Learning Goal 5

ST7-2

a. Use the free cash flow valuation model to estimate the value of Envin's entire Active Shoe Division.

b. Use your finding in part a along with the data provided to find this division's common stock value.

c. If the Active Shoe Division as a public company will have 500.000 shares outstanding, use your finding in part b to calculate as value per share.

Want to see the full answer?

Check out a sample textbook solution

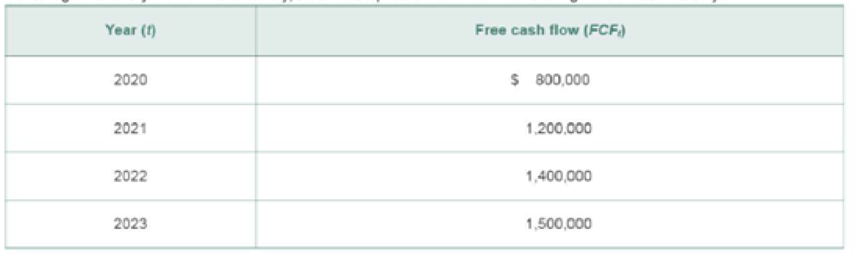

- Free Cash Flow Valuation Dozier Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFs) during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Dozier’s weighted average cost of capital is WACC = 13%. What is Dozier’s horizon value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) What is the current value of operations for Dozier? Suppose Dozier has $10 million in marketable securities, $100 million in debt, and 10 million shares of stock. What is the intrinsic price per share?arrow_forwardAFN Equation Refer to Problem 9-1. What would be the additional funds needed if the companys year-end 2018 assets had been 7 million? Assume that all other numbers, including sales, are the same as in Problem 9-1 and that the company is operating at full capacity. Why is this AFN different from the one you found in Problem 9-1? Is the companys capital intensity ratio the same or different?arrow_forwardFenton, Inc., has established a new strategic plan that calls for new capital investment. The company has a 9.8% required rate of return and an 8.3% cost of capital. Fenton currently has a return of 10% on its other investments. The proposed new investments have equal annual cash inflows expected. Management used a screening procedure of calculating a payback period for potential investments and annual cash flows, and the IRR for the 7 possible investments are displayed in image. Each investment has a 6-year expected useful life and no salvage value. A. Identify which project(s) is/are unacceptable and briefly state the conceptual justification as to why each of your choices is unacceptable. B. Assume Fenton has $330,000 available to spend. Which remaining projects should Fenton invest in and in what order? C. If Fenton was not limited to a spending amount, should they invest in all of the projects given the company is evaluated using return on investment?arrow_forward

- You expect ATM Corporation to generate the following free cash flows over the next five years: Year 1 2 3 4 5 FCF ($ millions) 75 84 96 111 120 Beginning with year six, you estimate that ATMʹs free cash flows will grow at 6% per year and that ATMʹs weighted average cost of capital is 15%. The enterprise value of ATM corporation is closest to: A. $1017.66 million B. $314.98 million C. $1413.33 million D. $702.67 millionarrow_forwardIntro IBM is planning to produce an expert system based on artificial intelligence and expects the following cash flows (in $ million) at the end of each year: Year Cash flow 0 -49 1 10 2 15 3 20 4 20 30 The company requires a return of 12% from this project. Part 1 What is the project's profitability index? 2+ decimals Submitarrow_forwardеВook Problem Walk-Through Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 years, after which FCF is expected to grow at a constant 5% rate. Dantzler's WACC is 13%. Year 2 FCF (S millions) $20 $30 $38 a. What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round intermediate calculations. Round your answer to two decimal places. million b. What is the firm's market value today? Assume that Dantzler has zero nonoperating assets. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round intermediate calculations. Round your answer to two decimal places. million c. Suppose Dantzler has $199.40 million of debt and 17 million shares of stock outstanding. What is…arrow_forward

- Chua Chang & Wu Inc. is planning its operations for next year, and the CEO wants you to forecast the firm's additional funds needed (AFN). Data for use in your forecast are shown below. Based on the AFN equation, what is the AFN for the coming year? $200,000 40% $127,500 20.0% Last year's sales = So Sales growth rate=g Last year's total assets = Ao Last year's profit margin = PM -$11,000 O O O O O a. b.-$25,571 c.-$7,000 d.-$25,000 e. -$19,000 Last year's accounts payable Last year's notes payable Last year's accruals Target payout ratio $50,000 $15,000 $20,000 25.0%arrow_forwardBased on the investor expectations of earning at least 12%, should this projected below be completed? Year 0 1 2 3 4 5 6 Cash Flow (133,000) 37,000 42,750 44,000 46,500 82,500 77,000 Please explain why or why not the company should move forward with this endeavor.arrow_forwardFree Cash Flow Valuation Dozier Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFs) during the next 3 years, after which FCF is expected to grow at a constant 5% rate. Dozier's weighted average cost of capital is WACC = 14%. Year 1 2 3 Free cash flow ($ millions) -$20 $30 $40 What is Dozier's horizon value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Round your answer to two decimal places.$ million What is the current value of operations for Dozier? Do not round intermediate calculations. Round your answer to two decimal places.$ million Suppose Dozier has $10 million in marketable securities, $100 million in debt, and 10 million shares of stock. What is the intrinsic price per share? Do not round intermediate calculations. Round your answer to the nearest cent.$arrow_forward

- You are evaluating a prospective LBO investment and determine that the Year 5 free cash flow (FCF) estimate is $850 million. Additionally, based on related work you estimate that the appropriate discount rate is 8.5% and the long term growth rate is 3.5%. Based on the perpetuity growth method, the Terminal Value of the company is _________ in Year Group of answer choices a. $17.6 bn, year 5 b. $17.0 bn, year 6 c. $10.0 bn, year 5 d. $17.6 bn, year 6arrow_forwardChachagogo, Inc. is planning its operations for next year, and the CEO wants you to forecast the firm's additional funds needed (AFN). Data for use in your forecast are shown below. Based on the AFN equation, what is the AFN for the coming year? Last year's sales P200,000 Sales growth rate 40% Last year's current assets 65,000 Last year's noncurrent assets 70,000 Last year's profit margin 20.0% L last year's accounts payable P50,000 Last year's notes payable P25,000 Last year's accruals P20,000 Target plowback ratio 75.0% choices: -44,000 -50,000 -54,000 -16,000 -40,000 Jonson, Inc. is planning its operations for the coming year, and the CEO wants you to forecast the firm's additional funds needed (AFN). Data for use in the forecast are shown below. However, the CEO is concerned about the impact of a change in the retention ratio from 90% that was used in the past to 50%, which the firm's investment bankers have recommended. Seventy-five percent of the total assets are considered…arrow_forwardCompany Rapid Growth is considering the following project: Year 0 1 2 3 4 5 Cash Flows -$87800 $10800 $26000 $33300 $35000 $53400 What's the profitability index of the project, assuming 8.66% discount rate?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT