Concept explainers

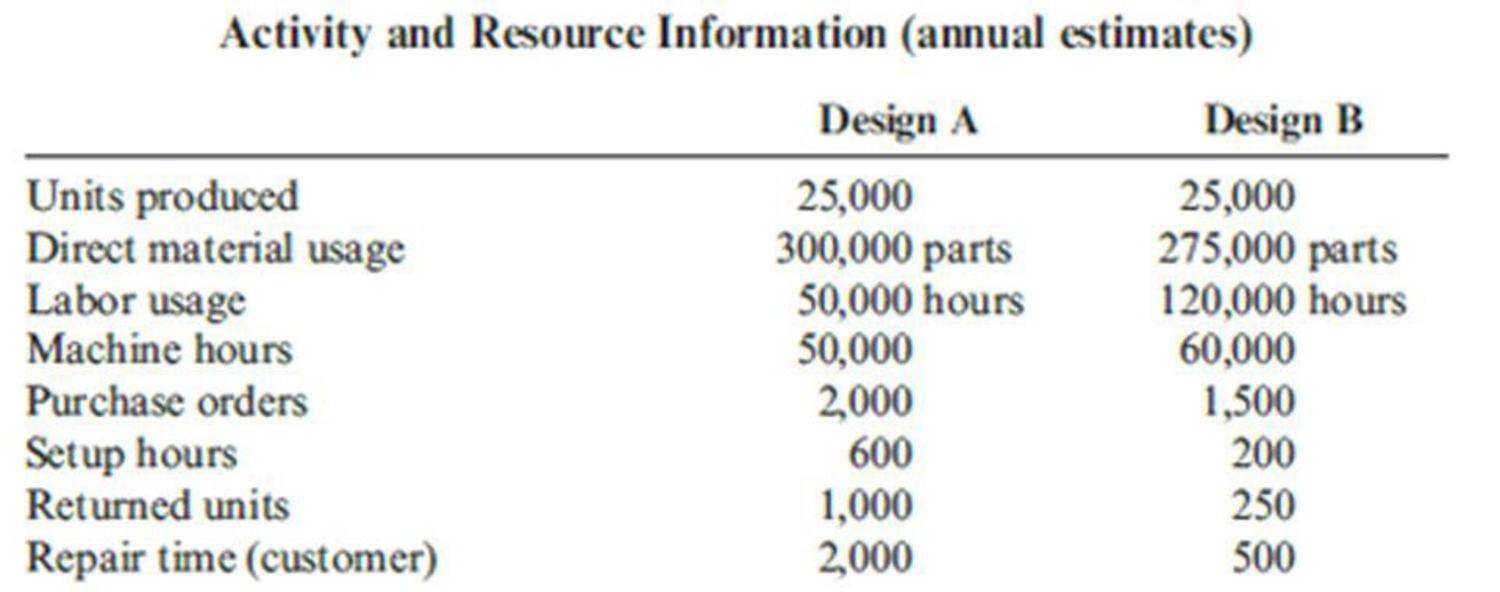

Kagle design engineers are in the process of developing a new “green” product, one that will significantly reduce impact on the environment and yet still provide the desired customer functionality. Currently, two designs are being considered. The manager of Kagle has told the engineers that the cost for the new product cannot exceed $550 per unit (target cost). In the past, the Cost Accounting Department has given estimated costs using a unit-based system. At the request of the Engineering Department, Cost Accounting is providing both unit-and activity-based accounting information (made possible by a recent pilot study producing the activity-based data).

Unit-based system:

Variable conversion activity rate: $100 per direct labor hour

Material usage rate: $20 per part

ABC system:

Labor usage: $15 per direct labor hour

Material usage (direct materials): $20 per part

Machining: $75 per machine hour

Purchasing activity: $150 per purchase order

Setup activity: $3,000 per setup hour

Warranty activity: $500 per returned unit (usually requires extensive rework)

Customer repair cost: $25 per repair hour (average)

Required:

- 1. Select the lower-cost design using unit-based costing. Are logistical and post-purchase activities considered in this analysis?

- 2. Select the lower-cost design using ABC analysis. Explain why the analysis differs from the unit-based analysis.

- 3. What if the post-purchase cost was an environmental contaminant and amounted to $10 per unit for Design A and $40 per unit for Design B? Assume that the environmental cost is borne by society. Now which is the better design?

Trending nowThis is a popular solution!

Chapter 11 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Toledo Tool Company plans to introduce a new product. The company also considers adopting a new computer-assisted manufacturing system. The new product can be manufactured by either the new computer assisted system or its traditional labor-intensive production system. The company can achieve the same quality of the product regardless of which the production system employed. The estimated product costs by the two production systems are as follows: Traditional Labor-Intensive Production Systems New Computer-Assisted Manufacturing Systems Direct Material (per unit) $10.5 $8.4 Direct Labor (per unit) $14.0 $9.0 Variable overhead (per unit) $5.5 $3.4 Fixed overhead $2M $3.5M The marketing department recommends that the unit selling price of the new product be at $65, and the company expects the selling expenses for the new product to be $830,000 annually plus $4 for each unit sold. The company is currently subject to a 40% income tax rate.…arrow_forwardThe Chopin Company has decided to introduce a new product. The new product can be manufactured by either a computer-assisted manufacturing (CAM) or a labor-intensive production (LIP) system. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs for each of the two methods are as follows. CAM System: Direct Material = $5.0 Direct Labor (DLH) = 0.5 DLH X $12 = $6 Variable Overhead = 0.5DLHx$6 = $3 Fixed Iverhead* = $ 2,440,000 LIP System: Direct Material = $5.6 Direct Labor (DLH) = 0.8 DLH X $9 = $7.2 Variable Overhead = 0.8 DLH X $6 = $4.8 Fixed Overhead* = $1,320,000 *These costs are directly traceable to the new product line. They would not be incurred if the new product were not produced. The company’s marketing research department has recommended an introductory unit sales price of $30. Selling expenses are estimated to be $500,000 annually plus $2 for each unit sold. (Ignore income taxes.) Required: Calculate the estimated…arrow_forwardThe Chopin Company has decided to introduce a new product. The new product can be manufactured by either a computer-assisted manufacturing (CAM) or a labor-intensive production (LIP) system. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs for each of the two methods are as follows. CAM System: Direct Material = $5.0 Direct Labor (DLH) = 0.5 DLH X $12 = $6 Variable Overhead = 0.5DLHx$6 = $3 Fixed Iverhead* = $ 2,440,000 LIP System: Direct Material = $5.6 Direct Labor (DLH) = 0.8 DLH X $9 = $7.2 Variable Overhead = 0.8 DLH X $6 = $4.8 Fixed Overhead* = $1,320,000 *These costs are directly traceable to the new product line. They would not be incurred if the new product were not produced. The company’s marketing research department has recommended an introductory unit sales price of $30. Selling expenses are estimated to be $500,000 annually plus $2 for each unit sold. (Ignore income taxes.) Required 4. Describe the circumstances under…arrow_forward

- Data Master is a computer software consulting company. Its three major functional areas are computer programming, information systems consulting, and software training. Cynthia Moore, a pricing analyst in the Accounting Department, has been asked to develop total costs for the functional areas. These costs will be used as a guide in pricing a new contract. In computing these costs, Moore is considering three different methods of allocating overhead costs: the direct method, the step method, and the reciprocal method. Moore assembled the following data on overhead from its two service departments, the Information Systems Department and the Facilities Department. Service Departments User Departments Info Systems Facilities Computer Program Consulting $ 50,000 $110,000 600 $25,000 400 $75,000 1,100 400,000 200,000 600,000 information systems are allocated on the basis of hours of computer usage; facilities are allocated on the basis of floor space. Required: Allocate the service…arrow_forwardData Master is a computer software consulting company. Its three major functional areas are computer programming, information systems consulting, and software training. Cynthia Moore, a pricing analyst in the Accounting Department, has been asked to develop total costs for the functional areas. These costs will be used as a guide in pricing a new contract. In computing these costs, Moore is considering three different methods of allocating overhead costs-the direct method, the step method, and the reciprocal method. Moore assembled the following data on overhead from its two service departments, the Information Systems Department and the Facilities Department. Service Departments User Departments Info Systems Facilities Computer Program Consult Training Total Budgeted Overhead $ 50,000 $ 25,000 $ 75,000 $ 110,000 $ 85,000 $ 345,000 Info Systems (hrs.) 400 1,100 600 900 3,000 Facilities (Square feet) 200,000…arrow_forwardMariah Enterprises makes a variety of consumer electronic products. Its camera manufacturing plant is considering choosing between two different processes, named Alpha and Beta, which can be used to make two component parts A and B. To make the correct decision, the managers would like to compare the labor and multifactor productivity of process Alpha with that of process Beta. The value of process output for component A and B are $175 and $140 per unit, respectively. The corresponding overhead costs are $6,000 and $5,000, respectively. Process Alpha Process Beta Product A B C D Output (units) 50 60 30 80 Labor ($) $1,200 $1,400 $1,000 $2,000 Material ($) $2,500 $3,000 $1,400 $3,500 a. Which process, Alpha or Beta, is more productive? b. What conclusions can you draw from your analysis?arrow_forward

- A new product is being designed by an engineering team at Golem Security. Several managers and employees from the cost accounting department and the marketing department are also on the team to evaluate the product and determine the cost using a target costing methodology. An analysis of similar products on the market suggests a price of $132.00 per unit. The company requires a profit of 0.20 of selling price. How much is the target cost per unit? Round to two decimal places.arrow_forwardKing Bathroom Fixtures (KBF) makes faucets, basins, and so on primarily for home use and sold through major retail chains. The design team at KBF has been working on a unique design to provide reasonable pressure while still conserving water. The market is quite competitive and KBF analysts believe that the fixture could sell for a unit price of $36.40. The cost accounting team at KBF has estimated the following manufacturing costs for the new design. Direct materials $ 19.75 Direct labor 5.90 Manufacturing overhead 8.85 Total $ 34.50 An operating profit of 12 percent of manufacturing costs is required for all new products at KBF without the explicit consent of the top executive team. At KBF, operating margin is defined as revenues less manufacturing costs, all divided by manufacturing costs). Required: a. Suppose KBF uses cost-plus pricing, setting the price equal to manufacturing costs plus 12 percent of manufacturing costs. What price should it charge for the…arrow_forwardMozaic Inc. has decided to introduce a new product, which can be manufactured by either a computer-assisted manufacturing system (CAM) or a labor-intensive production system (LIP). The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows: CAM System LIP System Direct Material $5.00 $5.60 Direct Labor (DLH) 0.5 DLH x $12 $6.00 0.8 DLH x $9 $7.20 Variable Overhead 0.5 DLH x $6 $3.00 0.8 DLH x $6 $4.80 Fixed Overhead* $2,440,000 $1,320,000 * These costs are directly traceable to the new product line. They would not be incurred if the new product were not produced. The company's marketing research department has recommended an introductory unit sales price of $30. Selling expenses are estimated to be $500,000 annually plus $2 for each unit sold. (Ignore income taxes.) Required: 1. Calculate the estimated break-even point in annual unit sales of the new product if the company uses the (a) computer-assisted…arrow_forward

- RUE BENNETT Company develops software for small businesses and household computers. The majority of the company's computer programmers are working on developing software that will perform relatively specialized functions in a user-friendly manner. Before the working model is released to production for the preparation of masters and additional testing, it undergoes extensive testing. As a result of this meticulous planning, various computer software packages have been developed that have proven to be very successful in the industry. RUE BENNETT Company incurred the following costs during 2020: Cost to reproduce and prepare software for sale 200,002 Amortization of capitalized software development costs from current and prior years 94,321 Expenses related to projects after technological feasibility has been established but before software is available for commercial production 151,323 Salaries and wages of programmers doing research 910,000 Expenses related…arrow_forwardLloyd Gettys, a client of Kevin Lomax, is considering two different processes to make his product—process 1 and process 2. Process 1 requires Lloyd to manufacture subcomponents of the product in-house. As a result, materials are less expensive, but fixed overhead is higher. Process 2 involves purchasing all subcomponents from outside suppliers. The direct materials costs are higher, but fixed factory overhead is considerably lower. Relevant data for a sales level of 30,000 units follow: Process 1 Process 2 Sales $8,010,000 $8,010,000 Variable expenses 2,700,000 4,200,000 Contribution margin $5,310,000 $3,810,000 Less total fixed expenses 3,650,625 1,428,750 Operating income $1,659,375 $2,381,250 Unit selling price $267 $267 Unit variable cost $90 $140 Unit contribution margin $177 $127 a. Compute the degree of operating leverage for each process. b. Suppose that sales are 20 percent higher than budgeted. By what percentage will operating income increase for each process? What will be…arrow_forwardData Performance, a computer software consulting company, has three major functional areas: computer programming, information systems consulting, and software training. Carol Bingham, a pricing analyst, has been asked to develop total costs for the functional areas. These costs will be used as a guide in pricing a new contract. In computing these costs, Carol is considering three different methods of the departmental allocation approach to allocate overhead costs: the direct method, the step method, and the reciprocal method. She assembled the following data from the two service departments, information systems and facilities: Service Departments Production Departments Information Systems Facilities Computer Programming Information Systems Consulting Software Training Total Budgeted overhead (base) $ 368,000 $ 184,000 $ 736,000 $ 874,000 $ 575,000 $ 2,737,000 Information Systems (computer hours) 600 1,200 300 900 3,000 Facilities (square feet) 240 960 600 600…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning