Activity-Based Costing of Customers

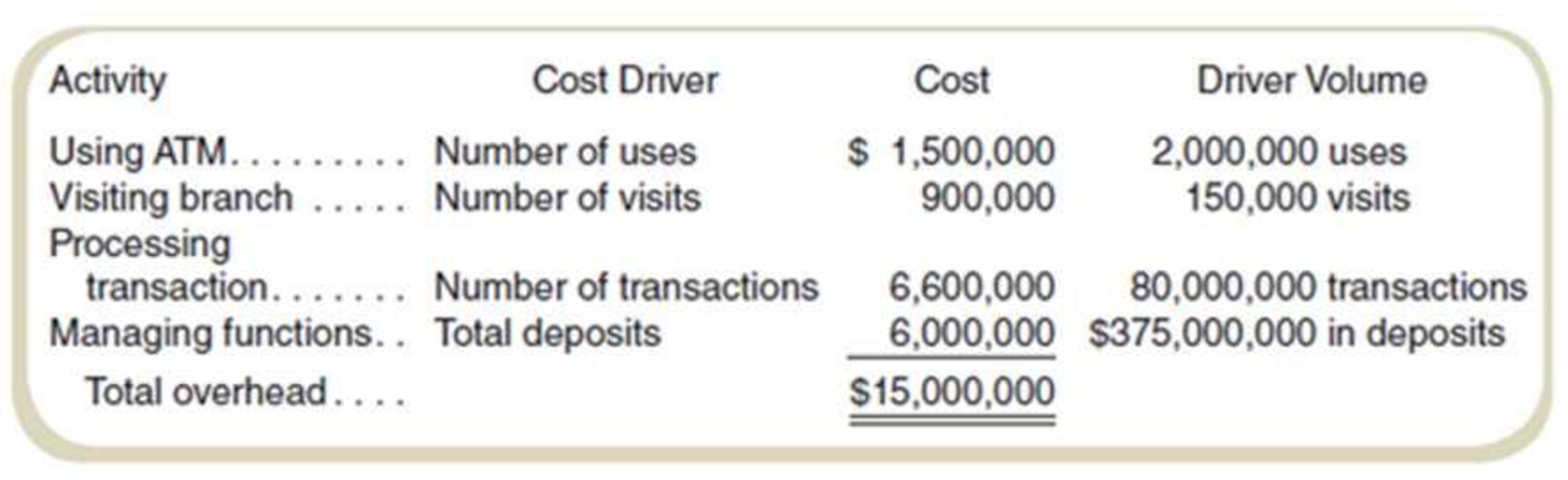

Rock Solid Bank and Trust (RSB&T) oilers only checking accounts. Customers can write checks and use a network of automated teller machines. RSB&T earns revenue by investing the money deposited; currently, it averages 5.2 percent annually on its investments of those deposits. To compete with larger banks. RSB&T pays depositors 0.5 percent on all deposits. A recent study classified the bank’s annual operating costs into four activities:

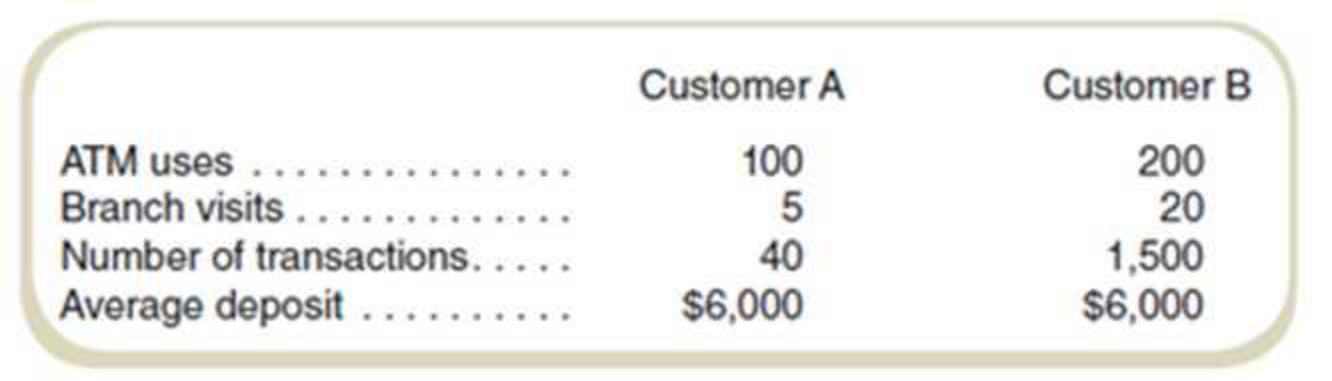

Data on two representative customers follow:

Required

- a. Compute RSB&T’s operating profits.

- b. Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits. Interest costs = 0.5 percent of deposits; operating costs are 4 percent (= $15,000,000/$375,000,000) of deposits.

- c. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information in the activity-based costing analysis.

a.

Compute the operating profit.

Explanation of Solution

Operating profit:

Operating profit is the amount retained by subtracting the total costs of operations occurred from the sales revenues earned.

Compute the operating profit:

| Particulars | Amount |

|

Sales revenue | $19,500,000 |

| Costs: | |

|

Interest on deposits | $1,875,000 |

| Operating costs | $15,000,000 |

|

Total costs | $16,875,000 |

|

Operating profit | $2,625,000 |

Table: (1)

b.

Compute the profit from customer A and customer B according to the information given in the question.

Explanation of Solution

Profit:

Profit is the amount retained by subtracting the total costs from the sales revenues earned.

Compute the customer profit of both the customers:

| Particulars | Customer A | Customer B |

|

Sales revenue | $312 | $312 |

|

Interest on deposits | $30 | $30 |

|

Operating costs | $240 | $240 |

|

Customer profit | $42 | $42 |

Table: (2)

Measures that are used for computation:

| Particulars | Details |

| Deposit of customer A | $6,000 |

| Deposit of customer B | $6,000 |

| Interest earned | 5.20% |

| Interests charged | 0.50% |

| Operating cost | 4.00% |

Table: (3)

c.

Compute the profit from customer A and customer B according to the information given in the question.

Explanation of Solution

Cost driver:

Cost driver refers to the factor that causes changes in the determination of the cost of the activity.

Compute the rates required for the computation of the customer profit:

| Activity | Cost driver |

Cost |

Driver volume |

Rate |

| Use ATM | Number of uses | $1,500,000 | 2,000,000 | 0.75 |

| Visit Branch | Number of visits | $900,000 | 150,000 | 6.00 |

| Process transaction | Number of transactions | $6,600,000 | 80,000,000 | 0.0825 |

| General bank overhead | Total deposits | $6,000,000 | 375,000,000 | 1.60% |

Table: (4)

| Customer A | Customer B | |

| Activity | Amount | Amount |

|

Sales revenue | $312 | $312 |

|

Interest on deposit | $30 | $30 |

| Account margin | $282 | $282 |

| Operating costs: | ||

|

Use ATM | $75 | $150 |

|

Add: Visit branch | $30 | $120 |

|

Add: Process transaction | $3 | $124 |

|

Add: General bank overhead | $96 | $69 |

| Total operating cost | $204 | $490 |

|

Customer profit | $78 | ($208) |

Table: (5)

| Particulars | Details |

| Deposit of customer A | $6,000 |

| Deposit of customer B | $6,000 |

| Interest earned | 5.20% |

| Interests charged | 0.50% |

Table: (6)

Want to see more full solutions like this?

Chapter 10 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Northwestern Bank (NB) offers only checking accounts. Customers can write checks and use a network of automated teller machines. NB earns revenue by investing the money deposited; currently, it averages 4.1 percent annually on its investments of those deposits. To compete with larger banks, NB pays depositors 0.3 percent on all deposits. A recent study classified the bank’s annual operating costs into four activities. Activity Cost Driver Cost Driver Volume Using ATM Number of uses $ 1,929,600 3,216,000 uses Visiting branch Number of visits 1,857,600 387,000 visits Processing transactions Number of transactions 8,490,240 128,640,000 transactions Managing functions Total deposits 7,315,200 $ 612,270,000 in deposits Total overhead $ 19,592,640 Data on two representative customers follow: Emily Jacob ATM uses 40 130 Branch visits 5 45 Number of transactions 200 520 Average deposit $ 10,000 $ 10,000 Required: Compute the operating profit for…arrow_forwardBird's Eye Treehouses, Incorporated, a Kentucky company, has determined that a majority of its customers are located in the Pennsylvania area. It therefore is considering using a lockbox system offered by a bank located in Pittsburgh. The bank has estimated that use of the system will reduce collection time by 1.5 days. Assume 365 days a year. Average number of payments per day Average value of payment Variable lockbox fee (per transaction) Annual interest rate on money market securities 850 $ 800 $.10 a. NPV b. NPV 3.2% a. What is the NPV of the new lockbox system? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Suppose in addition to the variable charge that there is an annual fixed charge of $3,000 to be paid at the end of each year. What is the NPV now? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardFordson Bank operates a branch in a relatively small rural community. Fordson has a strong customer service focus and knows that branch visits can be important in fostering a reputation for good customer service. However, as internet banking increases in popularity, the financial staff at Fordson question whether the costs of the branch are worth it. As part of looking at the question, a financial analyst has collected monthly data on the number of customer visits to the branch and the operating cost of the branch over the last fiscal year. The data follow: Month Customer Visits 1 2 3 4 5 6 7 8 10 12 962 1,378 1,170 1,014 1,586 1,222 1,144 1,248 1,430 1,040 1,092 1,066 Branch Cost $ 71,534 90,046 80,790 73,848 99,302 83,104 79,633 84,261 Branch cost= 92,360 75,005 77,319 76,162 Required: a. Estimate the monthly fixed costs and the unit variable cost per customer visit using the high-low estimation method. Note: Round variable cost per unit to 2 decimal places. per visit Customer visitsarrow_forward

- A credit card company is studying its late fee policy. The company has two types of customers: revolvers and transactors. It has 30% revolvers and 70% transactors. The 21. balance carried by each type of customer is shown below: Balance, $ 2000 4000 6000 Revolver probability 0.2 0.3 0.5 Transactor probability 0.5 0.4 0.1 When late fees are assessed, customers call and request a reversal. The policy is to allow revolvers to get a refund of the fees, and to deny refunds to transactors. When denied refunds, 30% of accounts close their accounts within a year, while 20% of the others whose fees were returned also close their accounts (perhaps they are still unhappy). If you start with 20 accounts (all of whom are assessed late fees), simulate the total balance at the end of the year.arrow_forwardBird's Eye Treehouses Inc. has determined that a majority of its customers are located in the Winnipeg area. It therefore is considering using a lockbox system offered by a bank in Manitoba. The bank has estimated that use of the system will reduc collection time by 1.5 days. Average number of payments per day 760 Average value of payment $ 770 Variable lockbox fee (per transaction) $ 0.10 Annual interest rate on money market securities 4.0% e-1. What is the NPV of the new lockbox system? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit "$" sign in your response.) NPV $170558.7 a-2. Should the lockbox project be accepted? 13 Yes No b-1. If there were a fixed charge of $7,000 per year in addition to the variable charge, what is the NPV of the new lockbox system? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit "$" sign in your response.) NPV $ b-2.…arrow_forwardA bank has estimated its expected (predicted) loan loss rate on its consumer loans at 3.25%. If the bank wishes to earn 8% on it consumer loans, what rate should it charge its customers? 11.34% 11.63% 4.60% 4.35% The following is not an example of a closed-end loan Automobile Loans Home mortgages Recreational vehicle loan Credit Card Core deposits of a commercial bank consist of the following except: Demand deposits Savings deposits Money market deposits Eurodollar depositsarrow_forward

- TB MC Qu. 9-77 (Algo) Banc Corp. Trust is considering either a bankwide... Banc Corp. Trust is considering either a bankwide overhead rate or department overhead rates to allocate $368,000 of indirect costs. The bankwide rate could be based on either direct labor hours (DLH) or the number of loans processed. The departmental rates would be based on direct labor hours for Consumer Loans and a dual rate based on direct labor hours and the number of loans processed for Commercial Loans. The following information was gathered for the upcoming period: Department DLH Loans Processed Direct Costs Consumer 15,000 850 $ 260,000 Commercial 8,000 150 $ 140,000 If Banc Corp. Trust uses a bankwide rate based on direct labor hours, what would be the indirect costs allocated to the Commercial Department? Multiple Choice $128,000. $125,600. $130,400. $140,000.arrow_forwardPLEASE MAKE IT IN EXCEL AND SHOW THE FORMULAS (Take screenshots) La Resolana, S.A., has credit sales of $180,000 per year, with net payment terms of 30 days, which is also the average collection period. La Resolana does not currently offer any cash discounts, so customers take the 30 days to pay. What is the average accounts receivable balance? What is the accounts receivable turnover?arrow_forwardBob's Product Company takes 20 days to convert its raw materials to finished goods, 15 days to sell it, and 25 days to collect its credit sales. What is the company’s days receivable period? Group of answer choices 60 35 25 10 15 A bank letter of credit, sometimes called a standby letter of credit, is a written promise by a bank that it will make a payment on behalf of the customer. This is different than a line of credit, which is a akin to a credit card….a line of credit allows the company to borrow funds as needed to pay any bills. A LETTER of credit is specific to the party that the company might owe money to. Group of answer choices True Falsearrow_forward

- Customers as a Cost Object Morrisom National Bank has requested an analysis of checking account profitability by customer type. Customers are categorized according to the size of their account: low balances, medium balances, and high balances. The activities associated with the three different customer categories and their associated annual costs are as follows: Additional data concerning the usage of the activities by the various customers are also provided: Required: (Note: Round answers to two decimal places.) 1. Calculate a cost per account per year by dividing the total cost of processing and maintaining checking accounts by the total number of accounts. What is the average fee per month that the bank should charge to cover the costs incurred because of checking accounts? 2. Calculate a cost per account by customer category by using activity rates. 3. Currently, the bank offers free checking to all of its customers. The interest revenues average 90 per account; however, the interest revenues earned per account by category are 80, 100, and 165 for the low-, medium-, and high-balance accounts, respectively. Calculate the average profit per account (average revenue minus average cost from Requirement 1). Then calculate the profit per account by using the revenue per customer type and the unit cost per customer type calculated in Requirement 2. 4. CONCEPTUAL CONNECTION After the analysis in Requirement 3, a vice president recommended eliminating the free checking feature for low-balance customers. The bank president expressed reluctance to do so, arguing that the low-balance customers more than made up for the loss through cross-sales. He presented a survey that showed that 50% of the customers would switch banks if a checking fee were imposed. Explain how you could verify the presidents argument by using ABC.arrow_forwardQ6: 13. The First American Bank of Rapid City has one outside drive-up teller. It takes the teller an average of 4 minutes to serve a bank customer. Customers arrive at the drive-up window at a rate of 12 hour. The bank operations officer is currently analyzing the possibility of adding a second drive-up window, at an annual cost of $20,000. It is assumed that arriving cars would be equally per divided between both windows. The operations officer estimates that each minute's reduction in customer waiting time would increase the bank's revenue by $2,000 annually. Should the second drive-up window be installed? Q7:23. A vending machine at City Airport dispenses hot coffee, hot lote or hot tea in a constant service time of 20 seconds.arrow_forwardAn FI has estimated the following annual costs for its demand deposits: management cost per account = $150, average account size = $1600, average number of cheques processed per account per month = 75, cost of clearing a cheque = $0.10, fees charged to customer per cheque = $0.05, and average fee charged per customer per month = $15. (a) What is the implicit interest cost of demand deposits for the FI? (b) If the FI has to keep an average of 8 per cent of demand deposits as required reserves with the RBA paying no interest, what is the implicit interest cost of demand deposits for the FI? (c) What should be the per-cheque fee charged to customers to reduce the implicit interest costs to 3 per cent? Ignore the reserve requirements.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning