(a)

To find:

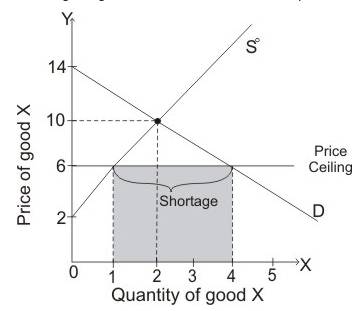

The shortage and full economic price.

Answer to Problem 8CACQ

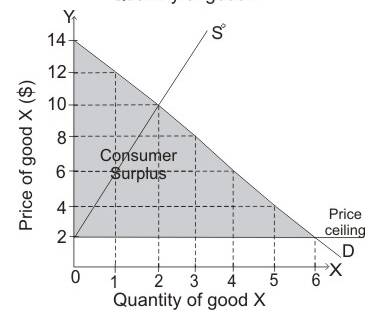

There is shortage of three units and thefull economic price is $12.

Explanation of Solution

The diagram given below shows the effect of

When

Full economic price is the total amount paid by the consumer in getting the product.

Price ceiling:

Price ceiling is the minimum price imposed by a government below which goods are supplied.

Full economic price:

Full economic price is the total amount paid by the consumer in getting the product below the imposed price ceiling.

(b)

To find:

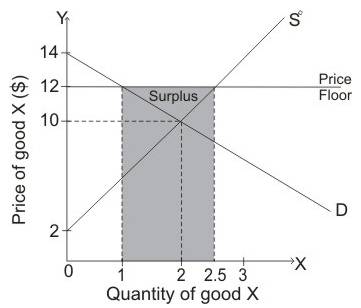

The surplus as a result of imposition of $12 as price support and costs to the government in purchasing the units and all unsold units.

Answer to Problem 8CACQ

The costs to the government in purchasing units is $12.

Explanation of Solution

The diagram given below shows the effect of

When demand curve is D and Supply curve is S0then equilibrium is attained when price of commodity is $10 and quantity demanded is 2 units. When government imposed the price floor of $12, then quantity supplied is greater than the quantity demanded so there is surplus of goods in an economy. Thus, there is surplus of 1.5units.

The shaded area in the diagram shows the surplus of good in an economy.

When price of commodity is more than the

Price floor:

Price floor is the maximum price which government has imposed above which goods are sold in the market.

(c)

To find:

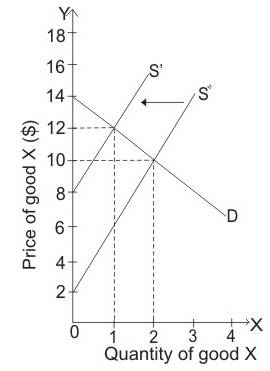

The equilibrium price after excise tax of $6 is imposed, the price received by producers and the number of units that are sold.

Answer to Problem 8CACQ

The price paid by consumer is $12 per unit while the price received by the producer is $6 per unit. The number of units sold is 1 unit.

Explanation of Solution

When equilibrium price is $10 and government imposes excise tax of $6, then supply curve will shift leftwards from S0 to S1,which leads to rise in equilibrium price from $10 to $12. At equilibrium price of $12, quantity demanded is 1 unit.

The price paid by consumer is $12 per unit while the price received by the producer is $6 per unit. The number of units sold is 1 unit.

Excise tax:

An excise tax is a tax imposed on manufacturers for producing goods.

(d)

To explain:

The level of

Answer to Problem 8CACQ

The value of

Explanation of Solution

When demand curve D and supply curve S0 intersects then equilibrium is attained at price of $10 while

Consumer surplus is the below demand curve and above the price level $10. So, consumer’s surplus is equal to:

Thus, the value of consumer surplus is $4.

Producer surplus is the area above curve and below the price level $10. So, producer’s surplus is equal to:

Thus, the value of producer surplus is $4.

Consumer surplus:

Consumer surplus is the variance in the amount that consumers are ready to pay and the price which is actually paid by them. The area of consumer surplus is below the demand curve and above the price.

Consumer surplus:

Producer surplus is the variance in the amount at which producers accept the quantity and the amount at which they sell. Producer surplus is the area above curve and below the price level.

(e)

To explain:

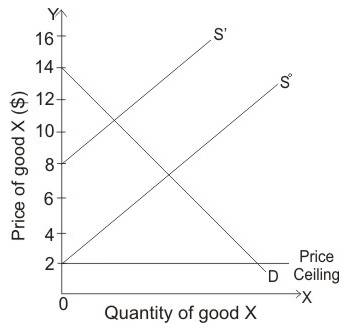

Whether the price can be benefitted with the price ceiling of $2.

Explanation of Solution

When price ceiling is $2 then producers do not want to produce any commodity while consumers want to consume any commodity which is produced.

At price of $2, all consumers will benefit if producers supply commodity but at this low-price firms are not interested to produce any commodity.

Price ceiling:

Price ceiling is the maximum price imposed by a government below which goods are supplied.

Want to see more full solutions like this?

Chapter 2 Solutions

Managerial Economics & Business Strategy (Mcgraw-hill Series Economics)

- Recently, the spot market price of U.S. hot rolled steel plummeted to $400 per ton. Just one year ago, this same ton of steel cost $700. According to Metals Monitor, the drop in price was due to falling oil prices, along with a rise in cheap imports and excess capacity. These dramatic market changes have greatly impacted the supply of raw steel. Suppose that last year the supply for raw steel was QS, raw = 600 +4P, but this year it has shifted to QS raw- = 4,200 +4P. Assuming the market for raw steel is competitive and that the current worldwide demand for steel is Qara raw 9,000 -8P, compute the equilibrium price and quantity for the steel market one year ago, and the equilibrium price-quantity combination for the current steel market. Instructions: Enter your responses as whole numbers. Price one year ago: $ Quantity one year ago: Price for current market: $ Quantity for current market: Suppose the cost function of a representative steel producer is C(Q) = 1,200 + -15Q². How much raw…arrow_forwardSuppose demand and supply are given by: (LO3, LO4) Qx d = 14 − 1/2 Px and Qx s = 1/4Px − 1 a. Determine the equilibrium price and quantity. Show the equilibrium graphically. B. Supposed a $ 12 excise tax is imposed on the good. Determine the new equilibrium price and quantity C. How much tax revenue does the government earn with the $12 taxarrow_forwardSuppose demand and supply are given by: (LO3, LO4)Qx d = 14 − 1/2Px and Qx s = 1/4Px − 1a. Determine the equilibrium price and quantity.arrow_forward

- Suppose that you are the vice president of operations of a manufacturing firm that sells an industrial lubricant. Further suppose that your economist gives you the following supply and demand equations: Supply equation: QS = 0.5P-20 Demand equation: P = 100 a ) Calculate the equilibrium price and quantity that characterizes this good b) Graphically show the market equilibrium price and quantity you found in part a). Please label this point "A". c) Suppose that the local government imposes a $4 per-unit sales tax on consumers. Calculate the new equilibrium price and quantity that characterizes this good under this new scenario. d) Graphically show the new market equilibrium on the graph you drew in part b). Please label this point "B".arrow_forwardAn economist estimates that a market has a demand curve of the form P = 37- (1.23) Q and a supply curve of the form P = 1 + (0.984) Q. (See the curves graphed in the figure below.) Accordingly, she estimates that the quantity equilibrium (Qe) in this market will be 16.26 (or 16.260163) and that the equilibrium price (Pe) in the market will be. (Answer may be rounded to nearest hundredth.) Supply X Demand Q OA. $20.84 O B. $12.20 O C. $23.00 O D. $17arrow_forwardSuppose demand and supply are given by: (LO3, LO4)Qx d = 14 − 1/2 Px and Qx s = 1/4Px − 1a. Determine the equilibrium price and quantity. Show the equilibrium graphically.arrow_forward

- The Australian government have suggested that they might need to increase GST to help fund the COVID-19 rescue package. GST is a tax on goods and services usually paid at the point of sale. Consider the market for bread. Suppose a loaf costs $4.15 and includes a 15-cent tax per loaf. q3- Suppose that at a price of $4.15 eight hundred loaves are sold and when the tax is increased to 20 cents seven hundred loaves are sold. Calculate the total tax revenue for the government before and after the change in the tax rate.arrow_forwardQ3. Let D(x) and S(x) represent, respectively, the Demand and Supply functions, for a certain commodity, where y is the unit price and x is the number of items for that unit price. For the given Demand and Supply functions. Demand: D(x) = y = -2x +100 Supply: S(x) = y = x² + 4x – 60 a) Find the equilibrium quantity (if it exists) [Spts] b) Find the equilibrium price. [5pts] c) For which values of x, market has shortage. [5pts] d) For which values of x, market has surplus. [5pts] e) Draw the graphs of demand and supply functions on the same coordinate systems. [5pts]arrow_forwardWe obtain the following demand curve of beef in a market: Q = 44506.941 - 3338.553 ln(P), where Q is quantity demanded of beef measured in pounds, P is price measured in dollars per pound. We know 8.781 and 13016.956. Based on this information, if price increases by 1 dollar, quantity demanded decreases by ____%. (Only type in the number in your answer, do not type in the percentage sign "%" again.)arrow_forward

- As newly appointed “Energy Czar,” your goal is to reduce the total demand for residential heating fuel in your state. You must choose one of three legislative proposals designed to accomplish this goal: (a) a tax that would effectively increase the price of residential heating fuel by $1, (b) a subsidy that would effectively reduce the price of natural gas by $3, or (c) a tax that would effectively increase the price of electricity (produced by hydroelectric facilities) by $4. To assist you in your decision, an economist in your office has estimated the demand for residential heating fuel using a linear demand specification. The regression results are presented as follows. Based on this information, which proposal would you favor? Explain.arrow_forward4. The demand for good X is given by Q² = 6,000 − ¹ P₁ − P₁₂ + 9P₂ + + TOM 10arrow_forward**Asking for part (d) only** Suppose the demand for crossing the Golden Gate Bridge is given by Q = 10,000 − 1,000P. (LO6) a. If the toll (P) is $3, how much revenue is collected? b. What is the price elasticity of demand at this point? c. Could the bridge authorities increase their revenues by changing their price? d. In 2019, the San Francisco Bay area Water Emer- gency Transportation Authority (WETA) announced it was considering the implementation of hovercraft service as a supplement to existing ferries. Suppose that a fast hovercraft alternative to the Golden Gate Bridge is implemented between Marin County and San Francisco. How would the new service affect the elasticity of demand for trips across the Golden Gate Bridge?arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education