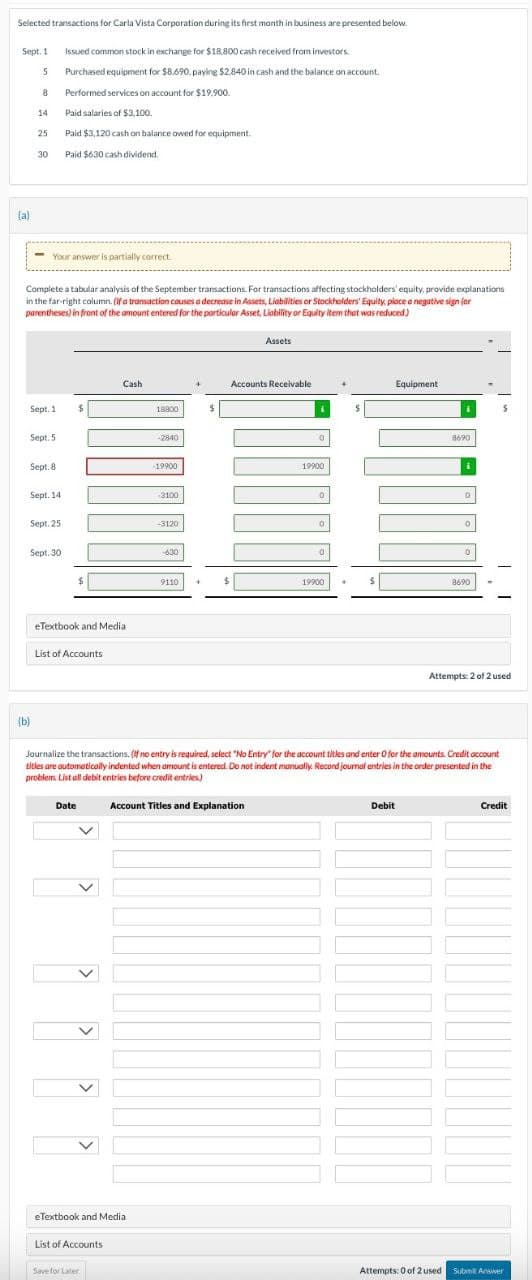

Selected transactions for Carla Vista Corporation during its first month in business are presented below. Sept. 1 Issued common stock in exchange for $18,800 cash received from investors. 5 Purchased equipment for $8.690, paying $2.840 in cash and the balance on account. 8 Performed services on account for $19.900. 14 Paid salaries of $3,100. 25 Paid $3,120 cash on balance owed for equipment. 30 Paid $630 cash dividend Your answer is partially correct Complete a tabular analysis of the September transactions. For transactions affecting stockholders' equity, provide explanations in the far-right column. (If a transaction couses a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced)

Selected transactions for Carla Vista Corporation during its first month in business are presented below. Sept. 1 Issued common stock in exchange for $18,800 cash received from investors. 5 Purchased equipment for $8.690, paying $2.840 in cash and the balance on account. 8 Performed services on account for $19.900. 14 Paid salaries of $3,100. 25 Paid $3,120 cash on balance owed for equipment. 30 Paid $630 cash dividend Your answer is partially correct Complete a tabular analysis of the September transactions. For transactions affecting stockholders' equity, provide explanations in the far-right column. (If a transaction couses a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced)

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter2: Basic Accounting Systems: Cash Basis

Section: Chapter Questions

Problem 2.10E: Effects of transactions on Accounting equation On Time Delivery Service had the following selected...

Related questions

Question

Transcribed Image Text:Selected transactions for Carla Vista Corporation during its first month in business are presented below.

Sept. 1

Issued common stock in exchange for $18,800 cash received from investors.

(a)

5

Purchased equipment for $8.690. paying $2.840 in cash and the balance on account.

8

Performed services on account for $19.900.

Paid salaries of $3,100.

25

Paid $3,120 cash on balance owed for equipment.

30

Paid $630 cash dividend.

Your answer is partially correct

Complete a tabular analysis of the September transactions. For transactions affecting stockholders' equity, provide explanations

in the far-right column. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or

parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced)

Assets

Cashi

Sept. 1

18800

Accounts Receivable

Sept. 5

-2840

0

Sept. 8

-19900

19900

111111

Sept. 14

Sept. 25

Sept. 30

3100

-3120

°

0

(b)

eTextbook and Media

List of Accounts

Equipment

8690

0

°

9110

$

19900

8690

Attempts: 2 of 2 used

Journalize the transactions. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account

titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the

problem. List all debit entries before credit entries)

Date

Account Titles and Explanation

eTextbook and Media

List of Accounts

Save for Later

Debit

Credit

Attempts: 0 of 2 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,