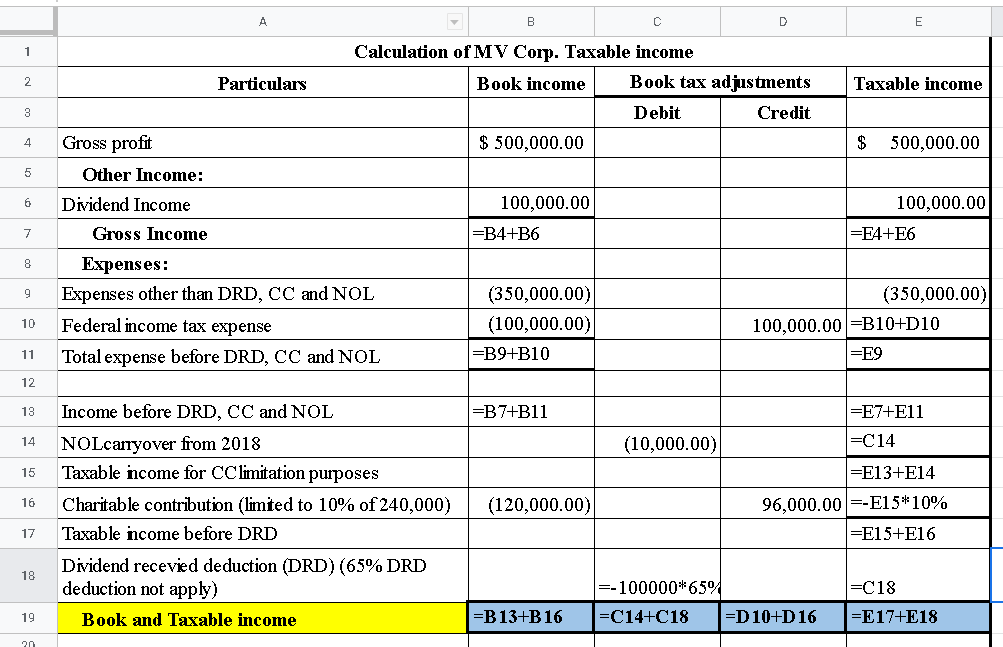

Compute MV Corp.'s 2020 taxable income given the following information relating to its year 1 activities. Also, compute MV M-1 assuming that MV's federal income tax expense for book purposes is $100,000. Use Exhibit 16-6. • Gross profit from inventory sales of $500,000 (no book-tax differences). • Dividends MV received from 25 percent-owned corporation of $100,000 (assume this is also MV's pro rata share of the d corporation's earnings). • Expenses other than DRD, charitable contribution (CC), and net operating loss (NOL) are $350,000 (no book-tax differene • NOL carryover from 2019 of $10,000. • Cash charitable contribution of $120,000. Complete this question by entering your answers in the tabs below. Req 1 Req 2

Compute MV Corp.'s 2020 taxable income given the following information relating to its year 1 activities. Also, compute MV M-1 assuming that MV's federal income tax expense for book purposes is $100,000. Use Exhibit 16-6. • Gross profit from inventory sales of $500,000 (no book-tax differences). • Dividends MV received from 25 percent-owned corporation of $100,000 (assume this is also MV's pro rata share of the d corporation's earnings). • Expenses other than DRD, charitable contribution (CC), and net operating loss (NOL) are $350,000 (no book-tax differene • NOL carryover from 2019 of $10,000. • Cash charitable contribution of $120,000. Complete this question by entering your answers in the tabs below. Req 1 Req 2

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 47P

Related questions

Question

Transcribed Image Text:Compute MV Corp.'s 2020 taxable income given the following information relating to its year 1 activities. Also, compute MV's Schedule

M-1 assuming that MV's federal income tax expense for book purposes is $100,000. Use Exhibit 16-6.

• Gross profit from inventory sales of $500,000 (no book-tax differences).

• Dividends MV received from 25 percent-owned corporation of $100,000 (assume this is also MV's pro rata share of the distributing

corporation's earnings).

• Expenses other than DRD, charitable contribution (CC), and net operating loss (NOL) are $350,000 (no book-tax differences).

• NOL carryover from 2019 of $10,000.

• Cash charitable contribution of $120,000.

Complete this question by entering your answers in the tabs below.

Req 1

Req 2

Compute MV's Schedule M-1 assuming that MV's federal income tax expense for book purposes is $100,000. (Enter all values

as positive numbers.)

Expert Solution

Step 1

Taxable income calculation formula table:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you