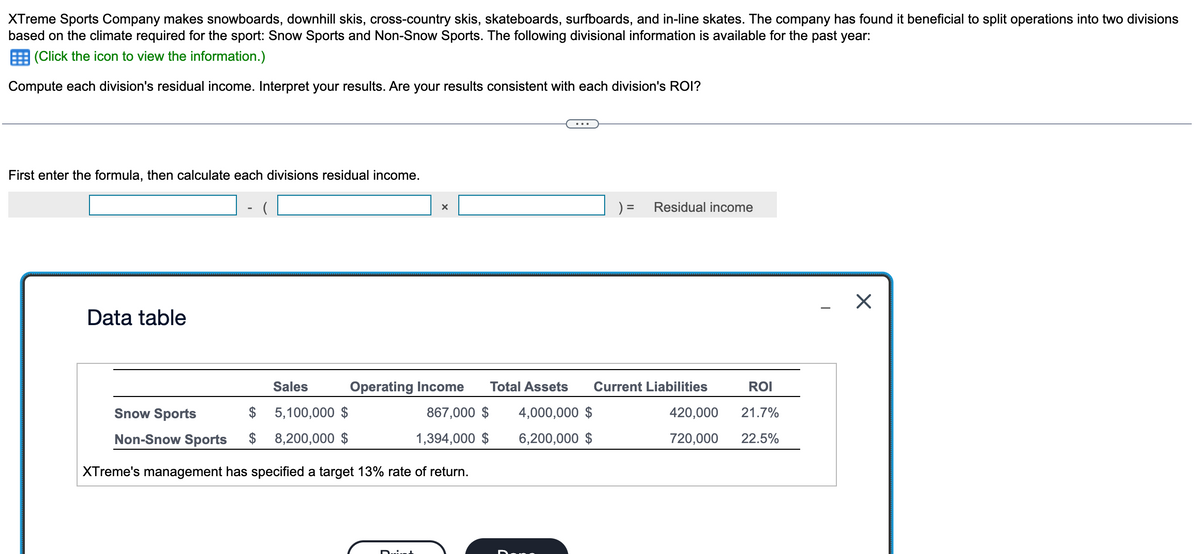

XTreme Sports Company makes snowboards, downhill skis, cross-country skis, skateboards, surfboards, and in-line skates. The company has found it beneficial to split operations into two divisions based on the climate required for the sport: Snow Sports and Non-Snow Sports. The following divisional information is available for the past year: (Click the icon to view the information.) Compute each division's residual income. Interpret your results. Are your results consistent with each division's ROI? First enter the formula, then calculate each divisions residual income. Data table Snow Sports Non-Snow Sports Sales $ 5,100,000 $ 8,200,000 $ ) = Residual income Operating Income Total Assets Current Liabilities ROI 867,000 $ 1,394,000 $ 4,000,000 $ 6,200,000 $ 720,000 420,000 21.7% 22.5% XTreme's management has specified a target 13% rate of return. ☑

XTreme Sports Company makes snowboards, downhill skis, cross-country skis, skateboards, surfboards, and in-line skates. The company has found it beneficial to split operations into two divisions based on the climate required for the sport: Snow Sports and Non-Snow Sports. The following divisional information is available for the past year: (Click the icon to view the information.) Compute each division's residual income. Interpret your results. Are your results consistent with each division's ROI? First enter the formula, then calculate each divisions residual income. Data table Snow Sports Non-Snow Sports Sales $ 5,100,000 $ 8,200,000 $ ) = Residual income Operating Income Total Assets Current Liabilities ROI 867,000 $ 1,394,000 $ 4,000,000 $ 6,200,000 $ 720,000 420,000 21.7% 22.5% XTreme's management has specified a target 13% rate of return. ☑

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 37P: Katayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions...

Related questions

Question

Transcribed Image Text:XTreme Sports Company makes snowboards, downhill skis, cross-country skis, skateboards, surfboards, and in-line skates. The company has found it beneficial to split operations into two divisions

based on the climate required for the sport: Snow Sports and Non-Snow Sports. The following divisional information is available for the past year:

(Click the icon to view the information.)

Compute each division's residual income. Interpret your results. Are your results consistent with each division's ROI?

First enter the formula, then calculate each divisions residual income.

Data table

Snow Sports

Non-Snow Sports

Sales

$ 5,100,000 $

8,200,000 $

) =

Residual income

Operating Income

Total Assets

Current Liabilities

ROI

867,000 $

1,394,000 $

4,000,000 $

6,200,000 $

720,000

420,000 21.7%

22.5%

XTreme's management has specified a target 13% rate of return.

☑

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning