Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 4E

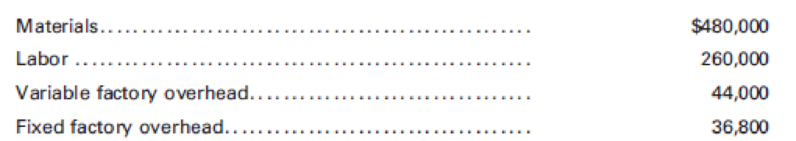

The following production data came from the records of Olympic Enterprises for the year ended December 31, 2016:

During the year, 40,000 units were manufactured but only 35,000 units were sold.

Determine the effect on

- 1. Total inventoriable costs and the cost of the 35,000 units sold and of the 5,000 units in the ending inventory, using variable costing.

- 2. Total inventoriable costs and the cost of the 35,000 units sold and of the 5,000 units in the ending inventory, using absorption costing.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following information is available for Crouching Alligator Manufacturing Company for the month ending October 31, 2016:

Cost of goods manufactured $450,000

Selling expenses $144,500

Administrative expenses $75,900

Sales $911,250

Finished goods inventory, July 1 $101,250

Finished goods inventory, July 31 $93,800

For the month ended October 31, 2016, determine Crouching Alligators (a) cost of goods sold, (b) gross profit, and (c) net income.

The following information was extracted from the accounting records of Hilton Manufacturers for the year ended September

2024:

Inventory at the beginning of the year

Production for the year

Sales for the year

Selling price per unit

Direct Materials cost per unit

Direct Labour cost per unit

Variable Manufacturing overheads per unit

Variable selling and administrative cost per unit

Fixed manufacturing overhead cost

Fixed selling and administrative cost

The company utilises the first-in-first-out method of inventory valuation.

REQUIRED:

(Round of to two decimal places)

2.1 Prepare the Income Statement using the Marginal Costing method.

UNITS

Nil

28 500

24 000

R82

R

22

11

7

5

274 000

95 000

The management of Sheffield Corp. asks your help in determining the comparative effects of the FIFO and LIFO inventory cost flow methods. For 2017, the accounting

records show these data.

Inventory, January 1 (9,340 units)

$ 34,558

Cost of 119,140 units purchased

488,390

Selling price of 95,990 units sold

684,900

Operating expenses

113,080

Units purchased consisted of 35,340 units at $3.90 on May 10; 60,520 units at $4.10 on August 15; and 23,280 units at $4.40 on November 20. Income taxes

are 26%.

(a)

Prepare comparative condensed income statements for 2017 under FIFO and LIFO. (Round answers to 0 decimal places, e.g. 5,125.)

Chapter 10 Solutions

Principles of Cost Accounting

Ch. 10 - What is the difference between absorption costing...Ch. 10 - Distinguish between product costs and period...Ch. 10 - What effect will applying variable costing have on...Ch. 10 - What are the advantages and disadvantages of using...Ch. 10 - Prob. 5QCh. 10 - What is the difference between gross margin and...Ch. 10 - Why are there objections to using absorption...Ch. 10 - What are common costs?Ch. 10 - How is a contribution margin determined, and why...Ch. 10 - What are considered direct costs in segment...

Ch. 10 - What is cost-volume-profit analysis?Ch. 10 - Prob. 12QCh. 10 - What steps are required in constructing a...Ch. 10 - What is the difference between the contribution...Ch. 10 - What impact does income tax have on the break-even...Ch. 10 - Define differential analysis, differential...Ch. 10 - Prob. 17QCh. 10 - Prob. 18QCh. 10 - What are distribution costs?Ch. 10 - What is the purpose of the analysis of...Ch. 10 - In cost analysis, what determines which costs...Ch. 10 - Yellowstone Fabricators uses a process cost system...Ch. 10 - Using the information presented in E10-1, prepare...Ch. 10 - The chief executive officer of Acadia, Inc....Ch. 10 - The following production data came from the...Ch. 10 - A company had income of 50,000, using variable...Ch. 10 - The fixed overhead budgeted for Ranier Industries...Ch. 10 - Columbia Products Inc. has two divisions, Salem...Ch. 10 - The sales price per unit is 13 for the Voyageur...Ch. 10 - Teton, Inc. sells its only product for 50 per...Ch. 10 - A new product is expected to have sales of...Ch. 10 - Augusta Industries manufactures and sells two...Ch. 10 - A company has sales of 1,000,000, variable costs...Ch. 10 - Prob. 13ECh. 10 - A company has prepared the following statistics...Ch. 10 - Prob. 15ECh. 10 - Prob. 16ECh. 10 - Redwood Industries needs 20,000 units of a certain...Ch. 10 - Prob. 18ECh. 10 - Biscayne Industries has determined the cost of...Ch. 10 - Roosevelt Enterprises has determined the cost of...Ch. 10 - Prob. 3PCh. 10 - Prob. 4PCh. 10 - Prob. 5PCh. 10 - Arctic Software Inc. has two product lines. The...Ch. 10 - Prob. 7PCh. 10 - The production of a new product required Zion...Ch. 10 - Grand Canyon Manufacturing Inc. produces and sells...Ch. 10 - Prob. 10PCh. 10 - Emerald Island Company is considering building a...Ch. 10 - Royale Aluminum desires an after-tax income of...Ch. 10 - Deuce Sporting Goods manufactures a high-end model...Ch. 10 - Prob. 14PCh. 10 - Prob. 15PCh. 10 - Prob. 1MCCh. 10 - Denali Company manufactures household products...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Based on your answers to the above questions, should Lockwood invest in the machinery?

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (11th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting

Plantwide and Departmental Overhead Allocation; Activity-Based Costing; Segmented Income Statements Koontz Comp...

Introduction To Managerial Accounting

What are assets limited as to use and how do they differ from restricted assets?

Accounting For Governmental & Nonprofit Entities

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Habicht Company was formed in 2018 to produce a single product. The production and sales for the next 4 years were as follows: Required: 1. Determine the gross profit for each year under each of the following periodic inventory methods: a. FIFO b. LIFO c. Average cost (Round unit costs to 3 decimal places.) 2. Next Level Explain whether the companys return on assets (net income divided by average total assets) would be higher under FIFO or LIFO.arrow_forwardThe Lubao Company reported the following information for the year 2009: Gross profit -P560,000; Finished Goods Inventory, end - P240,000; and Cost of Goods Available for Sale - P360,000. How much is the total Sales for the year?arrow_forwardTelamark Company uses the moving weighted average method for inventory costing.The following incomplete inventory sheet regarding Product W506 is available for the month of March 2020. Complete the inventory sheet. (Image 1 attached) Note: March 4 reflects a return made by a customer of incorrect items shipped on March 3; these items were returned to inventory.2. Analysis Component:The gross profit realized on the sale of Product W506 during February 2020 was 39.19%. The selling price was $166 during both February and March. Calculate the gross profit ratio for Product W506 for March 2020 and determine whether the change is favorable or unfavorable from February. (Round your intermediate calculations and final answer to 2 decimal places.) Gross Profit Ratio =?arrow_forward

- The management of Oriole Company asks your help in determining the comparative effects of the FIFO and LIFO inventory cost flow methods. For 2017, the accounting records show these data. Inventory, January 1 (9,220 units) $ 31,348 Cost of 131,450 units purchased 501,454 Selling price of 95,340 units sold 745,200 Operating expenses 120,500 Units purchased consisted of 37,740 units at $3.60 on May 10; 62,070 units at $3.80 on August 15; and 31,640 units at $4.10 on November 20. Income taxes are 26%.(a) Prepare comparative condensed income statements for 2017 under FIFO and LIFO. (Round answers to 0 decimal places, e.g. 5,125.) Oriole CompanyCondensed Income Statements FIFO LIFO $ $ $ $arrow_forwardMonroe Manufacturing, Inc. reported the following information related to inventory, which sells for $20 per unit: Beginning inventory: 3,000 units at $3 unit cost Purchase 1: 4,000 units at $4 unit cost Purchase 2: 5,000 units at $5 unit cost At the end of the period, the company has 4,000 units in ending inventory. Compute the cost of goods sold and ending inventory using the following methods: Weighted Average, FIFO, and LIFO methods.arrow_forwardThe comparative inventory data for SAN JOSE Manufacturing Corporation for the year ended December 31, 2014 is summarized below: January 1 P 55,000 December 31 P 53,000 Raw Materials inventory Work in process inventory Finished goods inventory 49,000 59,000 45,000 47,000 During the year 2014, the corporation completed, among others, the following transactions: Purchases, all on account, direct materials, P2,100,000; indirect materials, P400,000. The total materials requisitioned for use during the year included P360,000 for indirect materials. The payroll for the year was a follows: direct labor, P1,650,000, indirect labor, P550,000. The payroll was vouchered, and analysis disclosed the following details: w/H Tax a. b. C. d. Gross P 1,650,000 P80,000 Phil Health P 12,000 SS HDMF ECC Direct labor P 40,000 P 38,000 P 6,000 Indirect labor 550,000 40,000 12,500 3,000 12,000 1,500 e. Other manufacturing expenses vouchered amounted to P920,000, and depreciation charges were P450,000 on plant…arrow_forward

- The Holden Corp. company has the following purchases and sales during the year ended December 31, 2014. Inventory and Purchases Beginning: 130 units@ $51/unit March 28: 150 units @ $54/unit June 28: 150 units @ $50/unit The units have a selling price of $65.00 per unit. a) Please fill in the table by calculating the dollar value of cost of goods sold and ending inventory, as well as the gross profit earned by Holden Corp. using the FIFO system. Cost of Goods Sold Ending Inventory Gross Profit Date b) Prepare journal entries to record the following (assuming all sales and purchases are for cash): (a) The purchase on June 28, (b) The sale on July 17. Enter the transaction letter as the description when preparing a journal entry. When a transaction requires two separate journal entries, use the same letter for both descriptions. Dates must be entered in the format dd/mmm (ie. 15/Jan). 14 F Sales February 9:30 units July 17: 200 units FIFO E General Journal Account/Explanation Page GJB F…arrow_forwardCille Yuan Manufacturing Company makes only one product. The company has a normal capacity of 32,000 units annually. Cille Yuan is expecting to produce 30,000 units next year but during the year, it actually produced 31,000 units. The company accountant has budgeted the following factory overhead costs for the coming year: Indirect materials P2 per unit 144,000 plus P2 per unit 60,000 plus PO.04 per unit 20,000 plus PO.34 per unit 16,000 plus PO.12 per unit 210,000 per year 50,000 per year 12,000 per year Indirect labor Plant utilities Repairs for the plant Material handling costs Depreciation plant assets Rent of plant building Insurance on plant building Using the most appropriate overhead application based, the applied factory overhead for the year isarrow_forwardThe following data are obtained from Gianne Manufacturing Company: Cost of goods manufactured is P187,500 Inventory variations are as follows: raw materials ending inventory is one-third based on raw materials beginning; no initial inventory of work-in-process, but at end of period P12,500 was on hand; finished goods inventory was four times as large at end of period as at the start. Net income after taxes amounted to P26,000, income tax rate is 35%. Purchase of raw materials amounted to net income before taxes. Breakdown of costs incurred in manufacturing cost was as follows: Raw materials consumed 50% 30% 20% Direct labor Overhead Compute the amount raw materials beginning inventory: P38,571 P60,000 P90,000 P40,000arrow_forward

- Sully Company's inventory records for the most recent year contain the following data: (Click the icon to view the data.) Sully Company sold a total of 19,600 units during the year. Read the requirements. Requirement 1. Using the average-cost method, compute the cost of goods sold and ending inventory for the year. (Round the average cost per unit to the nearest cent.) Average-cost method cost of goods sold = Average-cost method ending inventory = Requirements 22.3 1. Using the average-cost method, compute the cost of goods sold and ending inventory for the year. 2. Using the FIFO method, compute the cost of goods sold and ending inventory for the year. 3. Using the LIFO method, compute the cost of goods sold and ending inventory for the year. Print Done X Data table Beginning inventory Purchases during year Print Quantity 2,000 $ 18,000 $ Unit Cost 16.00 18.00 Done Xarrow_forwardSuppose that applied accounts of a production company is as attached. The inventory balances is as follows: raw materials (beginning: 140.000 TL, ending: 115.000 TL), work-in process (beginning: 60.000 TL, ending: 55.000 TL) and finished goods (beginning: 65.000 TL, ending: 80.000 TL). The sales revenue is 2.000.000 TL. Prepare the income statement. Applied to the cost Applied to the period costs Applied to the idle Applied to the cost of TOTAL of production capacity losses PPE Direct materials cost applied account 850,000.00 20,000.00 870.000.00 Direct labor cost applied account 260.000.00 250.000.00 10.000.00 400,000.00 10.000.00 40.000.00 450.000.00 Factory overhead applied account Selling expenses applied account General adm. Exp. Applied acount Financing expenses applied account 70.000.00 70,000.00 120,000,00 120.000.00 30.000.00 15.000.00 45.000.00 TOTAL 1.500.000.00 230.000.00 40.000.00 45.000.00 L815.000.00arrow_forwardThe inventory of Royal Decking consisted of five products. Information about the December 31, 2016, inventory is as follows: Per Unit TTT Product Selling Price Cost $ 40 $ 60 90 100 40 80 100 130 20 30 Costs to sell consist only of a sales commission equal to 10% of selling price and shipping costs equal to 5% of cost. Required: What unit value should Royal Decking use for each of its products when applying the lower of cost and net realiz- able value rule to units of inventory?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

INVENTORY & COST OF GOODS SOLD; Author: Accounting Stuff;https://www.youtube.com/watch?v=OB6RDzqvNbk;License: Standard Youtube License