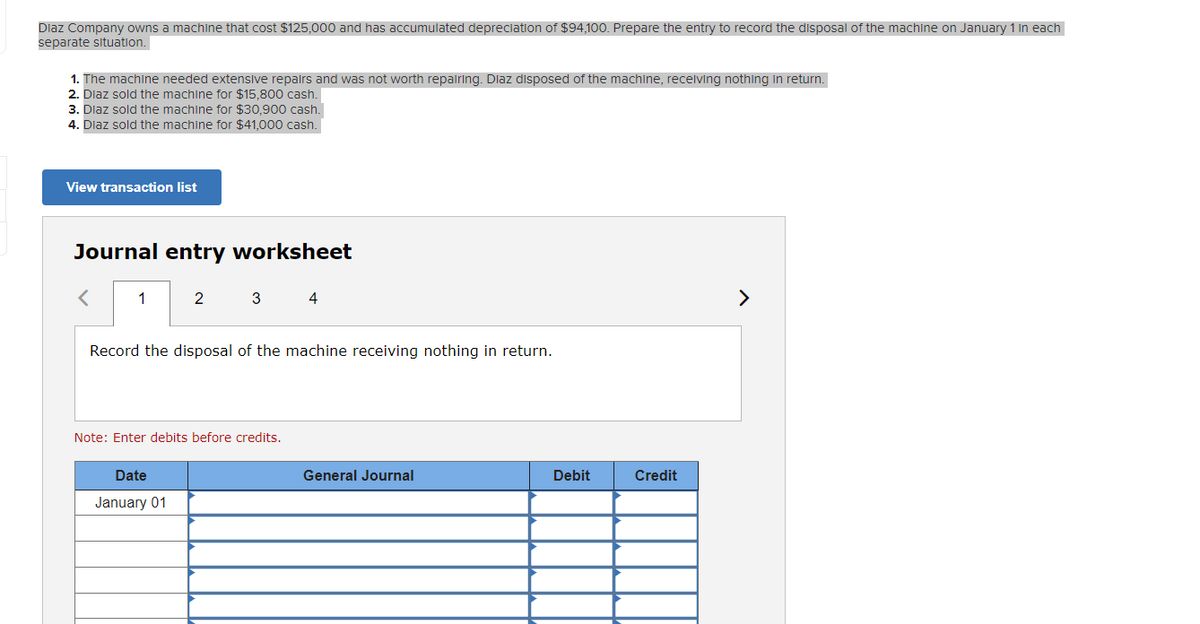

Diaz Company owns a machine that cost $125,000 and has accumulated depreciation of $94,100. Prepare the entry to record the disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return. 2. Diaz sold the machine for $15,800 cash. 3. Diaz sold the machine for $30,900 cash. 4. Diaz sold the machine for $41,000 cash.

Diaz Company owns a machine that cost $125,000 and has accumulated depreciation of $94,100. Prepare the entry to record the disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return. 2. Diaz sold the machine for $15,800 cash. 3. Diaz sold the machine for $30,900 cash. 4. Diaz sold the machine for $41,000 cash.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter17: Business Tax Credits And The Alternative Minimum Tax

Section: Chapter Questions

Problem 6CE

Related questions

Question

rmn.3

Transcribed Image Text:Diaz Company owns a machine that cost $125,000 and has accumulated depreciation of $94,100. Prepare the entry to record the disposal of the machine on January 1 in each

separate situation.

1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return.

2. Diaz sold the machine for $15,800 cash.

3. Diaz sold the machine for $30,900 cash.

4. Diaz sold the machine for $41,000 cash.

View transaction list

Journal entry worksheet

<

1

2

3

4

Record the disposal of the machine receiving nothing in return.

Note: Enter debits before credits.

Date

January 01

General Journal

Debit

Credit

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College