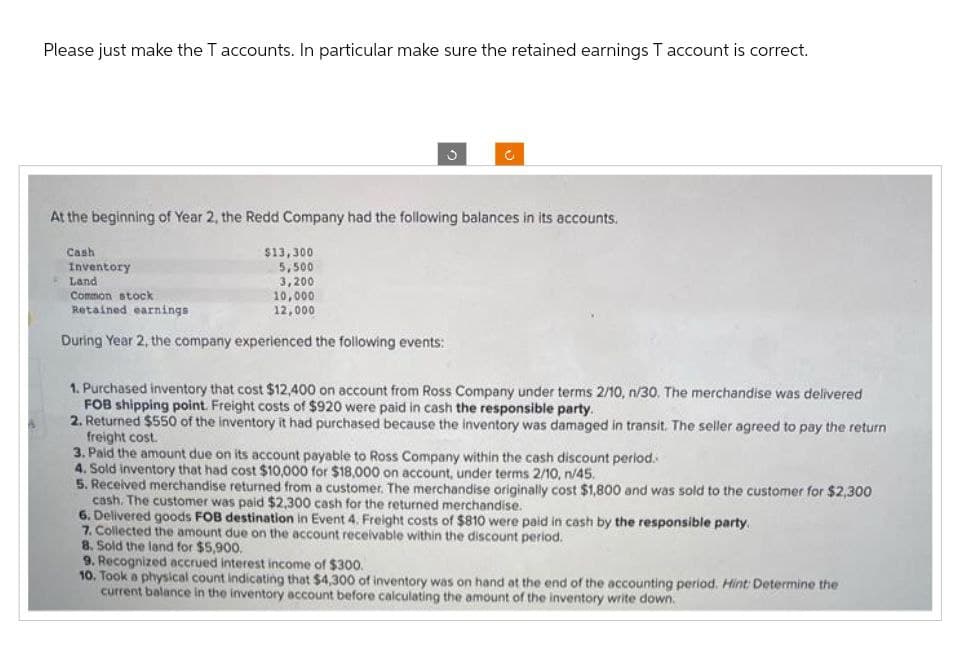

Please just make the T accounts. In particular make sure the retained earnings T account is correct. ง At the beginning of Year 2, the Redd Company had the following balances in its accounts. Cash Inventory Land Common stock Retained earnings $13,300 5,500 3,200 10,000 12,000 During Year 2, the company experienced the following events: 1. Purchased inventory that cost $12,400 on account from Ross Company under terms 2/10, n/30. The merchandise was delivered FOB shipping point. Freight costs of $920 were paid in cash the responsible party. 2. Returned $550 of the inventory it had purchased because the inventory was damaged in transit. The seller agreed to pay the return freight cost. 3. Paid the amount due on its account payable to Ross Company within the cash discount period. 4. Sold inventory that had cost $10,000 for $18,000 on account, under terms 2/10, n/45. 5. Received merchandise returned from a customer. The merchandise originally cost $1,800 and was sold to the customer for $2,300 cash. The customer was paid $2,300 cash for the returned merchandise. 6. Delivered goods FOB destination in Event 4. Freight costs of $810 were paid in cash by the responsible party. 7. Collected the amount due on the account receivable within the discount period. 8. Sold the land for $5,900. 9. Recognized accrued interest income of $300. 10. Took a physical count indicating that $4,300 of inventory was on hand at the end of the accounting period. Hint: Determine the current balance in the inventory account before calculating the amount of the inventory write down.

Please just make the T accounts. In particular make sure the retained earnings T account is correct. ง At the beginning of Year 2, the Redd Company had the following balances in its accounts. Cash Inventory Land Common stock Retained earnings $13,300 5,500 3,200 10,000 12,000 During Year 2, the company experienced the following events: 1. Purchased inventory that cost $12,400 on account from Ross Company under terms 2/10, n/30. The merchandise was delivered FOB shipping point. Freight costs of $920 were paid in cash the responsible party. 2. Returned $550 of the inventory it had purchased because the inventory was damaged in transit. The seller agreed to pay the return freight cost. 3. Paid the amount due on its account payable to Ross Company within the cash discount period. 4. Sold inventory that had cost $10,000 for $18,000 on account, under terms 2/10, n/45. 5. Received merchandise returned from a customer. The merchandise originally cost $1,800 and was sold to the customer for $2,300 cash. The customer was paid $2,300 cash for the returned merchandise. 6. Delivered goods FOB destination in Event 4. Freight costs of $810 were paid in cash by the responsible party. 7. Collected the amount due on the account receivable within the discount period. 8. Sold the land for $5,900. 9. Recognized accrued interest income of $300. 10. Took a physical count indicating that $4,300 of inventory was on hand at the end of the accounting period. Hint: Determine the current balance in the inventory account before calculating the amount of the inventory write down.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 19PA: Post the following November transactions to T-accounts for Accounts Payable, Inventory, and Cash,...

Related questions

Question

Transcribed Image Text:Please just make the T accounts. In particular make sure the retained earnings T account is correct.

At the beginning of Year 2, the Redd Company had the following balances in its accounts.

Cash

Inventory

Land

Common stock

Retained earnings

$13,300

5,500

3,200

10,000

12,000

During Year 2, the company experienced the following events:

1. Purchased inventory that cost $12,400 on account from Ross Company under terms 2/10, n/30. The merchandise was delivered

FOB shipping point. Freight costs of $920 were paid in cash the responsible party.

2. Returned $550 of the inventory it had purchased because the inventory was damaged in transit. The seller agreed to pay the return

freight cost.

3. Paid the amount due on its account payable to Ross Company within the cash discount period.

4. Sold inventory that had cost $10,000 for $18,000 on account, under terms 2/10, n/45.

5. Received merchandise returned from a customer. The merchandise originally cost $1,800 and was sold to the customer for $2,300

cash. The customer was paid $2,300 cash for the returned merchandise.

6. Delivered goods FOB destination in Event 4. Freight costs of $810 were paid in cash by the responsible party.

7. Collected the amount due on the account receivable within the discount period.

8. Sold the land for $5,900.

9. Recognized accrued interest income of $300.

10. Took a physical count indicating that $4,300 of inventory was on hand at the end of the accounting period. Hint: Determine the

current balance in the inventory account before calculating the amount of the inventory write down.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage