Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15.MJ, Problem 2IFRS

IFRS Activity 2

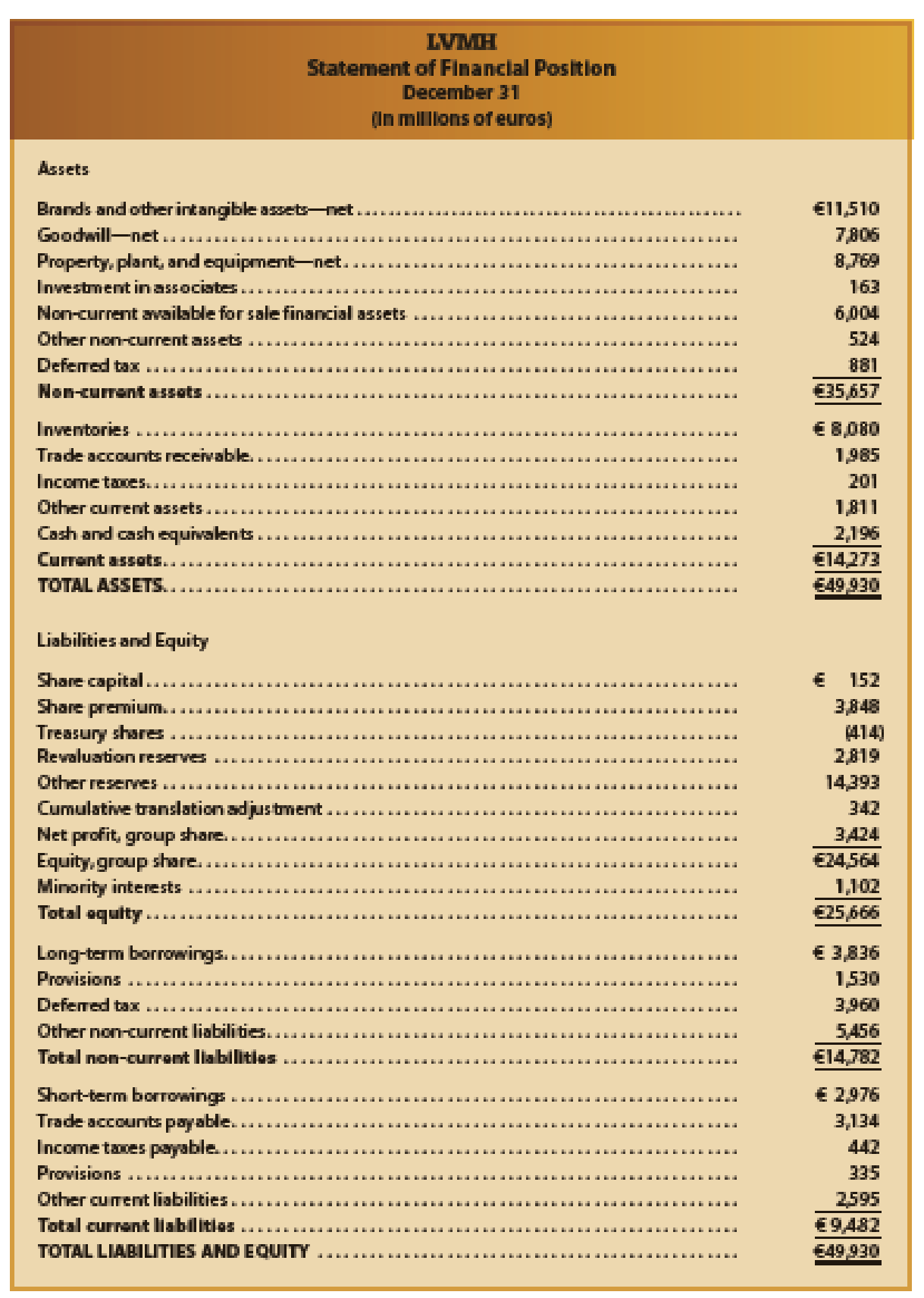

The following is a recent consolidated

- a. Identify presentation differences between the balance sheet of LVMH and a balance sheet prepared under U.S. GAAP. Use the Mornin’ Joe balance sheet (Exhibit 2) as an example of a U.S. GAAP balance sheet. (Ignore minority interests and cumulative translation adjustment.)

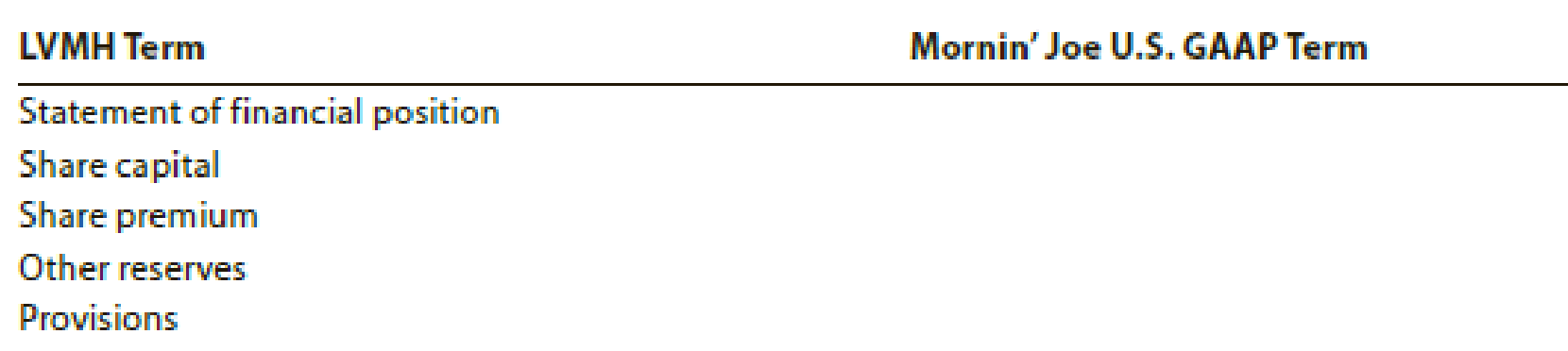

- b. Compare the terms used in this balance sheet with the terms used by Mornin’ Joe (Exhibit 2), using the table that follows:

- c. What does the “Revaluation reserves” in the Equity section of the balance sheet represent?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

O

Terminology Matching

Long-Term Investments

Ratio Analysis

Depreciation

Intangible Assets

Current Liabilities

Long-Term Liabilities

Liquidity Ratios

Solvency Ratios

SEC

IFRS

Hg continued - Academic Resou...

Terminology Matching - Academic Res...

Oversees U.S. financial markets and accounting standard-

setting bodies

Obligations to pay within the next year of the operating cycle

Set accounting standards that have been adopted by many

countries outside the United States

Expresses the relationship among selected items of financial

statements

Allocation of the cost of an asset to a number of years

Examples: Current ratio, working capital ratio

Examples: Bonds payable, mortgages payable, long-term

notes payable, lease liabilities, pension liabilities

Measures the ability of the organization to survive over a long

period of time

Examples: Stocks and bonds that are held more than 1 year,

land, buildings, long-term notes

Examples: Goodwill, character, patents, copyrights,

trademarks,…

Consider this simplified balance sheet for Geomorph Trading:

Current assets

Long-term assets

$ 110

510

Net working capital

$ 620

a.

Debt-equity ratio

b Long-term debt-to-capital ratio

C.

d. Current ratio

a. What is the company's debt-equity ratio? (Round your answer to 2 decimal places.)

b. What is the ratio of total long-term debt to total long-term capital? (Round your answer to 2 decimal places.)

c. What is its net working capital?

d. What is its current ratio? (Round your answer to 2 decimal places.)

Current liabilities

Long-term debt

Other liabilities

Equity

$ 65

275

80

200

$ 620

Translation of financial statements

Use the following information for the next three questions:

Entity A started its operations on January 1, 20x1. On this date, Entity A's equity consisted of

P2M share capital, which were issued also on this date. Entity A's functional currency is the

Philippine peso (P). However, it wishes to present its 20x1 financial statements into Chinese

yuan (¥). The following information was gathered on December 31, 20x1, after a year of

operations.

Total assets

PIOM

Total liabilities

P5M

Share capital

Retained earnings

Total liabilities and equity

2M

3M

P10M

Income

P7M

Expenses

(4M)

Profit

P3M

Relevant exchange rates:

January 1, 20x1 (historical rate for the share capital) P5¥1

Average rate

December 31, 20x1 (closing rate)

P8:¥1

P10:¥1

How much is the translated equity?

Chapter 15 Solutions

Financial Accounting

Ch. 15.MJ - Prob. 1DQCh. 15.MJ - What is the difference between classifying an...Ch. 15.MJ - If a functional expense classification is used for...Ch. 15.MJ - Prob. 4DQCh. 15.MJ - What are two main differences in inventory...Ch. 15.MJ - Prob. 6DQCh. 15.MJ - Prob. 7DQCh. 15.MJ - Prob. 8DQCh. 15.MJ - Prob. 9DQCh. 15.MJ - How is treasury stock reported under IFRS? How...

Ch. 15.MJ - IFRS Activity 1

Unilever Group is a global company...Ch. 15.MJ - IFRS Activity 2 The following is a recent...Ch. 15.MJ - Prob. 3IFRSCh. 15 - Why might a business invest cash in temporary...Ch. 15 - What causes a gain or loss on the sale of a bond...Ch. 15 - When is the equity method the appropriate...Ch. 15 - Prob. 4DQCh. 15 - Prob. 5DQCh. 15 - Prob. 6DQCh. 15 - Prob. 7DQCh. 15 - Prob. 8DQCh. 15 - Prob. 9DQCh. 15 - Prob. 10DQCh. 15 - Prob. 1PEACh. 15 - Prob. 1PEBCh. 15 - On February 10, 15,000 shares of Sting Company are...Ch. 15 - Prob. 2PEBCh. 15 - Prob. 3PEACh. 15 - Prob. 3PEBCh. 15 - Prob. 4PEACh. 15 - Prob. 4PEBCh. 15 - Prob. 5PEACh. 15 - On January 1, 2016, Valuation Allowance for...Ch. 15 - Prob. 6PEACh. 15 - Prob. 6PEBCh. 15 - Parilo Company acquired 170,000 of Makofske Co.,...Ch. 15 - Prob. 2ECh. 15 - Prob. 3ECh. 15 - Prob. 4ECh. 15 - Prob. 5ECh. 15 - On March 4, Breen Corporation acquired 7,500...Ch. 15 - Prob. 7ECh. 15 - Prob. 8ECh. 15 - Seamus Industries Inc. buys and sells investments...Ch. 15 - Prob. 10ECh. 15 - Prob. 11ECh. 15 - Prob. 12ECh. 15 - Prob. 13ECh. 15 - JED Capital Inc. makes investments in trading...Ch. 15 - Prob. 15ECh. 15 - Prob. 16ECh. 15 - Prob. 17ECh. 15 - Prob. 18ECh. 15 - Prob. 19ECh. 15 - The investments of Steelers Inc. include a single...Ch. 15 - Prob. 21ECh. 15 - Storm, Inc. purchased the following...Ch. 15 - Prob. 23ECh. 15 - Prob. 24ECh. 15 - Prob. 25ECh. 15 - Prob. 26ECh. 15 - Prob. 27ECh. 15 - Prob. 28ECh. 15 - Prob. 29ECh. 15 - Prob. 1PACh. 15 - Prob. 2PACh. 15 - Prob. 3PACh. 15 - OBrien Industries Inc. is a book publisher. The...Ch. 15 - Prob. 1PBCh. 15 - Prob. 2PBCh. 15 - Prob. 3PBCh. 15 - Prob. 4PBCh. 15 - Selected transactions completed by Equinox...Ch. 15 - On July 16, 1998, Wyatt Corp. purchased 40 acres...Ch. 15 - International Financial Reporting Standard No. 16...Ch. 15 - Prob. 3CPCh. 15 - Berkshire Hathaway, the investment holding company...Ch. 15 - Prob. 5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Effect of Industry Characteristics on Financial Statement Relations: A Global Perspective. Effective financial statement analysis requires an understanding of a firms economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.24 (pages 6667) presents common-size condensed balance sheets and income statements for 12 firms in different industries. These common-size balance sheets and income statements express various items as a percentage of operating revenues. (That is, the statement divides all amounts by operating revenues for the year.) A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large for the firm to disclose it. A list of the 12 companies, the country of their headquarters, and a brief description of their activities follow. A. Accor (France): Worlds largest hotel group, operating hotels under the names of Sofitel, Novotel, Motel 6, and others. Accor has grown in recent years by acquiring established hotel chains. B. Carrefour (France): Operates grocery supermarkets and hypermarkets in Europe, Latin America, and Asia. C. Deutsche Telekom (Germany): Europes largest provider of wired and wireless telecommunication services. The telecommunications industry has experienced increased deregulation in recent years. D. E.ON AG (Germany): One of the major public utility companies in Europe and the worlds largest privately owned energy service provider. E. Fortis (Netherlands): Offers insurance and banking services. Operating revenues include insurance premiums received, investment income, and interest revenue on loans. Operating expenses include amounts actually paid or amounts it expects to pay in the future on insurance coverage outstanding during the year. F. Interpublic Group (U.S.): Creates advertising copy for clients. Interpublic purchases advertising time and space from various media and sells it to clients. Operating revenues represent the commissions or fees earned for creating advertising copy and selling media time and space. Operating expenses include employee compensation. G. Marks Spencer (U.K.): Operates department stores in England and other retail stores in Europe and the United States. Offers its own credit card for customers purchases. H. Nestl (Switzerland): Worlds largest food processor, offering prepared foods, coffees, milk-based products, and mineral waters. I. Roche Holding (Switzerland): Creates, manufactures, and distributes a wide variety of prescription drugs. J. Sumitomo Metal (Japan): Manufacturer and seller of steel sheets and plates and other construction materials. K. Sun Microsystems (U.S.): Designs, manufactures, and sells workstations and servers used to maintain integrated computer networks. Sun outsources the manufacture of many of its computer components. L. Toyota Motor (Japan): Manufactures automobiles and offers financing services to its customers. REQUIRED Use the ratios to match the companies in Exhibit 1.24 with the firms listed above.arrow_forwardEffect of Industry Characteristics on Financial Statement Relations. Effective financial statement analysis requires an understanding of a firms economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.22 (pages 6061) presents common-size condensed balance sheets and income statements for 12 firms in different industries. These common-size balance sheets and income statements express various items as a percentage of operating revenues. (That is, the statement divides all amounts by operating revenues for the year.) Exhibit 1.22 also shows the ratio of cash flow from operations to capital expenditures. A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large enough for the firm to disclose it. Amounts that are not meaningful are shown as n.m. A list of the 12 companies and a brief description of their activities follow. A. Amazon.com: Operates websites to sell a wide variety of products online. The firm operated at a net loss in all years prior to that reported in Exhibit 1.22. B. Carnival Corporation: Owns and operates cruise ships. C. Cisco Systems: Manufactures and sells computer networking and communications products. D. Citigroup: Offers a wide range of financial services in the commercial banking, insurance, and securities business. Operating expenses represent the compensation of employees. E. eBay: Operates an online trading platform for buyers to purchase and sellers to sell a variety of goods. The firm has grown in part by acquiring other companies to enhance or support its online trading platform. F. Goldman Sachs: Offers brokerage and investment banking services. Operating expenses represent the compensation of employees. G. Johnson Johnson: Develops, manufactures, and sells pharmaceutical products, medical equipment, and branded over-the-counter consumer personal care products. H. Kelloggs: Manufactures and distributes cereal and other food products. The firm acquired other branded food companies in recent years. I. MGM Mirage: Owns and operates hotels, casinos, and golf courses. J. Molson Coors: Manufactures and distributes beer. Molson Coors has made minority ownership investments in other beer manufacturers in recent years. K. Verizon: Maintains a telecommunications network and offers telecommunications services. Operating expenses represent the compensation of employees. Verizon has made minority investments in other cellular and wireless providers. L. Yum! Brands: Operates chains of name-brand restaurants, including Taco Bell, KFC, and Pizza Hut. REQUIRED Use the ratios to match the companies in Exhibit 1.22 with the firms listed above.arrow_forwardEffect of Industry Characteristics on Financial Statement Relations. Effective financial statement analysis requires an understanding of a firms economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.23 (pages 6263) presents common-size condensed balance sheets and income statements for 12 firms in different industries. These common-size balance sheets and income statements express various items as a percentage of operating revenues. (That is, the statement divides all amounts by operating revenues for the year.) Exhibit 1.23 also shows the ratio of cash flow from operations to capital expenditures. A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large for the firm to disclose it. A list of the 12 companies and a brief description of their activities follow. A. Abercrombie Fitch: Sells retail apparel primarily through stores to the fashionconscious young adult and has established itself as a trendy, popular player in the specialty retailing apparel industry. B. Allstate Insurance: Sells property and casualty insurance, primarily on buildings and automobiles. Operating revenues include insurance premiums from customers and revenues earned from investments made with cash received from customers before Allstate pays customers claims. Operating expenses include amounts actually paid or expected to be paid in the future on insurance coverage outstanding during the year. C. Best Buy: Operates a chain of retail stores selling consumer electronic and entertainment equipment at competitively low prices. D. E. I. du Pont de Nemours: Manufactures chemical and electronics products. E. Hewlett-Packard: Develops, manufactures, and sells computer hardware. The firm outsources manufacturing of many of its computer components. F. HSBC Finance: Lends money to consumers for periods ranging from several months to several years. Operating expenses include provisions for estimated uncollectible loans (bad debts expense). G. Kelly Services: Provides temporary office services to businesses and other firms. Operating revenues represent amounts billed to customers for temporary help services, and operating expenses include amounts paid to the temporary help employees of Kelly. H. McDonalds: Operates fast-food restaurants worldwide. A large percentage of McDonalds restaurants are owned and operated by franchisees. McDonalds frequently owns the restaurant buildings of franchisees and leases them to franchisees under long-term leases. I. Merck: A leading research-driven pharmaceutical products and services company. Merck discovers, develops, manufactures, and markets a broad range of products to improve human and animal health directly and through its joint ventures. J. Omnicom Group: Creates advertising copy for clients and is the largest marketing services firm in the world. Omnicom purchases advertising time and space from various media and sells it to clients. Operating revenues represent commissions and fees earned by creating advertising copy and selling media time and space. Operating expenses includes employee compensation. K. Pacific Gas Electric: Generates and sells power to customers in the western United States. L. Procter Gamble: Manufactures and markets a broad line of branded consumer products. REQUIRED Use the ratios to match the companies in Exhibit 1.23 with the firms listed above.arrow_forward

- MANCOSA POSTGRADUATE DIPLOMA IN PRORCT MANAGEMENT QUESTION REQUIRED Use the information provided below to calculate the following ratios. Where applicable, und e answers to two decimal places 111 Gross profe margin 312 Operating profit margin 31.3 invertory turnover period 31.4 Trade recelvatles peried 31.5 Trade payables period 31 316 Current ratio 3.1.7 Acid test ratio 3.18 Return on capital employed 32 Comment on the control ef debtors by Saturn imited Sugpest TWO 2) ways in which Saturn Limited can improve its operating profit margin. 33 INFORMATION Excerpts of financial data of Satum Limited for 2019 are as follows: STATEMENT OF COMPREHINSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2019 2600 00 Cost of sales Gros proft Operating profit 1400 000 600 000 40 000 S60 00 Interest expense Proft before tas Tan N STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER: 2019 2008 ASSETS Non-current assets Inventories Accounts recelvable 780000 500 000 240 000 120 000 45L000 1250 p0 EQUITY AND…arrow_forwardTranslation exposure results when an MNC translates each subsidiary's financial data to its home currency for consolidated financial statements. Group of answer choices True Falsearrow_forwardAssignment for ACG3111 This is the problem: The accounting records of Jamaican Importers, Inc., at January 1, 2018, included the following: Assets: Investments in IBM common shares 1,845,000 Less: Fair Value Adjustment (195,000) 1,650,000 No changes occurred during 2018 in the investment portfolio. Prepare appropriate adjusting entries at Dec 31, 2018, assuming that the values of the common share were: 1,315,000 My question is if this problem is relating to an AFS security, the unrealized holding loss on AFS investment would be debited to OCI instead of NI. However, when I did my homework, it seems that the correct answer is unrealized holding loss on AFS investment - NI. Could you tell me the explanation behind this answer, please?arrow_forward

- case: IFRS Reporting Visit the International Financial Reporting Standards (IFRS) Foundation and the International Accounting Standards Board (IASB) website at www.ifrs.org. Under the IFRS tab, click on “Use around the world,” or “Who uses IFRS” and complete the instructions below. Instruction: 1. Select a country of your choice and prepare a report summarizing the extent to which full IFRS and IFRS for Small and Medium-Size Enterprises (SMEs) are used in that jurisdiction.arrow_forwardCurrent Attempt in Progress XYZ provided the following financial information: XYZBalance SheetAs of 12/31/19 Assets: Liabilities and Equity: Cash and marketable securities $27,476 Accounts payable and accruals $154,860 Accounts receivable $143,519 Short-term notes payable $21,255 Inventory $212,379 Total current liabilities $176,115 Total current assets $383,374 Long term debt $155,510 Net plant and equipment $602,704 Total liabilities $331,625 Goodwill and other assets $42,422 Common stock $312,719 Retained earnings $384,156 Total assets $1,028,500 Total liabilities and equity $1,028,500 In addition, it was reported that the firm had a net income of: $158,402 and net sales of: $4,272,431 Calculate the following ratios for this firm (Use 365 days for calculation. Round answers to 2 decimal places, e.g.…arrow_forwardHello! look at the attached images and answer: (a) Calculate ratios for the year ended 31 December 2021 (showing your workings) for Primrose Plc, equivalent to those provided above. i. Return on year-end capital employed ii. Net asset turnover iii. Gross profit margin iv. Net profit margin v. Current ratio vi. Closing inventory holding period vii. Trade receivables’ collection period viii. Trade payables’ payment period ix. Dividend yield x. Dividend cover (b) Analyse the financial performance and position of Primrose Plc for the year ended 31 December 2021 compared to 31 December 2020. (c) Explain the uses and the general limitations of ratio analysis. Thanks a lot!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Business Diversification; Author: GreggU;https://www.youtube.com/watch?v=50-d__Pn_Ac;License: Standard Youtube License