College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 2PA

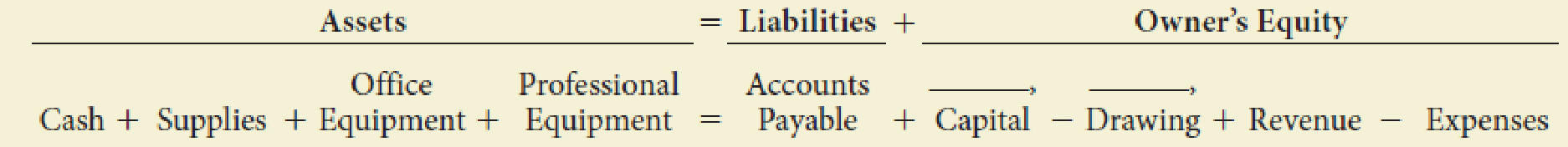

On July 1 of this year, R. Green established the Green Rehab Clinic. The organization’s account headings are presented below. Transactions completed during the month of July follow.

- a. Green deposited $30,000 in a bank account in the name of the business.

- b. Paid the office rent for the month, $1,800, Ck. No. 2001 (Rent Expense).

- c. Bought supplies for cash, $362, Ck. No. 2002.

- d. Bought professional equipment on account from Rehab Equipment Company, $18,000.

- e. Bought office equipment from Hi-Tech Computers, $2,890, paying $890 in cash and placing the balance on account, Ck. No. 2003.

- f. Sold professional services for cash, $4,600 (Professional Fees).

- g. Paid on account to Rehab Equipment Company, $700, Ck. No. 2004.

- h. Received and paid the bill for utilities, $367, Ck. No. 2005 (Utilities Expense).

- i. Paid the salary of the assistant, $1,150, Ck. No. 2006 (Salary Expense).

- j. Sold professional services for cash, $3,868 (Professional Fees).

- k. Green withdrew cash for personal use, $1,800, Ck. No. 2007.

Required

- 1. In the equation, write the owner’s name above the terms Capital and Drawing.

- 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses.

- 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

On July 1, 2019, Pat Glenn established Half Moon Realty. Pat completed the following transactions during the month of July:

a. Opened a business bank account with a deposit of $30,000 from personal funds.

b. Purchased office supplies on account, $3,010.

c. Paid creditor on account, $1,900.

d. Earned sales commissions, receiving cash, $30,690.

On July 1, 20Y7, Pat Glenn established Half

Moon Realty. Pat completed the following

transactions during the month of July:

A. Opened a business bank account with a

deposit of $20,000 from personal funds.

B.

C.

D.

E.

பட்

H.

Purchased office supplies on account,

$1,800.

Paid creditor on account, $1,350.

Earned sales commissions, receiving

cash, $40,000.

G. Paid automobile expenses (including

rental charge) for month, $3,050, and

miscellaneous expenses, $1,600.

Paid office salaries, $3,500.

Determined that the cost of supplies on

hand was $850; therefore, the cost of

supplies used was $950.

I.

Paid rent on office and equipment for the

month, $3,300.

Withdrew cash for personal use, $3,600.

Need Accounting equation grid

income statement

statement of owners equity

balance sheet

Journalize the following:

1. On the books & records of Company A:

On May 2nd, Company A received $100 of interest income from the bank earned in April. If the books are on an accrual basis, record the entry in April and in May when cash was received

April May

2. On the books & records of Company A:

In January, Company A purchased Investment in XYZ for $100. Payment was made in cash.

In March, Company A sold Investment in XYZ for $150. Payment was received in cash.

3. On the books & records of Company A:

On April 1st, Company A paid $1,200 for insurance expense that covers the year 4/1/17-3/31/18.

Record 4/1/17 entry for payment of $1,200

Record 4/30/17 journal entry

4. There are 2 parallel funds, Fund A and Fund B. Together, the funds will make an investment of $100k, with a 65/35 split. The investment will be paid in cash, however, Fund B does not currently have any cash so Fund…

Chapter 1 Solutions

College Accounting (Book Only): A Career Approach

Ch. 1 - Prob. 1QYCh. 1 - Prob. 2QYCh. 1 - Which of the following accounts would increase...Ch. 1 - Which of the following statements is true? a....Ch. 1 - M. Parish purchased supplies on credit. What is...Ch. 1 - Define assets, liabilities, owners equity,...Ch. 1 - Prob. 2DQCh. 1 - How do Accounts Payable and Accounts Receivable...Ch. 1 - Describe two ways to increase owners equity and...Ch. 1 - What is the effect on the fundamental accounting...

Ch. 1 - When an owner withdraws cash or goods from the...Ch. 1 - Define chart of accounts and identify the...Ch. 1 - What account titles would you suggest for the...Ch. 1 - Prob. 1ECh. 1 - Determine the following amounts: a. The amount of...Ch. 1 - Dr. L. M. Patton is an ophthalmologist. As of...Ch. 1 - Describe a business transaction that will do the...Ch. 1 - Describe a transaction that resulted in each of...Ch. 1 - Label each of the following accounts as asset (A),...Ch. 1 - Describe a transaction that resulted in the...Ch. 1 - Describe the transactions that are recorded in the...Ch. 1 - On June 1 of this year, J. Larkin, Optometrist,...Ch. 1 - On July 1 of this year, R. Green established the...Ch. 1 - S. Davis, a graphic artist, opened a studio for...Ch. 1 - On March 1 of this year, B. Gervais established...Ch. 1 - In April, J. Rodriguez established an apartment...Ch. 1 - Prob. 1PBCh. 1 - In March, K. Haas, M.D., established the Haas...Ch. 1 - Prob. 3PBCh. 1 - In March, T. Carter established Carter Delivery...Ch. 1 - In October, A. Nguyen established an apartment...Ch. 1 - Why Does It Matter? MACS CUSTOM CATERING, Eugene,...Ch. 1 - What Would You Say? A friend of yours wants to...Ch. 1 - Prob. 3A

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On July 1, 2019, Pat Glenn established Half Moon Realty. Pat completed the following transactions during the month of July:a. Opened a business bank account with a deposit of $25,000 from personal funds.b. Purchased office supplies on account, $1,850. c. Paid creditor on account, $1,200.d. Earned sales commissions, receiving cash, $41,500.e. Paid rent on office and equipment for the month, $3,600.f. Withdrew cash for personal use, $4,000.g. Paid automobile expenses (including rental charge) for the month, $3,050, and miscellaneous expenses, $1,600.h. Paid office salaries, $5,000.i. Determined that the cost of supplies on hand was $950; therefore, the cost of supplies used was $900.arrow_forwardBelow were selected transactions of FDNACCT Services for the month of September: • Paid rent for the month, P43,000 • Received the electricity bill, P17,000 • Paid salary of the secretary, P29,000 • Paid water bill, $4,400 Based on these transactions alone, how much was the total amount credited to Cash account?arrow_forwardDomingo Company started its business on January 1, 2019. The following transactions occurredduring the month of May. Prepare the journal entries in the journal on Page 1.A. The owners invested $10,000 from their personal account to the business account.B. Paid rent $500 with check #101.C. Initiated a petty cash fund $500 with check #102.D. Received $1,000 cash for services rendered.E. Purchased office supplies for $158 with check #103.F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30days.G. Received $800 cash for services rendered.H. Paid wages $600, check #105.I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77,miscellaneous expense $55. Cash on hand $11. Check #106.J. Increased petty cash by $30, check #107.arrow_forward

- Consider each of the transaction below independently. All expenditures were made in cash In march, the Cleanway Laundromat bought equipment. Cleanway paid $5,000 down and signed a noninterest-bearing note requiring the payment of $30,000 in nine months. The cash price for the equipment was $34,000. Prepare all necessary journal entries to record each the transaction. Use this format: Date Account Titles DR CRarrow_forwardPrepare the following journal entry, all transactions that occurred in January: The Corporation purchased a Delivery Van for customer deliveries. The Delivery Van cost $21,400. A down payment of cash in the amount of $5,000 was paid to the Car Dealership, and a promissory note was signed for the remaining amount owed.arrow_forwardOn May 1, 2018, Ma Concepcion Manalo established the Manalo Rehab Clinic. Transactions completed during the month of July follow: a. Manalo deposited P150,000 in a bank account in the name of the business. b. Paid office rent for the month P11,000. c. Bought supplies for cash , P2,750. d. Bought professional equipment on account from J. Perez Equipment, P142,000. e. Bought office equipment from S. Lacorte Computers, P18,700, paying P8,700 in cash and the remaining balance on account. f. Performed professional services for cash, P32,800. g. Paid accounts to S. Lacorte Computers, P5,000 h. Received and paid the bill for the utilities, P2,830 i. Paid salaries of the part-time assistants, P10,000 j. Performed professional services for cash, P37,250 k. Manalo withdrew cash for personal use, P16,000 Record the transactions for the month of July 2018 using a financial transaction worksheet. Use the following accounts: cash, account receivable, professional equipment, office equipment,…arrow_forward

- Javier Jimenez operates a delivery service. During the month of April, the firm had the following transactions. April 1 Issued a check in the amount of $4,800 to pay the monthly rent for the next 3 months. April 2 Javier made an additional investment of cash in amount of $11,200. April 4 Performed services for $715 in cash. April 6 Sent a check in the amount of $410 to the utility company to pay the monthly bill. April 7 Purchased supplies in the amount of $870 on credit. Prepare journal entries to record the above transactions. View transaction list Journal entry worksheet 1 2 3 Date April 01 Issued a check in the amount of $4,800 to pay the monthly rent for the next 3 months. Note: Enter debits before credits. 5 General Journal Debit Credit >arrow_forwardOn October 1, 20Y6, Jay Crowley established Affordable Realty, which completed the following transactions during the month: Oct. Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $31,500. Paid rent on office and equipment for the month, $2,650. Purchased supplies on account, $2,200. Paid creditor on account, $830. Earned sales commissions, receiving cash, $14,580. Paid automobile expenses (including rental charge) for month, $1,630, and miscellaneous expenses, $460. 7 Paid office salaries, $2,400. 8 Determined that the cost of supplies used was $1,150. 9 Paid dividends, $3,200. 1 2 3 4 5 6 1. Journalize entries for transactions Oct. 1 through 9. Refer to the Chart of Accounts for exact wording of account titles. 2. Post the journal entries to the T accounts, selecting the appropriate date to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete.…arrow_forwardOn April 1, 2019, Maria Adams established Custom Realty. Maria completed the following transactions during the month of April:a. Opened a business bank account with a deposit of $24,000 from personal funds.b. Paid rent on office and equipment for the month, $3,600.c. Paid automobile expenses (including rental charge) for the month, $1,350, and miscellaneous expenses, $600.d. Purchased office supplies on account, $1,200.e. Earned sales commissions (revenue) from selling real estate, receiving cash, $19,800.f. Paid creditor on account, $750.g. Paid office salaries, $2,500.h. Withdrew cash for personal use, $3,500.i. Determined that the cost of supplies on hand was $300; therefore, the cost of supplies used was $900.arrow_forward

- Carmelita Budoy, a dentist, established Budoy Clinic. The following transactions occurred during June of this year: Budoy deposited P280,000 in a bank account in the name of the business. Bought a 3-in-1 office equipment from E. Alcantara Equipment for P4,950, paying P1,000 in cash and the balance on account. Bought waiting room chairs and a table, paying cash, P12,300. Bought office intercom on account from Marikina Office Supply, P2,750. Received and paid the telephone bill, P1,080. Performed professional services on account, P12,940. Received and paid the electric bill, P1,850. Received and paid the bill for the Regional Dental Convention, P3,500. Performed professional services for cash, P17,650. Partially settled accounts with Marikina Office Supply, P1,000. Paid rent for the month, P8,400. Paid salaries of the part-time receptionist, P3,500. Budoy withdrew cash for personal use, P8,500. Received P5,500 on account from patients who were previously billed. Required: Prepare…arrow_forwardBayoud has started a computer servicing center on May 1, 2021. Following are some events andtransactions that occurred in the month of May:May 1 Bayoud invested $7,000 cash in the business.3 Purchased $600 of supplies on account.5 Paid $125 to advertise in the County News.9 Received $4,000 cash for services performed.15 Received $5,400 for services to be performed in July.17 Paid $2,500 for employee salaries.20 Paid the one year’s rent in advance $1200.29 Purchased equipment for $4,200 on account.Instructions:(i) Show the tabular analysis of the above transactions. (ii) Give the necessary journals. (iii) Prepare the ledger for Cash accountarrow_forwardBayoud has started a computer servicing center on May 1, 2021. Following are some events andtransactions that occurred in the month of May:May 1 Bayoud invested $7,000 cash in the business.3 Purchased $600 of supplies on account.5 Paid $125 to advertise in the County News.9 Received $4,000 cash for services performed.15 Received $5,400 for services to be performed in July.17 Paid $2,500 for employee salaries.20 Paid the one year’s rent in advance $1200.29 Purchased equipment for $4,200 on account.Instructions:Prepare the ledger for Cash account.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY