ood X as an input into its manufacturing process. It buys 8000 units of good X 1000 units of good Y, which it sells for $400 per unit. It pays $200000 in wag es, with the rest as profits. =nt takes in taxes from only these two firms, and uses it to pay wages to provid. ervices, for instance national defense. te GDP using the three different methods. (Of course, you'll arrive at the same cate clearly what values you're using in each case to arrive at the final answer, know what is included in each method of calculating GDP.) coach: approach: ue-added) approach:

ood X as an input into its manufacturing process. It buys 8000 units of good X 1000 units of good Y, which it sells for $400 per unit. It pays $200000 in wag es, with the rest as profits. =nt takes in taxes from only these two firms, and uses it to pay wages to provid. ervices, for instance national defense. te GDP using the three different methods. (Of course, you'll arrive at the same cate clearly what values you're using in each case to arrive at the final answer, know what is included in each method of calculating GDP.) coach: approach: ue-added) approach:

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter13: Positive Externalities And Public Goods

Section: Chapter Questions

Problem 9RQ: In what ways (it) company investments in research and development create positive externalities?

Related questions

Question

Transcribed Image Text:Question 1

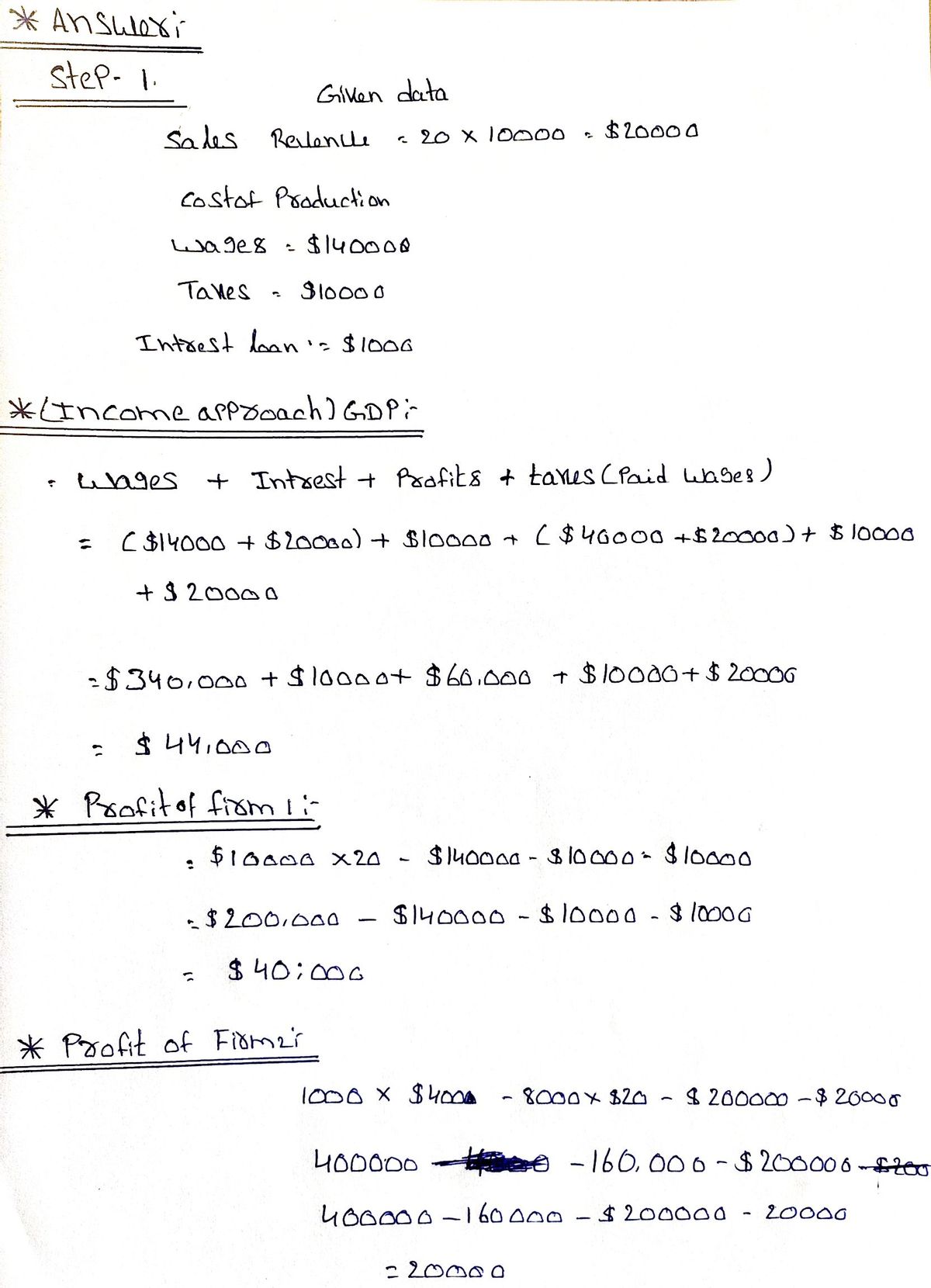

Consider an economy with two firms and a government. Firm 1 produces 10000 units of good X, which

it sells for $20 per unit. It uses this revenue to pay $140000 in wages, $10000 in taxes, and $10000 in

interest on a loan, with the rest as profits. Firm 1 sells some of its output to consumers, and some to

Firm 2 as an intermediate good in their production process.

Firm 2 uses good X as an input into its manufacturing process. It buys 8000 units of good X and uses

them to create 1000 units of good Y, which it sells for $400 per unit. It pays $200000 in wages and

$20000 in taxes, with the rest as profits.

The government takes in taxes from only these two firms, and uses it to pay wages to provide

government services, for instance national defense.

Please calculate GDP using the three different methods. (Of course, you'll arrive at the same answer;

however, indicate clearly what values you're using in each case to arrive at the final answer, so as to

illustrate you know what is included in each method of calculating GDP.)

1)Income approach:

2)Expenditure approach:

3)Product (value-added) approach:

Expert Solution

Step 1

*Answer:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax