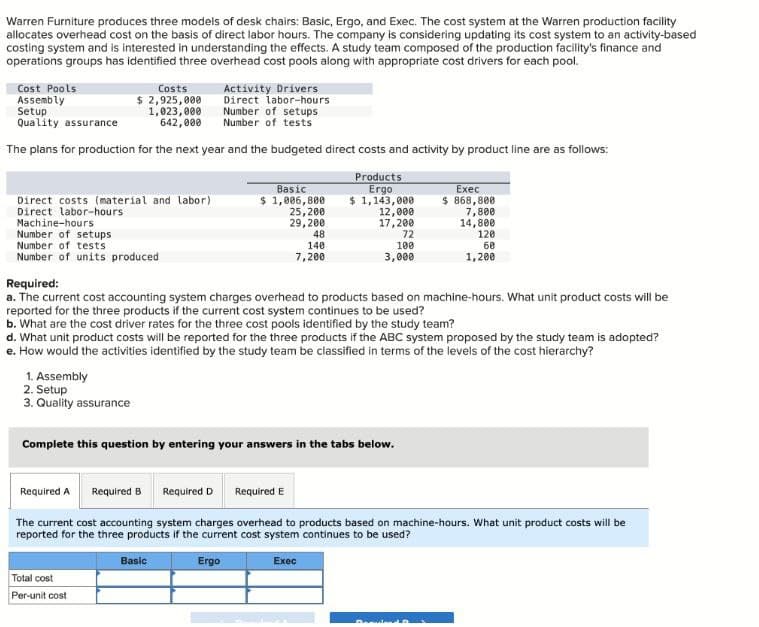

Warren Furniture produces three models of desk chairs: Basic, Ergo, and Exec. The cost system at the Warren production facility allocates overhead cost on the basis of direct labor hours. The company is considering updating its cost system to an activity-based costing system and is interested in understanding the effects. A study team composed of the production facility's finance and operations groups has identified three overhead cost pools along with appropriate cost drivers for each pool. Cost Pools Assembly Setup Quality assurance Costs $ 2,925,000 1,023,000 642,000 Activity Drivers Direct labor-hours Number of setups Number of tests The plans for production for the next year and the budgeted direct costs and activity by product line are as follows: Direct costs (material and labor) Basic $ 1,006,800 Products Ergo Direct labor-hours Machine-hours 25,200 29,200 $ 1,143,000 12,000 Exec 868,800 7,800 17,200 14,800 Number of setups 48 72 120 Number of tests Number of units produced 140 7,200 100 60 3,000 1,200 Required: a. The current cost accounting system charges overhead to products based on machine-hours. What unit product costs will be reported for the three products if the current cost system continues to be used? b. What are the cost driver rates for the three cost pools identified by the study team? d. What unit product costs will be reported for the three products if the ABC system proposed by the study team is adopted? e. How would the activities identified by the study team be classified in terms of the levels of the cost hierarchy? 1. Assembly 2. Setup 3. Quality assurance

Warren Furniture produces three models of desk chairs: Basic, Ergo, and Exec. The cost system at the Warren production facility allocates overhead cost on the basis of direct labor hours. The company is considering updating its cost system to an activity-based costing system and is interested in understanding the effects. A study team composed of the production facility's finance and operations groups has identified three overhead cost pools along with appropriate cost drivers for each pool. Cost Pools Assembly Setup Quality assurance Costs $ 2,925,000 1,023,000 642,000 Activity Drivers Direct labor-hours Number of setups Number of tests The plans for production for the next year and the budgeted direct costs and activity by product line are as follows: Direct costs (material and labor) Basic $ 1,006,800 Products Ergo Direct labor-hours Machine-hours 25,200 29,200 $ 1,143,000 12,000 Exec 868,800 7,800 17,200 14,800 Number of setups 48 72 120 Number of tests Number of units produced 140 7,200 100 60 3,000 1,200 Required: a. The current cost accounting system charges overhead to products based on machine-hours. What unit product costs will be reported for the three products if the current cost system continues to be used? b. What are the cost driver rates for the three cost pools identified by the study team? d. What unit product costs will be reported for the three products if the ABC system proposed by the study team is adopted? e. How would the activities identified by the study team be classified in terms of the levels of the cost hierarchy? 1. Assembly 2. Setup 3. Quality assurance

Chapter6: Activity-based, Variable, And Absorption Costing

Section: Chapter Questions

Problem 13EB: Stacks manufactures two different levels of hockey sticks: the Standard and the Slap Shot. The total...

Related questions

Question

Transcribed Image Text:Warren Furniture produces three models of desk chairs: Basic, Ergo, and Exec. The cost system at the Warren production facility

allocates overhead cost on the basis of direct labor hours. The company is considering updating its cost system to an activity-based

costing system and is interested in understanding the effects. A study team composed of the production facility's finance and

operations groups has identified three overhead cost pools along with appropriate cost drivers for each pool.

Cost Pools

Assembly

Setup

Quality assurance

Costs

$ 2,925,000

1,023,000

642,000

Activity Drivers

Direct labor-hours

Number of setups

Number of tests

The plans for production for the next year and the budgeted direct costs and activity by product line are as follows:

Direct costs (material and labor)

Basic

$ 1,006,800

Direct labor-hours

25,200

Products

Ergo

$ 1,143,000

12,000

Exec

$ 868,800

Machine-hours

29,200

17,200

Number of setups

Number of tests

Number of units produced

48

140

7,200

72

100

3,000

7,800

14,800

120

60

1,200

Required:

a. The current cost accounting system charges overhead to products based on machine-hours. What unit product costs will be

reported for the three products if the current cost system continues to be used?

b. What are the cost driver rates for the three cost pools identified by the study team?

d. What unit product costs will be reported for the three products if the ABC system proposed by the study team is adopted?

e. How would the activities identified by the study team be classified in terms of the levels of the cost hierarchy?

1. Assembly

2. Setup

3. Quality assurance

Complete this question by entering your answers in the tabs below.

Required A Required B Required D

Required E

The current cost accounting system charges overhead to products based on machine-hours. What unit product costs will be

reported for the three products if the current cost system continues to be used?

Total cost

Per-unit cost

Basic

Ergo

Exec

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning