College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 3PB

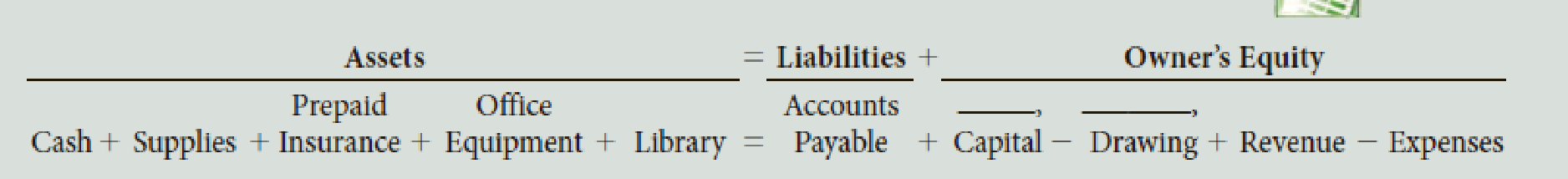

P. Schwartz, Attorney at Law, opened his office on October 1. The account headings are presented below. Transactions completed during the month follow.

- a. Schwartz deposited $25,000 in a bank account in the name of the business.

- b. Bought office equipment on account from QuipCo, $9,670.

- c. Schwartz invested his personal law library, which cost $2,800.

- d. Paid the office rent for the month, $1,700, Ck. No. 2000.

- e. Bought office supplies for cash, $418, Ck. No. 2001.

- f. Bought insurance for two years, $944, Ck. No. 2002.

- g. Sold legal services for cash, $8,518.

- h. Paid the salary of the part-time receptionist, $1,820, Ck. No. 2003.

- i. Received and paid the telephone bill, $388, Ck. No. 2004.

- j. Received and paid the bill for utilities, $368, Ck. No. 2005.

- k. Sold legal services for cash, $9,260.

- l. Paid on account to QuipCo, $2,670, Ck. No. 2006.

- m. Schwartz withdrew cash for personal use, $2,500, Ck. No. 2007.

Required

- 1. Record the transactions and the balance after each transaction.

- 2. Total the left side of the

accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Prepare the following journal entry, all transactions that occurred in January:

The Corporation purchased a Delivery Van for customer deliveries. The Delivery Van cost $21,400.

A down payment of cash in the amount of $5,000 was paid to the Car Dealership, and a promissory note was signed for the remaining amount owed.

The accounting records and bank statement of Jeff's Seashell Store provide the following information at the end of April. The closing 'Cash' account balance was $29000, and the bank statement shows a closing balance of $31000. On reviewing the bank statement it is found an account customer has deposited $2500 into the bank account for a March sale and the monthly insurance premium of $550 was automatically charged to the account. Interest of $1500 was paid by the bank and a bank fee of $50 was charged to the account. A payment of $950 to a supplier has been recorded twice in the accounts. After the calculation of the "ending reconciled cash balance", what is the balance of the 'cash' account?A. 33,350 B. None of the other answers C. 31,450 D. 29,000 E. 35,350

The following transactions occurred during the month of July 2021.

July 1 Paid employee salaries, $2,700 for June. Sharon pays her employees’ accrued salaries on the first day of each calendar month.

July 1 Paid office rent for the month of July, $2,300.

July 8 Received $7,200 cash from a client on account.

July 9 Purchased office supplies on credit, $2,000 14 Paid $3,500 of the accounts payable.

July 15 Invoiced customers for accounting services performed, $12,300.

July 25 Sharon withdrew capital of $2,250

July 31 Paid $4,200 for a one-year insurance policy.

a) Prepare the cash at bank ledger account as at 31 July 2021.

Chapter 1 Solutions

College Accounting (Book Only): A Career Approach

Ch. 1 - Prob. 1QYCh. 1 - Prob. 2QYCh. 1 - Which of the following accounts would increase...Ch. 1 - Which of the following statements is true? a....Ch. 1 - M. Parish purchased supplies on credit. What is...Ch. 1 - Define assets, liabilities, owners equity,...Ch. 1 - Prob. 2DQCh. 1 - How do Accounts Payable and Accounts Receivable...Ch. 1 - Describe two ways to increase owners equity and...Ch. 1 - What is the effect on the fundamental accounting...

