Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 7P

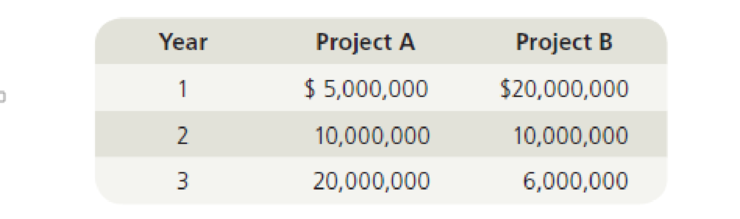

Your division is considering two investment projects, each of which requires an up-front expenditure of $15 million. You estimate that the investments will produce the following net cash flows:

- a. What are the two projects’

net present values , assuming the cost of capital is 5%? 10%? 15%? - b. What are the two projects’ IRRs at these same costs of capital?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You are considering an investment in two normal cash flow and mutually exclusive projects. Project Apple

has an internal rate of return of 13.6%, while Project Brewster has an internal rate of return of 15.75%. At a

discount rate of 9.8% each project has the same net present value. If the appropriate weighted average cost

of capital is 9.25%, which project(s), if any, should be adopted? Explain your decision.

You must analyze two projects, X and Y. Each project costs$10,000, and the firm’s WACC is 12%. The expected cash flows are as follows:a. Calculate each project’s NPV, IRR, MIRR, payback, and discounted payback.b. Which project(s) should be accepted if they are independent?c. Which project(s) should be accepted if they are mutually exclusive?d. How might a change in the WACC produce a conflict between the NPV and IRR rankingsof the two projects? Would there be a conflict if WACC were 5%? (Hint: Plot theNPV profiles. The crossover rate is 6.21875%.)e. Why does the conflict exist?

You are considering the following two projects and can take only one. Your cost of capital is 10.6%. The cash flows for the two projects a

as follows ($ million):

a. What is the IRR of each project?

b. What is the NPV of each project at your cost of capital?

c. At what cost of capital are you indifferent between the two projects?

d. What should you do?

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Project

Year 0

Year 1

Year 2

A

- $100

$24

$30

B

- $100

$48

$41

Year 3

$41

$30

Year 4

$48

$18

—

X

Chapter 12 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 12 - What types of projects require the least detailed...Ch. 12 - Prob. 3QCh. 12 - Prob. 4QCh. 12 - Prob. 5QCh. 12 - A project has an initial cost of 40,000, expected...Ch. 12 - IRR Refer to Problem 12-1. What is the projects...Ch. 12 - Prob. 3PCh. 12 - Prob. 4PCh. 12 - Prob. 5PCh. 12 - Prob. 6P

Ch. 12 - Your division is considering two investment...Ch. 12 - Edelman Engineering is considering including two...Ch. 12 - Prob. 9PCh. 12 - Project S has a cost of $10,000 and is expected to...Ch. 12 - Prob. 11PCh. 12 - After discovering a new gold vein in the Colorado...Ch. 12 - Prob. 13PCh. 12 - Prob. 14PCh. 12 - The Pinkerton Publishing Company is considering...Ch. 12 - Shao Airlines is considering the purchase of two...Ch. 12 - The Perez Company has the opportunity to invest in...Ch. 12 - Filkins Fabric Company is considering the...Ch. 12 - The Ulmer Uranium Company is deciding whether or...Ch. 12 - The Aubey Coffee Company is evaluating the...Ch. 12 - Your division is considering two investment...Ch. 12 - The Scampini Supplies Company recently purchased a...Ch. 12 - You have just graduated from the MBA program of a...Ch. 12 - Prob. 2MCCh. 12 - Define the term “net present value (NPV).” What is...Ch. 12 - Prob. 4MCCh. 12 - Prob. 5MCCh. 12 - What is the underlying cause of ranking conflicts...Ch. 12 - Prob. 7MCCh. 12 - Prob. 8MCCh. 12 - Prob. 9MCCh. 12 - Prob. 10MCCh. 12 - In an unrelated analysis, you have the opportunity...Ch. 12 - Prob. 12MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your division is considering two investment projects, each of which requires an up-front expenditure of 25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars): a. What is the regular payback period for each of the projects? b. What is the discounted payback period for each of the projects? c. If the two projects are independent and the cost of capital is 10%, which project or projects should the firm undertake? d. If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake? e. If the two projects are mutually exclusive and the cost of capital is 15%, which project should the firm undertake? f. What is the crossover rate? g. If the cost of capital is 10%, what is the modified IRR (MIRR) of each project?arrow_forwardYou are considering the following two projects and can take only one. Your cost of capital is 10.7%. The cash flows for the two projects are as follows ($ million) a. What is the IRR of each project? b. What is the NPV of each project at your cost of capital? c. At what cost of capital are you indifferent between the two projects? d. What should you do? a. What is the IRR of each project? The IRR for project A is %. (Round to one decimal place.) Data table D (Click on the following icon in order to copy its contents into a spreadsheet) Project A Year 0 -$100 B -$100 Year 1 $22 $49 Year 2 $31 $39 Print Done Year 3 Year 4 $39 $49 $31 $21 -arrow_forwardConsider the cash flows for the following investment projects: (a) For Project A. find the value of X that makes the equivalent annual receiptsequal the equivalent annual disbursement at i = 13%.(b) Would you accept Project Bat i = 15% based on the AE criterion?arrow_forward

- You are considering the following two projects and can take only one. Your cost of capital is 10.6%. The cash flows for the two projects are as follows ($ million): a. What is the NPV of each project at your cost of capital? b. What is the IRR of each project? c. At what cost of capital are you indifferent between the two projects? d. What should you do? a. What is the NPV of each project at your cost of capital? The NPV for project A is $ Data table million. (Round to two decimal places.) (Click on the following icon in order to copy its contents into a spreadsheet.) Year 1 Project A $22 B $48 Year 0 - $100 - $100 Year 2 $28 $42 Year 3 $42 $28 Year 4 $48 $20 - Xarrow_forwardYou are considering the following two projects and can take only one. Your cost of capital is 10.7%. The cash flows for the two projects are as follows ($ million): a. What is the IRR of each project? b. What is the NPV of each project at your cost of capital? c. At what cost of capital are you indifferent between the two projects? d. What should you do? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) a. What is the IRR of each project? Year 0 Year 1 Year 2 Year 3 Project A The IRR for project A is %. (Round to one decimal place.) $24 $31 $38 - $102 - $102 B $49 $38 $31 The IRR for project B is%. (Round to one decimal place.) b. What is the NPV of each project at your cost of capital? The NPV for project A is $ million. (Round to two decimal places.) Done The NPV for project B is $ million. (Round to two decimal places.) c. At what cost of capital are you indifferent between the two projects? You will be indifferent if the cost of capital is%.…arrow_forwardYou are considering the following two projects and can take only one. Your cost of capital is 11.2%. The cash flows for the two projects are as follows ($ million): Project Year 0 Year 1 Year 2 Year 3 Year 4 A -100 26 28 42 48 B-100 48 42 28 19 a. What is the IRR of each project? b. What is the NPV of each project at your cost of capital? c. At what cost of capital are you indifferent between the two projects? d. What should you do?arrow_forward

- The following net cash flows relate to two projects: (i) Calculate the NPVs for each project, assuming 10% cost of capital.(ii) Assuming that the two projects are independent, would youaccept them if the cost of capital is 15%?(iii) What is the IRR of each project?(iv) Which of the two projects would you prefer if they are mutuallyexclusive, given a 15% discount rate? NET CASH FLOW (IN $1,000) Year 0 1 2 3 4 5 6 Project A -60 20 20 20 20 20 20 Project B -72 45 22 20 13 13 13arrow_forwardYour company is currently considering two investment projects. Each project requires an upfront expenditure of $25 million. You estimate that the cost of capital is 10% and the investments will produce the after tax cash flows on the attached image . a)Calculate the payback period for both projects,then compare to identify which project the firm should undertake. b)Evaluate the advantages and disadvantages of using the payback method in investment decisions and assess the situations where it should be used .arrow_forwardConsider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 −$29,000 −$29000 1 14,400 4,300 2 12,300 9,800 3 9,200 15,200 4 5,100 16,800 a) What is the Internal Rate of Return (IRR) for each of these projects? b) Using the IRR decision rule, which project should the company accept? c) If the required return is 11 percent, what is the Net Present Value (NV) for each of these projects? d) Using the NPV decision rule, which project should the company accept? e) Why do you think the NPV and IRR rules do not agree on same project approval/rejection direction?arrow_forward

- Consider two investments with the following sequences of cash flows: (a) Compute the IRR for each investment.(b) At MARR = 10%, determine the acceptability of each project.(c) If A and B are mutually exclusive projects, which project would you selecton the basis of the rate of return on incremental investment?arrow_forwardYour company has a project available with the following cash flows : If the required return is 14 percent should the project be accepted based on IRR?arrow_forwardYour division is considering two projects. The required rate of return for both projects is 12%. Below are the cash flows of both the projects: Projects Initial investment Year 1 Year 2 Year 3 Year 4 A -$50 $7 $12 $17 $25 B -$50 $20 $18 $12 $11 a) Calculate the Payback period and discounted payback period. Why are they different? b) Calculate the NPV for both the projects c) Calculate the NPV for both the projecarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License