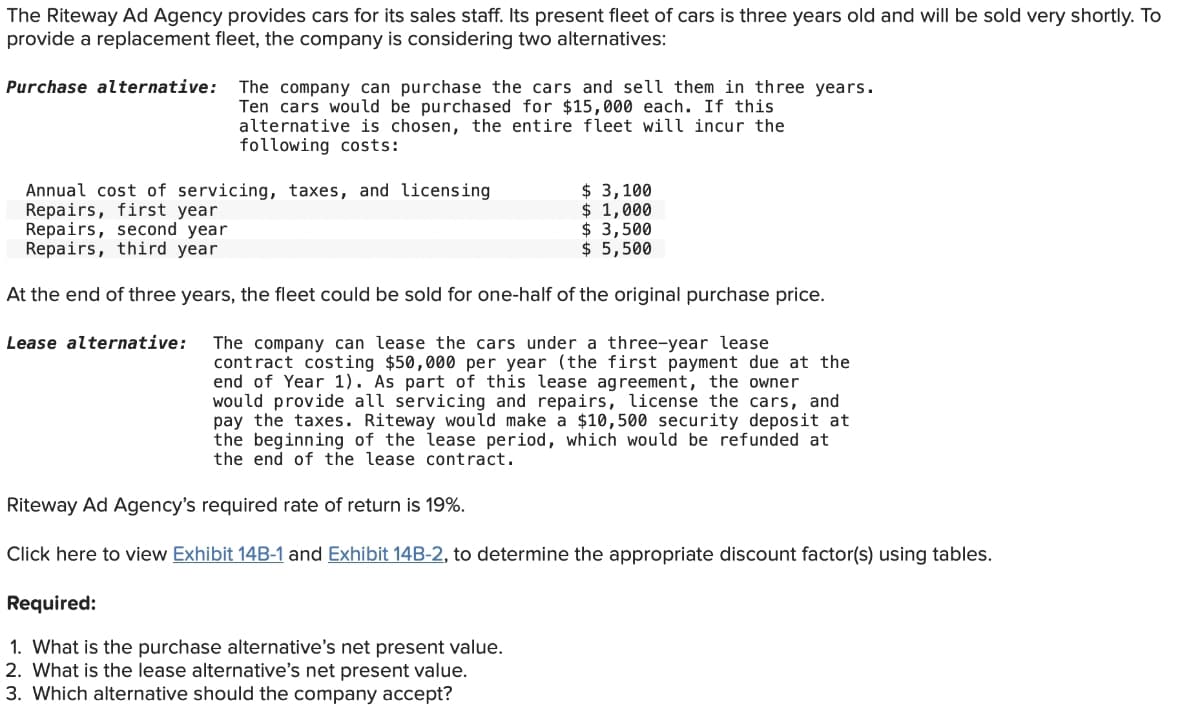

The Riteway Ad Agency provides cars for its sales staff. Its present fleet of cars is three years old and will be sold very shortly. To provide a replacement fleet, the company is considering two alternatives: Purchase alternative: The company can purchase the cars and sell them in three years. Ten cars would be purchased for $15,000 each. If this alternative is chosen, the entire fleet will incur the following costs: Annual cost of servicing, taxes, and licensing $ 3,100 Repairs, first year $ 1,000 Repairs, second year $ 3,500 $ 5,500 Repairs, third year At the end of three years, the fleet could be sold for one-half of the original purchase price. Lease alternative: The company can lease the cars under a three-year lease contract costing $50,000 per year (the first payment due at the end of Year 1). As part of this lease agreement, the owner would provide all servicing and repairs, license the cars, and pay the taxes. Riteway would make a $10,500 security deposit at the beginning of the lease period, which would be refunded at the end of the lease contract. Riteway Ad Agency's required rate of return is 19%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What is the purchase alternative's net present value. 2. What is the lease alternative's net present value. 3. Which alternative should the company accept?

The Riteway Ad Agency provides cars for its sales staff. Its present fleet of cars is three years old and will be sold very shortly. To provide a replacement fleet, the company is considering two alternatives: Purchase alternative: The company can purchase the cars and sell them in three years. Ten cars would be purchased for $15,000 each. If this alternative is chosen, the entire fleet will incur the following costs: Annual cost of servicing, taxes, and licensing $ 3,100 Repairs, first year $ 1,000 Repairs, second year $ 3,500 $ 5,500 Repairs, third year At the end of three years, the fleet could be sold for one-half of the original purchase price. Lease alternative: The company can lease the cars under a three-year lease contract costing $50,000 per year (the first payment due at the end of Year 1). As part of this lease agreement, the owner would provide all servicing and repairs, license the cars, and pay the taxes. Riteway would make a $10,500 security deposit at the beginning of the lease period, which would be refunded at the end of the lease contract. Riteway Ad Agency's required rate of return is 19%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What is the purchase alternative's net present value. 2. What is the lease alternative's net present value. 3. Which alternative should the company accept?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 4E

Related questions

Question

Transcribed Image Text:The Riteway Ad Agency provides cars for its sales staff. Its present fleet of cars is three years old and will be sold very shortly. To

provide a replacement fleet, the company is considering two alternatives:

Purchase alternative: The company can purchase the cars and sell them in three years.

Ten cars would be purchased for $15,000 each. If this

alternative is chosen, the entire fleet will incur the

following costs:

Annual cost of servicing, taxes, and licensing

$ 3,100

Repairs, first year

$ 1,000

Repairs, second year

$ 3,500

$ 5,500

Repairs, third year

At the end of three years, the fleet could be sold for one-half of the original purchase price.

Lease alternative:

The company can lease the cars under a three-year lease

contract costing $50,000 per year (the first payment due at the

end of Year 1). As part of this lease agreement, the owner

would provide all servicing and repairs, license the cars, and

pay the taxes. Riteway would make a $10,500 security deposit at

the beginning of the lease period, which would be refunded at

the end of the lease contract.

Riteway Ad Agency's required rate of return is 19%.

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables.

Required:

1. What is the purchase alternative's net present value.

2. What is the lease alternative's net present value.

3. Which alternative should the company accept?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning