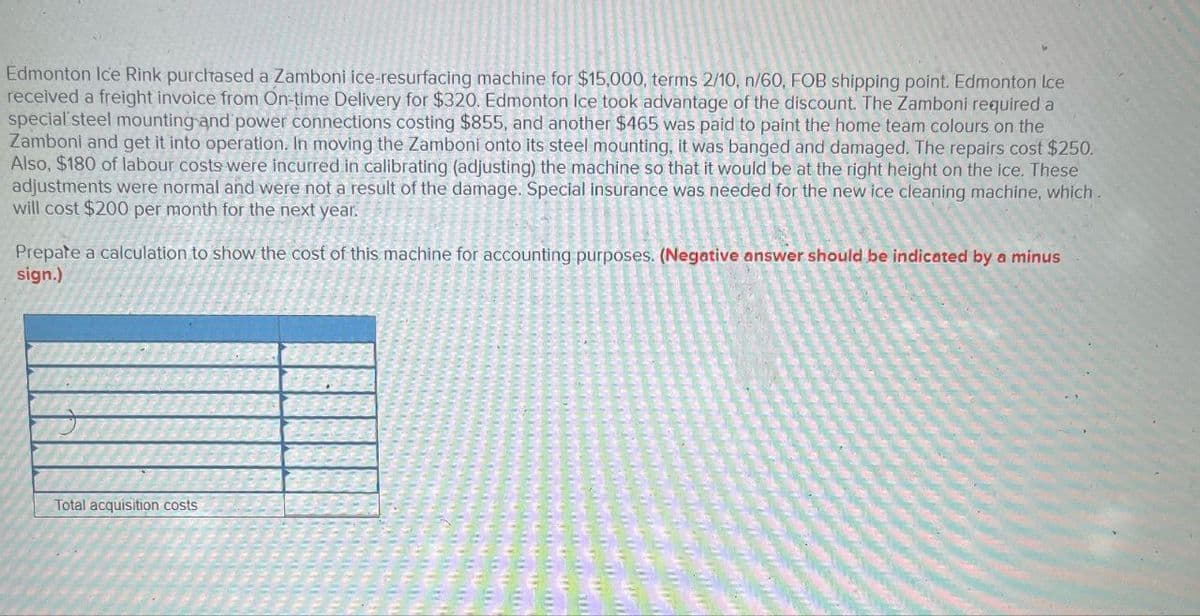

Edmonton Ice Rink purchased a Zamboni ice-resurfacing machine for $15,000, terms 2/10, n/60, FOB shipping point. Edmonton Ice received a freight invoice from On-time Delivery for $320. Edmonton Ice took advantage of the discount. The Zamboni required a special steel mounting and power connections costing $855, and another $465 was paid to paint the home team colours on the Zamboni and get it into operation. In moving the Zamboni onto its steel mounting, it was banged and damaged. The repairs cost $250. Also, $180 of labour costs were incurred in calibrating (adjusting) the machine so that it would be at the right height on the ice. These adjustments were normal and were not a result of the damage. Special insurance was needed for the new ice cleaning machine, which. will cost $200 per month for the next year.

Edmonton Ice Rink purchased a Zamboni ice-resurfacing machine for $15,000, terms 2/10, n/60, FOB shipping point. Edmonton Ice received a freight invoice from On-time Delivery for $320. Edmonton Ice took advantage of the discount. The Zamboni required a special steel mounting and power connections costing $855, and another $465 was paid to paint the home team colours on the Zamboni and get it into operation. In moving the Zamboni onto its steel mounting, it was banged and damaged. The repairs cost $250. Also, $180 of labour costs were incurred in calibrating (adjusting) the machine so that it would be at the right height on the ice. These adjustments were normal and were not a result of the damage. Special insurance was needed for the new ice cleaning machine, which. will cost $200 per month for the next year.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 9EB: Ronson recently purchased a new boat to help ship product overseas. The following information is...

Related questions

Question

Transcribed Image Text:Edmonton Ice Rink purchased a Zamboni Ice-resurfacing machine for $15,000, terms 2/10, n/60, FOB shipping point. Edmonton Ice

received a freight invoice from On-time Delivery for $320. Edmonton Ice took advantage of the discount. The Zamboni required a

special' steel mounting and power connections costing $855, and another $465 was paid to paint the home team colours on the

Zamboni and get it into operation. In moving the Zamboni onto its steel mounting, it was banged and damaged. The repairs cost $250.

Also, $180 of labour costs were incurred in calibrating (adjusting) the machine so that it would be at the right height on the ice. These

adjustments were normal and were not a result of the damage. Special insurance was needed for the new ice cleaning machine, which.

will cost $200 per month for the next year.

Prepare a calculation to show the cost of this machine for accounting purposes. (Negative answer should be indicated by a minus

sign.)

Total acquisition costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College