Giant Machinery Ltd is considering to invest in one of the two following Projects to buy a new equipment. Each project will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 9%. The cash flows of the projects are provided below. Required: a) Identify which project should the company accept based on NPV method. b) Identify which project should the company accept based on simple pay back method if the payback criteria is maximum 2 years. c) Which project Giant Machinery should choose if two methods are in conflict.

Giant Machinery Ltd is considering to invest in one of the two following Projects to buy a new equipment. Each project will last 5 years and have no salvage value at the end. The company’s required rate of

Required:

a) Identify which project should the company accept based on

b) Identify which project should the company accept based on simple pay back method if the payback criteria is maximum 2 years.

c) Which project Giant Machinery should choose if two methods are in conflict.

- a) NPV of both the projects is calculated using the formula of present value.

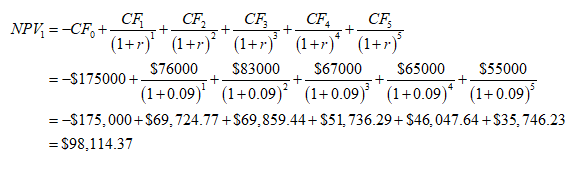

NPV of Project 1 can be calculated as below :

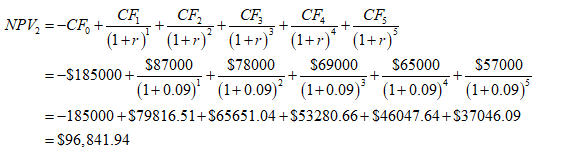

NPV of Project 2 can be calculated as below:

Answer: NPV of Project 1 is $98,114.37 is greater than Project 2’s $96,841.94. Hence Project 1 should be accepted.

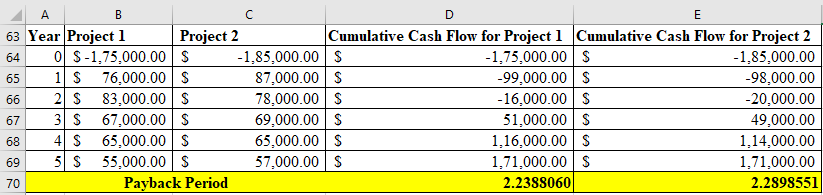

Simple payback period is calculated as the number of years to recover the cost of investment, ignoring the time value of money

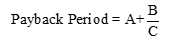

Payback Period is calculated as below:

Here,

A = Last period or year in which the cumulative cash flow is negative

B = Absolute vale of the cumulative cash flow at the period A

C = Total cash inflow just after the period A

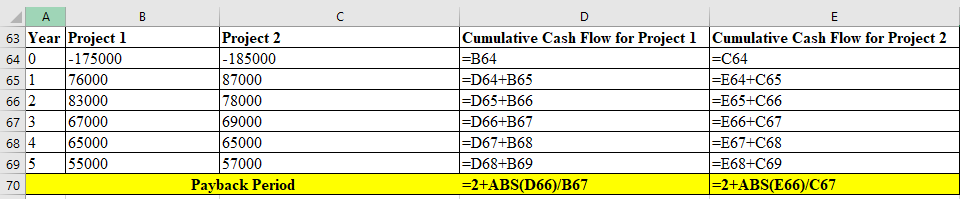

Please refer to the excel for calculations:

Workings:

Result:

Answer:

Payback Period:

Project 1 = 2.24 years

Project 2 = 2.29 years

Since, both the projects have payback period more than 2 years, neither of these should be chosen.

Step by step

Solved in 3 steps with 5 images