To calculate:

The

Answer to Problem 1SPPA

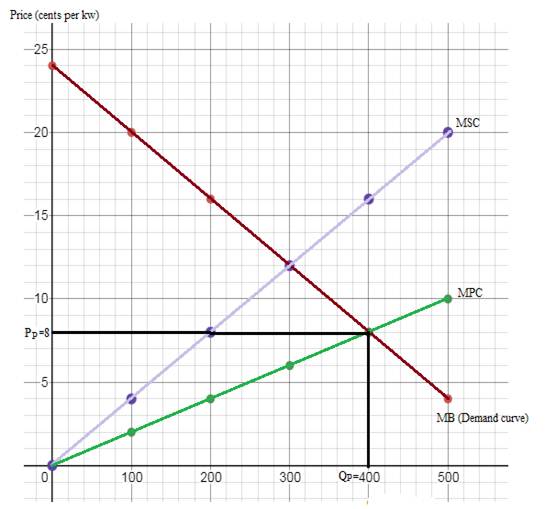

Without pollution control, equilibrium Output (QP) is 400,

Explanation of Solution

An externality refers to the cost and benefits that the third-party bears and it has no control over it. However, externalities can be negative and positive. The externalities that cost to the third party are considered as negative externality while if it benefits the third party then it is considered as positive externalities.

The price, output, marginal private cost (MPC) and marginal external cost (MEC) schedules are given as follows:

| Price (P) | Output (Q) | MPC | MEC | MSC |

| 4 | 500 | 10 | 10 | 20 |

| 8 | 400 | 8 | 8 | 16 |

| 12 | 300 | 6 | 6 | 12 |

| 16 | 200 | 4 | 4 | 8 |

| 20 | 100 | 2 | 2 | 4 |

| 24 | 0 | 0 | 0 | 0 |

Without pollution control, the coal burning utility would take output and price decisions according to the following condition:

MB=MPC

Where

MB is marginal benefit,

MPC is marginal private cost.

The marginal benefit is equal to the output (

Equilibrium output (QP) is 400, equilibrium price (PP) is 8 cents and marginal external cost (MEC) is 8 cents.

The diagram below shows the plot of marginal benefit/ demand (MB), marginal private cost (MPC) and marginal

Externalities:

Externality is the negative or positive effect of an action by an economic agent on another.

Marginal benefit:

Marginal benefit of an economic activity is the extra benefit received by undertaking an additional unit of that economic activity. It is also the demand curve.

Marginal cost:

Marginal cost of an economic activity is the extra cost incurred by undertaking an additional unit of that economic activity.

External cost:

When externality is negative, it is regarded as external cost.

Social cost:

Social cost is the sum of private cost and external cost.

Want to see more full solutions like this?

Chapter 10 Solutions

Foundations of Economics (8th Edition)

- The rows in Table 12.7 show three market-oriented tools for reducing pollution. The columns of the table show three complaints about command-and-control regulation. Fill in the table by stating briefly how each market-oriented tool addresses each of the three concerns.arrow_forwardMacmillan Learning The accompanying graph depicts the marginal social cost (MSC) and marginal social benefit (MSB) of pollution emissions. Move the point, P, to the point representing the optimal level of pollution. What is the optimal quantity of pollution? metric tons The optimal quantity of pollution is not zero because: 1,000 Dollars 900 800 700 600 500 400 300 200 100 0 27 2 P 3 4 5 6 Metric tons of pollution 7 8 9 MSC MSB 10arrow_forwardDefine pollution charge and will our economy be able to control pollution? Share your thoughts in a paragraph.arrow_forward

- Use a graph to explain the benefits a farmer will experience if pollution of a nearby industry decreases.arrow_forwardWhat should the government set their corrective tax to if they want to eliminate 7 units of pollution?arrow_forward10. A local drama company proposes a new neighborhood theater in San Francisco. Before approving the permit, the city planner completes a study of the theater's impact on the surrounding community. a. One finding of the study is that the theaters attract traffic, which adversely affects the community. The city planner estimates that the cost to the community from the extra traffic is $5 per ticket. What kind of an externality is this? Why? b. Graph the market for theater tickets, labeling the demand curve, the social-value curve, the supply curve, the social-cost curve, the market equilibrium level of output. Also show the per-unit amount of the externality. c. Upon further review, the city planner uncovers a second externality. Rehearsals for the plays tend to run until late at night, with actors, stagehands, and other theater members coming and going at various hours. The planner has found that the increased foot traffic improves the safety of the surrounding streets, an estimated…arrow_forward

- Which one does not belong to the externalities contributed by oil? a. Emissions that pollute the environment. b. National security c. Hydrocarbons that potentially contribute to climate d. Mercury emission from burning oil to produce electricity.arrow_forwardWhat is the air pollution policy in the United States?arrow_forwardThis graph shows the market for antifreeze. Use it to answer the next questions. 8 6. 1 100 200 300 400 500 600 700 800 900 1000 1100 Quantity Question 8 The production of antifreeze creates pollution. The pollution imposes a cost of $2 per gallon on society. What is the marginal social cost of the 500th gallon of antifreeze? Answer is a whole number; do not include a dollar sign (e.g. 10).arrow_forward

- create a scipt about pollution as a social issue for a commercial video.arrow_forwarda. If improved technology causes firms' abatement costs to fall, how, if at all, does this affect the amount of pollution that firms will emit when there is a tax? Explain briefly with a diagram.arrow_forwardDraw a graph of water pollution as a negative externality and explain itarrow_forward

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning