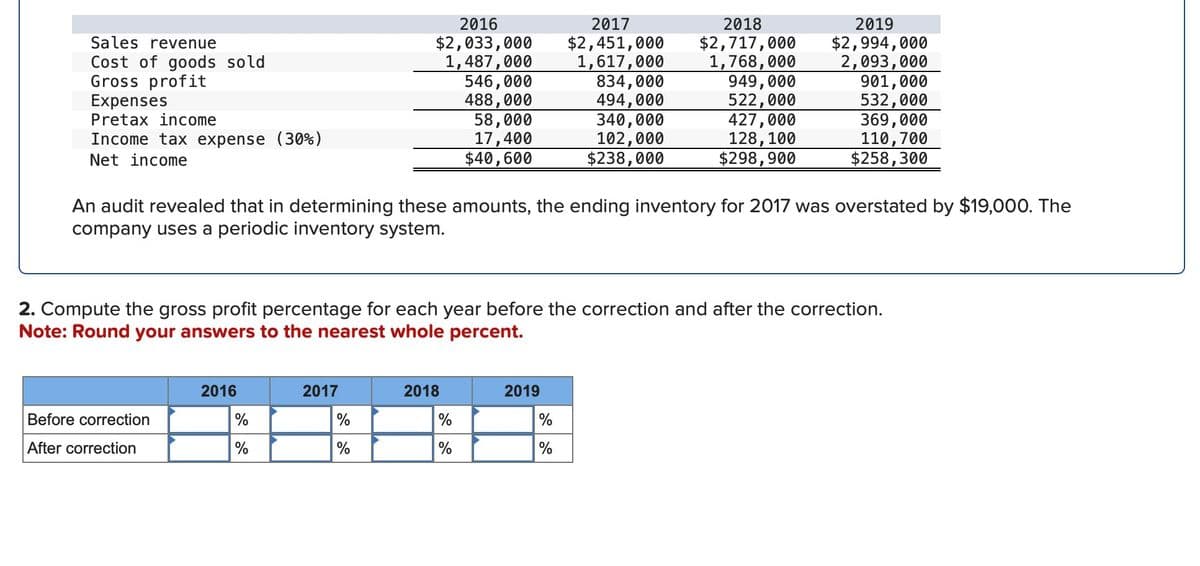

Sales revenue Cost of goods sold Gross profit Expenses Pretax income Income tax expense (30%) Net income 2016 $2,033,000 1,487,000 2017 $2,451,000 1,617,000 2018 $2,717,000 1,768,000 2019 $2,994,000 2,093,000 546,000 834,000 949,000 901,000 488,000 494,000 522,000 532,000 58,000 340,000 427,000 369,000 17,400 102,000 128,100 110,700 $40,600 $238,000 $298,900 $258,300 An audit revealed that in determining these amounts, the ending inventory for 2017 was overstated by $19,000. The company uses a periodic inventory system. 2. Compute the gross profit percentage for each year before the correction and after the correction. Note: Round your answers to the nearest whole percent.

Sales revenue Cost of goods sold Gross profit Expenses Pretax income Income tax expense (30%) Net income 2016 $2,033,000 1,487,000 2017 $2,451,000 1,617,000 2018 $2,717,000 1,768,000 2019 $2,994,000 2,093,000 546,000 834,000 949,000 901,000 488,000 494,000 522,000 532,000 58,000 340,000 427,000 369,000 17,400 102,000 128,100 110,700 $40,600 $238,000 $298,900 $258,300 An audit revealed that in determining these amounts, the ending inventory for 2017 was overstated by $19,000. The company uses a periodic inventory system. 2. Compute the gross profit percentage for each year before the correction and after the correction. Note: Round your answers to the nearest whole percent.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter5: Inventories And Cost Of Goods Sold

Section: Chapter Questions

Problem 5.9E: Working Backward: Gross Profit Ratio Acmes gross profit ratio increased by 20% over the prior year....

Related questions

Question

Transcribed Image Text:Sales revenue

Cost of goods sold

Gross profit

Expenses

Pretax income

Income tax expense (30%)

Net income

2016

$2,033,000

1,487,000

2017

$2,451,000

2018

$2,717,000

2019

$2,994,000

1,617,000

1,768,000

2,093,000

546,000

834,000

949,000

901,000

488,000

494,000

522,000

532,000

58,000

340,000

427,000

369,000

17,400

102,000

128,100

110,700

$40,600

$238,000

$298,900

$258,300

An audit revealed that in determining these amounts, the ending inventory for 2017 was overstated by $19,000. The

company uses a periodic inventory system.

2. Compute the gross profit percentage for each year before the correction and after the correction.

Note: Round your answers to the nearest whole percent.

2016

2017

2018

2019

Before correction

%

%

%

%

After correction

%

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning