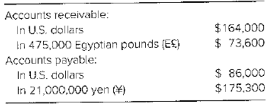

Chocolate De−lites imports and exports chocolate delicacies. Some transactions are denominated in U.S. dollars and others in foreign currencies. A summary of accounts receivable and accounts payable on December 31, 20X6, before adjustments for the effects of changes in exchange rates during 20X6, follows:

The spot rates on December 31, 20X6, were

E€1 = $0.176

¥1 = $0.0081

The average exchange rates during the collection and payment period in 20X7 are

E€1 = $0.18

¥1 = $0.0078

Required

a. Prepare the adjusting entries on December 31, 20X6.

b. Record the collection of the accounts receivable in 20X7.

c. Record the payment of the accounts payable in 20X7.

d. What was the foreign currency gain or loss on the accounts receivable transaction denominated in E€ for the year ended December 31, 20X6? For the year ended December 31, 20X7? Overall for this transaction?

e. What was the foreign currency gain or loss on the accounts receivable transaction denominated in ¥? For the year ended December 31, 20X6? For the year ended December 31, 20X7? Overall for this transaction?

f. What was the combined foreign currency gain or loss for both transactions? What could Chocolate De-lites have done to reduce the risk associated with the transactions denominated in foreign currencies?

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Advanced Financial Accounting

- Hello, please help with letter a. Thank you 1) ABC Corp has Accounts Receivable of FC 400,000 and Accounts Payable FC 300,000 on both March 31 and April 30, 2010. The applicable exchange rates at that date were as follows: March 30 April 30 Spot rate 1FC = .35 US 1FC = .37 US Forward rate(1 month). 1FC= .36 US. 1FC= .39 US a) What is the FX transaction gain or loss on Accounts REeceivable on April 30, 2010? b) What is the FX transaction gain or loss on Accounts Payable on April 30, 2010? c) If on March 31, ABC wishes to hedge its exposure to changing exchange rates what is the appropriate action it will take. Answer by saying whether ABC will enter a spot contract or forward contract and say whether the contract will involve purchasing FC and selling US dollars, or purchasing US dollards and selling FC and specify the appropriate exchange…arrow_forward1. Based on the following information, answer the problems showing procedure for each problem. CURRENCY SPOT & FORWARD RATES TABLE_1 U.S./Can. $1 U.S. $1 Cdn Cdn.$ U.S. $ in in Country per unit per unit Cdn.$= U.S.$= 1.5833 0.6316 SPOT 1 month forward 1.5847 2 months forward 1.5861 3months forward 1.5879 6months forward 1.5932 12months forward 1.6041 3years forward 1.6328 5years forward 1.6538| 7years forward 1.6738 10years forward 1.7133 Britain 1 m forward 2 m forward 3 m forward 6 m forward 12 m forward Europe 1 m forward 3 m forward 6 m forward 12 m forward Japan (pound) 2.4582 2.4559 2.454 2.4525 2.4474 2.4392 1.5504 1.5497 1.549 1.5489 1.5506 (Yen) 0.013034 0.008232 1 m forward 0.013066 0.008245 1.5526 1.5498 1.5472 1.5445 1.5362 1.5206 0.9792 0.9779 0.9755 0.9722 0.9666 0.631 0.6305 0.6298 0.6277 0.6234 0.6124 0.6047 0.5974 0.5837 (euro) Cdn.$ in 2001: High 1.5028 Low 1.6183 Average 1.5701 0.6654 0.6179 0.6369 3 m forward 0.013131 0.00827 6 m forward 0.013231 0.008305 12 m…arrow_forwardAccounting for foreign currency - denominated receivables and payables - multiple years The accounts of Lin, a U.S. corporation, show $81,300 accounts receivables and $38,900 accounts payable at December 31, 2016, before adjusting entries are made. An analysis of the balances reveals the following Accounts Receivable Receivable Dominated in US dollars $28,500 Receivable Dominated in 20,000 Swedish krona $11,800 Receivable Dominated in 25,000 British pounds $41,000 Total $81,300 Accounts Payable Payable dominated in US dollars $6,850 Payable dominated in 10,000 canadian dollars $7,600 Payable dominated in 15,000 British pounds $24,450 Total $38,900 Current exchange rates for Swedish krona,…arrow_forward

- Adjusting Entry at Balance Sheet Date Yum! Brands, Inc. has the following receivables and payables denominated in foreign currencies, prior to closing on December 31. The spot rates at December 31 are also given. Item Current $ balance FC balance December 31 spot rate 1. Receivable $65,000 1,000,000 Mexican pesos $0.06 2. Receivable 165,000 225,000 Canadian dollars 0.75 3. Payable 556,000 400,000 Jordan dinar 1.41 4. Payable 56,000 200,000 Saudi Arabian riyal 0.27 Required Prepare the adjusting entry recorded by Yum! Brands at December 31. Description Debit Credit AnswerAccounts receivableCashExchange gainExchange loss? AnswerAccounts receivableCashExchange gainExchange loss? Accounts payablearrow_forwardGreenView Company's receivable from a foreign customer is denominated in the customers local currency, the Brazilian Real (BRL). This receivable totaled 900,000 BRL and was translated to $300,000 at December 31, 20X5. On January 31, 20X6, the receivable was collected from the customer at an exchange rate of 4 BRL to $1. What journal entry should GreenView record in January? Dr. Foreign currency units 300,000 Cr. Accounts receivable Dr. Foreign currency units 225,000 2. Cr. Accounts receivable 01. 03. 4. Dr. Foreign currency units 300,000 Cr. Exchange gain Cr. Accounts receivable Dr. Foreign currency units Dr. Exchange loss Cr. Accounts receivable 225,000 75,000 300,000 225,000 75,000 225,000 300,000arrow_forwardThe Simpson Corporation is calculating their adjusted balance sheet into U.S. Dollars. The exchange rate at the beginning of the year was $1 Euro = $1 U.S. dollar. The current exchange rate is .80 Euros to $1.00. Net Income for the year was zero. How much is the accounting gain/loss due to the exchange rate change? Beginning Balance Sheet: Assets = 3,000 EurosEquity = 1,500 EurosLiabilities = 1,500 Euros $125, gain $375, loss $375, gain $500, loss $500, gainarrow_forward

- (b) White Cliffs Co, whose year-end is 31 December, buys some goods from Rinka SA of France on 30 September. The invoice value is €40,000 and is due for settlement in equal instalments on 30 November and 31 January. The exchange rate moved as follows. € to $1 |30 September 30 November 1.60 | 1.80 31 December 31 January 1.90 1.85 Required State the accounting entries in the books of White Cliffs Co.arrow_forward2 XYZ Company sells goods to a foreign customer on June 8. Payment of 3,000,000 foreign currency units (FC) is due in one month. June 30 is XYZ Company’s fiscal year-end. The following exchange rates were in effect during the period: June 8 Spot rate $1.10 June 8 30 day forward rate $1.15 June 30 Spot rate $1.14 July 8 Spot rate $1.20 A For what amount should XYZ Accounts Receivable be debited on June 8 B How much foreign exchange gain or loss should XYZ record on June 30arrow_forwardRecording Export Transactions Daisy Brands, a U.S. company, sells items abroad. Daisy prices many of these transactions in the currency of the customer. Following are four such transactions made in the last accounting period, plus the direct exchange rates for each date: Country Amount Currency Spot rate at sale Spot rate at collection Argentina . . . . . . . . . . . . . . . . . . . . . . 250,000 Peso $0.056 $0.049 Canada . . . . . . . . . . . . . . . . . . . . . . . . 400,000 Dollar 0.732 0.713 India . . . . . . . . . . . . . . . . . . . . . . . . . . 300,000 Rupee 0.016 0.018 South Africa . . . . . . . . . . . . . . . . . . . . 100,000 Rand 0.074 0.077 Required Prepare the journal entries made by Daisy Brands to record the above sale and collection transactionsarrow_forward

- Accounting records of Company C are expressed in EUR. On 30 April 20XX, it sells goods to a foreign company that requests the amount of the sale to be expressed in USD. No VAT to be charged. When the invoice is sent to the client for an amount of USD 1.000, the exchange rate EUR / USD is 1. On 31 May 20XX, the client paid the invoice in USD on the EUR bank account so that the amount in USD is immediately converted into EUR at the current exchange rate. The current exchange rate is 1EUR = 1,10 USD. Prepare the accounting journal entries for the sale and the repayment.arrow_forwardThe Simpson Corporation is calculating their adjusted balance sheet into U.S. Dollars. The exchange rate at the beginning of the year was $1 Euro = $1 U.S. dollar. The current exchange rate is .80 Euros to $1.00. Net Income for the year was zero. How much is the accounting gain/loss due to the exchange rate change? Beginning Balance Sheet: Assets = 3,000 Euros Equity = 1,500 Euros Liabilities = 1,500 Eurosarrow_forwardOn November 30, P Corporation purchased inventory from a Chinese supplier. The Chinese company requires payment to be made in Yuan. What exchange rate should be used to value the account payable on the balance sheet? a_ Weighted average exchange rate for the year. B) Exchange rate at the end of the year C) Exchange rate on the settlement date D) Exchange rate on the date of purchase.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning