College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 19, Problem 10SPB

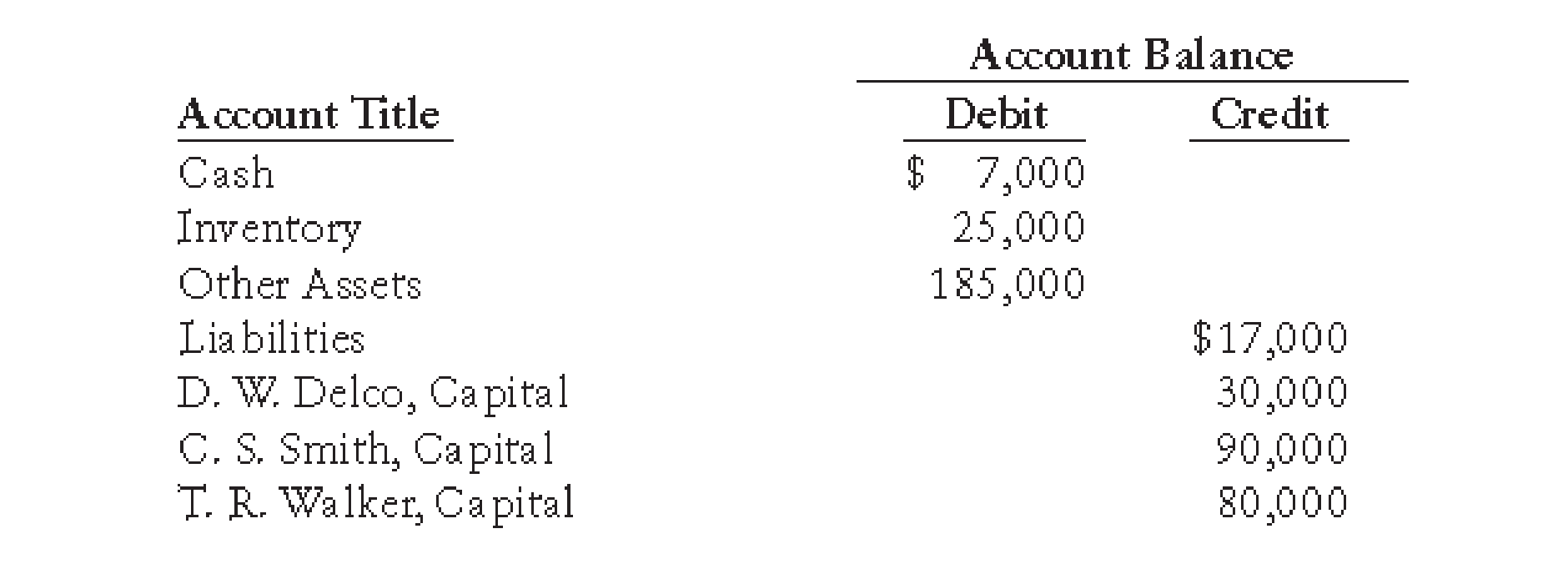

STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS After several years of operations, the

The noncash assets are sold for $165,000.

REQUIRED

1. Prepare a statement of partnership liquidation for the period April 1–15, 20--, showing the following:

(a) The sale of noncash assets on April 1

(b) The allocation of any gain or loss to the partners on April 1

(c) The payment of the liabilities on April 12

(d) The distribution of cash to the partners on April 15

2. Journalize these four transactions in a general journal.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The partnership of Donald, Healey & Jaguar has experienced operating losses. The partners—who have shared profits and losses in the ratio of Donald, 10%; Healey, 30%; and Jaguar, 60%—are liquidating the business. They ask you to analyze the effects of liquidation and present the following partnership balance sheet at December 31, end of the current year:

Requirements

1. Prepare a summary of liquidation transactions (as illustrated in Exhibit 12-5). The noncash assets are sold for $192,000.

2. Journalize the liquidation transactions.

On December 31, 2018, the Statement of Financial Position of JKL Partnership with profit or loss ratio of 4:1:5 is presented below: On January 1, 2019, JKL partnership decided to liquidate. During their first month of liquidation, noncash asset with book value of P1,500,000 has been sold at a loss of P500,000. Liquidation expense amounting to P100,000 has been incurred and paid for the month of January while P150,000 is anticipated in the coming period. Liability to creditors has been paid in the amount of P750,000. What is the amount of cash distributed to K on the first month of liquidation?a. 175,000b. 250,000c. 162,500d. None

Immediately prior to the process of liquidation, partners Micco, Niccum, and Orwell have capital balances of $70,000, $20,000, and $30,000, respectively. There is a cash balance of $10,000, noncash assets total $160,000, and liabilities total $50,000. The partners share net income and losses in the ratio of 2:2:1.

Journalize the entries for the following liquidation using Noncash Assets as the account title for the noncash assets and Liabilities as the account title for all creditors' claims.

Sold the noncash assets for $80,000 in cash.

Divided the loss on realization.

Paid the liabilities.

Received cash from the partner with the deficiency.

Distributed the cash to the partners.

If an amount box does not require an entry, leave it blank.

Chapter 19 Solutions

College Accounting, Chapters 1-27

Ch. 19 - Prob. 1TFCh. 19 - Prob. 2TFCh. 19 - Prob. 3TFCh. 19 - Prob. 4TFCh. 19 - Prob. 5TFCh. 19 - Prob. 1MCCh. 19 - Prob. 2MCCh. 19 - Prob. 3MCCh. 19 - Prob. 4MCCh. 19 - Prob. 5MC

Ch. 19 - Prob. 1CECh. 19 - Prob. 2CECh. 19 - Prob. 3CECh. 19 - Prob. 4CECh. 19 - Prob. 5CECh. 19 - Prob. 1RQCh. 19 - Prob. 2RQCh. 19 - Prob. 3RQCh. 19 - Prob. 4RQCh. 19 - Prob. 5RQCh. 19 - Prob. 6RQCh. 19 - Prob. 7RQCh. 19 - Prob. 8RQCh. 19 - Prob. 9RQCh. 19 - Prob. 1SEACh. 19 - Prob. 2SEACh. 19 - Prob. 3SEACh. 19 - Prob. 4SEACh. 19 - ENTRIES: PARTNERSHIP LIQUIDATION On liquidation of...Ch. 19 - Prob. 6SPACh. 19 - Prob. 7SPACh. 19 - Prob. 8SPACh. 19 - Prob. 9SPACh. 19 - STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS...Ch. 19 - Prob. 1SEBCh. 19 - Prob. 2SEBCh. 19 - Prob. 3SEBCh. 19 - Prob. 4SEBCh. 19 - Prob. 5SEBCh. 19 - Prob. 6SPBCh. 19 - Prob. 7SPBCh. 19 - ENTRIES FOR DISSOLUTION OF PARTNERSHIP Cummings...Ch. 19 - Prob. 9SPBCh. 19 - STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS...Ch. 19 - Prob. 1MYWCh. 19 - Prob. 1ECCh. 19 - Prob. 1MPCh. 19 - Prob. 1CPCh. 19 - Prob. 1COP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS After several years of operations, the partnership of Nelson, Pope, and Williams is to be liquidated. After making closing entries on March 31, 20--, the following accounts remain open: REQUIRED 1. Prepare a statement of partnership liquidation for the period July 120, 20--, showing the following: (a) The sale of noncash assets on July 1 (b) The allocation of any gain or loss to the partners on July 1 (c) The payment of the liabilities on July 15 (d) The distribution of cash to the partners on July 20 2. Journalize these four transactions in a general journal.arrow_forwardENTRIES: PARTNERSHIP LIQUIDATION On liquidation of the partnership of J. Hui and K. Cline, as of November 1, 20--, inventory with a book value of 180,000 is sold for 230,000. Given that Hui and Cline share profits and losses equally, prepare the entries for the sale and the allocation of gain.arrow_forwardPrior to proceeding with the liquidation, the partnership should ________. A. prepare adjusting entries without closing B. complete the accounting cycle for final operational period C. prepare only closing entries D. complete financial statements onlyarrow_forward

- Immediately prior to the process of liquidation, partners M, N, and O have capital balances of $70,000, $20,000, and $30,000 respectively. There is a cash balance of $10,000, noncash assets total $160,000, and liabilities total $50,000. The partners share net income and losses in the ratio of 2:2:1. Journalize the entries to record the liquidation outlined below, using “Assets” as the account title for the noncash assets and “Liabilities” as the account title for all creditors' claims. (a) Sold the noncash assets for $80,000 in cash. (b) Divided the loss on realization. (c) Paid the liabilities. (d) Received cash from the partner with the deficiency. (e) Distributed the cash to the partners. (for each Journal Entry, omit the 4th journalizing step of providing a brief explanation) JOURNAL Date Post. DR CR (a)…arrow_forwardVictory Worship Partnership has the following account balances before liquidation (see attached photo):During December, some non-cash assets were sold for a loss of P1,845. Liquidation expenses of P7,000 were paid and additional expenses amounting to P3,600 were expected to be incurred through the following months of liquidating the partnership. Liabilities to outsiders amounting to P35,000 were paid. What is the book value of non-cash assets sold for Co to receive P22,222?arrow_forwardVictory Worship Partnership has the following account balances before liquidation (see attached photo):During December, some non-cash assets were sold for a loss of P1,845. Liquidation expenses of P7,000 were paid and additional expenses amounting to P3,600 were expected to be incurred through the following months of liquidating the partnership. Liabilities to outsiders amounting to P35,000 were paid. What is the book value of non-cash assets sold for Co to receive P22,222? A. 83,355 B. 85,200 C. 95,000 D. 93,155arrow_forward

- Given information for question below: MAQHUZE WELDERS had the following balances when they commenced a simultenous liquidation of the partnership: 432 000 Welding equipment (cost).. Welding equipment (accumulated depreciation).. Trade receivables.. 145 800 70 200 Trade payables.. 32 400 The following transactions took place as part of the liquidation: 1. Welding equipment were sold for.. 2. Debtors settled their accounts in full 3. On settlement, the creditors granted a settlement discount of... 3. Liquidation costs amounted to... 216000 1700 27000 . *... QUESTION 1 Which one of the following alternatives represents the correct net profit (or loss) made on the simultaneous liquidation? A. 68 500 B. 74 500 C. 89 400 D. 76 200arrow_forwardA local partnership is to be liquidated. Commissions and other liquidation expenses are expected to total $19,000. The business’s balance sheet prior to the commencement of liquidation is as follows: Prepare a predistribution plan for this partnership.arrow_forwardWhat will i do for the liquidation expense stated in the problem related to parnership liquidation installment - cash priority program? Problem: On January 1, 2022, partners Kho, Lagman and Magno decided to liquidate their partnership. Prior to the liquidation, the partnersip had cash of P12,000, non-cash assets of P146,000, liabilities to outsiders of P36,000 and a note payable to Partner Magno of P14,000. The capital balances of the partners were: Kho - P36,000; Lagman-P54,000; Magno-P18,000. The partners share profits and losses in the ratio of 3:3:4,respectively.During January 2022, the partnership received cash of P30,000 from the sale of assets with a book value of P38,000 and paid P3,600 of liquidation expenses. During February, the partnership realized P44,000-from the sale of assets with a book value of P35,000 and paid liquidation expenses of P8,400. During March, the remaining assets were sold for P36,000. The partners agreed to distribute cash at the end of each…arrow_forward

- On December 1, 2021 – Apple, Banana, and Lemon decided to finally liquidate their partnership. (Statement of financial position/Balance sheet is given in the picture) Required: 1. Prepare the liquidation journal entries. 2. Prepare the statement of liquidation.arrow_forwardA balance sheet for the partnership of A, B, and C, who share profits 2:1:1, shows the following balances just before liquidation: Cash: P48,000 Other assets: 238,000 Liabilities: 80,000 A, Capital: 88,000 B, Capital: 62,000 C, Capital: 56,000 On the first month of liquidation, certain non-cash assets were sold resulting to a loss of P23,000. Liquidation expenses of P4,000 were paid, and additional liquidation expenses of P3,200 are withheld to anticipate payment before liquidation is completed. After creditors were paid, partner B received P13,000 on the initial installment. Determine the total book value of the non-cash assets on the first month.arrow_forwardAfter several years of operations, the partnership of Arenas, Dulay and Laurente is to be liquidated. After making the closing entries on June 30, 2018, the following accounts remained open: Account Title Debit Credit Cash P 50,000 Non-cash Assets 2,350,000 Liabilities P 400,000 Arenas, Capital 900,000 Dulay, Capital 500,000 Laurente, Capital 600,000 The non-cash assets are sold for P2,650,000. Profits and losses are shared equally. Prepare a Statement of Partnership Liquidation and the entries to record the following: 1. Distribution of cash to the partnersarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

What is liquidity?; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XtjS7CfUSsA;License: Standard Youtube License