College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 10SPA

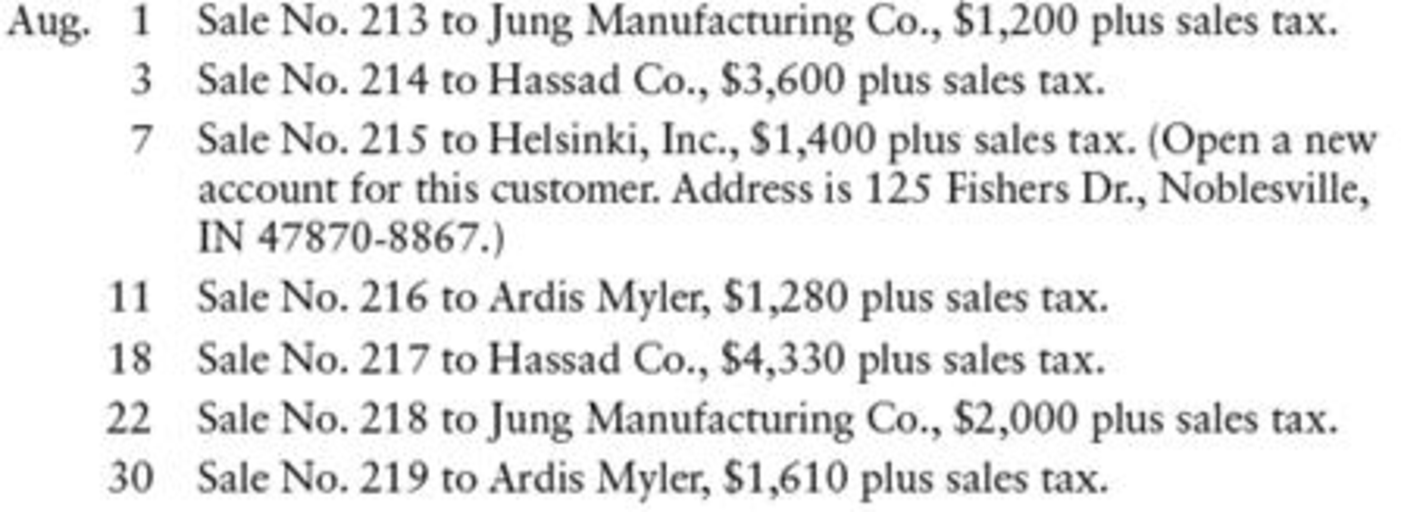

SALES TRANSACTIONS J. K. Bijan owns a retail business and made the following sales on account during the month of August 20--. There is a 6% sales tax on all sales.

REQUIRED

- 1. Record the transactions starting on page 15 of a general journal.

- 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

SALES AND CASH RECEIPTS TRANSACTIONS Paul Jackson owns a retail business. The following sales, returns, and cash receipts are for April 20--. There is a 7% sales tax.Apr. 1 Sale on account No. 111 to O. L. Meyers, $2,100 plus sales tax.3 Sale on account No. 112 to Andrew Plaa, $1,000 plus sales tax.6 O. L. Meyers returned merchandise from Sale No. 111 for a credit(Credit Memo No. 42), $50 plus sales tax.7 Cash sales for the week were $3,240 plus sales tax.9 Received payment from O. L. Meyers for Sale No. 111 less CreditMemo No. 42.12 Sale on account No. 113 to Melissa Richfield, $980 plus sales tax.14 Cash sales for the week were $2,180 plus sales tax.17 Melissa Richfield returned merchandise from Sale No. 113 for a credit(Credit Memo No. 43), $40 plus sales tax.19 Sale on account No. 114 to Kelsay Munkres, $1,020 plus sales tax.21 Cash sales for the week were $2,600 plus sales tax.24 Sale on account No. 115 to O. L. Meyers, $920 plus sales tax.27 Sale on account No. 116 to Andrew…

Sales taxes collected from customers are sent to the state at the end of each month. What journal entry is prepared? A. debit Sales Taxes Payable and credit Cash OB. debit

Sales Tax Payable and credit Sales OC. debit Accounts Receivable and credit Sales O D. debit Accounts Payable and credit Cash

Target Shoppers Inc. reported cash sales of $28,800 for the month of June. Sales taxes payable are recorded at the point of sale.

a. Assume that sales are subject to a 6% sales tax. Record the sales entry.b. Now assume that the cash collected on sales includes the 6% sales tax. Record the sales entry.

● Note: Round your answers to the nearest whole dollar.

Account Name

Dr.

Cr.

a.

To record the sale entry.

b.

To record the sale entry.

Chapter 10 Solutions

College Accounting, Chapters 1-27

Ch. 10 - Prob. 1TFCh. 10 - All sales, for cash or on credit, can be recorded...Ch. 10 - Sales Tax Payable is a liability account that is...Ch. 10 - Prob. 4TFCh. 10 - Prob. 5TFCh. 10 - A credit sale of 250 plus a 6% sales tax would...Ch. 10 - When 25 of merchandise is returned for a credit on...Ch. 10 - Prob. 3MCCh. 10 - Prob. 4MCCh. 10 - Prob. 5MC

Ch. 10 - Prob. 1CECh. 10 - Prepare journal entries for the following sales...Ch. 10 - Prob. 3CECh. 10 - On March 24, MS Companys Accounts Receivable...Ch. 10 - Prob. 1RQCh. 10 - What is the purpose of a credit memo?Ch. 10 - Prob. 3RQCh. 10 - Prob. 4RQCh. 10 - Prob. 5RQCh. 10 - Prob. 6RQCh. 10 - What steps are followed in posting cash receipts...Ch. 10 - What steps are followed in posting cash receipts...Ch. 10 - Prob. 9RQCh. 10 - Prob. 1SEACh. 10 - SALES TRANSACTIONS AND T ACCOUNTS Using T accounts...Ch. 10 - Prob. 3SEACh. 10 - SALES RETURNS AND ALLOWANCES ADJUSTMENT At the end...Ch. 10 - Prob. 5SEACh. 10 - JOURNALIZING SALES TRANSACTIONS Enter the...Ch. 10 - Prob. 7SEACh. 10 - JOURNALIZING CASH RECEIPTS Enter the following...Ch. 10 - SCHEDULE OF ACCOUNTS RECEIVABLE From the accounts...Ch. 10 - SALES TRANSACTIONS J. K. Bijan owns a retail...Ch. 10 - Prob. 11SPACh. 10 - SALES AND CASH RECEIPTS TRANSACTIONS Sourk...Ch. 10 - SCHEDULE OF ACCOUNTS RECEIVABLE Based on the...Ch. 10 - Prob. 1SEBCh. 10 - SALES TRANSACTIONS AND T ACCOUNTS Using T accounts...Ch. 10 - Prob. 3SEBCh. 10 - SALES RETURNS AND ALLOWANCES ADJUSTMENT At the end...Ch. 10 - Prob. 5SEBCh. 10 - JOURNALIZING SALES TRANSACTIONS Enter the...Ch. 10 - JOURNALIZING SALES RETURNS AND ALLOWANCES Enter...Ch. 10 - JOURNALIZING CASH RECEIPTS Enter the following...Ch. 10 - SCHEDULE OF ACCOUNTS RECEIVABLE From the accounts...Ch. 10 - SALES TRANSACTIONS T. M. Maxwell owns a retail...Ch. 10 - CASH RECEIPTS TRANSACTIONS Color Florists, a...Ch. 10 - SALES AND CASH RECEIPTS TRANSACTIONS Paul Jackson...Ch. 10 - SCHEDULE OF ACCOUNTS RECEIVABLE Based on the...Ch. 10 - You and your spouse have separate charge accounts...Ch. 10 - Prob. 1ECCh. 10 - Geoff and Sandy Harland own and operate Wayward...Ch. 10 - Enter the following transactions in a general...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- SALES TRANSACTIONS T. M. Maxwell owns a retail business and made the following sales on account during the month of July 20--. There is a 5% sales tax on all sales. REQUIRED 1. Record the transactions starting on page 15 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardSALES AND CASH RECEIPTS TRANSACTIONS Paul Jackson owns a retail business. The following sales, returns, and cash receipts are for April 20--. There is a 7% sales tax. REQUIRED 1. Record the transactions starring on page 7 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardCASH RECEIPTS TRANSACTIONS Color Florists, a retail business, had the following cash receipts during January 20--. The sales tax is 5%. REQUIRED 1. Record the transactions starting on page 20 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forward

- Catherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forwardBeth uses the net invoice method to record sales on account. Beth made sales of $40,000 with terms 3/15, net 45. The customer pays after 25 days. Journalize: Date Accounts Debit Creditarrow_forwardPrepare journal entries for each of the following sales transactions by Elegant Electronics, including a 3.5% sales tax, and the remittance of all sales tax to the tax board on October 23. Accounts Payable Merchandise Inventory Sales Discount Cash Sales Sale Tax Payable PLEASE NOTE: You must follow the format in the textbook and enter the account names exactly as written above and all dollar amounts will be rounded to two decimal places with "$" and commas as needed (i.e. $12,345.67). Elegant Electronics sells a cellular phone on September 2 for $450: DR DR or CR? CR On September 6, Elegant sells another cellular phone for $500: DR DR or CR? CR The remittance of all sales tax to the tax board on October 23: DR CRarrow_forward

- business issued a credit memo $235 to NECinc.regarding the sales on oct 1 give journal entryarrow_forwardJournalizing Sales Transactions Enter the following transactions in a sales journal. Use a 6% sales tax rate. May 1 Sold merchandise on account to J. Adams, $2,000, plus sales tax. Sale No. 488. 4 Sold merchandise on account to B. Clark, $1,800, plus sales tax. Sale No. 489. 8 Sold merchandise on account to A. Duck, $1,500, plus sales tax. Sale No. 490. 11 Sold merchandise on account to E. Hill, $1,950, plus sales tax. Sale No. 491 Page: 1 SALES TAX PAYABLE ACCOUNTS GENERAL SALES SALE POST. DATE TO WHOM SOLD RECEIVABLE REF. DEBIT CREDIT NO. CREDIT DEBIT CREDIT М.d 1 1 М.d 2 2 М.d 3 М.d 4 0000arrow_forwardYou are to enter the following items in the books, post to personal accounts, and show the transfers to the General Ledger. Balance all accounts. 2009 July 1 Credit purchases form: K Hill $380; M Norman $500; N Senior $106. 3 Credit sales to: E Rigby $510; E Phillips $246; F Thompson $356. 5 Credit purchases from: R Morton $200; J Cook $180; D Edwards $410; C Davies $66. 8 Credit sales to: A Green $307; H George $250; J Ferguson $185. 12 Returns outwards to: M Norman $30; N Senior $16. 14 Return inwards from: E Phillips $18; F Thompson $22. 20 Credit sales to: E Phillips $188; F Powell $310; E Lee $420. 24 Credit purchases from: C Ferguson $550; K Ennevor $900. 31 Return inwards from: E Phillips $27; E Rigby $30. 31 Return outwards to: J Cook $13; C Davies $11.arrow_forward

- Journalizing Sales Transactions Enter the following transactions in a sales journal. Use a 6% sales tax rate. May 1 Sold merchandise on account to J. Adams, $2,000, plus sales tax. Sale No. 488. 4 Sold merchandise on account to B. Clark, $1,800, plus sales tax. Sale No. 489. 8 Sold merchandise on account to A. Duck, $1,500, plus sales tax. Sale No. 490. 11 Sold merchandise on account to E. Hill, $1,950, plus sales tax. Sale No. 491.arrow_forwardDirections: Record the following transactions in the appropriate journals. Lloyd Gurango Co. completed the following sales transactions during the month of June 2021. A credit sales have terms of 3/10, n/30, and all invoices are dates as at the transaction date. June 1 4 7 9 13 ಈ 15 18 20 Mr. Gurango invested P52 000 of his funds in the business Sold merchandise on account to KRA Company, P32 000. Invoice number 377 Sold P46 000 of merchandise for cash. Received payment from KRA Company, fewer discounts. Received payment from LRM Trading, fewer discounts. Sold merchandise to JPT Store on account, P62 000. Invoice number 379. Collected the amount due from JPT Store. Fewer discounts. Paid the employees' wages for the month amounting to P5,000 Acquired merchandise to YMC Trading worth P15, 000 payable next month Acquired merchandise on credit from ABS Manufacturing worth P15, 000. The invoice number is 201 and the credit term is n/30arrow_forwardJournalizing Sales Transactions Enter the following transactions in a general journal. Use a 6% sales tax rate. May Sold merchandise on account to J. Adams, $4,000 plus ' sales tax. Sale No. 488. Sold merchandise on account to B. Clark, $3,800 plus sales tax. Sale No. 489. Sold merchandise on account to A. Duck, $3,500 plus 8. sales tax. Sale No. 490. Sold merchandise on account to E. Hill, $3,950 plus sales 11 tax. Sale No. 491. Page: ACCOUNT TITLE DOC. POST. NO. REF. DATE DEBIT CREDIT 20-- May 1 2 2 3 4 4 5 May 4 6. 7 8. 8 9 May 8 9 10 10 11 11 12 12 13 May 11 13 14 14 15 15arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License