Ch. 1 - When an owner withdraws cash or goods from the...Ch. 1 - Define chart of accounts and identify the...Ch. 1 - What account titles would you suggest for the...Ch. 1 - Prob. 1ECh. 1 - Determine the following amounts: a. The amount of...Ch. 1 - Dr. L. M. Patton is an ophthalmologist. As of...Ch. 1 - Describe a business transaction that will do the...Ch. 1 - Describe a transaction that resulted in each of...Ch. 1 - Label each of the following accounts as asset (A),...Ch. 1 - Describe a transaction that resulted in the...Ch. 1 - Describe the transactions that are recorded in the...Ch. 1 - On June 1 of this year, J. Larkin, Optometrist,...Ch. 1 - On July 1 of this year, R. Green established the...Ch. 1 - S. Davis, a graphic artist, opened a studio for...Ch. 1 - On March 1 of this year, B. Gervais established...Ch. 1 - In April, J. Rodriguez established an apartment...Ch. 1 - In July of this year, M. Wallace established a...Ch. 1 - In March, K. Haas, M.D., established the Haas...Ch. 1 - P. Schwartz, Attorney at Law, opened his office on...Ch. 1 - In March, T. Carter established Carter Delivery...Ch. 1 - In October, A. Nguyen established an apartment...Ch. 1 - Why Does It Matter? MACS CUSTOM CATERING, Eugene,...Ch. 1 - What Would You Say? A friend of yours wants to...Ch. 1 - Prob. 3A

Additional Business Textbook Solutions

Find more solutions based on key concepts

The amount that should be recorded by Company R for building under historical cost principle.

Financial Accounting (11th Edition)

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing And Assurance Services

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals Of Cost Accounting (6th Edition)

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals of Cost Accounting

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- After operating for several months, artist Paul Marciano completed the following transactions during the latter part of June: June 15: Borrowed $25,000 from the bank, signing a note payable. June 22: Painted a portrait for a client on account totaling $9,000. June 28: Received $5,000 cash on account from clients. June 29: Received a utility bill of $ 600, which will be paid during July. June 30: Paid monthly salary of $2,500 to gallery assistant. Journalize the transactions of Paul Marciano, Artist. Include an explanation with each journal entry.arrow_forwardConsider each of the transaction below independently. All expenditures were made in cash In march, the Cleanway Laundromat bought equipment. Cleanway paid $5,000 down and signed a noninterest-bearing note requiring the payment of $30,000 in nine months. The cash price for the equipment was $34,000. Prepare all necessary journal entries to record each the transaction. Use this format: Date Account Titles DR CRarrow_forwardLizzie Gunderson is trying to establish a credit history and has a Visa charge card. She received a September 3 statement that shows a balance of $254.80 from the previous month. The statement shows the following transactions: payment on September 12 of $50, charge on September 15 of $35.18, charge on September 20 of $120, and a final charge on October 2 of $14.60. Calculate the average daily balance for September.arrow_forward

- 19 Dec. Borrowed $28,000 from the bank for personal use. The loan carried an interest rate of 6% a year and the first payment was due on 19 January. Williamson signed a note payable to the bank in the name of the business. How would this be journaled, put on an income statment, balance sheet, and cash flow statment for december 31st?arrow_forwardA CPA prepares tax returns for clients and bills them after the work is completed. It usually takes two weeks of work to prepare the tax returns. It takes 30 days on average to receive payment from the clients. The CPA uses cash-basis accounting. The revenue should be recorded when the CPA: O A. receives payments from the clients O B. bills the clients. OC. starts working on the tax returns O D. completes working on the tax returns. Click to select your answer. 11-50nm 99+arrow_forwardFollowing are some transactions and events of Business Solutions. February 26 The company paid cash to Lyn Addie for eight days' work at $120 per day. March 25 The company sold merchandise with a $2,100 cost for $3,300 on credit to Wildcat Services, invoice dated March 25. Required: 1. Assume that Lyn Addie is an unmarried employee. Her $960 of wages have deductions for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $96. Compute her net pay for the eight days' work paid on February 26. 2. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1. 3. Record the journal entry to reflect the (employer) payroll tax expenses for the February 26 payroll payment. Assume Lyn Addie has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company). 4. Record the entries for the merchandise sold on March 25 if a 4% sales tax rate applies.…arrow_forward

- Home Office collected 100,000 from Branch’s customers on account. Requirements:a. Prepare the journal entries for both the Home Office and Branch books based on theabove transactions.arrow_forwardFollowing are some transactions and events of Business Solutions. February 26 The company paid cash to Lyn Addie for eight days' work at $140 per day. March 25 The company sold merchandise with a $2,300 cost for $3,500 on credit to Wildcat Services, invoice dated March 25. Required: 1. Assume that Lyn Addie is an unmarried employee. Her $1,120 of wages have deductions for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $112. Compute her net pay for the eight days' work paid on February 26. 2. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1. 3. Record the journal entry to reflect the (employer) payroll tax expenses for the February 26 payroll payment. Assume Lyn Addie has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company). 4. Record the entries for the merchandise sold on March 25 if a 4% sales tax rate applies.…arrow_forwardFollowing are some transactions and events of Business Solutions. February 26 The company paid cash to Lyn Addie for eight days' work at $140 per day. March 25 The company sold merchandise with a $2,500 cost for $3,100 on credit to Wildcat Services, invoice dated March 25. Required: 1. Assume that Lyn Addie is an unmarried employee. Her $1,120 of wages have deductions for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $112. Compute her net pay for the eight days' work paid on February 26. 2. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1. 3. Record the journal entry to reflect the (employer) payroll tax expenses for the February 26 payroll payment. Assume Lyn Addie has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company). 4. Record the entries for the merchandise sold on March 25 if a 4% sales tax rate applies.…arrow_forward

- Dyle Lagomo, Attorney-at-Law, opened his office on September 1, 2019. The following transactions were completed during the month:a. Deposited P210,000 in the bank in the name of the business.b. Bought office equipment on account from Daraga Corp., P147,000.c. Invested his personal law library into the business, P57,000.d. Paid office rent for the month, P7,600.e. Bought office supplies for cash, P8,850.f. Paid the premium for a one-year fire insurance policy on the equipment and the library, P1,860.g. Received professional fees for services rendered, P24,600.h. Received and paid bill for the use of a landline, P2,280.i. Paid salaries of two part-time legal researchers, P9,600.j. Paid car rental expense, P2,880.k. Received professional fees for services rendered, P21,200.l. Paid Daraga Corp. a portion of the amount owed for the acquisition of the office equipment recorded earlier, P15,000.m. Lagomo withdrew cash for personal use, P20,750.Required: Record the transactions for the month…arrow_forwardJames Howard owns Howard Auto Sales. He periodically borrows money from Bay City State Bank and Trust. He permits some customers to sign short-term notes for their purchases. He usually discounts these notes at the bank. Following are selected transactions that occurred in March 20X1. DATE TRANSACTIONS 20X1 Mar. 4 Mr. Howard borrows $34,560 from the bank on a note payable for the business. Terms of the note are 10 percent interest for 45 days. 11 A 90-day $47,520 note payable to the bank is discounted at a rate of 8 percent. 22 Sold a car to Darnell Jones for $40,320 on a 75-day note receivable, bearing interest at 7 percent. 23 Discounted the Jones note with the bank. The bank charges a discount rate of 10 percent. 25 Sold a car for $48,960 to Henry Thomas. Thomas paid $4,000 cash and signed a 30-day note, bearing interest at 9 percent, for the balance. 28 Alfred Herron's account receivable is overdue. Howard requires him to sign a 8…arrow_forwardJames Howard owns Howard Auto Sales. He periodically borrows money from Bay City State Bank and Trust. He permits some customers to sign short-term notes for their purchases. He usually discounts these notes at the bank. Following are selected transactions that occurred in March 20X1. DATE TRANSACTIONS 20X1 Mar. 4 Mr. Howard borrows $34,560 from the bank on a note payable for the business. Terms of the note are 10 percent interest for 45 days. 11 A 90-day $47,520 note payable to the bank is discounted at a rate of 8 percent. 22 Sold a car to Darnell Jones for $40,320 on a 75-day note receivable, bearing interest at 7 percent. 23 Discounted the Jones note with the bank. The bank charges a discount rate of 10 percent. 25 Sold a car for $48,960 to Henry Thomas. Thomas paid $4,000 cash and signed a 30-day note, bearing interest at 9 percent, for the balance. 28 Alfred Herron's account receivable is overdue. Howard requires him to sign a 8…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License