the 2019 debt is LL’s debt prior to the acquisition. Hager’s management is new to the merger game, so Zona has been asked to answer some basic questions about mergers as well as to perform the merger analysis. To structure the task, Zona has developed the following questions, which you must answer and then defend to Hager’s board: Briefly describe the differences between a hostile merger and a friendly merger.arrow_forwardYou get hired as the CFO of a large, Danish company that manufactures bulletproof vests. You are appointed by the board of directors to serve the interest of the shareholders. As the CFO, you are considering to invest in the development of a new line of vests known as the Mariachi Vest. You know little about your company, except that it is a firm traded on Nasdaq OMX, and its stock is quite risky according to the estimated beta of the firm, which is 1.60. Thus, the first thing you do when you start your analyses is to look at the firm's capital structure. You see that it is 75% financed by debt, and debt holders require a 5% rate of return on their investment. The cost of constructing the plant for developing the vest is DKK 50,000,000 upfront. The plant then would have an expected life of 10 years. The firm expects to sell 4000 vests a year till the plant closes down. All the expenditure made for the plant today will be depreciated straight-line over 10 years (from year 1 to year 10)…arrow_forward

- Happy Times, Incorporated, wants to expand its party stores into the Southeast. In order to establish an immediate presence in the area, the company is considering the purchase of the privately held Joe's Party Supply. Happy Times currently has debt outstanding with a market value of $220 million and a YTM of 5.8 percent. The company's market capitalization is $460 million and the required return on equity is 12 percent. Joe's currently has debt outstanding with a market value of $34.5 million. The EBIT for Joe's next year is projected to be $14 million. EBIT is expected to grow at 10 percent per year for the next five years before slowing to 3 percent in perpetuity. Net working capital, capital spending, and depreciation as a percentage of EBIT are expected to be 9 percent, 15 percent, and 8 percent, respectively. Joe's has 2.25 million shares outstanding and the tax rate for both companies is 23 percent. a. What is the maximum share price that Happy Times should be willing to pay for…arrow_forwardYou get hired as the CFO of a large, Danish company that manufactures bulletproof vests. You are appointed by the board of directors to serve the interest of the shareholders. As the CFO, you are considering to invest in the development of a new line of vests known as the Mariachi Vest. You know little about your company, except that it is a firm traded on Nasdaq OMX, and its stock is quite risky according to the estimated beta of the firm, which is 1.60. Thus, the first thing you do when you start your analyses is to look at the firm's capital structure. You see that it is 75% financed by debt, and debt holders require a 5% rate of return on their investment. The cost of constructing the plant for developing the vest is DKK 50,000,000 upfront. The plant then would have an expected life of 10 years. The firm expects to sell 4000 vests a year till the plant closes down. All the expenditure made for the plant today will be depreciated straight-line over 10 years (from year 1 to year 10)…arrow_forwardHappy Times, Incorporated, wants to expand its party stores into the Southeast. In order to establish an immediate presence in the area, the company is considering the purchase of the privately held Joe’s Party Supply. Happy Times currently has debt outstanding with a market value of $200 million and a YTM of 5.8 percent. The company’s market capitalization is $440 million and the required return on equity is 11 percent. Joe’s currently has debt outstanding with a market value of $33.5 million. The EBIT for Joe’s next year is projected to be $13 million. EBIT is expected to grow at 8 percent per year for the next five years before slowing to 3 percent in perpetuity. Net working capital, capital spending, and depreciation as a percentage of EBIT are expected to be 7 percent, 13 percent, and 6 percent, respectively. Joe’s has 2.15 million shares outstanding and the tax rate for both companies is 21 percent. a. What is the maximum share price that Happy Times should be willing to pay for…arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning