Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 1MAD

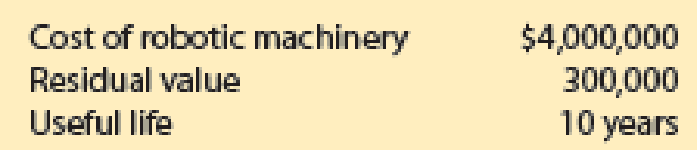

San Lucas Corporation is considering investment in robotic machinery based upon the following estimates:

- a. Determine the

net present value of the equipment, assuming a desiredrate of return of 10% and annual net cash flows of $700,000. Use the present value tables appearing in Exhibits 2 and 5 of this chapter. - b. Determine the net present value of the equipment, assuming a desired rate of return of 10% and annual net cash flows of $500,000, $700,000, and $900,000. Use the present value tables (Exhibits 2 and 5) provided in the chapter in determining your answer.

- c. Determine the minimum annual net cash flow necessary to generate a positive net present value, assuming a desired rate of return of 10%. Round to the nearest dollar.

- d.

Interpret the results of parts (a), (b), and (c).

Interpret the results of parts (a), (b), and (c).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

From the attached please answer

a. Determine the initial outlay of the project.b. Calculate the annual after-tax operating cash flow for Years 1 -5.c. Determine the terminal year non-operating cash flow in year 5:d. Taking into consideration all the information given, determine the Net Present Value of the project and advice the company on whether to invest in the new line of product.e. What is the estimated Internal Rate of Return (IRR) of the project?f. Should the project be accepted based on the IRR?

g. Calculate to the following for Pharmos considering its tax rate of 25 percent.

i. Total Market Value for the Firm

ii, After-tax cost of Loaniii. After-tax cost of Bondsiv. Cost of Equityv. Cost of Preferred Stockvi. Weighted Average Cost of Capital (WACC)

DuraTech Manufacturing is evaluating a process improvement project. The estimated receipts and disbursements associated with the project are shown below. MARR is 6%/year. Solve, a. What is the present worth of this investment? b. What is the decision rule for judging the attractiveness of investments based on present worth? c. Should DuraTech implement the proposed process improvement?

DuraTech Manufacturing is evaluating a process improvement project. The estimated receipts and disbursements associated with the project are shown below. MARR is 6%/year. Solve, a.What is the future worth of this investment?b. What is the decision rule for judging the attractiveness of investments based on future worth? c. Should DuraTech implement the proposed process improvement?

Chapter 12 Solutions

Managerial Accounting

Ch. 12 - What are the principal objections to the use of...Ch. 12 - Discuss the principal limitations of the cash...Ch. 12 - Prob. 3DQCh. 12 - Your boss has suggested that a one-year payback...Ch. 12 - Prob. 5DQCh. 12 - Prob. 6DQCh. 12 - A net present value analysis used to evaluate a...Ch. 12 - Two projects have an identical net present value...Ch. 12 - Prob. 9DQCh. 12 - What are the major disadvantages of the use of the...

Ch. 12 - Prob. 11DQCh. 12 - Prob. 12DQCh. 12 - Average rate of return Determine the average rate...Ch. 12 - Prob. 2BECh. 12 - Prob. 3BECh. 12 - Internal rate of return A project is estimated to...Ch. 12 - Prob. 5BECh. 12 - Average rate of return The following data are...Ch. 12 - Average rate of returncost savings Maui...Ch. 12 - Average rate of returnnew product Hana Inc. is...Ch. 12 - Determine cash flows Natural Foods Inc. is...Ch. 12 - Cash payback period for a service company Janes...Ch. 12 - Cash payback method Lily Products Company is...Ch. 12 - Prob. 7ECh. 12 - Net present value method for a service company...Ch. 12 - Net present value methodannuity for a service...Ch. 12 - Net present value methodannuity Jones Excavation...Ch. 12 - Prob. 11ECh. 12 - Prob. 12ECh. 12 - Prob. 13ECh. 12 - Prob. 14ECh. 12 - Prob. 15ECh. 12 - Prob. 16ECh. 12 - Prob. 17ECh. 12 - Prob. 18ECh. 12 - Prob. 19ECh. 12 - Prob. 20ECh. 12 - Net present value-unequal lives Bunker Hill Mining...Ch. 12 - Prob. 22ECh. 12 - Average rate of return method, net present value...Ch. 12 - Prob. 2PACh. 12 - Net present value method, present value index, and...Ch. 12 - Net present value method, internal rate of return...Ch. 12 - Prob. 5PACh. 12 - Prob. 6PACh. 12 - Prob. 1PBCh. 12 - Prob. 2PBCh. 12 - Net present value method, present value index, and...Ch. 12 - Prob. 4PBCh. 12 - Prob. 5PBCh. 12 - Prob. 6PBCh. 12 - San Lucas Corporation is considering investment in...Ch. 12 - Prob. 2MADCh. 12 - Prob. 3MADCh. 12 - Prob. 4MADCh. 12 - Prob. 5MADCh. 12 - Assume Home Garden Inc. in MAD 26-5 assigns the...Ch. 12 - Ethics in Action Danielle Hastings was recently...Ch. 12 - Prob. 4TIFCh. 12 - CEO, Worthington Industries (WOR) (a...Ch. 12 - Prob. 6TIFCh. 12 - Prob. 1CMACh. 12 - Staten Corporation is considering two mutually...Ch. 12 - Prob. 3CMACh. 12 - Foster Manufacturing is analyzing a capital...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume Home Garden Inc. in MAD 26-5 assigns the following probabilities to the estimated construction cost of the warehouse and annual net cash flows: a. Compute the expected value of the construction cost. b. Compute the expected value of the annual net cash flows. c. Determine the expected net present value of building the distribution warehouse, assuming a desired rate of return of 14% and using the expected values computed in parts (a) and (b). Use the present value tables provided in Appendix A. Round to the nearest dollar. d. Based on your results in part (c), should Home Garden Inc. build the distribution warehouse?arrow_forwardDetermine which equipment should be favored, comparing the net present values of the two proposals and assuming a minimum rate of return of 15%. Use the present value table appearing above. Processing Mill Electric Shovel EE Present value of net cash flow total Less amount to be invested Net present value Which project should be favored?arrow_forwardLehigh Products Company is considering the purchase of nen automated equipment. The project has an expected set present value of $250,000 with a standard deviation of $100,000. Question: 1. What is the probability that the project will have a net present value less than $50,000, assuming that net present value is normally distributed?arrow_forward

- The most possible values of an investment project are as follows: First cost, $ 300,000 Annual operating cost, $ 10,000 Annual benefit, $ 120,000 Salvage value, $ 80,000 Life, year 30 MARR per year 15% The most uncertain parameters are annual operating cost and annual benefit. Perform a multiparameter sensitivity analysis and write your conclusions. Consider the cash flow given. Calculate the payback period with time value. Calculate the B/C ratios based on both PW and AW.arrow_forwardDuraTech Manufacturing is evaluating a process improvement project. The estimated receipts and disbursements associated with the project are shown below. MARR is 6%/yr. Solve, a. What is the internal rate of return of this investment? b. What is the decision rule for judging the attractiveness of investments based on internal rate of return? c. Should DuraTech implement the proposed process improvement?arrow_forwardS T m Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2022. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. New assets will be depreciated under the MACRS system rather than being fully expensed right away. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent. Type of Capital Budgeting Decision OA. $34,400 OB. $66,400 1 Expansion OC. $80,000 OD. $13,600 Type of Project Cost of new asset Installation costs MACRS (new asset) Original cost of old asset Purchase date (old asset) Sale proceeds (old asset) MACRS (old asset) Annual net profits before depreciation & taxes (old) Annual net profits before depreciation & taxes (new)…arrow_forward

- Home Garden Inc. is considering the construction of a distribution warehouse in West Virginia to service its east coast stores based on the following estimates: a. Determine the net present value of building the warehouse, assuming a construction cost of 20,000,000, an annual net cost savings of 4,000,000, and a desired rate of return of 14%. Use the present value tables provided in Appendix A. b. Determine the net present value of building the warehouse, assuming a construction cost of 25,000,000, an annual net cost savings of 2,500,000, and a desired rate of return of 14%. Use the present value tables provided in Appendix A. c. Interpret the results of parts (a) and (b).arrow_forwardRoberts Company is considering an investment in equipment that is capable of producing more efficiently than the current technology. The outlay required is 2,293,200. The equipment is expected to last five years and will have no salvage value. The expected cash flows associated with the project are as follows: Required: 1. Compute the projects payback period. 2. Compute the projects accounting rate of return. 3. Compute the projects net present value, assuming a required rate of return of 10 percent. 4. Compute the projects internal rate of return.arrow_forwardAssume San Lucas Corporation in MAD 26-1 assigns the following probabilities to the estimated annual net cash flows: a. Compute the expected value of the annual net cash flows. b. Determine the expected net present value of the equipment, assuming a desired rate of return of 10% and the expected annual net cash flows computed in part (a). Use the present value tables (Exhibits 2 and 5) provided in the chapter in determining your answer. c. Based on your results in parts (a) and (b), should San Lucas Corporation invest in the equipment?arrow_forward

- Spencer Enterprises is attempting to choose among a series of new investment alternatives. The potential investment alternatives, the net present value of the future stream of returns, the capital requirements, and the available capital funds over the next three years are summarized as follows: Develop and solve an integer programming model for maximizing the net present value. Assume that only one of the warehouse expansion projects can be implemented. Modify your model from part (a). Suppose that if test marketing of the new product is carried out, the advertising campaign also must be conducted. Modify your formulation from part (b) to reflect this new situation.arrow_forwardCalculate the project cash flows for each year. Based on these cash flows and the average project cost of capital, what are the projects NPV, IRR, MIRR, PI, payback, and discounted payback? Do these indicators suggest that the project should be undertaken?arrow_forwardThere are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: Use the information from the previous exercise to calculate the internal rate of return on both projects and make a recommendation on which one to accept. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Asset impairment explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=lWMDdtHF4ZU;License: Standard Youtube License