1.

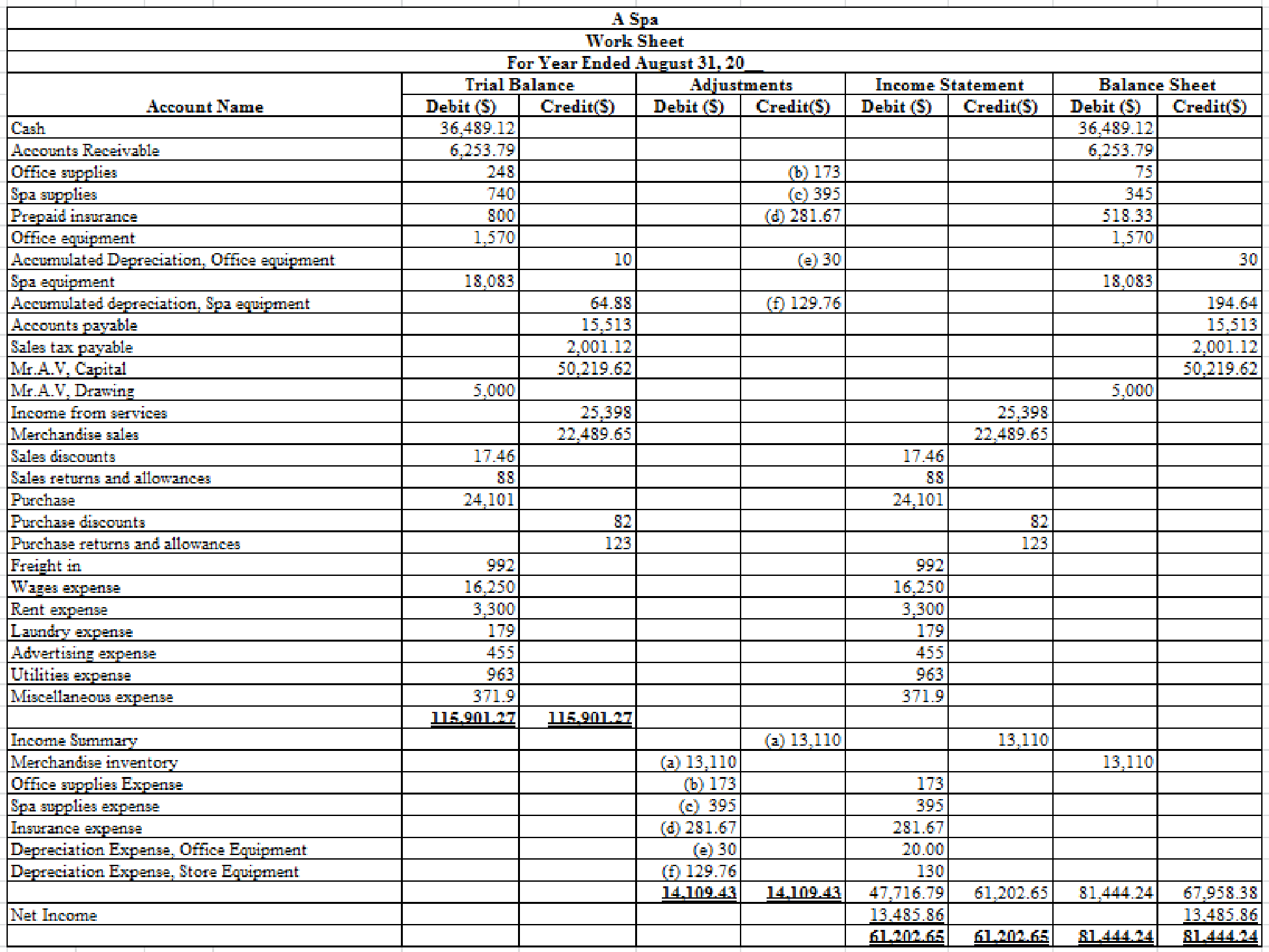

Prepare worksheet for A Spa as of August.

1.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (

Worksheet: A worksheet is a spreadsheet used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Prepare worksheet for A Spa.

Table (1)

2.

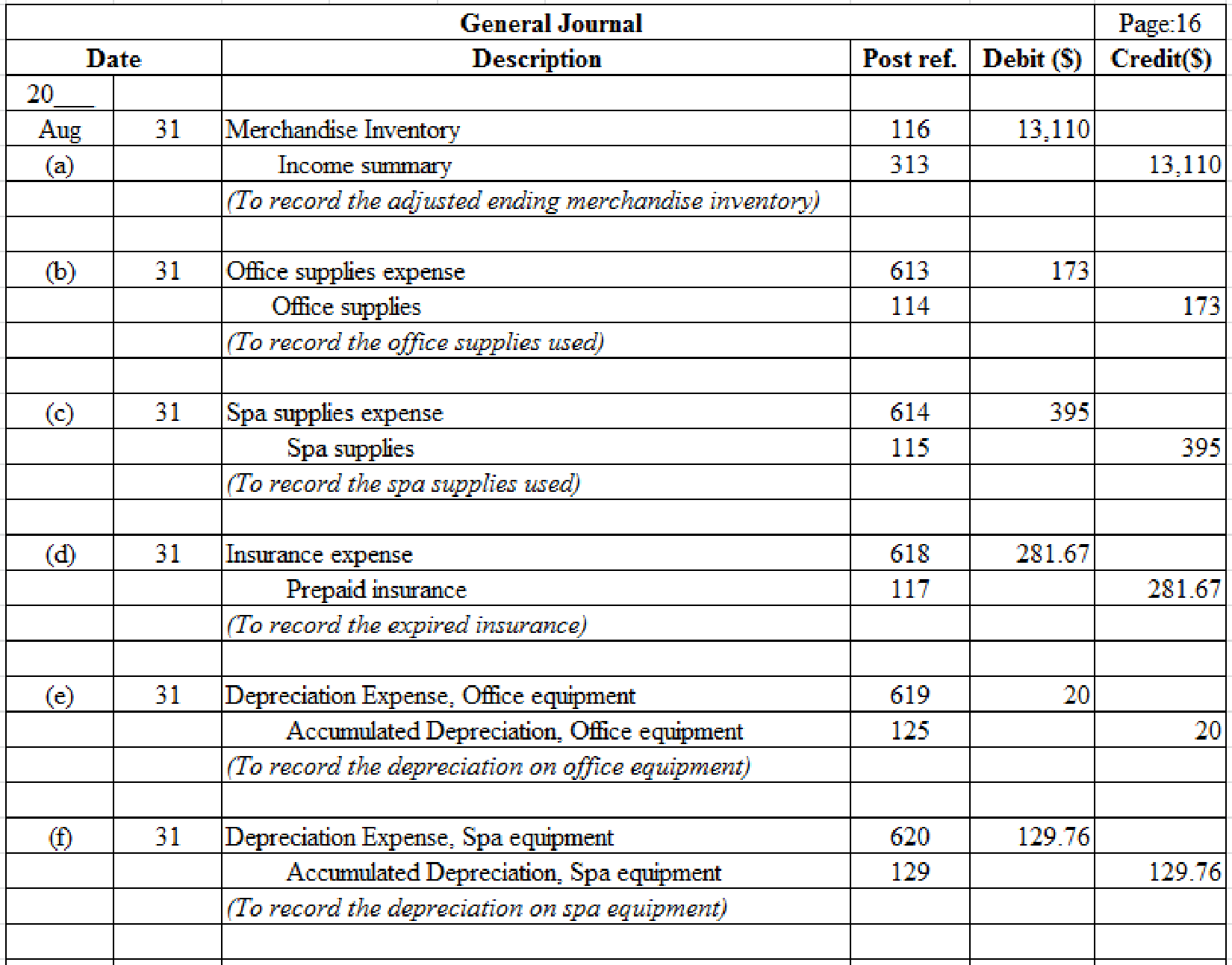

Journalize the

2.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

General journal: This is a journal used to record infrequent transactions like adjusting entries, closing entries, accounting errors, sale of assets, or

Journalize the adjusting entries.

Table (2)

Description:

- (a) Merchandise Inventory is an asset (current) account and it is increased. Therefore, debit the merchandise inventory. Income summary is a temporary account and it is closed. Therefore, credit the income summary.

- (b) Office supplies expense is an expense account and it is increased. Therefore, debit the Office supplies expense. Office supplies are a liability account and it is increased. Therefore, credit the Office supplies.

- (c) Spa supplies expense is revenue account and it is increased. Therefore, debit the Spa supplies expense. Spa supplies (on hand) are an asset (current) account and it is decreased. Therefore, credit the Spa supplies (on hand).

- (d) Insurance expense is an expense (operating) account and it is increased. Therefore, debit the insurance expense. Prepaid insurance is an asset (current) account and it is decreased. Therefore, credit the prepaid insurance.

- (e) Depreciation expense (on office equipment) is an expense account and it is increased. Therefore, debit the depreciation expense. Accumulated depreciation (on office equipment) is a contra asset account and it is decreased. Therefore, credit the accumulated depreciation.

- (f) Depreciation expense (on spa equipment) is an expense account and it is increased. Therefore, debit the depreciation expense. Accumulated depreciation (on spa equipment) is a contra asset account and it is decreased. Therefore, credit the accumulated depreciation.

3.

Post the adjusting entries to the general ledger.

3.

Explanation of Solution

Posting of transaction: The process of transferring the journalized transactions into the accounts of the ledger is known as posting of transaction.

Post the adjusting entries to the general ledger:

| General ledger | |||||||

| Account: Cash | Account No: 111 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 36,489.12 | ||||

| Account: Accounts receivable | Account No: 113 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 6,253.79 | ||||

| Account: Office supplies | Account No: 114 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 248 | ||||

| Adjusting | J16 | 173 | 75 | ||||

| Account: Spa supplies | Account No: 115 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 740 | ||||

| Adjusting | J16 | 395 | 345 | ||||

| Account: Merchandise inventory | Account No: 116 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 13,110 | 13,110 | ||

| Account: Prepaid insurance | Account No: 117 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 800 | ||||

| Adjusting | J16 | 281.67 | 518.33 | ||||

| Account: Office equipment | Account No: 124 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 1,570 | ||||

| Account: Accumulated depreciation, Office equipment | Account No: 125 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 10 | ||||

| Adjusting | J11 | 20 | 30 | ||||

| Account: Spa equipment | Account No: 128 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 18,083 | ||||

| Account: Accumulated depreciation, Spa equipment | Account No: 129 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 64.88 | ||||

| Adjusting | J16 | 129.76 | 194.64 | ||||

| Account: Accounts payable | Account No: 211 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 15,513 | ||||

| Account: Wages payable | Account No: 212 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | ||||||

| Account: sales tax payable | Account No: 215 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 2,001.1 | ||||

| Account: Mr. A.V, capital | Account No: 311 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 50,219.62 | ||||

| Account: Mr. A.V, Drawing | Account No: 312 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 4,500 | ||||

| Account: Income summary | Account No: 313 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 13,110 | 13,110 | ||

| Account: Income from services | Account No: 411 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 25,398 | ||||

| Account: Merchandise sales | Account No: 412 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 22,489.65 | ||||

| Account: Sales discount | Account No: 413 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 17.46 | ||||

| Account: Sales returns and allowances | Account No: 414 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 88 | ||||

| Account: Purchase | Account No: 511 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 24,101 | ||||

| Account: Purchase discount | Account No: 512 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 82 | ||||

| Account: Purchase returns and allowances | Account No: 513 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 123 | ||||

| Account: Freight in | Account No: 515 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 992 | ||||

| Account: Wages expense | Account No: 611 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 16,250 | ||||

| Account: Rent expense | Account No: 612 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 3,300 | ||||

| Account: Office supplies expense | Account No: 613 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 173 | 173 | ||

| Account: Spa supplies expense | Account No: 614 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 395 | 395 | ||

| Account: Laundry expense | Account No: 615 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 179 | ||||

| Account: Advertising expense | Account No: 616 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 455 | ||||

| Account: Utilities expense | Account No: 617 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 963 | ||||

| Account: Insurance expense | Account No: 618 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 281.67 | 281.67 | ||

| Account: Depreciation expense, Office equipment | Account No: 619 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 20 | 20 | ||

| Account: Depreciation expense, Spa equipment | Account No: 620 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 129.67 | 129.67 | ||

| Account: Promotional expense | Account No: 630 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 371.9 | ||||

Table (3)

4.

Prepare a trail balance for 31st August.

4.

Explanation of Solution

Prepare a trial balance.

| A Spa | ||

| Trail balance (Adjusted) | ||

| August 31, 20__ | ||

| Account name | Debit ($) | Credit($) |

| Cash | 36,489.12 | |

| Accounts receivable | 6,253.79 | |

| Office supplies | 75 | |

| Spa supplies | 345 | |

| Merchandise inventory | 13,110 | |

| Prepaid insurance | 518.33 | |

| Office equipment | 1,570 | |

| Accumulated depreciation, office equipment | 30 | |

| Spa equipment | 18,083 | |

| Accumulated depreciation, spa equipment | 194.64 | |

| Accounts payable | 15,513 | |

| Sales tax payable | 2,001.12 | |

| Mr. A.V, capital | 50,219.62 | |

| Mr. A.V, drawings | 5,000 | |

| Income summary | 13,110 | |

| Income from services | 25,398 | |

| Merchandise sales | 22,489.65 | |

| Sales discounts | 17.46 | |

| Sales returns and allowances | 88 | |

| Purchases | 24,101 | |

| Purchases discounts | 82 | |

| Purchases returns and allowances | 123 | |

| Freight in | 992 | |

| Wages expense | 16,250 | |

| Rent expense | 3,300 | |

| Office supplies expense | 173 | |

| Spa supplies expense | 395 | |

| Laundry expense | 179 | |

| Advertising expense | 455 | |

| Utilities expense | 963 | |

| Insurance expense | 281.67 | |

| Depreciation expense, office equipment | 20 | |

| Depreciation expense, spa equipment | 129.76 | |

| Miscellaneous expense | 371.9 | |

| Total | 129,161.03 | 129,161.03 |

Table (4)

Want to see more full solutions like this?

Chapter 11 Solutions

College Accounting (Book Only): A Career Approach

- Bay Book and Software has two sales departments: Book and Software. After recording and posting all adjustments, including the adjustments for merchandise inventory, the accountant prepared the adjusted trial balance (shown on the next page) at the end of the fiscal year. Merchandise inventories at the beginning of the year were as follows: Book Department, 53,410; Software Department, 23,839. The bases (and sources of figures) for apportioning expenses to the two departments are as follows (rounded to the nearest dollar): Sales Salary Expense (payroll register): Book Department, 45,559; Software Department, 35,629 Advertising Expense (newspaper column inches): Book Department, 550 inches; Software Department, 450 inches Depreciation Expense, Store Equipment (property and equipment ledger): Book Department, 7,851; Software Department, 2,682 Store Supplies Expense (requisitions): Book Department, 205; Software Department, 199 Miscellaneous Selling Expense (volume of gross sales): Book Department, 240; Software Department, 110 Rent Expense and Utilities Expense (floor space): Book Department, 9,000 square feet; Software Department, 7,000 square feet Bad Debts Expense (volume of gross sales): Book Department, 1,029; Software Department, 441 Miscellaneous General Expense (volume of gross sales): Book Department, 364; Software Department, 156 Required Prepare an income statement by department to show income from operations, as well as a nondepartmentalized income statement (using the Total columns) to show net income for the entire company.arrow_forwardMacDonald Bookshop had the following transactions that occurred during February of this year: Required 1. Journalize the transactions for February in the cash payments journal. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journal. Prove the equality of the debit and credit totals.arrow_forwardReview the following transactions, and prepare any necessary journal entries for Renovation Goods. A. On May 12, Renovation Goods purchases 750 square feet of flooring (Flooring Inventory) at $3.00 per square foot from a supplier, on credit. Terms of the purchase are 2/10, n/30 from the invoice date of May 12. B. On May 15, Renovation Goods purchases 200 measuring tapes (Tape Inventory) at $5.75 per tape from a supplier, on credit. Terms of the purchase are 4/15, n/60 from the invoice date of May 15. C. On May 22, Renovation Goods pays cash for the amount due to the flooring supplier from the May 12 transaction. D. On June 3, Renovation Goods pays cash for the amount due to the tape supplier from the May 15 transaction.arrow_forward

- Palisade Creek Co. is a retail business that uses the perpetual inventory system. The account balances for Palisade Creek as of May 1, 20Y6 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Record the following transactions on Page 21 of the journal: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for May, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of stockholders equity, and a balance sheet. Assume that additional common stock of 10,000 was issued in January 20Y6. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the retained earnings account. 10. Prepare a post-closing trial balance.arrow_forwardOn December 31, the end of the year, the accountant for Fireside Magazine was called away suddenly because of an emergency. However, before leaving, the accountant jotted down a few notes pertaining to the adjustments. Journalize the necessary adjusting entries. Assume that Fireside Magazine uses the periodic inventory system. ab. A physical count of inventory revealed a balance of 199,830. The Merchandise Inventory account shows a balance of 202,839. c. Subscriptions received in advance amounting to 156,200 were recorded as Unearned Subscriptions. At year-end, 103,120 has been earned. d. Depreciation of equipment for the year is 12,300. e. The amount of expired insurance for the year is 1,612. f. The balance of Prepaid Rent is 2,400, representing four months rent. Three months rent has expired. g. Three days salaries will be unpaid at the end of the year; total weekly (five days) salaries are 4,000. h. As of December 31, the balance of the supplies account is 1,800. A physical inventory of the supplies was taken, with an amount of 920 determined to be on hand.arrow_forwardPalisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2016 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the owners capital account. 10. Prepare a post-closing trial balance.arrow_forward

- Kelley Company has completed the following October sales and purchases journals: a. Total and post the journals to T accounts for the general ledger and the accounts receivable and accounts payable ledgers. b. Complete a schedule of accounts receivable for October 31, 20--. c. Complete a schedule of accounts payable for October 31, 20--. d. Compare the balances of the schedules with their respective general ledger accounts. If they are not the same, find and correct the error(s).arrow_forwardPalisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2019 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section and place a check mark () in the Posting Reference column. Journalize the transactions for May, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. Insert the new balance in the owners capital account. 10. Prepare a post-closing trial balance.arrow_forwardPrepare journal entries to record the following transactions. Create a T-account for AccountsPayable, post any entries that affect the account, and calculate the ending balance for the account. Assume anAccounts Payable beginning balance of $7,500.A. May 12, purchased merchandise inventory on account. $9,200B. June 10, paid creditor for part of previous month’s purchase, $11,350arrow_forward

- On December 31, the end of the year, the accountant for Fireside Magazine was called away suddenly because of an emergency. However, before leaving, the accountant jotted down a few notes pertaining to the adjustments. Journalize the necessary adjusting entries. Assume that Fireside Magazine uses the periodic inventory system. a-b. A physical count of inventory revealed a balance of $204,073. The Merchandise Inventory account shows a balance of $207,572. c. Subscriptions received in advance amounting to $142,456 were recorded as Unearned Subscriptions. At year-end, $101,502 has been earned. d. Depreciation of equipment for the year is $12,183. e. The amount of expired insurance for the year is $1,553. f. The balance of Prepaid Rent is $2,540, representing four months' rent. Three months' rent has expired. g. Three days' salaries will be unpaid at the end of the year; total weekly (five days') salaries are $3,880. h. As of December 31, the balance of the…arrow_forwardUser Rancho Furniture completed the following transactions relating to the purchase of merchandise during August, the first month of operation. It is the policy of the company to record all purchase invoices at the net amount and to pay invoices within the discount period. Aug.1 Purchased merchandise from Carolina Corporation, invoice price, $21,000; terms 2/10, n/30. Aug.8 Purchased merchandise from Thomas Company, $36,000; terms 2/10, n/30. Aug. 8 Merchandise with an invoice price of $3,000 purchased from Carolina Corporation on August 1 was found to be defective. It was returned to the supplier accompanied by debit memorandum no. 118. Aug. 18 Paid Thomas Company's invoice of August 8, less cash discount. Aug. 25 Purchased merchandise from Shenren Company, $22, 800; terms 2/10, n/30. Aug. 30 Paid Carolina Corporation's invoice of August 1, taking into consideration the return of defective goods on August 8. Assume that the inventory of merchandise on August 1 was $79, 400; on August…arrow_forwardPatricia Flynn owns a business called Patty's Place. The company uses a periodic inventory system. The beginning inventory balance was $31,000. A physical count determined her ending inventory was $25,000. Based on past experience, Patricia estimates that $3,000 of sales from this year will be returned next year. The cost of the merchandise expected to be returned is $900. Which of the following journal entries would record the ending inventory? a.Debit Income Summary for $25,000 and credit Merchandise Inventory for $25,000 b.Debit Income Summary for $6,000 and credit Merchandise Inventory for $6,000 c.Debit Merchandise Inventory for $6,000 and credit Cost of Goods Sold for $6,000 d.Debit Merchandise Inventory for $25,000 and credit Income Summary for $25,000arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,